Mutual Fund SIP is one of the best investment options. You can easily beat inflation and generate two-digit returns by investing money in mutual funds.

If you are serious about wealth creation, you should invest in Mutual Funds via SIP way. Leaving surplus cash in the savings account is not the correct way to grow your fund and fulfill your financial goals.

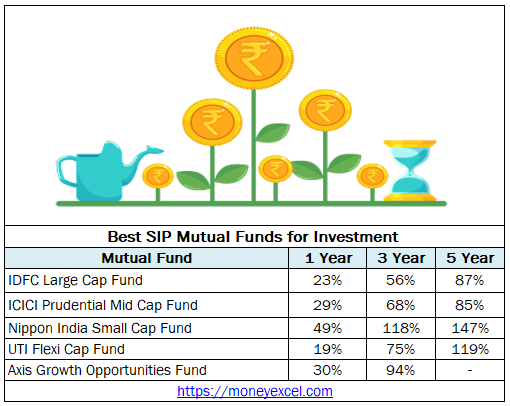

Here is a list of the 5 Best SIP Mutual Fund Schemes for Investment in 2022. You can build your mutual fund portfolio by investing money in these schemes.

The list of schemes given here contains mutual funds from every category such as large-cap, mid-cap, small-cap, flexicap, and large cap-mid cap categories.

5 Best SIP Mutual Fund Schemes for Investment 2022

#1 IDFC Large Cap Fund

The first fund is from the large-cap category – IDFC Large Cap Fund. IDFC Large cap fund is one of the most popular mutual fund schemes for investment. IDFC Large cap fund has given 23% absolute returns (As of April 2022) in the last year. Historically also this fund has generated very good returns for the investors. The major portion of this mutual fund portfolio contains very good large-cap stocks such as HDFC Bank, SBI, Infosys, Reliance, etc. It is a four-star rated fund by CRISIL.

Historical performance of IDFC Large Cap Fund

| Duration | Returns |

| 1 year | 23% |

| 3 years | 56% |

| 5 years | 87% |

| Since launch | 407% |

#2 ICICI Prudential Mid Cap Fund

The second fund is from the Midcap category – ICICI Prudential Mid Cap Fund. ICICI prudential mid-cap fund has given a very good return to the investors in the last five years. This fund is managed by an experienced fund manager. It is a 3 star rated fund by CRISIL. The portfolio of this stock consists of 50% investment in mid-cap, 23% in small-cap, and 7% in large-cap stocks.

Historical performance of ICICI Prudential Mid Cap Fund

| Duration | Returns |

| 1 year | 29% |

| 3 years | 68% |

| 5 years | 85% |

| Since launch | 1527% |

Best Mutual Funds to Invest in 2022 – Top 10 Mutual Funds India 2022

#3 Nippon India Small Cap Fund

The third best mutual fund is from small cap category – Nippon India Small Cap Fund. Nippon India Small Cap fund is a four-star rated fund by CRISIL. In the last year (up to March 2022) this fund has given 49% returns to the investors. In the last five years, this fund has generated 147% returns. This fund has surpassed the benchmark return of Nifty 50 this year. You can invest in this fund for a long-term perspective.

Historical performance of Nippon India Small Cap Fund

| Duration | Returns |

| 1 year | 49% |

| 3 years | 118% |

| 5 years | 147% |

| Since launch | 783% |

#4 UTI Flexi Cap Fund

The fourth best mutual fund is from the Flexi cap category – UTI Flexi Cap Fund. UTI Flexi Cap Fund is a five-star rated fund. It is a high-risk fund. This fund has generated 75% returns for the investors in the last 3 years. The portfolio of this fund contains well-known stocks such as Bajaj Finance, L&T Infotech, HDFC Bank, Infosys, etc. The expense ratio of this fund is low.

Historical performance of UTI Flexi Cap Fund

| Duration | Returns |

| 1 year | 19% |

| 3 years | 75% |

| 5 years | 119% |

| Since launch | 1070% |

#5 Axis Growth Opportunities Fund

The fifth best mutual fund for the SIP route is the Axis Growth Opportunities fund. Axis Growth Opportunities fund is five star rated fund by value research. This fund is turn out to be one of the best performing funds in the last year. This fund has generated 94% returns to the investors in the last 3 years. The expense ratio of this fund is low.

Historical performance of Axis Growth Opportunities Fund

| Duration | Returns |

| 1 year | 30% |

| 3 years | 94% |

| Since launch | 109% |

Important points for the Selection of Mutual Funds

- Don’t invest in a fund because of its popularity or rating. Make sure that the fund objective is matching with your financial goal.

- The fund that offers a higher return in a shorter duration is better for investment. However, a higher return is not the only factor in investing.

- Know about the applicability of tax on the mutual fund before investing.

- Equity-oriented mutual funds are best for long-term investment.

- A direct plan for mutual funds gives you higher returns as compared to the regular plan of mutual fund schemes.

Make sure to review your investment portfolio once in a few weeks.

Over to you

Share this best mutual fund list with your freinds and give them chance to invest and earn more.