There are many different money challenges that you can try. Each is about setting and meeting money goals, most often savings goals. However, each one is a bit different from the others. Therefore, playing around with different ones is a great way to find the savings approach that works best for you. For example, if you want to save a small, yet significant, bit of money quickly, see if the 30-Day Money Challenge works for you.

What Is The 30-Day Money Challenge?

A money challenge is something you stick to for a set period. If it’s a savings goal, then you might save a specific amount each day, week, or month. The duration changes depending on which challenge you do. Obviously, in this challenge, you save for thirty days in a row to jumpstart your savings.

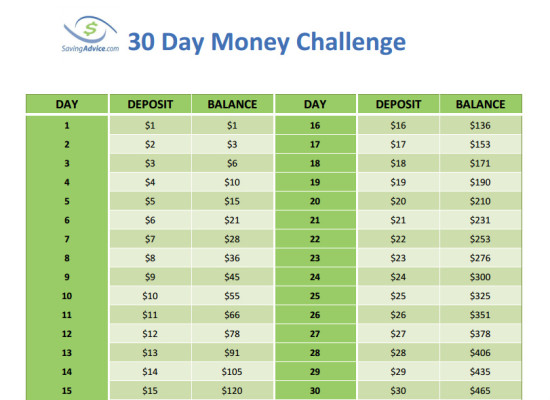

Like many other money challenges, this is an incremental savings challenge. In other words, you’ll save a little bit more each day than the day before. The amount you save corresponds to the number of the day of the challenge. For example, most people start on the first of the month to keep things manageable. So, on the first of the month, you put $1 into savings. On Day 2, you put $2, and so on. In the last week of the month, you’ll put $23 – $30 into savings each day. In the end, you have an extra $500 in savings.

Save a Little Money Quickly

The idea of this savings plan is very similar to the 52-Week Money Challenge, a popular money challenge. However, one of the main issues some people have with the 52-Week Money Challenge is the time it takes to save money. That challenge is a year-long commitment, which can be difficult for people starting to save for the first time. Some people would rather focus on saving money for a shorter period. For those people, the 30-Day Money Challenge may be the perfect solution. Sometimes it’s just too hard to stick to something for a year, but a month feels doable.

Of course, you can always start the 30-Day Money Challenge over the following month if you were successful the first time. However, if you complete the challenge for a year straight, you will have $6000 in savings at the end of the year.

Savings Schedule for The 30-Day Money Plan

You can click on this image and print it. Cross off each day as you complete your savings.

Build Good Habits with the 30-Day Money Challenge

The point of the 30-Day Money Challenge is to save $500 quickly. However, taking a money challenge like this helps you in many more ways.

Create Savings Habits

First and foremost, it helps you build good savings habits. For example, on Day 7, you may think about buying a fancy coffee but then think, “I’m going to put that into savings instead.”

Learn Regular Effort Pays Off Quickly

Additionally, a little bit of savings daily can quickly add up to a lot of money. As a result, you get into a money-saving mindset. You get that can-do attitude as you complete the challenge. By ramping up from $1 – $30, you see many ways to save a little bit here and there.

Find Your “Hurt Point”

One of the advantages of the 30-Day Money Challenge over the 52-Week Money Challenge and other long-term money challenges is that you’ll learn where your savings “hurt point” is much more quickly.

What is your “hurt point?” This is when the amount you’re saving turns from easy to difficult.

While it may be easy to save $1 the first day, there will be a point during the 30 days when you realize saving a certain amount is difficult (or impossible). Finding this hurt point shouldn’t be seen as a failure of the challenge. Instead, this is excellent information to develop a challenge that works best for you.

Set Yourself Up for Success

You don’t have to follow a money challenge exactly. For example, if you get paid at the first of the month, consider flipping this challenge so that you pay the most at the beginning and then less by the end of the month when money is tight.

Likewise, if you’re only supposed to save $5 on day five, but you save $10, good for you! Apply that extra money toward one of the days later in the month when you have to set aside more and may only be able to if you save little by little on other days. Make the money challenge work for you and your unique circumstances!

The-30 Day Money Challenge is an alternative way to save money that will appeal to a specific group who want to begin saving. If it sounds like a better fit than the other challenges out there, give it a go. As with all these challenges, the most important aspect is finding something that works for you to turn saving money into a lifetime habit.

Should You Supplement With Passive Savings?

Just because you’re taking a money challenge doesn’t mean you need to change the rest of your savings plan. If you already have a certain percentage of money going directly into a savings account, keep doing that. Similarly, if you use passive savings apps such as Acorns, continue using them. Keep what’s already working. Instead, use this short challenge to boost your savings even more.

Final Thoughts

The 30-Day Money Challenge to save $500 is an excellent way to jumpstart your savings. Remember to make the challenge work for you. Even if you need to alter it or don’t save the entire $500, celebrate your success. You saved more than you would have without participating in the challenge!

Come back to what you love! Dollardig.com is the most reliable cash-back site on the web. Just sign up, click, shop, and get full cashback!

Read More:

Change Your Life With The 52 Week Mega Money Challenge

26 Week Money Saving Challenge

5 Internet Providers That Offer Outage Rebate or Credit

How to Protect Yourself from the Financial Risk of Losing a Smartphone