What is the difference between sales tax and value-added tax (VAT)? Both sales tax and VAT are types of indirect tax – a tax collected by the seller who charges the buyer at the time of purchase and then pays or remits the tax to the government on behalf of the buyer. Sales tax and VAT are a common cause of confusion within the corporate tax community. To explain further, let’s outline the similarities and differences between these two types of indirect tax.

Jump to:

Sales tax vs. VAT overview

Sales tax is collected by the retailer when the final sale in the supply chain is reached. In other words, end consumers pay sales tax when they purchase goods or services. When buying supplies or materials that will be resold, businesses can issue resale certificates to sellers and are not liable for sales tax. Until the sale is made to the final consumer, sales tax is not collected, and tax jurisdictions do not receive tax revenue.

VAT (value-added tax), on the other hand, is collected by all sellers in each stage of the supply chain. Suppliers, manufacturers, distributors, and retailers all collect VAT on taxable sales. Similarly, suppliers, manufacturers, distributors, retailers, and end consumers all pay VAT on their purchases. Businesses must track and document the VAT they pay on purchases to receive a credit for the VAT paid on their tax return. Under a VAT regime, tax jurisdictions receive tax revenue throughout the entire supply chain, not just at the point of sale to the final consumer.

What triggers the tax administration requirement?

Sales tax obligations are triggered by:

- Nexus — e.g. taxpayers with a physical presence in a tax jurisdiction or who meet economic nexus thresholds

Before the 2018 South Dakota v. Wayfair Supreme Court ruling, nexus depended on a company’s “physical presence” in the state. But in a post-Wayfair world, if your business sells goods in any state — even if you don’t have physical presence in that state and the transaction is online only — you may now be obligated to register in that state and collect sales tax if you exceed the “economic nexus” threshold. Sales tax automation software can help you understand and determine if you have met the nexus threshold.

VAT collection is required under the following circumstances:

- Permanent establishment – Existence of a facility, bookkeeping facilities, or ability to enter contracts

- Registration threshold – Taxpayers with business activities that exceed the monetary threshold in a tax jurisdiction

- Sometimes a specific activity triggers a VAT registration obligation (e.g. legal services)

Who collects and remits sales tax and VAT?

For both sales tax and VAT, the seller is responsible for collecting the tax and remitting to the appropriate tax authority, although there are cases where the buyer must recognize the tax instead.

Invoicing

- Sales tax: The seller should separately state sales tax.

- VAT: The seller should separately state VAT and include a registration number for a VAT invoice; however, in most VAT jurisdictions, prices are tax inclusive.

Who pays sales tax and VAT?

- Sales tax: Only the final consumer pays.

- VAT: All purchasers pay VAT; however, the economic burden of VAT is on the final consumer as they do not have the right to deduct input VAT.

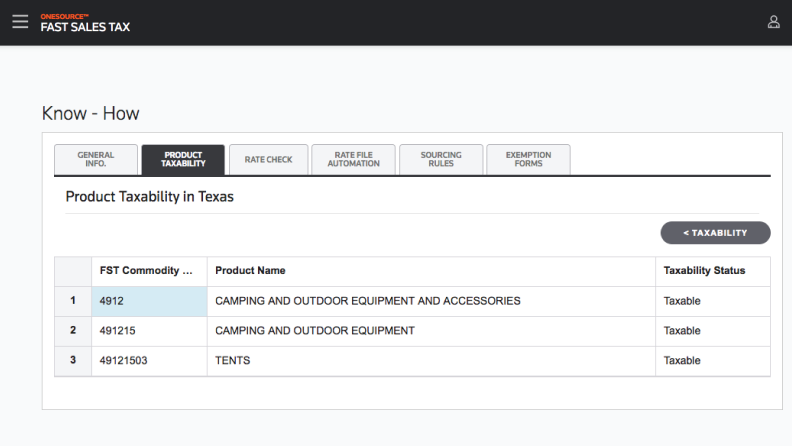

ONESOURCEFast Sales Tax features:

|

|

Taxability of purchases by business

- Sales tax: Resellers issue a tax exemption certificate to the vendor and do not pay tax on purchases of items to be resold.

- VAT: Resellers pay tax to the vendor and reclaim the VAT for the tax amount paid on business inputs.

Audit risks for sales tax and VAT

- Sales tax: Vendors that sell to resellers must keep valid exemption certificates on file or risk an audit assessment turning exempt sales into taxable sales.

- VAT: All parties must keep invoices for purchases documenting VAT paid in order to get the reclaimed VAT.

Revenue timing for tax authorities

- Sales tax: Tax authorities do not receive tax revenue until the sale to the final consumer.

- VAT: Tax authorities receive tax receipts much earlier, receiving tax revenue throughout the entire distribution chain as value is added.

What should a purchaser do when a vendor does not have a liability to collect tax, or to collect tax on specific items, as stated in tax law?

- Sales tax: Calculate and remit the appropriate use tax to the appropriate tax authority.

- VAT: As a general rule, a purchaser should calculate and report a reverse charge when necessary.

How can Thomson Reuters ONESOURCE® help you manage sales tax, VAT, and other indirect taxes?

If you are a corporate tax professional dealing with indirect taxes such as sales tax and VAT, learn how global tax determination software like ONESOURCE Determination can help you get tax right the first time, every time.