Passive investing is picking up pace in India. This is evident from the sharp jump in the number of NFOs (New fund offer) in the passive space by mutual fund companies.

In my post on How to Build a Long-Term portfolio, the core equity portfolio consisted on index funds and ETFs. And no portfolio is complete without including the Nifty (Sensex) ETF or index fund. This is despite my findings in the post on How to construct the best portfolio using index funds and ETFs.

Assume you have taken the leap of faith from actively managed funds to passive funds. You are now looking for a Nifty 50 index fund to invest in. Which Nifty index fund/Nifty ETF to invest in? Which is the best Nifty index fund?

You may ask, aren’t all the Nifty index funds the same? Don’t all of them simply give you Nifty returns?

Well, that’s the aim but there is tracking error.

Tracking error = Index Returns – Index fund returns

And the tracking error can vary across the various Nifty index funds/ETFs.

Obviously, you would want to index pick funds with lower tracking error.

Why would the Index Funds have tracking error?

This is a valid question since a Nifty 50 index fund has the same portfolio as the index.

Why can’t the Index funds track the indices perfectly?

Well, there are certain costs and practical issues that create this drag and eat into returns from index funds and ETFs.

- Expense ratio (the AMC won’t run the index fund for free)

- Securities transaction tax (STT) and brokerage: The fund must pay the brokerage on each buy and sell transaction. Based on the volumes, the AMC can still negotiate on the brokerage. No such relief with STT. STT (0.1%) is applicable on sale of stocks. This creates drag at the time of rebalance. Nifty 50 TRI does not pay any STT or brokerage.

- Slippage/Impact cost: On the rebalance date, the benchmark index rebalances at the day end price. However, to effect this change in the index fund, the fund manager must buy and sell the stocks on the markets. When buy on the markets, there is liquidity, impact cost etc. to take care of. Purchase and sale may happen at different prices.

- Cash inflows and outflows: Even apart from the rebalance, the fund manager must buy stocks to manage cash inflows and sell stocks to manage outflows. Brokerage, STT and slippage again. And this will affect smaller index funds more.

- Cash drag: The index fund may keep a small percentage in cash to manage cash outflows. This can create difference (both ways).

- Dividends: Dividend record date will be different from the date of actual receipt of funds. TRI will consider dividends reinvested on the record date. The AMC may get dividends after a few days. The difference of timing in dividend reinvestment can also cause a difference (both ways).

Then we just need to pick the Index fund with the lowest expense ratio

A simple way to select Nifty index funds could be to compare the expense ratios and pick the one with the smallest expense ratio.

This is fine if you believe

Nifty Index Fund return = Nifty Total Returns index return – Fund expense ratio

Close but not exactly true.

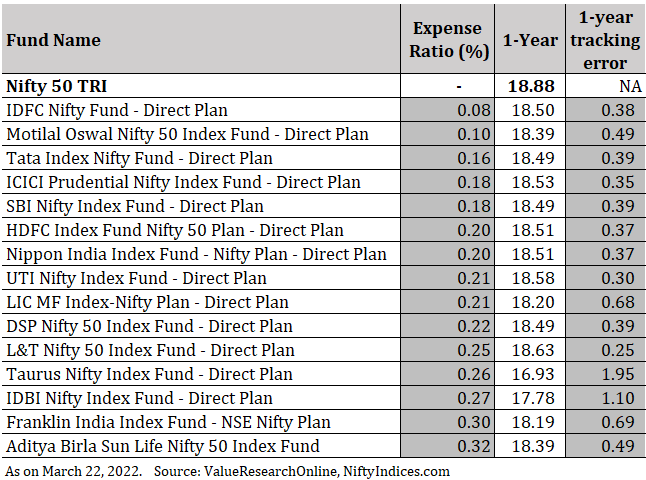

We have seen the reasons above. The tracking error comes not only from the expense ratio and can be much higher than the expense ratio. There are other aspects too. Low cost (and slippage) trade execution is crucial in keeping the tracking error (unexplained by expense ratios) low.

Don’t trust me? Let’s look at performance data of various index funds.

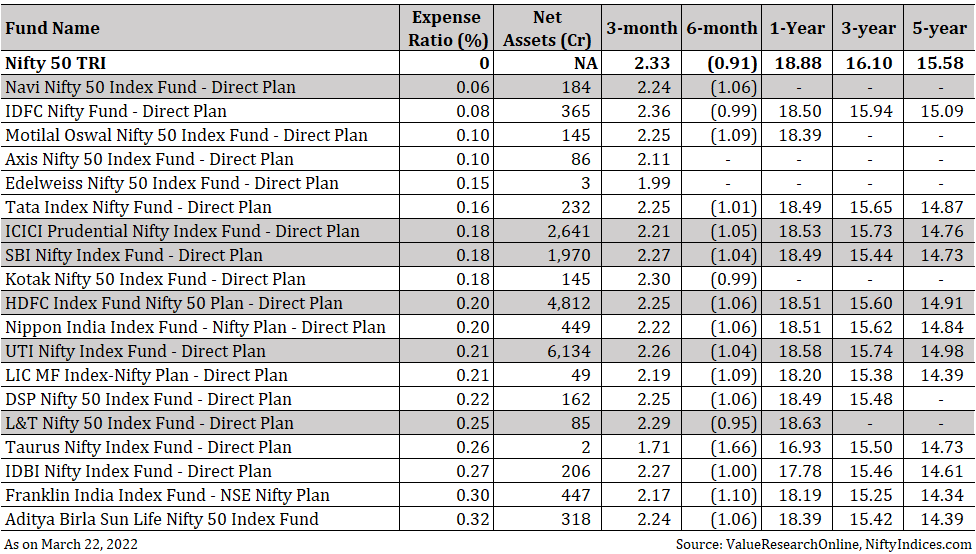

I have listed down all the Nifty index funds and sorted in ascending order based on expense ratios. You can see that the tracking error is much higher than the expense ratio. Or the expense ratio does not explain the entire tracking error.

You can see that Navi Nifty 50 index fund has the lowest expense ratio. A new fund. However, in its limited history, there are other expensive funds that have been able to track the Nifty 50 index better.

Note: The expense ratios of the index funds keep changing. This is completely at the AMC’s discretion. Good part is that the competition will not let them increase the expense ratios too much. Additionally, I have picked up only direct plans. Performance of regular plans of Nifty index funds will be much inferior.

What about Nifty ETFs?

Think of ETFs as index funds that trade on the stock exchanges. Many merits and a few demerits.

ETFs are superior products than index funds provided there is adequate liquidity in the counter and you can navigate the Price-NAV difference.

Why?

ETFs usually have lower expense ratios than index funds. The fund house need not worry about cash inflows and outflows. This reduces drag on the portfolio. For more on difference between index funds and ETFs, refer to this post.

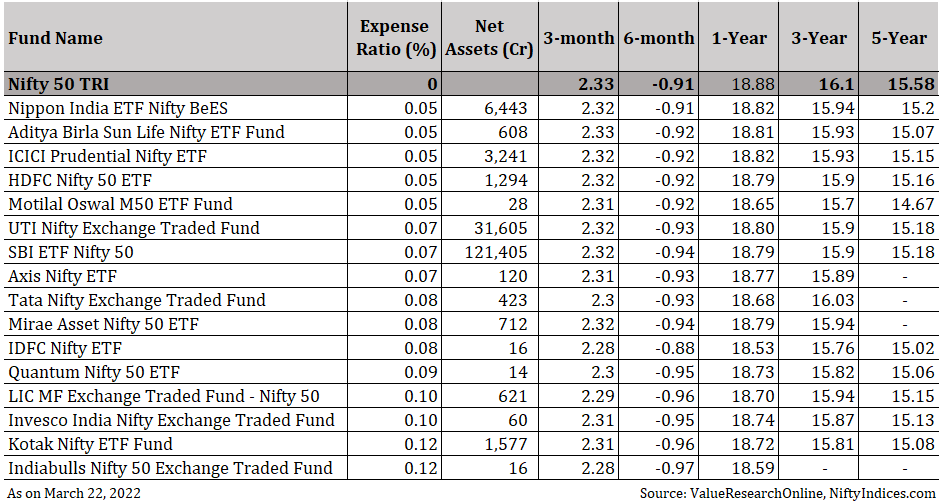

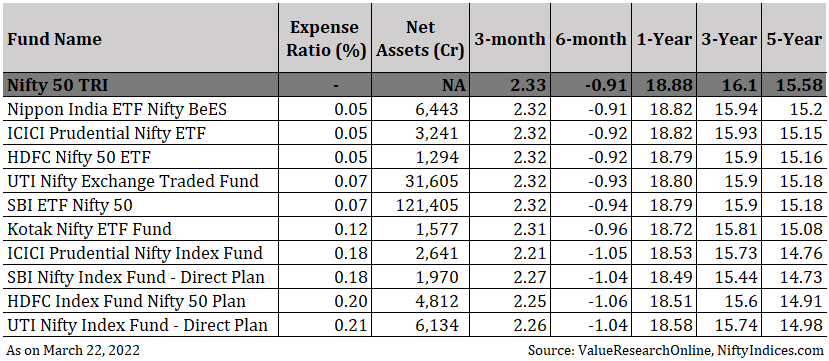

If you compare the performance of Nifty ETF with Nifty index funds, almost all the Nifty 50 ETFs have beaten even the best Nifty index fund on every timeframe.

The tracking error of the Nifty ETFs is much lower than the Nifty index funds.

In the table below, I have listed all the Nifty ETFs and Nifty index funds whose AUM is greater than Rs 1,000 crores. You can see the ETFs consistently beat the index funds.

Shouldn’t you be investing in Nifty ETFs instead of Nifty index funds?

Right but there are a few caveats.

- You need to demat account to buy ETFs. No such requirement for investing in index funds. Hence, for many of us, index funds are easy to invest and do SIPs in.

- The Nifty ETF performance shown above is based on day-end NAV. NAV is the total value of the portfolio divided by the number of units.

- However, you don’t buy ETF at their NAV. You buy and sell on the stock exchanges just like you buy stocks. And trading price can be different from the underlying NAV. As a buyer, you wouldn’t want to purchase at a price higher than the NAV. As a seller, you wouldn’t want to sell a price much lower than the NAV.

- Unfortunately, the difference between Price and NAV is quite high for many ETFs (there are many ETFs tracking other indices too). Fortunately, for a few Nifty 50 ETFs, the difference is manageable.

- You must pay brokerage when you buy ETFs. No such cost while buying index funds. Plus, you may have to pay more than the NAV (to buy).

- On the other hand, in ETFs, you incur this cost just once. In index funds, you feel drag until you are invested.

Which is the Best Nifty Index Fund?

I prefer Nifty index funds with low expense ratio and not-too-small size.

Among the larger Nifty index funds, UTI Nifty Index Fund stands out.

Also note, there is not much difference. Do not spend too much time on choosing the best Nifty index fund. If you compare the 1-year return as on March 22, there are 8 funds between 18.49% and 18.58%. So, if you are investing in HDFC Nifty Index fund instead of UTI Nifty Index, that’s alright. The expense ratios and tracking error can change.

Keep an eye on Navi Nifty 50 index fund too. It is the lowest cost index fund (expense ratio of 6 bps compared to 20 bps in UTI Nifty Index Fund). Would expect this to eventually start showing up as the fund matures. A bit of underperformance in the fund may be because of small size, where cash inflows and outflows can create drag.

If you are looking for a Nifty ETF, my vote goes to Nippon India ETF Nifty Bees .

Note: I could have compared 1-year rolling returns on Nifty 50 index funds/ETFs to get a more accurate picture. However, since these are index funds, I have just gone ahead with lookback data as on March 22, 2022.

Additional Read/Source/Credit

CapitalMind: Which is the best Nifty index fund?