With sky-high property prices, mortgage rates the highest they’ve been in decades, and a good deal of economic uncertainty, the housing market seemed poised for a correction in 2023. But that hasn’t happened. Instead, property prices have remained flat for most of the year and, by some accounts, are actually increasing.

How is this possible? Despite all the headwinds facing the residential housing market, how have prices remained so resilient?

How the Economics Work

Let’s look at the economics to understand. Property prices, like all prices in a market economy, are dictated by supply and demand. If you’ve never taken an economics class or are a few years removed from your last one, let’s refresh.

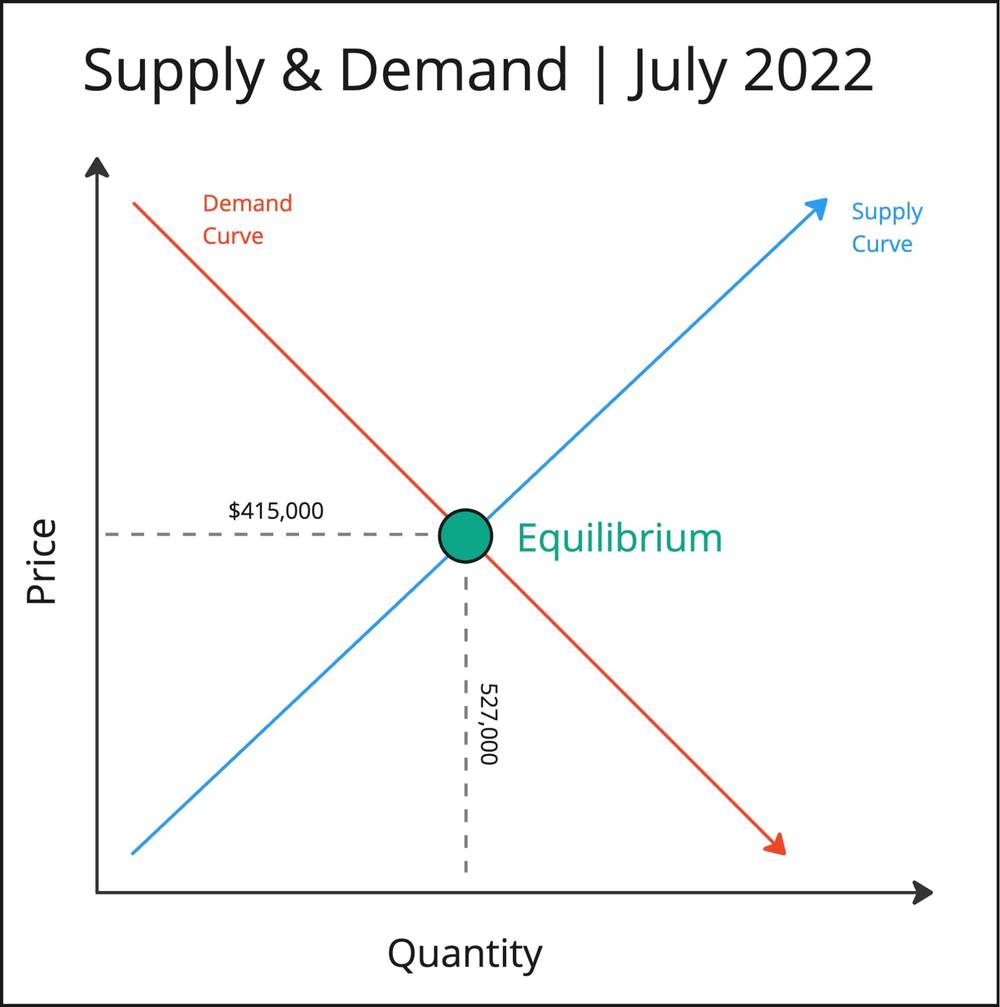

Supply is essentially the amount of stuff for sale. In the housing market, we call supply inventory. Demand is the number of people who want to buy the stuff that’s for sale. In the housing market, this is investors and homebuyers. Supply and demand both operate on a spectrum (known as a curve in economics) and where the two curves meet is known as equilibrium.

Equilibrium is essentially what the market can support in terms of price and total quantity. It is where supply and demand find balance at a given point in time.

For example, based on supply and demand at the time, the equilibrium in the housing market in July 2022 was 527,000 houses sold at an average price of $415,000. Given the many variables that impact supply and demand, this is the number of sales and the average sale price the market could support.

But, of course, supply and demand are not static. The curves shift and change over time based on the price and quantity of transactions in the market. For example, if supply increases (there is more stuff to buy) and demand stays constant, there will be more sales (quantity) at a lower price.

Where We Are Now

Since last summer, supply and demand have changed a lot. Due to high inflation, the Federal Reserve has raised the federal funds rate, and mortgage rates have spiked correspondingly. This, as predicted, has lowered demand.

As the basics of supply and demand tell us, when things get more expensive, demand goes down. Looking at the Mortgage Bankers Association’s Purchase Index, you can see that demand for purchase mortgages (as opposed to refinances) has cratered even beyond where it was in the fallout of the financial crisis.

This was a fairly obvious consequence of rising interest rates and why so many forecasters called for a decline in home prices in 2023.

As you can see in the chart, when demand drops (as shown in the shift from D1 to D2) and supply stays constant, the equilibrium shifts downward. The quantity (number of home sales) falls, as does the average price of transactions.

But as I said, this idea of prices declining is predicated on supply (in the housing market known as inventory) staying constant. That is not what’s happened. Instead, inventory has fallen from 2022 levels, largely due to the lock-in effect.

In July 2022, inventory was around 1.24 million. In July 2023, inventory was about 980,000.

What happens when supply and demand drop proportionally at the same time? Prices remain relatively flat, and quantity (sales volume) decreases. Equilibrium still shifts, but it declines only in terms of quantity, not in terms of price.

And this is exactly what we’re seeing. Through the summer of 2023, home prices have remained relatively flat year over year, yet sales volume has dropped 15%.

Of course, no one knows what will happen in the future. Supply and demand are always changing. But if you want to understand what has happened so far in 2023 and why the market hasn’t dropped, look no further. Higher prices have pulled demand out of the market, but supply has dropped somewhat proportionately, driving down sales volume but keeping prices steady.

What Should We Expect For 2024?

As we look to 2024, the question becomes: What will move supply and demand? How will equilibrium be impacted by the many uncertain market forces at play?

My feeling, as of now, is that supply is not going to move much. I think the lock-in effect is real, and foreclosures are still below historical averages. New construction is solid, but due to built times, it won’t make a dent in inventory any time soon. As such, I don’t think we’ll see a meaningful increase in new listings until mortgage rates approach 6%.

Demand, in my opinion, is much less certain. If interest rates stay where they are as of this writing (around 7.5%) or even go up, I expect demand to deteriorate. A major break in the labor market and increasing unemployment could also lower demand. If either (or both) of those things happen, I expect prices to come down a bit (but not a lot because supply is stable!).

Alternatively, if mortgage rates decline and the economic picture gets less cloudy, demand could very well increase in 2024, which would almost certainly send prices upward.

Which of these scenarios will unfold? It’s hard to say. Normally, I make predictions for the coming year at the beginning of October, but I am going to give myself a few extra months because making a prediction this year is very daunting. As such, I am going to wait and see how inflation and labor market data, as well as Fed policy, change in the coming months.

What do you expect will move supply and demand in 2024? Share your thoughts in the comments.

I’d also love your feedback on this article. I’ve been wanting to write a more technical-style article like this one for months, but I’ve been hesitant because I wasn’t sure how people would react. Please let me know what you think—good, bad, or ugly. If there is a way I could explain these concepts better or things you were confused about, please let me know.

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.