On December 31, 2019, Oelschlager Investments launched the Towpath Focus Fund (TOWFX). The fund invests in 25-40 domestic stocks regardless of market capitalization. The fund is managed by Mark Oelschlager.

On December 31, 2019, Oelschlager Investments launched the Towpath Focus Fund (TOWFX). The fund invests in 25-40 domestic stocks regardless of market capitalization. The fund is managed by Mark Oelschlager.

Towpath is a concentrated, all-cap equity fund. The portfolio currently holds 41 securities. About 15% of the portfolio is invested in non-US stocks and 12% in cash. Compared to its Morningstar peers, the fund has more cash, more international, and more small-cap exposure. The portfolio stocks are higher growth companies (measured by sales, cash-flow, and book value growth) that sell for lower prices (measured by price-to-book, price-to-earnings, and price-to-sales) with higher returns than either their peers or their index.

Portfolio construction begins with macro-level assessments of the economy, proceeds to analyses of industries and sectors, then ends by buying and holding the most attractive stocks in the most attractive sectors. Mr. Oelschlager has a long and adamant tradition in favor of buying and holding just a few best-of-class stocks so that one might anticipate turnover in the single digits. While the reported turnover is higher than that, almost all of the portfolio stocks were first purchased in the fund’s opening months. In 2022, just three new names appeared: Novartis, Hillenbrand (a manufacturer most known for its funeral products subsidiary, Batesville), and online travel agency Booking Holdings.

The portfolio is not static but is responsive to long-term dynamics rather than short-term frenzies.

We manage our portfolios in a way that respects the potential for change. In fact, we regularly try to find opportunities in stocks that would be positively impacted by the potential change. Oftentimes, the market prices securities as if prevailing conditions will be in place for a long time, but history shows that change is normal. Understanding this helps us not only find attractive investments but avoid potentially damaging ones as well. (2022 Q3 shareholder letter)

Sometimes, people matter

Sometimes, people matter

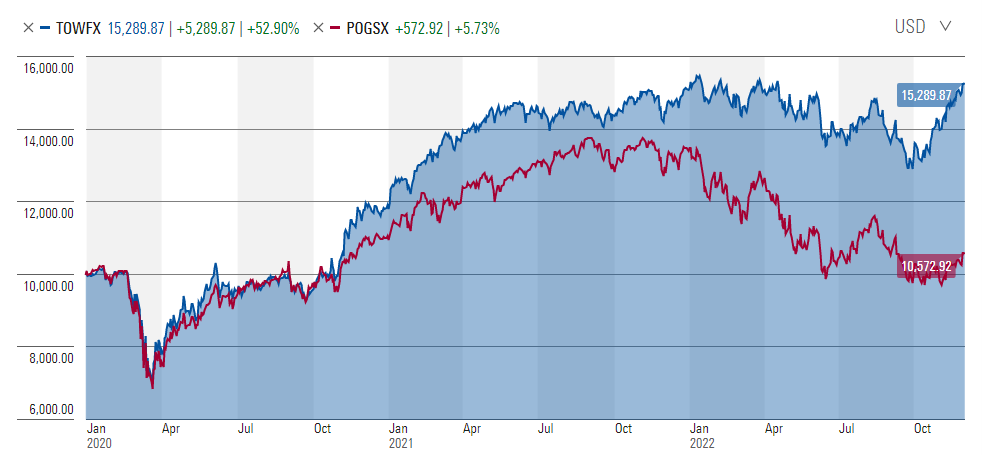

We first began tracking Mr. Oelschlager about 15 years ago during his time at Oak Associates. Mr. Oelschlager served as manager of Pin Oak Equity Fund (POGSX) from 2005-2019, initially as a co-manager, then beginning in June 2006, as sole manager. Mr. Oelschlager also managed or co-managed five other funds, served as the co-CIO for Oak Associates, and was responsible for about 700 million dollars in separately managed accounts.

His performance at Pin Oak Equity was consistently remarkable. Over a 10-year stretch in the heart of his time as manager, Pin Oak returned 11.3% annually and beat its peer group, and the S&P 500, by 400-500 bps. It was a bit more volatile than either, but its returns were so far superior that it beat its benchmark and peers by every risk-return metric we followed: Sharpe, Sortino, and Martin Ratio, as well as Ulcer Index. Our 2017 profile of Pin Oak Equity pointed to the fact that in the years following Morningstar’s decision to eliminate analyst coverage of the fund, it continued to club its peer group.

Then, in 2019, Mr. Oelschlager and his wife, Tina, who served as a Relationship Manager for Oak Associates, left Oak Associates and launched Oelschlager Investments together. The Oelschlagers demonstrated to the SEC that the strategy he pursued at Pin Oak is identical to the Towpath Focus strategy; as a result, they were able to include Pin Oak’s performance record in their initial prospectus.

The performance of the two funds since his highlights the point: sometimes people matter.

Same strategy, similar expenses, 5000 bps difference in returns.

In particular, it appears that Mr. Oelschlager matters. Towpath Focus has accumulated a remarkable record. Earlier in his career, Mr. Oelschlager generated substantially higher returns at the price of modestly higher volatility. Since the launch of Towpath, he’s had the rare distinction of higher returns plus lower volatility, reflected in dramatically stronger risk-adjusted performance.

Towpath Focus, performance from inception through 11/2022

| APR | APR vs peers | Max DD | Std Dev | DS Dev | Ulcer Index | Sharpe ratio | Sortino ratio | Martin ratio | MFO rating | |

| Towpath | 13.2 | – | -18.7 | 19.4 | 11.0 | 5.5 | 0.65 | 1.15 | 2.31 | 5 |

| Multi-cap value group | 6.9 | +6.3 | -27.7 | 22.6 | 15.7 | 10.0 | 0.28 | 0.41 | 0.67 | 3 |

| S&P 500 | 8.3 | +4.9 | -23.8 | 21.2 | 14.2 | 9.1 | 0.36 | 0.54 | 0.85 | 4 |

| Return | Risk | Risk-return metrics | ||||||||

The first two columns measure Towpath’s average annualized returns compared to both its peers and the S&P 500. The next three columns highlight volatility, sometimes abbreviated as “risk.” Those report the maximum drawdown (i.e., biggest fall), standard deviation (day-to-day volatility), and downside deviation (aka “bad volatility”). Finally, five measures that capture the balance between return and risk: the Ulcer Index (a measure that combines the depth and duration of an investment’s worst declines, whimsically anticipating how bad an ulcer you might from it), the three standard risk-return measures in order of increasing risk-aversion (if you really dislike losing money, focus on Martin rather than Sharpe) and finally MFO’s synthesis.

The fund shows the same pattern of outperformance against the Russell 3000, Lipper Multi-cap Core, and Morningstar Large Value benchmarks and peer groups.

Why are Towpath’s investors winning?

Our best guess: they’ve got a very good manager who has thrived through three bear markets, seven corrections, several periods of delusional investor exuberance, interest rates crashing to below zero, and Fed funds rates increasing 10-fold in a year. If we learn from adversity, Mr. Oelschlager seems to have taken the opportunity to learn rather a lot.

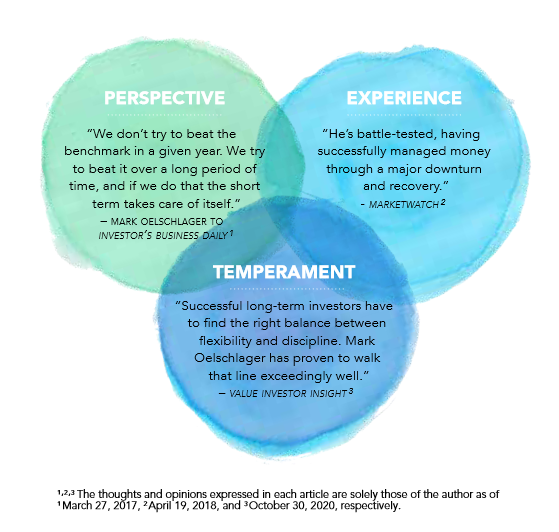

He argues that Towpath has three structural advantages: a longer-term perspective than most, more experience than most, and a more patient strategy than most. They encapsulate that claim in a nice graphic:

One of the nice things about smart, experienced managers is that they’ve got better impulse control than the rest of us. While the Robinhood investors are getting buzzed on Tesla stock, bored apes, and crypto exchanges (he notes that $2 trillion in crypto assets have evaporated in two years and “we largely avoided these traps”), Mr. Oelschlager was buying classic quality growth stocks that have been (temporarily) relegated to the dusty world of value investments.

Reflecting on what he’s learned in 31 years as a professional investor, a period that involved a variety of strategies and a variety of markets, he notes:

We manage the fund differently than we did a long time ago and with each cycle, we get a little bit better at limiting downside risk. I’m constantly thinking about how other people are behaving. I get more nervous when things are going well and I’m more nervous now than I was a year ago… My instinct right now is to move incrementally in the direction of stability and defensiveness.

We recognize that we’re not infallible; we have to protect ourselves and protect our shareholders from the possibility that we might be wrong.

The year ahead promises to be challenging (“the near-term picture is bleak,” he admits), and the decade ahead might well be nothing to write home about: Vanguard is forecasting 10-year US equity returns of 4.7-6.7%, Research Affiliates projects it at 2.3%, Morningstar sees 5.5% – all before adjusting for inflation).

The key to thriving in uncertain times is, we’ve argued, having a steady and rational strategy executed by a proven manager. Towpath offers that. You should go learn more.

The administrative stuff

The institutional shares carry a $2,000 minimum. That’s reduced to $1,000 for accounts set up with an automatic investing plan. The expense ratio, after waivers, is capped at 1.10%. The fund is available for direct purchase and through Schwab. If they can offer proof of sufficient investor interest, they’re willing to pursue the burdensome task of getting on other platforms as well.