Do you have a retirement plan? Chances are, you do. Retirement account owners typically have either a 401(k) from a current employer or an Individual Retirement Account (IRA). But did you know that you can use your IRA to start a business — or grow your existing business?

This is called 401(k) business financing — and it’s been increasing in popularity among aspiring and current small business owners. Essentially, 401(k) business financing lets you use money from your retirement plan to start a business or access more capital for your current business! And you can keep growing your retirement funds as your business grows.

Whether you have a 401(k) or an IRA, you should know how your retirement investment strategy can contribute to your financial success. You should also know how many dollars you have in retirement plans and how you can use them to your advantage.

But how do you know if you qualify for 401(k) business financing or if it’s the best business decision for you? Keep reading to find out. When it comes to business funding, the more you know up-front, the better!

What Are IRAs?

An Individual Retirement Account (IRA) can be a smart way to save and grow your financial assets. Why? You can get favorable tax arrangements when you put funds in an IRA.

In fact, if you ask a financial planner, you’ll likely hear that IRAs are one of the more flexible retirement-saving methods available to most people. Still, there’s a lot of misinformation about what you can do with the cash in your IRA, even among certified financial advisors.

Most know that you’ll face withdrawal and tax-penalty fees if you withdraw funds from your retirement early. But did you know that you can use your retirement assets — with tax-free withdrawals — to fund a business?

If you want to fund your business debt-free and cash-rich, you can use your IRA for business financing.

Can You Use Your IRA to Start a Business With a Loan?

Not technically. You’re not taking out a loan when you use your IRA to start a business or fund your business. Instead, you’re using the retirement dollars you already have in your IRA account as an investment into a privately held business. And it’s possible to do so without worrying about a taxable event or early withdrawal penalty fees.

All you need to know is the IRA transaction rules — and find the right financing method for you.

Business Financing with Rollovers for Business Startups (ROBS)

One of the most popular business financing methods is 401(k) business financing, also known as Rollovers for Business Startups (ROBS). ROBS allows you to simply roll over funds from your retirement plan into your business. In a nutshell, to use ROBS, you’ll need to register your business as a C Corporation business entity and create a 401(k) plan for your business. With ROBS, you can move money from your current retirement plan into your new 401(k) plan, which can then be used to fund your business debt-free. Remember: ROBS isn’t a loan! ROBS allows you to finance your business with money from your IRA or 401(k) plan. And you don’t have to worry about debt, tax penalties, or withdrawal fees.

Want to know the ins and outs of 401(k) business financing? See our Complete Guide on Rollovers for Business Startups (ROBS).

Borrow IRA Funds with 60-Day Rollovers

Another way to tap into your retirement funds is using the 60-day distribution rule. The Internal Revenue Service (IRS) often refers to this as 60-day rollovers. As the rule’s name suggests, the IRS will give you 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. While you can’t take funds directly from your IRA (like you can with ROBS), you can use the 60-day rollover to temporarily borrow money from your IRA. But using the 60-day rollover does come with risks.

Self-Directed IRAs

You can also invest more unique assets in your retirement savings through a self-directed IRA. A self-directed IRA is a type of individual retirement account. It allows you to save for retirement with unconventional assets like real estate or cryptocurrencies. However, a self-directed IRA can be complex, difficult to manage and incur additional fees. Some investors use the tax advantages of an IRA to diversify their investments and use non-traditional assets as investments.

Loan Differences Between an IRA and 401(k) Plan

There’s often confusion between IRAs and 401(k) plans because most 401(k) plans allow you to borrow from your account through “participant loans.” In other words, you can use the money from your 401(k) for any purpose — but you can only borrow up to $50,000, which is the lesser of 50 percent of the total amount of funds in your 401(k) plan, or $50,000. There might also be a relatively short repayment term. IRAs don’t allow participant loans, unlike 401(k)s and other plans such as 403(b)s, 457 plans, other types of profit-sharing plans, or as a defined benefit of a pension.

In short, you can’t take a loan from your IRA for any reason, including starting a business. The closest thing to taking a loan from your IRA is using a 60-day-rollover, which lets you borrow money from your IRA plan for 60 days. (See our above section “Borrow IRA Funds with 60-Day Rollovers” for more information.)

But you can still use the money in your IRA — without penalty or debt — to start a business or fund your business ventures through different types of transactions, like Rollovers for Business Startups (ROBS).

Can You Combine Retirement Plans for Business Financing?

Answer: No, you can’t combine retirement accounts with spouses or partners. But you can name a beneficiary of your account. Your spouse or partner can only roll over their retirement funds if they’re also involved in the business.

Do You Have to Quit Your Job to Use 401(k) Business Financing?

Answer: Not necessarily! You can keep your job and use 401(k) business financing by using an in-service rollover. An in-service rollover lets you access retirement funds from your current employer’s plan into your business’s 401(k) plan — while keeping your current employment.

You can also augment an in-service rollover with Rollovers for Business Startups (ROBS) to access funds from other retirement accounts.

Can Your IRA Invest in Your Business?

Investing your IRA funds can get confusing. Let’s break down some commonly used terms in IRA business funding, starting with prohibited transactions.

What’s a Prohibited Transaction?

The short answer? It’s a bad idea. The longer answer? A prohibited transaction is the improper use of IRA funds by the owner, which means you or the beneficiary of the plan, not the company or financial institution that holds the IRA.

The IRA assets are treated as if they were distributed on the first day of the year if a prohibited transaction occurs. But prohibited transactions come with consequences, like a taxable event, an additional tax on the amount involved, and early withdrawal fees (if you’re under the age of 59 ½). You want to avoid these scenarios! Let’s look at some examples of improper uses of IRA funds, which can cost you.

Examples of Improper Uses of IRA Funds:

- Taking a loan from the IRA. IRAs are prohibited from making loans to any party.

- Using IRA funds for a real estate purchase (including a rental home or other rental properties).

- Using IRA funds as collateral to secure a loan.

- Paying too much for IRA plan management.

Improper Uses of IRA Funds with Family Members:

- A sale, exchange, or property leasing between the IRA plan and a related family member.

- Lending money from your IRA plan to a related family member.

- Furnishing goods, services, or facilities using your IRA funds to a related family member.

- Transfer to, or use by, a related family member of the income or assets of the IRA plan.

- Act by a related family member whereby they deal with the income or assets of the IRA plan in their own interest or for their own account(s).

- Receipt of any benefit for their own personal account by any related family party in connection with a transaction involving the income or assets of the IRS plan.

What’s a Self-Directed IRA?

Are you a current or prospective business owner looking to use your IRA to fund a business? If so, you’ll need to know some key IRA rules. We briefly touched on self-directed IRAs earlier. In a nutshell, self-directed IRAs are passive investment vehicles used to invest funds in a business — but in most cases, not your own private business.

Note that you can’t use money from your IRA as collateral or as a down payment on a loan unless it’s a non-recourse loan. That means no personal guarantee is required. Additionally, these types of loans are only available through some private lenders who charge a healthy premium. And it’s challenging to find a private lender who will issue non-recourse loans. You’ll also want to be wary of predatory lending issues because these loans have less regulation!

If you use a self-directed IRA to invest in a business, keep in mind that you can’t be involved in running the business. Why? If you’re using money from your self-directed IRA to invest in a business you’re involved in, it’s considered a prohibited transaction.

Self-directed IRAs also don’t let you draw a salary from the business. You’ll only be able to possess up to 50 percent individual or personal ownership in the business.

How To Use Your IRA to Start a Business or Get Business Financing

Using an IRA to buy or fund a business is not prohibited as long as you use the right vehicle for that money. Rollovers as Business Startups (ROBS) is a strong financing option if you want to use your IRA to:

- Start a small business from scratch and buy business property.

- Buy an active business or become a franchise owner.

- Invest more into and expand your current business.

Remember: ROBS isn’t a loan or a self-directed IRA. With ROBS, you can access your money from your IRA penalty-free. It’s also important to note that ROBS is not a tax loophole; ROBS is a legal way to fund a business with your retirement funds. But how does ROBS work?

Let’s break down the crucial steps to fund your business with your retirement money using ROBS. See if your retirement plan qualifies for ROBS here.

How to Setup Rollovers for Business Startups (ROBS)

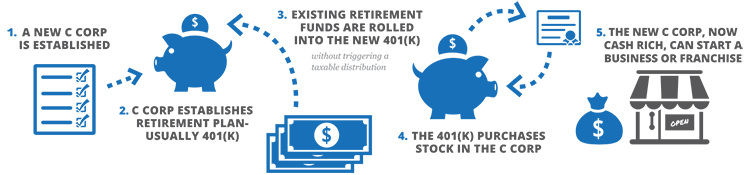

First, you need to establish a C Corporation (C Corp). That C Corp then establishes a retirement plan, usually a 401(k). Next, you can roll your existing retirement funds in your IRA or 401(k) into your new 401(k) for your C Corp.

Your C Corp’s 401(k) plan can also now act as your angel investor and purchase stock. The new C Corp can start a business or fund a franchise from there!

Once the ROBS process is complete and the business is funded, the money can be used for almost any business purpose. Unlike typical IRA investing or self-directed IRAs, the money from ROBS funding can be used to:

- Fund a start-up business from the ground up. With ROBS, you can easily use your IRA to start a business.

- Purchase an existing business or franchise.

- Put a down payment on a small business loan.

- Expand an existing business.

- Buy equipment, supplies, or rental property for your business.

ROBS funding allows new and seasoned small business owners to use their personal funds in an IRA to fund a business — without having to worry about prohibited transactions or loan payments.

And because you’re not working within the rules and regulations of self-directed IRAs, you can launch a fully operating business as an owner who can draw a salary. So, you’re in complete control of your retirement funds and your pay — without taking a taxable distribution. That’s why ROBS is becoming an increasingly popular way to use your IRA to start a business.

Want to know the ins and outs of 401(k) business financing? Look at our Complete Guide on Rollovers for Business Startups (ROBS).

Tailored Funding Options For You

If you’re ready to use your IRA to start a business or grow your current business, Guidant Financial can help you get started! We’ll walk you through the ROBS process and help you get the money you need stress-free, whether you’re a current or prospective business owner.

Contact us for a FREE consultation at 888-472-4455 or pre-qualify now for 401(k) business financing:

Hear our clients’ experience with Guidant and how they started their dream businesses using ROBS.