Staying compliant is no longer just about avoiding penalties; it is about optimizing resources and enabling tax departments to contribute strategically.

The world of indirect tax compliance is a complex and ever-changing landscape. This is especially true for businesses with e-commerce platforms navigating the constantly evolving rules and regulations across different jurisdictions. The world is moving towards digital tax systems and real-time reporting. Unsurprisingly, many corporate tax departments are struggling to keep up.

The price of inefficiency

A recent Thomson Reuters report, “Challenges and Changes in Indirect Tax & Compliance,” highlights the challenges tax departments face. The report paints a concerning picture. Businesses struggling with limited resources are more likely to face audits and penalties. 72% of under-resourced tax departments experienced audits compared to just 61% of well-resourced ones. This translates to significant financial repercussions, with companies incurring penalties exceeding $50,000.

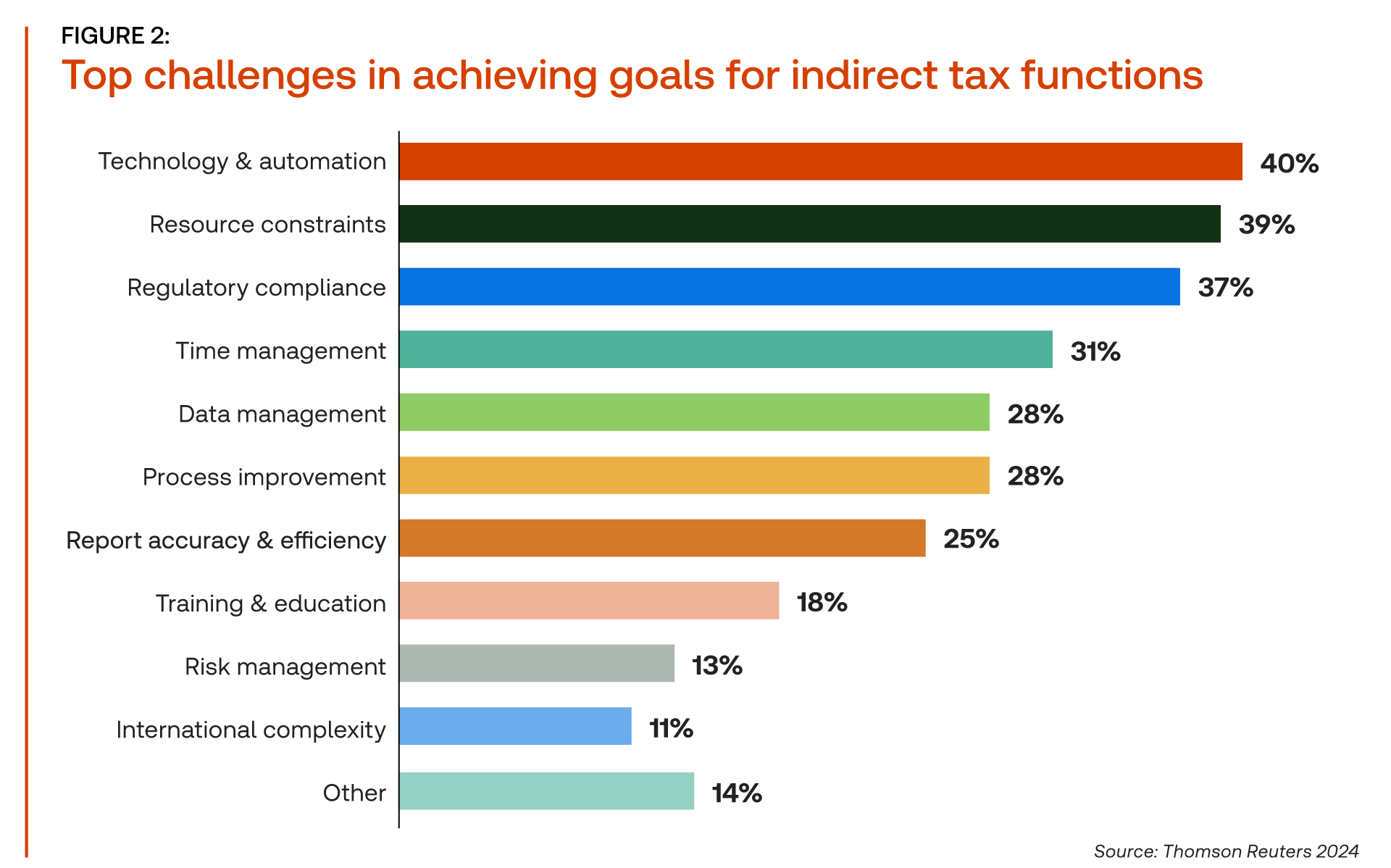

40% of respondents identified technology and automation as the biggest hurdle to achieving efficient tax function goals. Resource constraints were another major problem, with 39% feeling under-resourced and 25% feeling they could report accurately and efficiently.

These limitations often lead to inefficiencies in managing processes, data, and time. As a result, tax departments struggle to move beyond compliance and become strategic partners within their organizations

The power of automation in the indirect tax process

So, what’s the solution? The answer lies in embracing a unified, holistic approach to indirect tax transformation. This means moving away from separate, old systems and using integrated technology that can handle the needs of modern business taxation.

Imagine a system where a single change automatically updates all your systems, ensuring accurate tax calculations across all jurisdictions. This is the power of an automated tax engine integrated with your ERP. This centralized approach streamlines compliance, reduces errors, and frees up valuable time for tax teams to focus on strategic initiatives.

An integrated tax engine offers several benefits, including:

- Efficiency: Automates repetitive calculations, handles high transaction volumes quickly and accurately, and streamlines reporting processes.

- Compliance: Ensures adherence to local and international tax regulations, including e-invoicing requirements, and provides automatic updates for changing tax laws.

- Real-time insights: Offers real-time access to tax data, enabling immediate reporting and proactive adjustments for continuous compliance.

- Seamless integration: Integrates with existing ERP systems for a unified platform, reducing IT complexity and ensuring data consistency across all business functions.

- Cost-effectiveness: Minimizes manual effort, reduces the risk of costly penalties, and frees up resources for strategic allocation.

When choosing a tax management solution, prioritize:

- End-to-end automation: Look for a solution that automates the entire indirect tax process, from calculation to reporting.

- ERP integration: Ensure seamless data flow and accuracy with a solution that integrates directly with your ERP system.

- Real-time tax determination: Choose a solution that provides real-time tax calculations for both sales and purchase transactions.

- Global coverage: Seek a solution that covers a wide range of tax jurisdictions and provides automatic updates for changing regulations.

- Comprehensive reporting: Opt for a solution that offers robust reporting capabilities for analysis and audit defence.

- Cloud-based platform: Choose a cloud-based solution for accessibility, scalability, and data security.

- Strong vendor partnership: Select a vendor with proven experience, reliable support, and a robust integration program.

Remember, implementing new technology requires a well-planned approach to change management. Choose a vendor that prioritizes training and support to ensure a smooth transition and maximize the benefits of the solution.

Invest in automating the indirect tax process

Investing in an integrated, automated tax engine is not just about simplifying compliance. It is about helping corporate tax departments confidently handle today’s complicated tax laws. This lets them focus on what is most important – helping the business grow and succeed.

|

|