Explore how AI is driving change for tax and accounting professionals

– including over 400 within tax & accounting firms-were surveyed to gain insights into the forces driving change in professional services. Join us as we delve into the major trends transforming the tax profession and explore how tax professionals and leaders can gear up for future challenges.

|

|

Jump to:

AI’s growing impact on the tax profession ↗

Two areas where AI is driving improvements ↗

How to prepare for the future ↗

AI’s growing impact on the tax profession

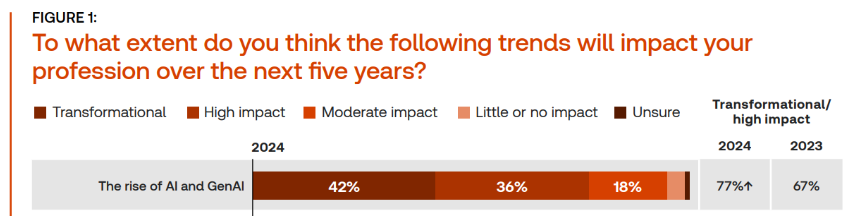

According to the report, an overwhelming majority of professionals acknowledge the high or transformational impact AI is expected to have on their work within the next five years. This sentiment is a sharp increase from the previous year, indicating a rapid shift in perception and adoption.

A sizable contingent of respondents expresses frustration with the sluggish adoption of AI within their respective firms. The idea of falling behind and surrendering competitive advantage looms large, underscoring the imperative for tax and accounting professionals to seize the opportunities presented by AI. Procrastination in AI implementation risks incurring avoidable costs and forfeiting lucrative growth prospects in the long term.

AI technologies are poised to revolutionize traditional practices by automating routine tasks such as data entry and task scheduling. This shift not only frees up valuable time but also allows professionals to focus on more complex and advisory aspects of their roles, thereby increasing their strategic importance to clients. Additionally, 45% of tax and accounting respondents saw immediate opportunities for improving client response times.

“As a professional, I do spend a lot of time explaining things to my client that can be very technical. I would draft emails in tax technical areas that explain [it] in layman’s terms.”

– Survey respondent, when asked how they’d use AI

Read the full report to learn more about:

- The state of AI now

- The forecasted pace of AI adoption

- Forces influencing the pace of AI adoption

Read the Future of Professionals 2024 Report ↗

Two areas where AI is driving improvements

According to the report, AI is set to drive improvements in workplace productivity, which will free up time for professionals to focus on delivering greater value.

Improved productivity

58% of tax & accounting professionals report feeling that they lack sufficient time to accomplish all their desired tasks in their current positions.

Our research indicates that tax & accounting professionals are extremely optimistic about the potential for AI to liberate additional hours for work, estimating saving an average of 5 hours per week within the first year. Given that the average professional works around 48 weeks annually, this translates to approximately 200 hours saved each year.

The question then becomes: How will professionals choose to use that time they’ve saved?

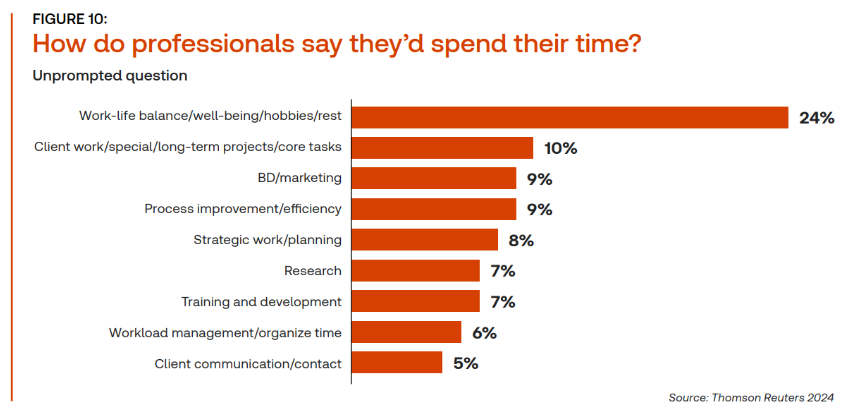

With AI handling routine tasks, tax professionals can reallocate their time to activities that truly matter. The top three activities that professionals would like more time for include:

- Work-life balance

- Client work

- Business development/marketing

24% of all respondents noted wanting more time for work-life balance, well-being, hobbies, and rest. With AI handling the more mundane aspects of work, professionals can use the time saved towards , such as personal well-being, family, and leisure activities, ultimately leading to increased job satisfaction and reduced burnout.

More than one-third (34%) of those respondents at tax & accounting firms mentioned work-life balance as the main area to which they’d like to devote more time.

Increased value

By reducing burnout and using new-found time to focus on strategic tasks, professionals can enhance value and position both themselves and their organizations for ongoing success in a complex and competitive landscape.

Respondents in the report noted three levels in which AI can help deliver greater value. One of those areas is the ability to add value directly to their work. In particular, respondents see AI’s value in handling large volumes of data more effectively, reducing human-made inaccuracies, and providing advanced analytics due to human error.

Almost 40% of respondents said they are most excited about the potential of new technology to help do the current work faster and add value to the work they do.

How to prepare for the future

It is crucial for tax professionals and leaders to proactively prepare for the future, as the impact of technology continues to grow. Here are three key areas where professionals should focus their efforts in the next year:

1. Stay educated and informed

Technology is always changing. Continuously learning and understanding AI advancements helps tax professionals remain competitive and compliant in a rapidly evolving digital landscape.

2. Explore and adopt new technologies

Proactively adopt and integrate trusted solutions to boost operations and services. By keeping up with technological innovations, tax professionals can enhance efficiency, offer greater value to clients, and secure a competitive advantage.

3. Embrace change and foster a culture of innovation

Encouraging a culture of new ideas is crucial, where individuals are empowered to try new advancements and approaches. Training and resources are essential to help employees develop their tech skills and stay updated with the latest developments in the field.

|

|