When it comes to who will inherit more in a family’s estate plan, being trustworthy and offering care may pay off — a lot.

A new survey by UBS Group AG details the awkward explanations — and uncomfortable realities — wealthy families face as they formulate their estate plans. The Swiss bank polled 4,500 people with at least $1 million in investable assets around the globe and found some hard truths.

Two thirds of investors said they struggle with dividing their assets fairly. Half said their heirs simply don’t know how much wealth they even have. Nearly the same amount said their heirs didn’t know where all their wealth was stashed. And 42% of benefactors said they don’t have up-to-date wills.

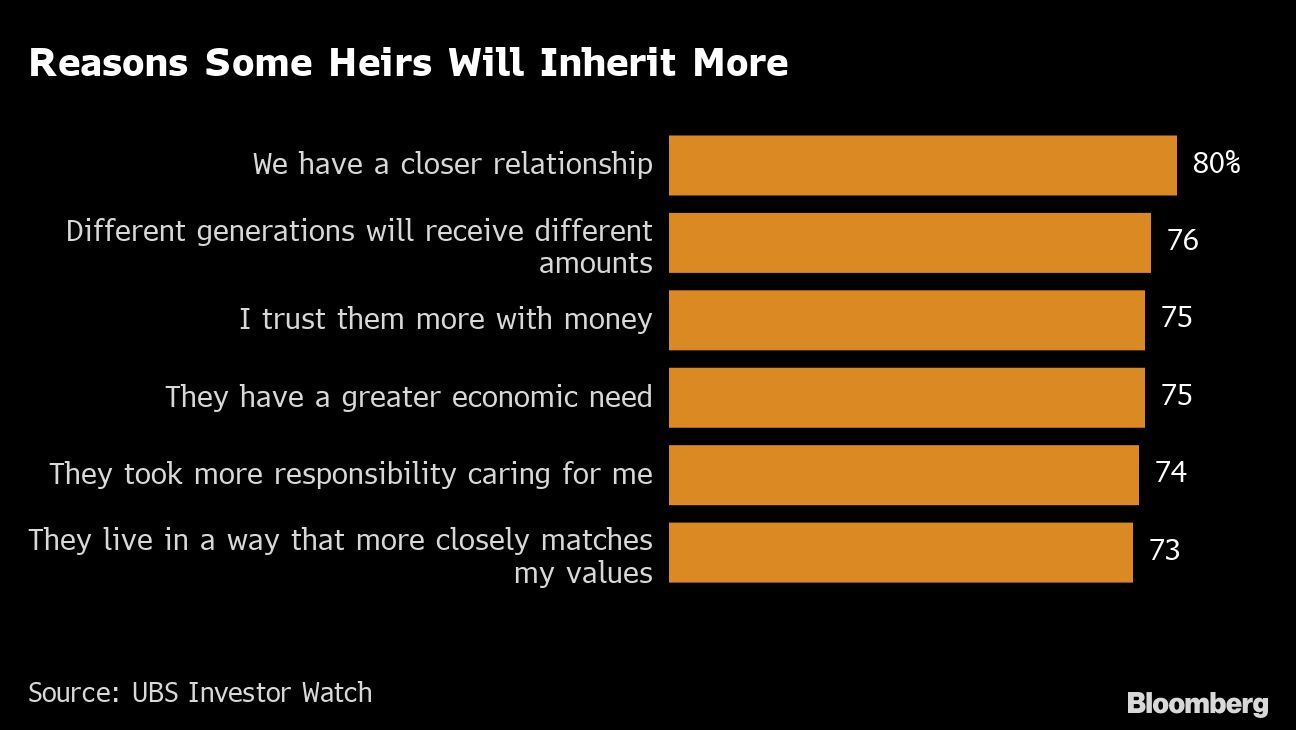

Justifications for uneven inheritances varied. A full 80% said they chose to favor some heirs over others because they had closer relationships. Three quarters said the favoritism came from trusting particular heirs more with money. And 74% gave a very straightforward answer: “They took more responsibility caring for me.”

The trouble is even more pronounced for blended families, with 87% reporting a struggle dividing assets fairly.

Respondents had a simple but potentially delicate solution. By wide majorities, both benefactors and heirs said they think having more open communication could help.

This article was provided by Bloomberg News.