There’s a lot of talk these days about economic cycles, particularly recessions. I’ve noticed that many people assume that with an economic downturn, real estate will get hit as hard as the broader economy and other asset classes.

The truth is, while real estate does sometimes get hurt during a downturn, there is much less correlation between real estate and the broader economy than most people believe.

In fact, during more than half of the previous 34 recessions, dating back over 150 years, real estate has either not been affected or hasn’t been affected nearly as severely as other asset classes like stocks.

Why Does Real Estate Not Get Impacted As Much?

A few reasons:

- Real estate isn’t just any old investment. There is intrinsic value in real estate assets, so they tend to be more resilient to economic forces.

- Recessions tend to occur after periods of increased inflation. Where do people like to put their money during inflationary periods? Real estate. Both the underlying asset and the debt that can be associated with real estate are great hedges against inflation.

- When the stock market drops and other asset classes get hit, many investors look to real estate as a wealth-preservation option. Real estate values rarely go to zero or anywhere near zero, unlike investments in some other asset classes.

For these reasons, real estate often operates in a counter-cyclical fashion to the broader economy.

In fact, back in the late 19th century, an American economist named Henry George wrote about why our economy goes up and down in cycles (remember, this was before the Federal Reserve existed). And, unlike today’s economists who attribute cycles to inflation and interest rates, George believed land speculation was the driving force behind these cycles.

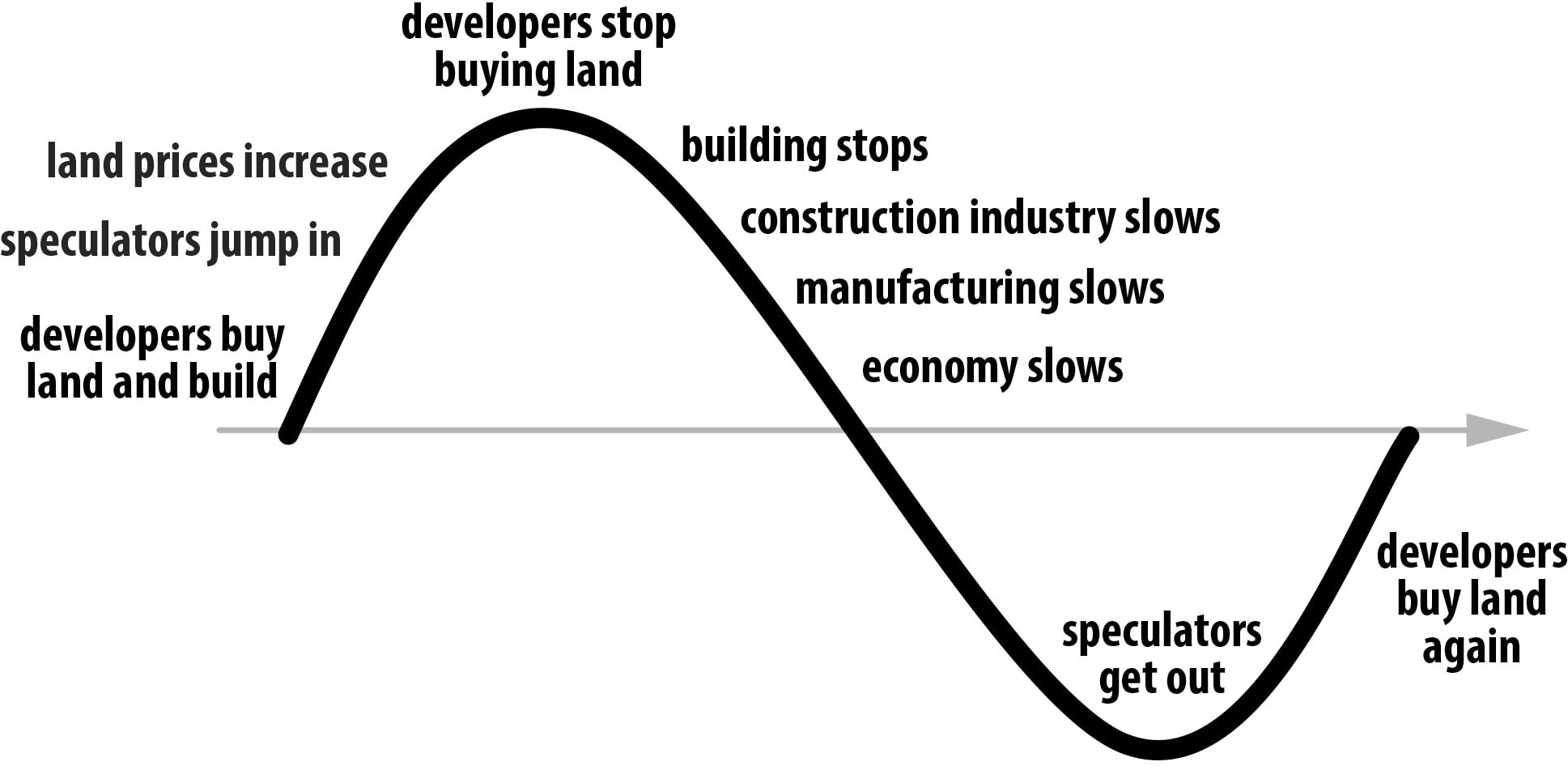

Here is George’s theory on how land speculation caused the boom/bust cycle we see in the economy:

First, we start with the fact that land has a fixed supply; we can’t make more of it. In economics, we refer to this as inelastic supply. When something has inelastic supply, if demand for that thing increases, so does the price. When the demand for land increases, the price of land increases.

Next, we assume that in most cases, developers purchase land to develop today and resell in the near future. The prices developers are willing to pay for raw land reflect what the developers can sell the property for in a year or two if they start developing now. But during an economic boom, investors (people like you and me) will start to buy land on speculation—in other words, not to develop now, but to hold in the hopes that the price will increase in the future. These speculative purchases push land prices beyond the point where developers can make a profit, so developers are forced to stop buying.

When developers stop buying, they stop building. And when they stop building, this causes an economic ripple throughout the economy, hurting industries such as construction, heavy equipment, and building material manufacturing. This results in an economic recession, especially in those industries.

Eventually, speculators realize that they won’t be able to make money on their land purchases, and they start selling off their inventory at reduced prices, spurring developers back into action. Developers start building again, manufacturers start selling again, and the whole cycle repeats.

See the image below for what this cycle looks like:

Over the past 160 years, this real estate cycle has been very consistent. It doesn’t occur as often as the general economic cycle we often talk about (the “business cycle”); instead, this cycle is on its own timetable. And, historically, it has occurred about every 18 years. With the exception of several decades after the Great Depression, this 18-year cycle has been remarkably consistent, producing downturns in the real estate market independent of the broader economic downturns we often talk about.

Final Thoughts

Personally, I believe that both the business cycle and the real estate cycle exist, and they are driven by different, though often interrelated, economic forces.

I would argue that in 2008, the severity of the Great Recession was exacerbated by the fact that the business and real estate cycles both hit a downturn simultaneously. The real estate market collapsed right on schedule, almost 18 years after the last major real estate downturn started in 1989, which saw a correction of over 25% in many markets. And we were about six years into the business cycle after the 2001 downturns, almost exactly the average length of time between business cycles over the past 150 years. So, while 2008 may not have been inevitable, for those of us who follow cycles, the timing wasn’t overly surprising.

While I’m certainly not going to claim that I have any reliable information about whether real estate will get hit during the upcoming recession, and if so, how badly. I would caution anyone from assuming that real estate will necessarily see a downturn as bad as the broader economy or other asset classes. Real estate could get hit, but if history is an indicator, it’s far from certain that we’re in for anything major.

In fact, if you believe in the history of cycles, you should probably be more worried about real estate in 2026, 18 years after the last major real estate crash, than 2022.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.