Let’s be blunt!

Why bury the lead?

“90% of everything is crap.”

That’s Ric Dillon, the fund’s PM, quoting Theodore Sturgeon (1918-85), a science-fiction author frustrated by a prevailing thought of his time– that works of science fiction are universally bad.

His defense of his chosen field, argued in a New York University lecture hall, can be boiled down to a simple argument.

- The law can be universally applied.

- To movies, tv shows, scientific studies, politicians, opinions

- And yes– to stocks

Why It Matters

While a broad generalization, Sturgeon’s Rule is a helpful reminder that investors should focus on owning funds with high quality and those, which in Mr. Dillon’s opinion, achieve higher returns with lower risk in the long run.

Go Deeper

Objective and strategy

The VELA Large Cap Plus Fund invests primarily in long and short positions in US large capitalization stocks with a targeted exposure of 80-100% of net assets.

The fund invests in companies that the Adviser believes are undervalued securities and shorts securities that are overvalued or have worse prospects than other investment opportunities.

It will also utilize derivatives to generate additional income in an attempt to limit the potential risks from short selling and for downside risk management.

The fund’s primary benchmark is the Russell 100 Index; its secondary is the S&P 500.

The fund’s long positions and their equivalents will generally range between 100% and 140% of the value of the fund’s net assets.

The fund’s short positions will generally range between 0% and 40% of the value of the fund’s net assets.

Adviser

Advisor VELA Investment Management, LLC

Founded in 2019, The Adviser also manages five Separate Account Strategies plus open-ended VESMX (a small cap value fund), VEITX (an international fund), and VIOIX ( an equity-oriented fund.

The family is rated Top by Mutual Fund Observer Premium (MFOP.)

Managers

The fund utilizes a full team approach. The PMs retain analyst responsibilities and use the title along with PM. Seven PMs total and four associates/analysts support the team as well.

Ric Dillon, CFA, one of the firm’s founders, serves as CEO and CIO and is joined by Lisa Wesolek, and Jason Job, CFA.

Together, they bring more than 90 years of combined investment experience to VELA.

They believe that vertically integrated wealth and asset management services and a strong grounding in a valuation-centric investment philosophy would uniquely enable the firm to meet their goal of delivering long-term results for their clients.

Early in his career, Mr. Dillon served as a portfolio manager for Loomis, Sayles & Company in Detroit, where it became the top-ranking office in the company with the large cap and Large Cap Plus value funds.

The Large Cap Plus fund that he started ranked No. 1 in its Lipper category after its first 12 months of existence.

In the 1990s, he founded Dillon Capital Management, serving as President and CIO until Loomis, Sayles & Company acquired the company, where he returned to work as a portfolio manager.

In 2000 he founded Diamond Hill Investments a public company (DHIL) based in Columbus, Ohio. During his tenure as CEO there, Diamond Hill ranked in the top 1% of all public companies in the US in terms of shareholder total return, with an annualized total return of 27%.

He retired from Diamond Hill Capital Management, Inc. as a portfolio manager effective June 30, 2018 and served as a portfolio manager for the Diamond Hill Long-Short Fund since its inception in June 2000, an experience he brings to VELIX.

Mr. Dillon received an MBA from the University of Dayton, an MA in Finance, and a BS in Business Administration from Ohio State University.

Kyle Schneider, CFA

Mr. Schneider is the co-portfolio manager of the Large Cap Plus Strategy and a research analyst. Prior to joining VELA, Kyle was a research analyst at Diamond Hill Capital Management covering healthcare.

He has industry experience since 2007, including various roles at Citigroup.

Kyle holds the Chartered Financial Analyst (CFA) designation, an MBA from the University of Chicago, where he graduated as a Wallman Scholar with High Honors, and a BS in Finance from The Ohio State University.

Go Deeper

Lisa Wesolek, CAP®, a co-founder of Vela with Mr. Dillon, serves as President and Chief Operating Officer and brings special expertise.

She has held senior leadership positions across firm operations, sales, client service, marketing, product development, finance, mergers and acquisitions, brand initiatives, product solutions and data-driven initiatives in the investment industry.

Also, she has worked with mutual funds, mutual fund complexes, mutual fund Boards, Institutional and Retail investors inclusive of all investment type structures such as hedge funds, hedge fund of funds, ETFs, separate accounts, commingled funds, private equity funds, all active funds and index funds in her thirty-plus year career.

She received an MBA from Ohio State University and a BS in Finance from Franklin University.

Strategy and closure

The managers anticipate closing the fund at 5B AUM.

Active Share 89% (Source Fact Check)

Management’s Stake in the Fund

Although limited evidence states that an invested board of trustees is a powerful predictor of risk-adjusted returns, none of the independent trustees have invested in the fund.

Among interested trustees, Lisa Wesolek has invested over 100K and Jason Job 10-50k. As of the January 14, 2022 SAI, no interested trustees owned shares of the fund. Lisa Wesolek owns 100K+ and Jacob Job 10-50K.

Opening date

September 30, 2020

Minimum investment

$2500

All of the Vela funds are offered at Vanguard with a $20 TF. I “lobbied” Vanguard to have them available because I knew that they could meet their listing requirements, which they did.

Schwab offers the fund for a $49.95 TF.

Expense ratio

Gross 1.87%. The total operating expense ratio inclusive of short dividends, interest charges, and the expense ratio of the MMF sweep is 1.87%.

If one takes those out, the expense ratio is 1.21%.

Comments

The story behind the VELA name and original inspiration comes from Vela (pronounced “vee-luh”), a constellation in the southern sky whose name is Latin for the sails of a ship.

Vela was originally part of a larger constellation, the ship Argo Navis, which was one of the 48 classical constellations first listed in the 2nd century.

This historical connection further parallels their time-honored investment approach.

A description of the word “VELA” as an acronym: A Valuation Centric approach, practiced by Experienced Investors with a Long-Term Temperament, guided by company policies designed to create an Alignment of Interests with our clients.

At VELA, the employees only invest in the firm’s strategies alongside their clients. They pay the same fees our clients pay in the mutual fund.

While Morningstar shows the fund as a large cap blend, it’s also categorized by Refinitive as an alternative long-short equity product.

However, it’s very important to note that while the managers do not object to being viewed as an alternative product, the fund’s net exposure is 80% at a minimum and typically in the 90%s, which is different from most long/short equity products that feature a wider range of net exposure.

Go Deeper

For example, as of September 30, 2022

- Cash was 13.7%

- Long positions 93.53

- Short positions -8.18%

- Options .92%

Because Refinitiv does not include a large cap blend category, we’ll examine the fund in the Alternative Long-Short category.

As of 202210, the category features 119 funds in the category by best APR lifetime.

Accordingly, its 13.2 APR ranks 5th in the category.

VELA Fund Returns (as of September 30, 2022, %)

| Inception | YTD | One-year | Since inception | |

| VELIX | 09/30/2020 | -13.44 | -6.80 | 13.19 |

| Russell 1000 | -24.59 | -17.22 | 4.12 | |

| S&P 500s | -23.87 | -23.87 | -15.47 | 4.83 |

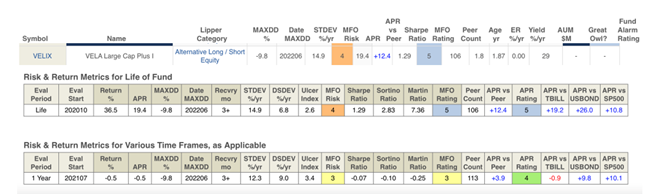

VELIX Lifetime Risk-Return Metrics Since 202010

| Maximum drawdown | Standard deviation | Downside deviation | Average APR | Sharpe ratio | Martin ratio | Sortino ratio | Ulcer index | |

| VELIX | -15.3 | 15.7 | 8.7 | 13.2 | .81 | 2.81 | 1.46 | 4.5 |

| Lipper peer group | -16.6 | 13.4 | 9.0 | 4.0 | 0.27 | 1.16 | .56 | 6.6 |

| S&P500 | -23.9 | 18.9 | 12.9 | 4.8 | 0.23 | 0.49 | .33 | 8.8 |

Why It Matters

- Its Risk-Return Metrics are 96% better than its category and the S&P 500.

Comments

In structuring the fund, Mr. Dillon notes that about 20% of asset managers achieve returns which meaningfully outperform both the relevant benchmarks and passive indexes over the long term.

He has taken each of those instrumental characteristics in achieving returns among the top quintile into each account in structuring VELA.

Second, fundamentally outperformance requires a portfolio which differs substantially from the index.

Thus, active managers like VELA are likely to produce short-term results different than passive alternatives, which are designed to mirror a given index.

Third, a valid investment approach is also necessary, and some approaches that are not time-tested may lack efficacy over the long term.

VELA’s valuation-centric philosophy was pioneered by Benjamin Graham nearly 100 years ago and taught to Warren Buffett, who has refined and popularized this philosophy for more than 60 years.

A core tenet of Graham’s philosophy is the belief that good businesses with sound fundamentals will continue to grow over the long term.

In the short term, financial markets are often driven by “noise” or emotional volatility as investors react based on limited information.

Conversely, the managers’ experience suggests that over time, the same markets tend to revert toward a more rational mean which is more closely aligned with each company’s underlying value.

Finally, most importantly, outperformance requires an active manager to align their business interest with the client’s return objectives.

Firm size, fees charged, and employee accounts are typically sources of misalignment.

To best align the firm’s interests with those of their clients, each VELA colleague commits to investing solely in VELA strategies for each asset class in which the firm participates.

VELIX Valuation-Centric & Long-Term Oriented Approach

Based on this idea, Mr. Dillon and his team actively seek out companies with experienced management teams, favorable industry position, and strong balance sheets.

Starting with a large investable universe, they apply a rigorous research process to narrow their focus to the companies in which they have the highest long-term conviction.

They invest when the price they can pay for those companies offers an attractive, risk-adjusted expected return based on their estimate of intrinsic value.

While prices may fluctuate over the short term, they believe these companies will likely continue to show positive growth over time.

Alignment of Interests

Of equal importance to the individual investment decisions they make on behalf of their clients are the organizational choices and commitments which guide their management of investment portfolios.

Most importantly, the business should be structured so that the motivations of the investment manager are aligned with clients’ interests.

In Mr. Dillon’s experience, incentive conflicts most often occur with regard to portfolio size, fees charged, and employee accounts.

With respect to portfolio size, managers’ revenues increase by growth in assets under management, and such growth may continue past a point which is beneficial to existing clients.

Similarly, fees and market impact costs will negatively impact a client’s returns.

Employee accounts can create misalignment, such as devoting time to one’s own account, which is time not utilized for clients’ accounts.

Firm Size

“Size is an Anchor to Performance” ~ Warren Buffett

The above quote directly captures a paradox of investing: good firms attract clients; however, if not disciplined in closing investment strategies, their growing assets under management will eventually diminish returns to investors.

Why It Matters

Each strategy needs to be limited in size so the portfolio manager can execute without undue burdens of market impact costs.

As assets in a portfolio grow, so does the likelihood that a given transaction will meaningfully impact the price of a security.

For example, if you decide to purchase the shares of a stock that is currently at $10.00, and when you finish your average cost is $10.25, then the market impact cost is $.25, or 2.50%.

Assuming this as an average for all transactions, and the portfolio turnover is 20% per year, the market impact costs are .50% annually (2.50% x 20% = .50%).

When added to a management fee of 0.75%, this becomes a meaningful figure.

At VELIX current size, the managers have a broader investible universe than their larger peers with minimal market impact costs.

- As of September 30, 2022, VELIX size was $30.4M

- Total firm AUM were $$278.5M.

Bottom Line

VELIX offers investors the opportunity to use a conservative and successful large cap blend fund from a management team with a strong track record and credentials from a firm aligned with its shareholders.

- It’s one reason I own it.

- It’s worthy of your consideration.

Fund website

www.velafunds.com and www.velafunds.com offer complete information about their funds and strategies.