I wasn’t a very good trader. I never blew myself up. I didn’t even lose a lot of money. But the problem was, I never made much either. I was looking at commodities today when I was reminded of my early days trying to master (lol) the market.

DBC, an ETF that tracks a broad basket of commodities is up 60% over the last year. It’s gone vertical in the last few sessions, tacking on another 4.5% today. It’s normal to look back on gigantic moves and beat yourself up for not being part of the ride. But unless you’ve tried and failed, you really don’t have an appreciation for how hard it is to ride winners.

Let me show you an example of a trade that I’ve done too many times to count.

You can clearly see that investors were more eager to sell than buy at the $19-$20 range in the summer of 2020. It tried four or five times to get past that level but was turned back every time. And then, finally, demand beat supply in the market equivalent of tug-of-war. DBC exploded higher, but then, as is often the case, the breakout was tested. The problem for me, and I suspect I’m not alone, is that I never wanted a winner to turn into a loser. It’s one thing to give back profits, it’s another to lose principal. So I would buy the breakout, and, like a dummy, sell the retest.

This story is probably familiar to many of you reading this. Whether or not you followed my pattern isn’t relevant, but we’ve all sold something only to see it run away from us after. “I’ll get it next time,” we tell ourselves. Lucky for me, I kept a trading journal. I didn’t get it the next time. Or the time after that. And I knew it because I had detailed records of everything I was doing.

I’m telling you this story because I’m excited about a new sponsor we had on The Compound and Friends whose product I really could have used circa 2009. For full transparency, they’re a paid sponsor of the podcast and are not paying me for this post. I didn’t even tell them I’m writing this. I think this is a neat product so wanted to share.

Composer lets investors remove the subjectivity of buying breakouts and then having to make decisions during the heat of the moment. Instead of discretionary trading, you can build if-then rules. For example, “If the S&P 500 is above its 50-day moving average, buy the best performing stock over the last 10 days in each sector and equally weight them.” Or, “If the S&P 500 is 10% off its highs, put 50% of my portfolio into intermediate-term treasuries, 25% into REITs, and 25% into Gold.

Or, if you don’t want to make your own symphony, as they call it, you can choose from one of theirs. Check this out.

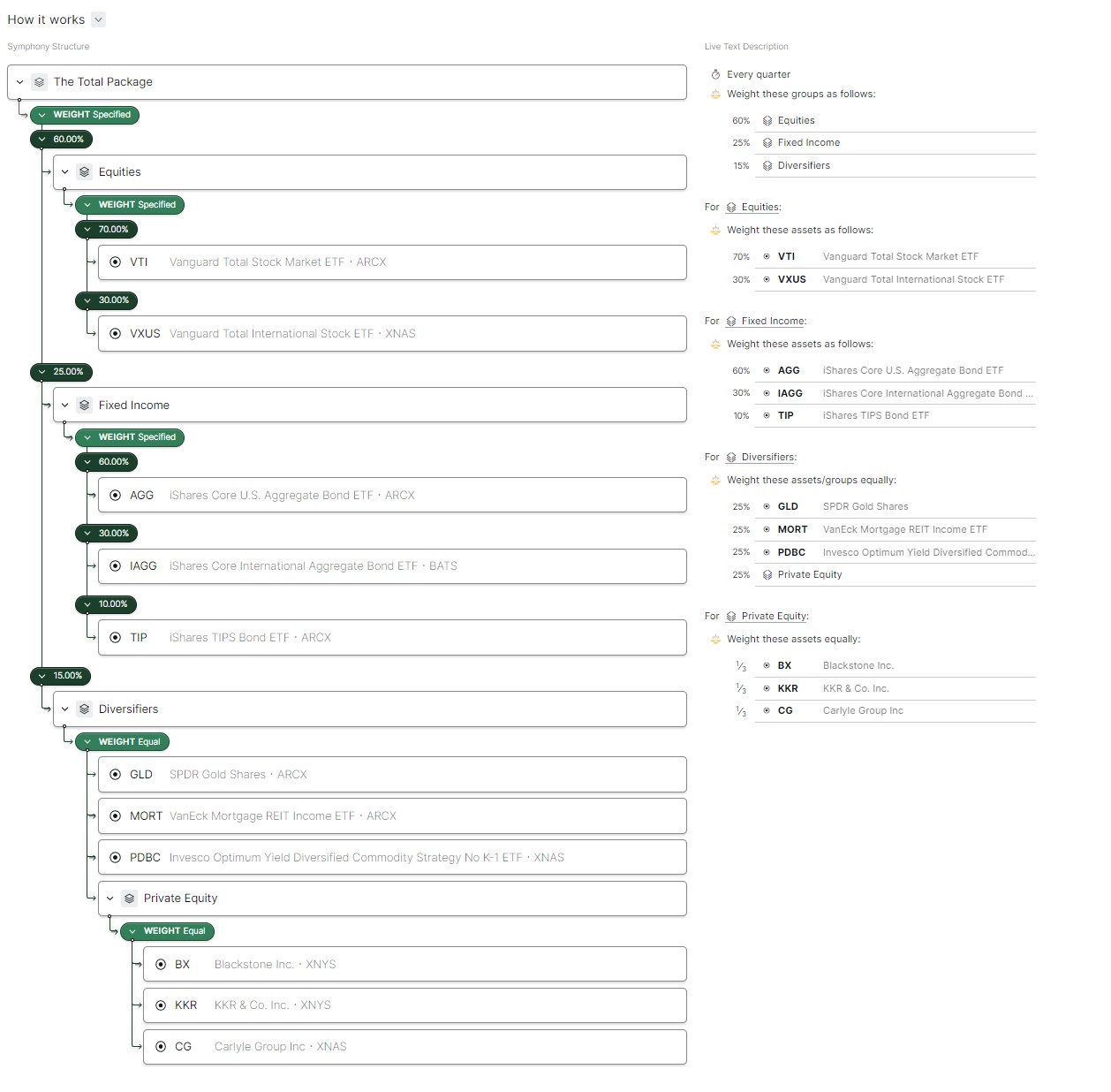

Let’s look under the hood of the first strategy, “the total package.”

For each symphony, Composer provides a description, a risk rating, and all the data you’d want on the backtested strategy. This strategy is fairly straightforward, 60% equities, 25% fixed income, and 15% diversified. Click the picture to blow it up.

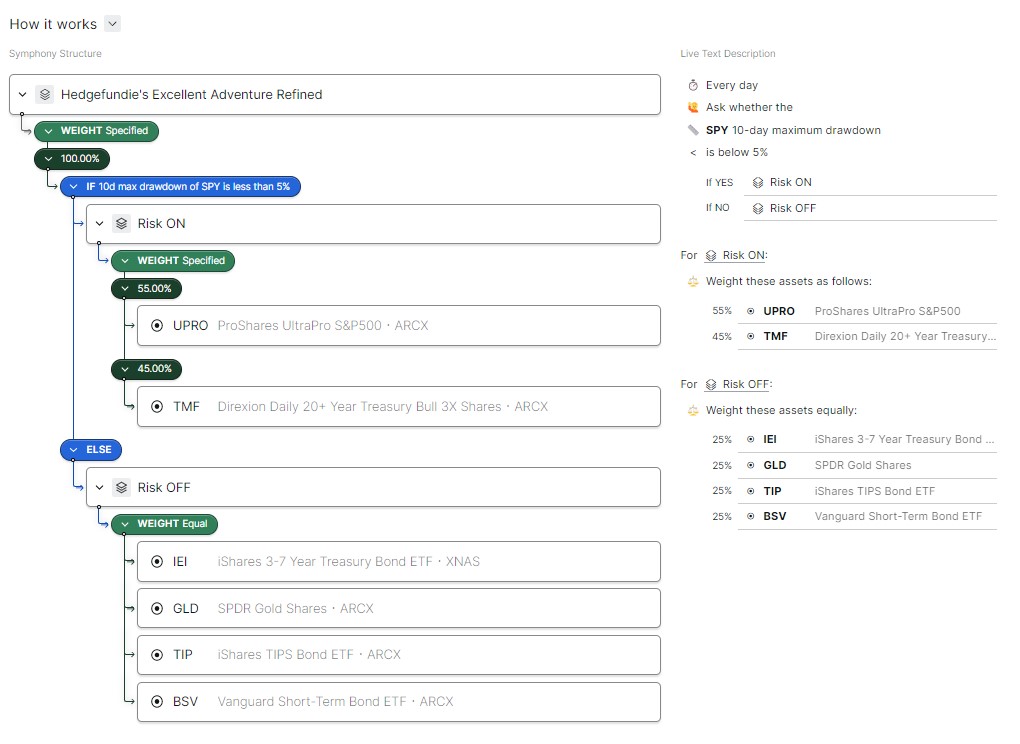

Let’s look at one that’s a little more exciting. This is not an endorsement, do your own diligence, etc. The next symphony they’re calling “Hedgefundie’s Excellent Adventure Refined.” The backtested returns on this thing are ludicrous. The strategy is pretty simple, but it’s been effective. If the S&P 500 10-day max drawdown is below 5%, they’re risk on. If not, it’s risk off.

When they’re risk on, it’s 55% levered S&P 500 (UPRO) and 45% levered bonds (TMF). When it’s risk off, they’re 25% in each of the following: 3-7 year treasuries, gold, TIPs, and short-term bonds. Needless to say, this is a high turnover strategy that should be run inside of a tax-sheltered vehicle.

I’m all about rules-based investing, so I’m super pumped to see a tool like this available for investors. The potential risk I see in something like this is that investors might jump from symphony to symphony when they get bored or the one they’re in stops working. But that risk already exists without Composer, so I’m hopeful their users can find a symphony or two that work for them and then stick with it.

Check them out here, and check out our episode with our friends Dan Nathan and J.C. Parets, and have an awesome weekend.