There’s a lot of uncertainty surrounding the economy, real estate market, and the role of inflation in the economic environment.

When it comes to inflation, it’s important to identify how we got here. By here, I mean on the verge of an economic downturn with near record high inflation.

The Cyclical Nature of the Economy

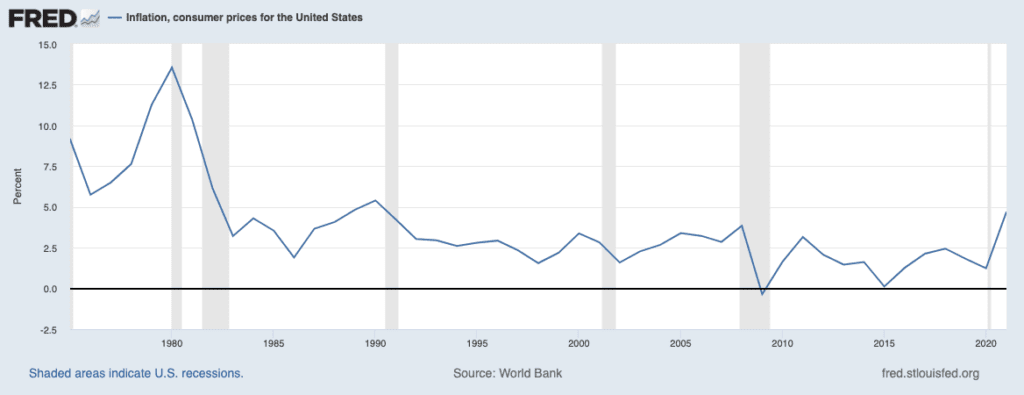

Our economy is cyclical. It goes up. It goes down. And repeats. If you’re familiar with historical economic cycles in the United States, it should be no surprise that after a nine-year bull run, things were poised to peak back in 2019 and 2020. That nine-year run was historically long and, in many ways, driven by the fact that inflation was low for most of the decade.

Typically, a cycle results in a downturn after economic growth leads to inflation, triggering the Federal Reserve to raise interest rates. A rise in interest rates makes it more costly to borrow and more beneficial to save, so people stop spending, start saving, and the economy slows down, which alleviates inflation.

But we weren’t seeing much inflation, so interest rates stayed relatively steady for much of the decade, and things kept chugging along. Who knows for how long they might have kept going. Then the pandemic happened.

The economy came to a screeching halt, and it looked like we were on the verge of an economic depression. So the Fed stepped in again.

The Fed controls interest rates and the money supply. They use these two things to manipulate the economy in an attempt to avoid large swings or catastrophic events. At least that’s the goal.

Unfortunately, when it comes to avoiding economic risk, the Fed historically over-corrects. They move too much or too quickly. That’s exactly what happened here. COVID-19 caused panic over what could become an economic catastrophe, and the Fed reacted by over-correcting.

They lowered rates excessively and quickly, released a bunch of new money into the system, loosened banking regulations, and more.

Those actions stimulated economic growth, which led to inflation, which drove the fed to raise interest rates, which is now (likely) leading us into the downturn.

A recession at this point should surprise nobody. I’m surprised we didn’t see it sooner. But again, we weren’t seeing huge inflation levels prior to last year, so the cycle got stretched out.

Why is Inflation as High as It is Now?

We came dangerously close to a severe economic catastrophe in 2008. Back then, the Fed also released a bunch of new money into the system and lowered interest rates, but we didn’t see sky-high inflation.

What’s the difference between then and now? Why was inflation at 2% for much of the decade after the Great Recession and now at 8% a year after this latest round of interest rate drops and money printing?

Inflation is all about supply and demand, so there are really two sides to inflation. The supply side—when supply is low, prices go up. And the demand side—when demand is high, prices go up.

This time around, we’re seeing inflationary pressure from both sides. On the supply side, thanks to global shutdowns, many small businesses going bankrupt, raw material and transportation pipelines getting sent into a tailspin, and a host of other things, supply chains have been a global mess for two years now.

You might be looking around and saying that the pandemic is over and things are back to normal, so there shouldn’t be any more supply chain issues. But, the U.S. is a very consumer-centric nation, not a producer-centric nation. We import stuff. We don’t produce stuff.

It doesn’t matter what you see when you look around the country regarding shutdowns and businesses operating. What matters is what you see in those countries where we get most of our products. There are still lockdowns, war, and political unrest in those countries.

Shipping logistics are upside down, energy prices are in the sky, chip manufacturing is slowed, there are global labor shortages, and while we don’t talk much about the trade war anymore, that 20-year-old battle is still an issue.

Long story short, supply is still constrained, which will naturally drive prices up.

The even bigger issue is on the demand side, though. Where’s the demand coming from? It’s coming from people, companies, and institutions spending the $9T that was created over the last several years.

Why is Inflation Higher Now Than It Was After the Great Recession?

In 2008, the Fed and the Treasury infused a lot of liquidity/money into the economy. But they did it indirectly. They mostly gave it to the banks, allowing them to open up their lending to businesses and consumers. That allowed all the extra money to trickle into the economy slowly.

This time around, after the pandemic began, we did things differently. Instead of putting money into the banking system and allowing it to trickle into the economy over time, the Fed decided that they needed to get the money out there much more quickly.

The Fed pumped a lot of that $9T into equities directly, companies through PPP loans, and sending checks to all Americans.

Injecting directly into the economy’s bloodstream was effective for its intended purpose. People had direct access to cash and didn’t have to work through banks. But, the aftershock is what we’re dealing with now. Off the rails inflation, making day-to-day life for the average American more and more difficult.

Long story short, the injection of cash directly into the economy served its purpose. It effectively stimulated everything to the point that there was no economic collapse. But, as usual, the Fed overcorrected, didn’t let off the gas soon enough, and here we are.

Of course, there is a solution, but it’s not pretty. We must manually contract the economy by raising interest rates, which has already begun. You can read more about that here.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.