I have had conversations with friends and family, and the question comes up, “Where should I put my money [cash] to earn a safe yield. This comes from younger people starting to build a nest egg and older people wanting to protect their nest egg. The options asked about are high yield savings accounts, certificates of deposits (CDs), or paying off mortgages. One concept has confused people when talking about bond funds. There are two components to fixed income return: 1) the yield, which is typically paid daily, monthly, quarterly, or annually, and 2) changes in yield that impact the price of the bonds. If the yield goes down, the value of the bonds appreciates. Together, yield and appreciation make up the total return of the bond.

Risk comes in the form of duration and the quality of the borrower. I have reviewed the risk of Lipper Bond Categories and segregated them loosely into three investment buckets for duration and quality risk-taking into account yield.

Note that in the following tables, the metrics are from the past three years, and I have increased the yields of Municipal Bonds to be the equivalent of a taxable yield for someone paying a marginal 22% tax rate.

Bucket Approach

Christine Benz at Morningstar is a champion of the Bucket Strategy. I will use her description from The Bucket Approach to Building a Retirement Portfolio to describe the bucket strategy.

The All-Important Bucket 1: The linchpin of any Bucket framework is a highly liquid component to meet near-term living expenses for one year or more. Bucket 1 is by no means a return engine, but the goal of this portfolio sleeve is to stabilize the principal to meet income needs not covered by other income sources.

Bucket 2: Under my framework, this portfolio segment contains five to eight years’ worth of living expenses, with a goal of income production and stability.

Bucket 3: The longest-term portion of the portfolio, Bucket 3 is dominated by stocks and more volatile bond types, such as junk bonds.

Bucket #1: Safety (Typically 1 to 3 Years)

I currently have about 18% of my investment in fixed income located in Bucket #1. Bond funds that are suitable for Bucket #1 (Safety) have both high-quality debt and short duration. I include short-duration investment grade bonds because the risk of drawdown is relatively low, but the yields are higher than Treasury bills. Over the past three months, the top five funds in the six Lipper Categories that I include in Bucket #1 have returned about 1 to 2% over the past three months. I show the five funds that my Ranking System rates the highest.

Table #1: Bond Bucket #1 for Safety

Source: Author using MFO Premium fund screener and Lipper global dataset; Morningstar for three-month return as of March 21st

“Yield – Treasury” is a measure of how much extra yield the fund is paying compared to short-term Treasuries, which are considered risk-free. “Yield/Ulcer” is a measure of how much risk the fund is taking for the yield that it pays. I limit the value to ten.

Bucket #2: Intermediate (Typically 3 to 10 Years)

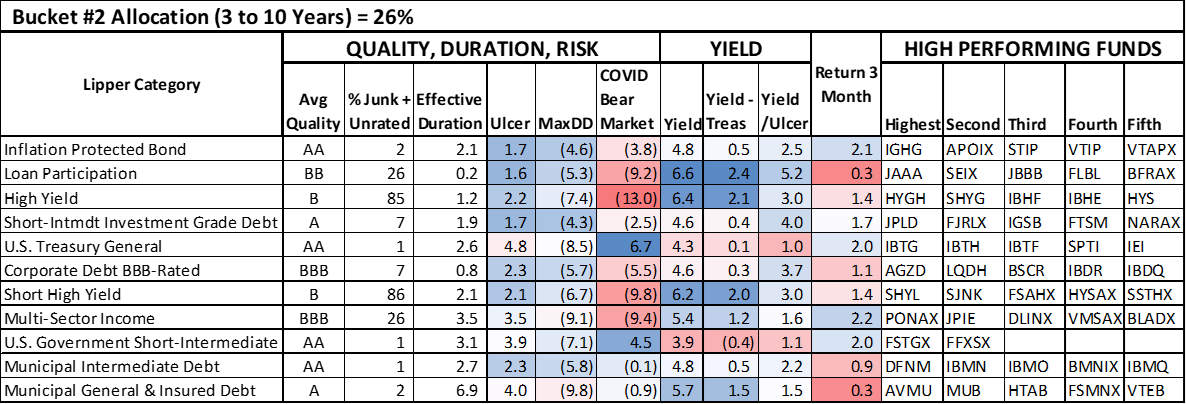

Bucket #2 is the most interesting to me because risks are moderate as measured by the Ulcer Index, and yields are favorable. I have about 26% of my investments in fixed income allocated to Bucket #2 Lipper Categories, plus another 18% in bond ladders.

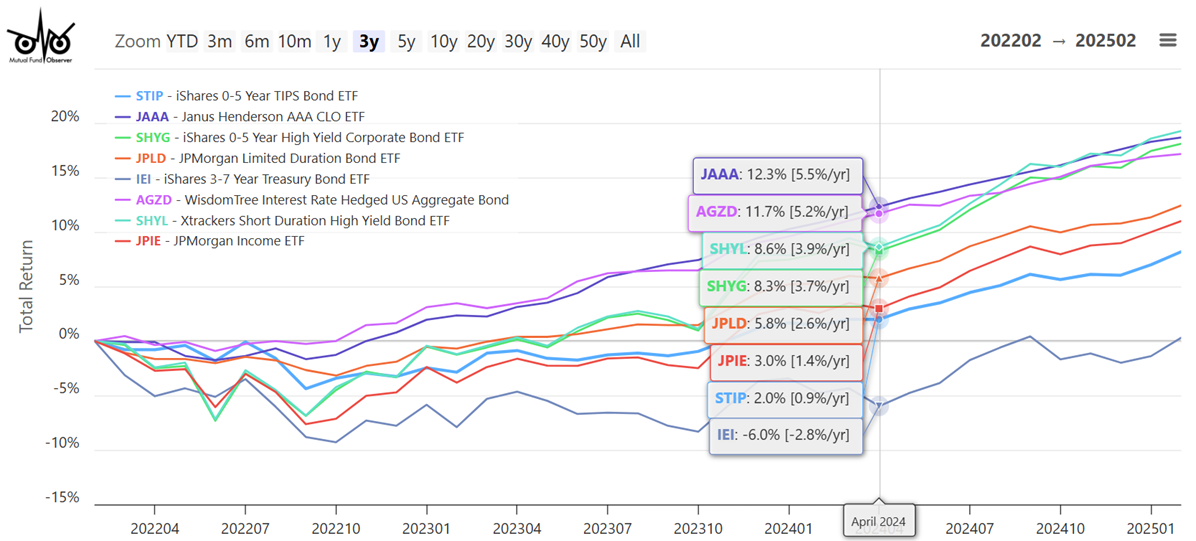

The categories are ranked by Drawdown Risk, Bond Quality Risk, Duration Risk, Yield, and Momentum. Inflation-Protected Bonds, Loan Participation, and Short Duration High Yield are rated high. Safe government bonds have had the highest return over the past three months. I have been investing in high yield funds with short durations and am monitoring performance.

Table #2: Bond Bucket #2 – Intermediate Time Horizon

Source: Author using MFO Premium fund screener and Lipper global dataset; Morningstar for three-month return as of March 21st

Figure #1: Performance of Selected Funds from Bond Bucket #2

Bucket #3: Long Term (Typically 10+ Years)

I currently have about 39% of my investments in fixed income allocated to Bucket #3 Lipper Categories. I am overweight in Traditional IRAs and consider them to be in Bucket #2 because of required minimum distributions. Some of the bond categories in Bucket #3 appear in my more aggressive Traditional IRA Bucket #2 sub-portfolios.

Bucket #3 contains bond funds that may lose over ten percent of their value when rates are rising, as they did in 2022. The advantage of some of the funds with higher quality is that they have a low correlation to stocks, so if stocks are falling, the high-quality bonds typically rise.

Intermediate Government Bonds have high momentum now as yields on intermediate bonds have fallen. The duration risk of these funds is high so that the Ulcer Index, which measures the depth and duration of drawdown, can be close to that of the S&P 500 (Ulcer Index = 7.4). This emphasizes the importance of diversifying across categories.

Table #3: Bond Bucket #3 – Long Term

Source: Author using MFO Premium fund screener and Lipper global dataset; Morningstar for three-month return as of March 21st

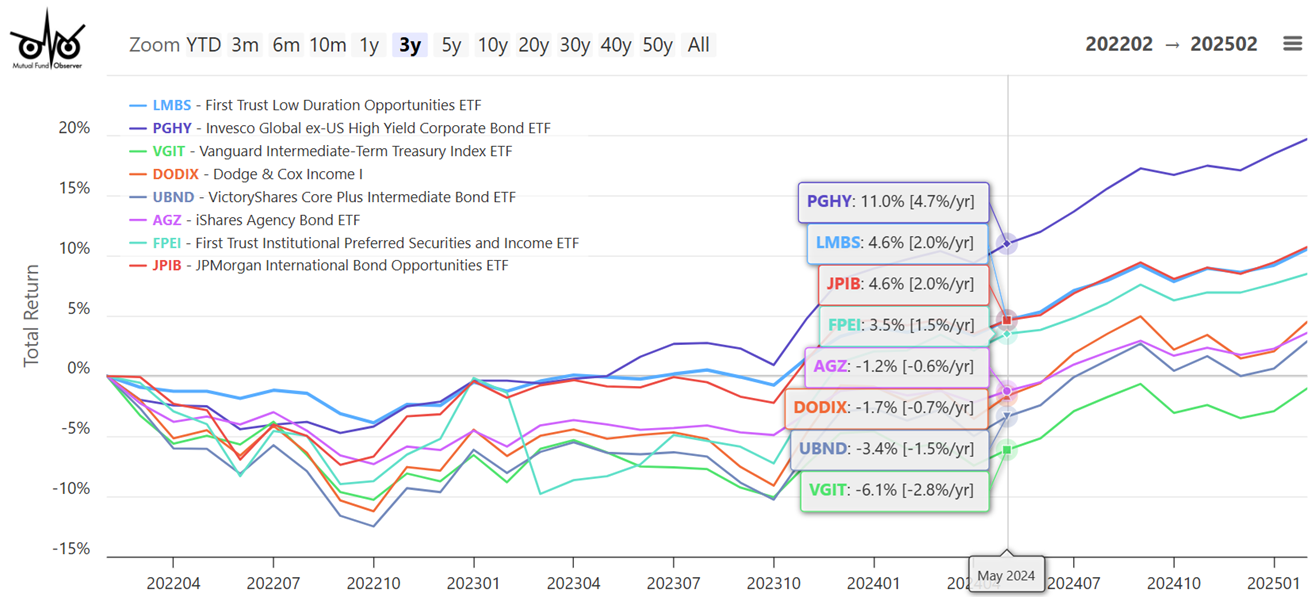

Figure #2: Performance of Selected Funds from Bond Bucket #3

Closing

I have written several articles for Mutual Fund Observer as I transitioned into retirement almost three years ago. The three biggest changes have been 1) increased reliance on the bucket strategy, 2) switched from a total return approach to income strategy in conservative Bucket #2 sub-portfolios to take advantage of higher yields, and 3) an increased use of Financial Advisors at Fidelity and Vanguard to manage asset allocation, asset location, rebalancing, and tax efficiency in more aggressive accounts.

Each month, I summarize the performance of investment buckets for the past three months. While keeping turnover low to minimize taxes, if a fund stops performing the way I expect, then I consider replacing it with something that seems to have longer-term potential. The above strategies helped me sail through the recent correction with little impact or anxiety.

My current endeavor has been to summarize the taxes paid last year on accounts and withdrawals. I plan to meet with my CPA this year to discuss tax efficiency and strategies. I began retirement planning over fifteen years ago when I read an inciteful book about the impact of taxes on retirement withdrawals. Taxes should not be an after-thought in investing strategies.