An investment in an initial public offering (IPO) has the potential to provide substantial profits. Prior to investing, however, it is critical to understand how the process of trading these assets differs from typical stock trading, as well as the unique risks and laws involved with IPO investments. In this article, we will be diving deeper into the understanding of IPO.

Definition of an Initial Public Offering (IPO)

An IPO, or initial public offering, is the procedure through which a private firm issues shares of stock to investors for the first time. When a firm goes public via an IPO, we frequently refer to it as “going public.”

Companies that are just getting started or those that have been in business for decades might choose to go public through an IPO. The IPO process enables a firm to generate funds to support operations, accelerate expansion, and pay down debt. An IPO also allows corporations to repay its investors, who have the option of selling their private shares in the IPO. In general, a private firm with significant development potential will explore going public, mostly for the reasons stated above. It’s the obvious and expected next step for successful companies in many respects. Airbnb, which went public in the winter of 2020, is one of the more high-profile recent examples of a firm going public.

After a firm decides to “go public,” it selects a lead underwriter to assist with the securities registration procedure and the distribution of shares to the public in an IPO. The lead underwriter then assembles a syndicate of investment banks and broker-dealers to sell IPO shares to institutional and individual investors.

How an IPO works?

A corporation is deemed private prior to an IPO. As a pre-IPO private company, the firm has grown with a limited number of shareholders, including early investors such as the founders, family, and friends, as well as professional investors such as venture capitalists or angel investors.

An IPO is a significant milestone for a company since it allows it to raise a large sum of money. This increases the company’s capacity to develop and expand. The enhanced openness and share listing credibility may also aid in obtaining better terms when seeking borrowed capital.

When a firm thinks it is mature enough for the rigours of Securities and Exchange Commission Rules and Regulations (SEC), as well as the rewards and obligations of public shareholders, it will begin to promote its interest in going public.

This stage of development is often achieved when a firm has attained a private valuation of about $1 billion, sometimes known as unicorn status. However, depending on market competition and their capacity to fulfil listing standards, private firms at varied valuations with good fundamentals and demonstrated profitability potential can potentially qualify for an IPO.

Underwriting due diligence is used to price a company’s IPO shares. When a corporation goes public, previously owned private share ownership transitions to public ownership, and current private shareholders’ shares are worth the public selling price. Special arrangements for private to public share ownership can also be included in share underwriting.

Meanwhile, the public market provides a large chance for millions of investors to acquire shares in a firm and contribute cash to the shareholders’ equity of a corporation. Any individual or institutional investor interested in investing in the firm is considered a member of the public.

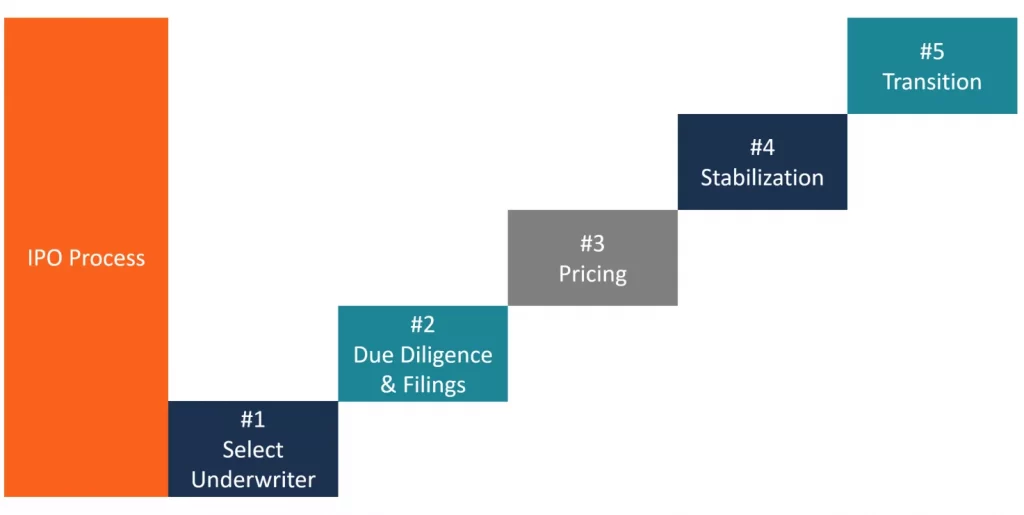

Overview of IPO Steps

Here are some steps a company must undertake to go public via an IPO process:

Select an Investment Bank

The issuing company’s first stage in the IPO process is to select an investment bank to advise it on its IPO and offer underwriting services. The investment bank is chosen based on the following criteria:

- Reputation

- The quality of research

- Industry expertise

- Distribution, i.e., if the investment bank can provide the issued securities to more institutional investors or to more individual investors

- Prior relationship with the investment bank

Due dilligence and regulatory filings

Underwriting is the procedure through which an investment bank (the underwriter) serves as a middleman between the issuing firm and the investing public in order to assist the issuing company in selling its initial set of shares. The issuing business can choose from the following underwriting options:

- Firm Commitment: In such a case, the underwriter buys the whole offer and resells the shares to the investing public. The firm commitment underwriting structure ensures that a specific amount of money will be obtained for the issuing business.

- Best Efforts Agreement: The underwriter does not guarantee the amount raised for the issuing business under such an arrangement. It solely sells securities on the company’s behalf.

- All or None Agreement: The offering is cancelled unless all of the offered shares are sold.

- Syndicate of Underwriters: Public offers can be managed alone by one underwriter or by numerous managers (shared management). When numerous managers are present, one investment bank is designated as the main or book-running manager. The lead investment bank develops a syndicate of underwriters by developing strategic agreements with other banks, each of which then sells a portion of the IPO. Such an agreement is formed when the main investment bank want to spread the risk of an IPO across many banks.

Some of the documents that have to be drafted by the underwriters are:

- Engagement letter

- Letter of Intent

- Underwriting Agreement

- Registration Statement

- Red Herring Document

Pricing

The effective date is determined once the SEC approves the IPO. On the day before the effective date, the issuing company and the underwriter agree on the offer price (i.e., the price at which the issuing company would sell the shares) and the exact number of shares to be sold. The offer price must be determined since it is the price at which the issuing firm raises funds for itself.

Stabilization

After bringing the issue to market, the underwriter must offer analyst recommendations, after-market stabilisation, and the creation of a market for the shares issued.

In the case of order imbalances, the underwriter performs after-market stabilisation by acquiring shares at or below the offering price.

Stabilization efforts can only be carried out for a limited time; nevertheless, during this time, the underwriter has the flexibility to trade and affect the price of the issue since price manipulation rules are suspended.

Transition to Market Competition

The last step of the IPO process, the transition to market competition, begins 25 days following the initial public offering when the SEC-mandated “silent period” expires.

During this time, investors shift from relying on mandated disclosures and prospectuses to depending on market forces for information about their stocks. After the 25-day period has passed, underwriters can submit estimates for the issuing company’s earnings and value. As a result, after the issue is made, the underwriter takes on the responsibilities of counsellor and assessor.

Advantages and Disadvantages of Going Public

| Advantages | Disadvantages |

|---|---|

| Capital can be used to fund research and development, capital expenditure, or pay off existing debt. | Public companies are regulated by the Securities Exchange Act of 1934 which may be difficult for newer public companies |

| Increased public awareness of the company | Must meet other rules and regulations that are monitored by the Securities and Exchange Commission (SEC) |

| Used by founding individuals as an exit strategy | The cost of complying with regulatory requirements can be very high. |

As previously said, the most obvious advantage is the cash reward in the form of capital raising. Capital can be utilised to support R&D, capital spending, or even to pay off current debt.

Another benefit is greater public knowledge of the firm, as IPOs frequently generate awareness by introducing their products to a new set of potential clients. As a result of this, the company’s market share may rise. An IPO may also be utilised as an exit strategy by founding members. Many venture capitalists have utilised initial public offerings (IPOs) to profit from successful firms that they helped launch.

Even with the benefits of an IPO, public firms frequently encounter a number of disadvantages that may cause them to reconsider going public. One of the most significant developments is the requirement for more investor transparency.

Furthermore, public corporations are subject to quarterly financial reporting requirements under the Securities Exchange Act of 1934, which may be onerous for newer public companies. They must also comply with other laws and regulations overseen by the Securities and Exchange Commission (SEC).

More significantly, especially for startups, the expense of complying with regulatory standards can be prohibitively expensive. The creation of financial reporting documentation, audit fees, investor relations departments, and accounting oversight committees are all examples of added expenditures.

Conclusion

When investing in IPOs, you should seek the advice of a financial expert and proceed with caution. If you are fortunate enough to obtain an allocation of shares at the offering price of an IPO, be careful to conduct comprehensive research and due diligence before investing.

Remember that an IPO’s price might go below its offering price when it hits the public market—it doesn’t necessarily go higher.

References

What Is an Initial Public Offering (IPO)?

Investing In IPOs And Other Equity New Issue Offerings

IPO Process

What Are The Advantages and Disadvantages Of A Company Going Public?