If you haven’t noticed, real estate is the most expensive it’s ever been. For newcomers and experienced investors, it’s been a lot harder to find good deals at affordable prices.

Luckily, real estate investing provides enough strategies that you can get around the barrier of entry by executing a tactic known as “house hacking”. Let’s talk about what that means.

What is House Hacking?

House hacking is where you leverage the home you live in by renting out some portion of the property to generate income and offset your monthly mortgage payment.

For most people, a monthly mortgage or rent payment is their biggest expense. If you could reduce or eliminate your monthly housing payment, you would inevitably have more financial independence, extra passive income for the lifestyle you want, and more cash to set aside for your next real estate investment.

In reality, house hacking is an actual life hack that forces your largest expense to work for you. It’s also one of the easiest ways to become a landlord.

Why Now is the Best Time To Start House Hacking

Just think of the headlines in real estate over the past two years: “historically low-interest rates”, “unprecedented appreciation”, “historic low inventory”, and “record inflation”. The list goes on.

We face surging inflation as we enter the aftermath of these unprecedented and historic runs. To combat it, the Fed has raised interest rates, and in conjunction, the 30-year fixed mortgage rate has already jumped from an average of mid-3% to over 5% in a few months.

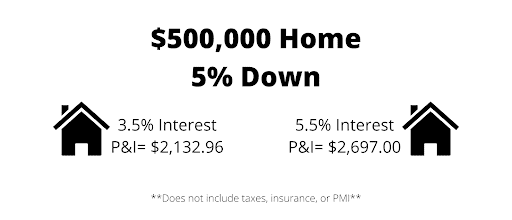

Here’s how that affects people’s wallets:

Let’s use a $500,000 home as an example.

Based on the 2% rise in interest, the monthly payment has increased by over $500! $500 extra each month can make a real impact on your budget. Based on the Fed’s indications, rates could continue to increase. People have also lost significant purchasing power because of the increased rates.

As the market fights against first-time home buyers and eager investors trying to get in, house hacking is an advantageous weapon in your arsenal.

Who is House Hacking For?

Technically, anyone can take advantage of the benefits of house hacking, but it isn’t for the faint of heart. It can be uncomfortable. You may have to share parts of your house that you previously enjoyed to yourself, or it may take a significant up-front financial investment.

While anybody can house hack, here are some categories of people who stand to gain the most by putting it into practice.

Those looking to save and earn more from their homes

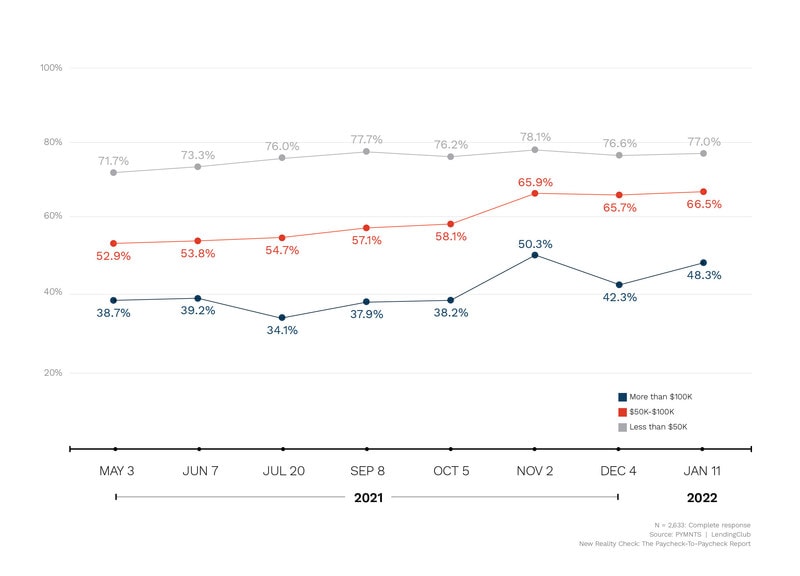

Studies show that up to 64% of Americans live paycheck to paycheck. It’s even higher depending on the income bracket.

Amongst these groups, a large portion of their paycheck goes towards housing costs. If the average American can lower or eliminate that housing cost, it can change their entire financial picture. Utilizing a house hacking strategy is a life-changing opportunity that affords the ability to save and have increased disposable income for individuals and families.

Those searching for financial independence

There is a large group of people that make decent money and have a comfortable life, but that comes at the expense of their time. Most of our lifestyles, homes, cars, and healthcare costs are all predicated on doing what someone else wants us to do and being where they require us to be for 40+ hours a week. Many of us work the job we do because we have to, not because we want to.

For example, I knew personally that to earn some degree of financial independence, house hacking was the right move. My wife and I downsized by renting out our comfortable four-bedroom home, invested our savings into another house, and flipped half of it into an Airbnb to eliminate the housing costs and get us one step closer to financial freedom.

It’s not stress-free, but there’s a substantial economic impact that will pay dividends for years to come. House hacking is an accelerant for those searching for financial independence.

The young and hungry

Hands down, the person who stands to gain the most from house hacking is a younger person looking to acquire more real estate sooner.

Generally, someone starting out in the workforce isn’t making a ton of money and may already have some significant debt with student loans.

It’s hard to save with lower wages, debt payments, and rent payments. If someone in this situation can get into home ownership and utilize house hacking to have lower costs than what they would pay in rent, they win!

They begin to leverage an asset, and real estate does its magic. Equity grows, cash-flow increases, the home appreciates, and they can save more to buy the next property sooner.

Ways to House Hack

1. Rent to roommates

This is the simplest and easiest way to house hack. Purchase a home and rent out some of the rooms to friends or even people you don’t know. Why pay a landlord when you can be the landlord?

I have a buyer in Denver who is a recent college grad trying to achieve this exact scenario. Rather than rent a room himself for $800-$1,000/month, or rent an apartment for $1,500-$2,000/month, he’s decided to buy real estate early and offset his costs through house hacking.

We are currently looking at 3-4 bedroom houses where he can rent out other rooms. Only $1000/month will come out of his pocket to own an appreciating, updated 3-4 bedroom home in Denver when he’s all done.

2. Start a short-term rental

Another lucrative way to house hack is by setting up a short-term rental (STR) through popular platforms like Airbnb and VRBO.

In my case, this is the strategy I use for house hacking. We purchased our second home in Denver with the goal of completely mitigating our mortgage. Our separate-entry guest suite with one bedroom, one bathroom, and living space consistently pays us more than our mortgage payment.

3. Buy a multifamily home

Many refer to this model as the “OG” of house hacking. Buy a duplex, triplex, or quadplex, live in one of the units and rent out the others. This allows an investor to get into multifamily investing for the least amount of money.

Generally, a multifamily investment takes a 25% down payment. You can get in for as low as 15% down if it is a primary residence.

In one move, you can purchase multiple units that can bring enough income to eliminate your out-of-pocket mortgage payment.

4. Build a “hackable” space

Many homeowners really love their homes, dislike the idea of moving, and don’t want to give up any space they already use. Those same people who have enjoyed living in their homes for a while have probably experienced unprecedented and historic appreciation over the past few years, giving them a ton of equity at their disposal.

I have friends who are in this exact dilemma. They want to get ahead by investing in real estate and find the extra income and financial independence that comes with house hacking, but they love their home and don’t want to move or give up any of their amenities.

What’s their solution?

Leveraging their equity with a home equity line of credit (HELOC) to build an addition to their house to create a short-term rental space.

We ran the numbers, and the income they stand to make from their Airbnb will pay for their mortgage payment plus the HELOC payment.

Final Thoughts

There are various house hackable spaces and ideas at hand for homeowners. Finishing out a basement, building an ADU, or even putting up an airstream in the backyard could make extra cash.

All of these ideas are subject to your city’s zoning and regulations, but the concept remains the same, there are ways to win by house hacking your home.

You’ll hear a lot of investors talk about house hacking time and time again because it works. It’s not the most flashy of investments. It can be uncomfortable and possibly invade your privacy. But house hacking has the power to radically reorganize your financial situation and reorient your mindset to making real estate work for your behalf.

That alone makes it worth it.