Hi, guys.

You made it. You survived Covid and being kicked off campus midway through spring of your freshman year. You survived a year of Zoom. You survived that weird casserole the dining commons kept serving. You survived me. And, at the end of it, you were standing together, laughing and glowing. We’re incredibly proud of you and hopeful for the good you can do in the world.

I’ve never aspired to deliver a “last lecture” for graduates, but you might consider this as my last advice before you sail too far from the safe harbor we’ve offered. Here’s the gist of it:

Do not let money rule your life. Money is just a tool to help you live a life that will make you feel engaged, secure, and satisfied. Money is not the object of life. Don’t obsess about it.

That has two parts: (1) live a conscious, frugal life. Buy what you need, not what you want. Spend money on experiences and time with friends. And (2) use reasonable frugality as a way to build security. That is, in the long term, you’re better off spending a little less and putting aside a little more because, when push comes to shove, your needs will be modest, and your resources will be rich.

Let me walk you through that.

A young investor has one great enemy: inflation.

We often think of inflation’s concrete, daily manifestations: a medium latte (they can call it “grande” if they want, but it’s “medium”) is four bucks, and a “one pound can of Folgers” now weighs 9.6 ounces. As if to reassure you, Cheerios now comes in MEGA SIZE (21.7 ounces), GIANT-SIZE (20 ounces), FAMILY SIZE (18 ounces – don’t blame me, the all-caps thing is their idea), LARGE SIZE (12 ounces) and, I guess, regular size (8.9 ounces). Regular translates to six wimpy bowls of cereal.

For an investor, inflation is an insidious enemy that chews your savings to bits. Inflation sits at about 3%. Deposit $100 in a savings account today (once you get past the teaser rates and asterisks, banks pay 0.05% on savings today), and it will buy $75 worth of stuff in 10 years. $56 worth of stuff in 20.

A young investor has one great ally: time.

The American economy and its stock market have grown relentlessly for 150 years. In the short term, there are horrifying setbacks. In the medium term, there are flat periods. But in the long term, there’s relentless growth, after inflation is accounted for, of about 8% per year. Here’s what that looks like: if you just put $100 into the market and walk away, then what happens if you budget $100 a month forever?

| Starting value of $100 | Inflation-adjusted return | Real return if you add $100 / month |

| 10 years later | $215 | 18,300 |

| 20 years later | 466 | 57,700 |

| 30 years later | 1006 | 142,300 |

| 40 years later | 2176 | 326,000 |

“Real return” is the amount you have after accounting for the effects of inflation. Your “nominal return” is the amount you’d see on your brokerage statement. At the end of 40 years, your account would have $564,000, but that would buy the equivalent then of having $326,000 today.

By the way, $100 in a savings account for 40 years leaves you with $30 in spending power. Add $100 a month to that savings account, and at 3% inflation, you’d end up with $14,900 in buying power.

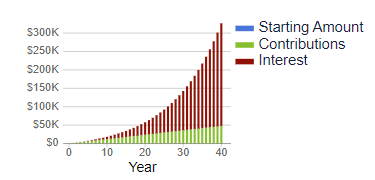

For visual learners, here’s the combination of starting early, chipping in monthly, and making purely ordinary returns in the stock market.

Yes, I know. Student loans. New apartment. Work clothes. Here’s your plan: you’ll get serious about investing in 10 years when you’ve paid off your loans and such. Here’s the price of surrendering ten years to inflation:

Yes, I know. Student loans. New apartment. Work clothes. Here’s your plan: you’ll get serious about investing in 10 years when you’ve paid off your loans and such. Here’s the price of surrendering ten years to inflation:

Start now: end with $326,000

Start in 10 years: end with $142,000

Start now, and it takes $100/month to hit $326,000 in 40 years. Starting in 10 years, it will take $220 a month for the next 30 years. Start now, and $48,000 in lifetime contributions will get you $326,000 in real returns. Wait a decade, and it will take $84,000 to get you there.

Can you imagine how happy you’d be to one day look in a shoebox under the bed and discover $564,000 in it? That’s what you’re capable of.

Don’t wait.

The three-step plan

-

-

Avoid stupid consumption.

You know this is my specialty (Comm 240 / Advertising and Consumer Culture for the past 30 years) and my passion. Collectively, marketers and advertisers in the US spend about $500 billion a year trying to get you to buy s**t you don’t need. Here’s the ugly truth: if you actually needed it, they wouldn’t have to spend a half trillion dollars to motivate you.

Do not buy from Shein. Their stuff is designed to last only two or three uses before being landfilled. The average Shein shopper spends… wait for it! $100 a month on disposable clothing on that site.

Do not subscribe to Amazon Prime. The cost keeps going up, and they’re playing danged intrusive ads on their movies. Amazon Prime tricks you into impulse purchases you’d never make if you had to pay a reasonable shipping fee. The average Amazon Prime subscriber spends $1400 a year at Amazon, more than twice what other people do. Including the Prime fee, you’re likely to sink $1550 a year into the Bezos Machine. Don’t.

Do not buy a high-end cell phone. We both know that you hate being addicted to them. That’s $1599 to have your life sucked away, pixel by pixel. You’d enjoy life a lot more with a flip phone/dumb phone/feature phone at $90. If your phone is sufficiently boring, you might be forced to, you know, stop phubbing, meet people and talk with them. And, who knows, maybe have sex? 35% of smartphone users admit that their love lives have sort of … shriveled.

Do not buy an SUV. Ever. SUVs and the things that used to be pickup trucks are 80% of new car sales in the US. They are huge, unwieldy, unsafe, and crazy expensive. They average $38,000 … and that’s before you factor in loan payments. The profit margin on an SUV is five times greater than on a car. They’re selling you a fantasy about domination and freedom and nature. Dude, you’re just going to the mall. Upgrade your fantasies, downgrade your vehicle.

Do not buy a new car. Ever. Nothing falls faster in value than a new car. The average price of a new Camry (my car) is $30,000. A year-old Camry runs $25,000. A two-year-old is around $23,000. With reasonable care, a Camry lasts 12-15 years. If your car loan is 48 months, you get 8-11 years without a car payment.

Don’t default to living in a trendy city. Much of America’s housing crisis is driven by the insistence that you really, really, really want to live in Phoenix (average house: $480,000, average July high: 104 degrees), Dallas ($370,000 and 97 degrees), Denver ($550,000, 84 degrees) or Chicago ($370,000, 86 degrees). Consider Green Bay ($250,000, 80 degrees), Pittsburgh ($217,000, 84 degrees) or the Quad Cities ($170,00, 86 degrees). And before you say anything silly, there are good jobs and interesting things to do there. Smaller cities tend to be more affordable, often offer a better quality of life … and many are located outside the Furnace Zone.

-

Open a brokerage account at Schwab.

It takes about ten minutes, a copy of your bank account information, and virtually no mental activity. Once you have an account, set it up to automatically transfer, say, $100 from your bank account to your Schwab account around the first of each month.

Really. Ten minutes.

-

Create a low-stress investment portfolio, then get on with life. In general, you want boring investments. Deadly dull stuff that you never need or want to look at. Interesting investments are dangerous, and exciting investments are deadly. Two reasons. First, because you’ll start looking hourly and tweaking daily and screw yourself by getting it wrong more often than you get it right. Second, because by the time you’ve learned about “the next big thing,” a million other people – including tens of thousands of predatory professionals with huge honkin’ computers and high-frequency trading algorithms – got there ahead of you and have thoroughly gamed the system.

No memes. No crypto. No AI. No fine art.

For the bold, an all-stock, all-the-time investment fund: GQG Global Quality Equity Fund. One of the world’s premier stock investors, Rajiv Jain, builds a portfolio of 40 exceptional companies, which he purchases only when the price is good. The fund has returned 16% a year for the past five years. Cost to open an account: $100.

For the bold, who prefer exchange-traded funds: GMO US Quality ETF, which is the first fund for regular people offered by GMO. This ETF uses the same process used in the $10 billion, five-star GMO Quality fund, which has made 17% a year over the past five years. Two differences: the ETF only invests in the US. And the ETF does not require a $5 million minimum purchase.

For people who really just want to start a one-stop retirement fund, Schwab Target 2060 Index. This ultra-cheap fund invests in a collection of other index funds; that is, funds that passively mirror the market rather than trying to outperform it as GQG and GMO do. It starts out by investing 95% of your money in stocks, but as retirement approaches, it becomes systematically more conservative so that you have less risk of falling victim to a stock market crash just as you were thinking of retiring. Minimum purchase: $1.

Finally, for people who would really prefer not to lose much money along the way (stock markets periodically cause 25-60% of your investment to evaporate, which some find disquieting), FPA Crescent combines the absolute value discipline that infuses the FPA operation with the willingness to invest in any part of an attractive firm’s capital structure: common or hybrid equity, debt, loans or whatever. The team’s emphasis is buying high-quality companies plus a small set of intriguing, shorter-term opportunities as they present themselves. At base, the absolute value investors say, “We’ll only buy if we’re offering an attractive security priced with a compelling margin of safety; absent that, we’re going to wait.”The fund has returned 11% a year over the past five years with dramatically less risk than the market. Minimum investment: $100.

-

I have enjoyed our time together. You have made my life richer with your intensity, your silliness, your questions, and your goofs. They’ve kept me alert and cheerful. I hope these final words do something similar for you, young Jedi.