This Motley Fool Stock Advisor Review was updated for 2022. Please read until the end to see how these investments are performing today!

The stock market has been extremely hectic over the past few months. There is no doubt about that. I haven’t been checking in on my investing portfolio simulator during all of the ups and downs because, generally speaking, it is best to let your investments sit for a while. However, I wanted to take a look and see how my Motley Fool stock advisor returns were performing. Here’s a look.

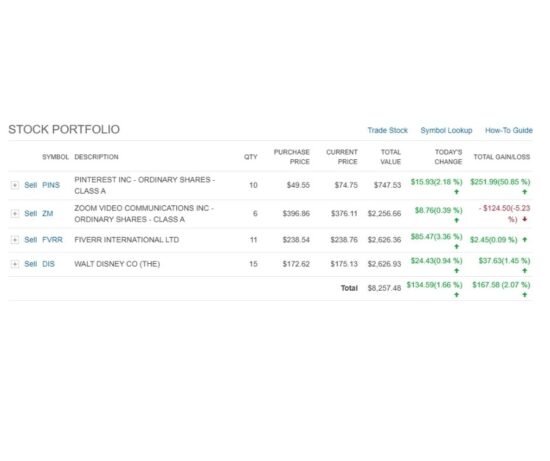

My Stock Advisor Returns

I was pretty shocked to see that many of my investments on the Investopedia simulator showed positive returns, despite the volatile trading environment we are in currently. The only investment I’ve lost money on is Zoom. Since buying my shares of Zoom, the stock has gone down about $20 per share. Again, given how the market has been, that’s really not that bad.

How The Motley Fool Suggestions Have Changed

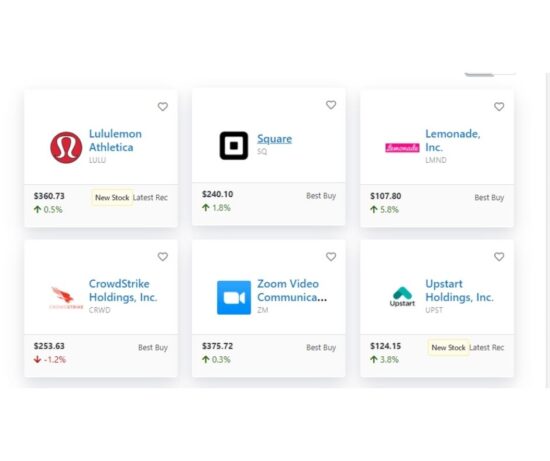

There isn’t much about The Motley Fool suggestions that have changed over the past few months. As it was before, many of the stocks they are suggesting people invest in are tech-focused. This continues to be true. Pinterest has been taken off their suggestion list for now though. It has been replaced by company names like Lululemon and Lemonade, Inc.

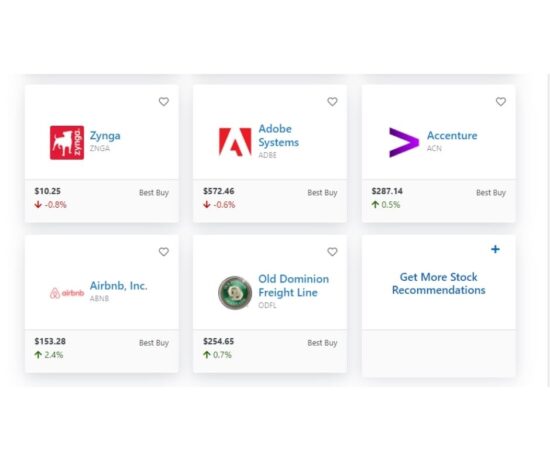

Airbnb and Old Dominion Freight Line are two new additions to the stock suggestions as well. Many of the other stocks listed have been previously suggested by The Motley Fool though.

Another thing that did not change is the stock advising pros are still suggesting people invest in Zoom. This is likely because people are continuing to work from home or remote workspaces. So, Zoom is going to continue to be a necessity for many employees to collaborate with their coworkers for the foreseeable future.

Will I Change My Investments?

Given what The Motley Fool’s services have taught me so far and their current suggestions, I’m not going to be making any changes to my investment simulator for now. Although they are not currently suggesting Pinterest, it has been a top performer for me from the beginning.

I’m also going to keep my Disney stock. As mentioned in my previous update, that is just a stock I’ve always wanted to own and it has historically performed well. It has done my portfolio some good too.

My other two investments, Fiverr and Zoom, are both tech-related stocks. Although they haven’t given my portfolio much right now (or even have lost me some money), I’m going to stick it out with these two and see how they fare. I think Fiverr will continue to do well with the rising gig economy and Zoom has continued to be recommended by The Motley Fool.

All of that being said, my stock advisor returns are still in the black for the year. I’m up 2% overall with some of my investments (I’m looking at you, Pinterest) earning more than 50% in returns thus far.

2022 Update – How Are My Investments Doing?

Life has really gotten crazy over the last year since I’ve updated you all about The Motley Fool‘s stock picks. Our family welcomed a little one into the world and I haven’t changed anything in the investment simulator since June 2021. Let me just say, wow! I feel for investors in today’s market.

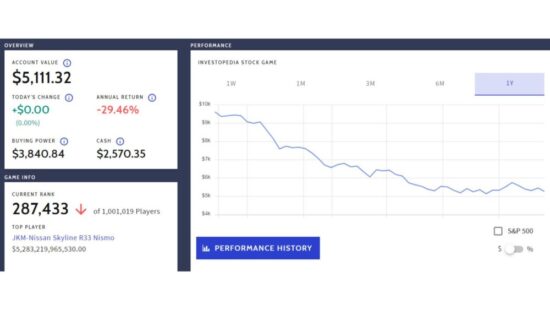

Here is a look at what my portfolio would have done over the last year, untouched.

As you can see, my investments have lost nearly half of their total initial value. I can’t blame The Motley Fool for that one though – I haven’t updated my portfolio or checked their picks. I’m interested to see how their suggestions have changed though!

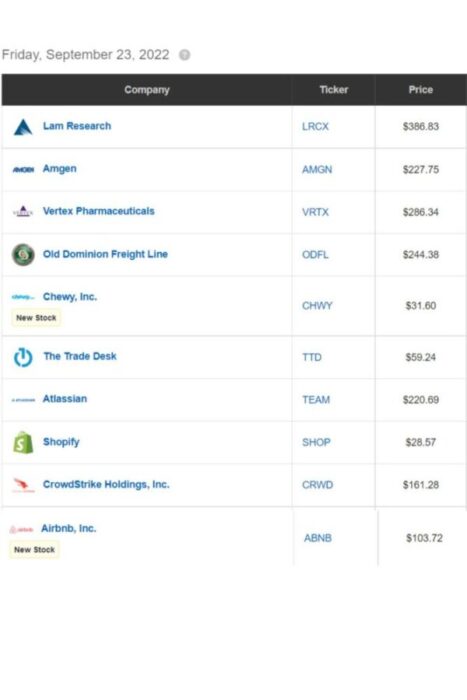

What Are The Motley Fool Stock Picks In September 2022?

The Motley Fool stock picks look completely different than they did in June 2021. It honestly feels like I’ve time traveled! Take a look at the difference…

Just a few of these companies held out in The Motley Fool stock picks over the last year or so. Old Dominion Freight Line held pretty solid. CrowdStrike Holdings, Inc. and Airbnb, Inc. also continue to be recommended by the investing experts.

Unfortunately for me, I did not decide to move forward with any of those companies back in June. Instead, I held Walt Disney, Fiverr, Pinterest, and Zoom. I’ll say, I’m glad that it was just a simulated investment! Then again, I’d probably have made some changes to my portfolio sooner if it was my money.

Latest Changes To My Portfolio

Given the strength of some of The Motley Fool‘s previous recommendations, I’ve moved some of my investments around. I decided to sell all of my previous stock and trade the following: Old Dominion Freight Line, Inc. (ODFL), CrowdStrike Holdings, Inc. (CRWD), Airbnb, Inc. (ABNB), and Chewy.com (CHWY).

I’ll give the investments some time to “do their thing” and come back to update you on how they perform.

Readers, have any of you tried a stock advising service? What was your experience?