The S&P 500 has fallen from 4,598 on July 27th of this year to 4,117 on October 28th for a decline of 10.5%, while yields on the ten-year Treasury have risen from 4.01% to 4.85% for a rise of 20.9%. The Fidelity Intermediate Treasury Bond Index (FUAMX) has had a price decline of 4% during this three-month period. I expected a larger decline in the S&P 500 and a lower rise in yields. Money market yields are hovering around 5%, and “cash is king.”

Economic growth is robust, along with relatively stable employment, while inflation has moderated. However, pandemic-era savings are being depleted, delinquency rates are rising, bankruptcies among small businesses are rising, and banks are tightening lending standards. The yield curve is still inverted. A possible recession has been pushed into early or mid-2024, the Federal Reserve has peaked its rate hikes or soon will, and speculation is that the Federal Reserve will begin lowering rates in mid-2024. How should we invest now?

I have concentrated on building fixed-income ladders for the past year, and as they mature, I have rolled them over into bond funds with longer durations. I have also employed wealth management services at Fidelity and Vanguard for longer horizon buckets. This month, I updated my spreadsheet that tracks the performance of over six hundred funds available at either Fidelity or Vanguard. I created a ranking system to reflect short-term performance and sentiment at this inflection point using 1) a three-month exponential moving average, 2) money flow, and 3) returns during September and October.

This article is divided into the following sections:

TRENDING LIPPER CATEGORIES

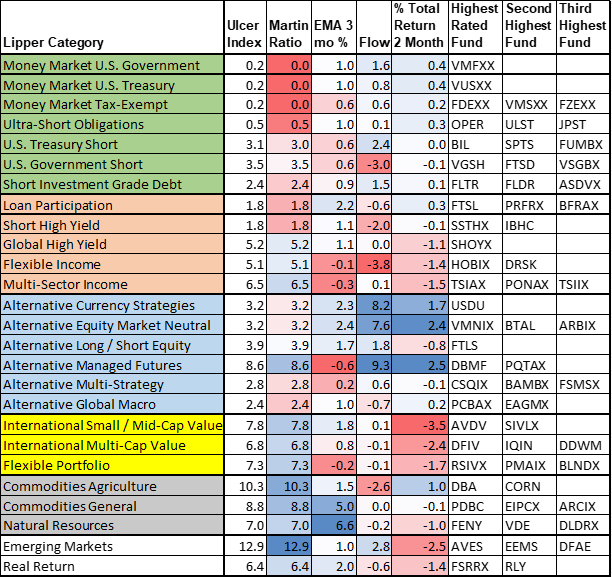

Table #1 contains the top-performing Lipper Categories for the 635 funds that I currently track. The first group of funds is money markets and short-term quality fixed income. Cash is king. Ulcer Index measures the depth and duration of drawdowns over the past two years, while Martin Ratio measures the risk-adjusted performance over the past two years. The next group of categories doing well is higher-risk fixed income. The third category performing well is “Alternatives”, some of which I have written about over the past year. International small and multi-cap funds that I track are performing better than domestic large-cap funds.

A balanced, low-volatility portfolio will contain funds that move in different directions at different times. The final section looks at how some of the uncorrelated [to the S&P 500] funds that I own compare during the past few months.

Table #1: Trending Lipper Categories – Ulcer & Martin Stats – Two Years

FIXED INCOME FUNDS

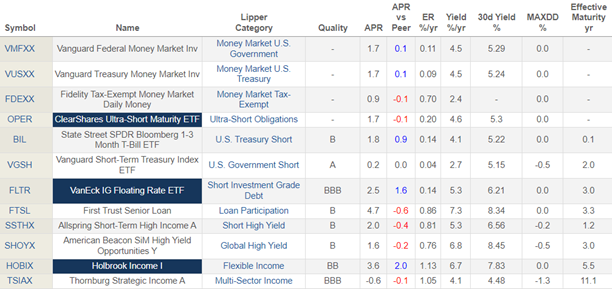

Table #2 contains the money market and short-term fixed-income funds that have done well over the past few months. The quality funds should continue to do well over the next year while the Federal Reserve is holding rates higher for longer. Lower-quality bond funds are likely to come under pressure if a recession becomes more likely. My current strategy is to invest in longer-duration funds of quality bonds while interest rates are high.

Table #2: Trending Fixed Income Funds (Metrics -Four Months)

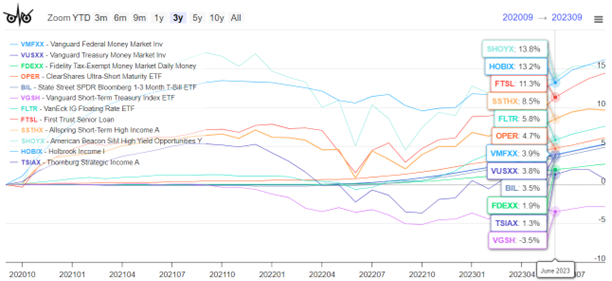

Figure #1: Trending Fixed Income Funds (Metrics -Four Months)

ALTERNATIVES AND EQUITY FUNDS

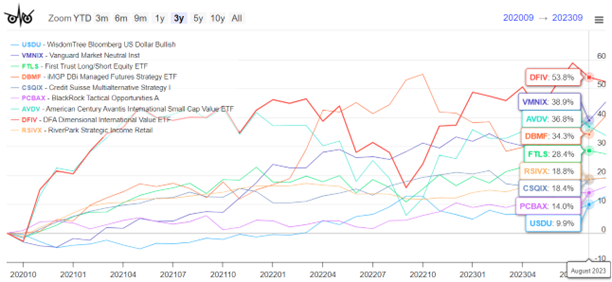

The types of alternative fund categories shown in Table #3 often tend to do well during times of uncertainty. As I have written, I own several of these and will continue to do so until the U.S. economy enters its next growth stage. I plan to maintain low allocations to equity for the next six months because of high geopolitical risks and recession risks.

Table #3: Trending Alternative and Equity Funds (Metrics -Four Months)

Note that the two international value funds (AVDV, DFIV) have been trending higher lately.

Figure #2: Trending Alternative and Equity Funds (Metrics -Four Months)

SHORT LIST OF TOP PERFORMING FUNDS

This section covers funds that performed relatively well over the past several months. These funds were selected by looking at individual funds instead of focusing first on the Lipper Category.

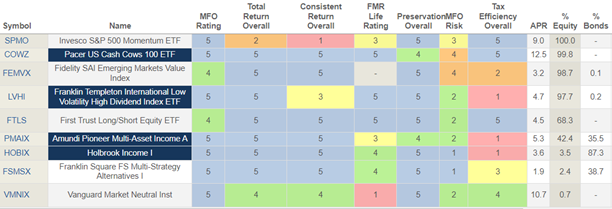

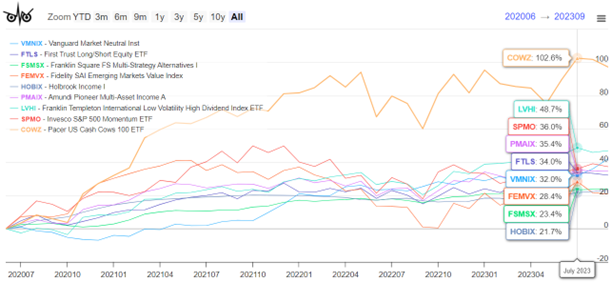

Table #4: Short List of Trending Funds (Metrics -Four Months)

Pacer US Cash Cows (COWS) has done well over the past few years. In the next section, I add the Pacer Trendpilot 100 Fund (PTNQ) for comparison.

Figure #3: Short List of Trending Funds (Metrics -Four Months)

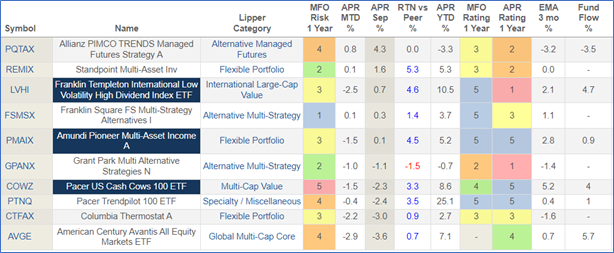

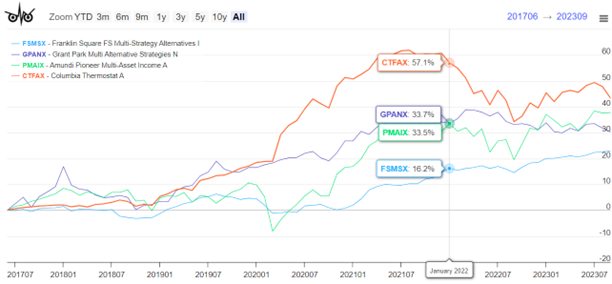

COMPARISON TO AUTHOR’S FUNDS

In this section, I selected some of the more conservative funds from the previous section and compared them to some of the funds that I own (PQTAX, REMIX, GPANX, CTFAX). I want to take a closer look at the two Alternative Multi-Strategy funds (FSMSX and GPANX) and the two Flexible Portfolio Funds (PMAIX and CTFAX) to see if I want to make a trade.

“APR MTD” returns are October returns through the 24th. I own a small starter position in American Century Avantis All Equity Markets (AVGE) and plan to add to it on major pullbacks.

Table #5: Comparison to Author’s Funds

While I am a bit disappointed with the short-term performance of GPANX and CTFAX, I am satisfied with their longer-term performance and not ready to make a trade at this time.

Figure #4: Comparison of Author’s Funds to Similar Categories

Closing Thoughts

October is typically a poor-performing month for stocks, and last month, stocks supported this trend. I initiated a Roth Conversion in a managed account, which will have a small impact on increasing allocations to equities. For the next few months, I will continue to extend the duration of bond funds. I expect that stocks will be lower next year as the economy slows, and I plan another Roth Conversion next year. If stocks do fall as I expect (hope), I will switch from buying longer-duration bond funds to equities.