It goes without saying that investors of all stripes have been spooked by the recent collapse of Silicon Valley Bank and Signature Bank, as well as the Swiss National Bank facilitating UBS’ $3.2 billion purchase of Credit Suisse, First Republic Bank’s stock falling more than 70% and bank stocks, on the whole, being hammered. Many seem to think a 2008-like financial crisis is beginning.

While it’s important not to understate the precarity of our current situation, there are major differences that make these two events, more or less, incomparable.

For one, Lehman Brothers was an investment bank, and both Silicon Valley Bank and Signature Bank were commercial banks. The size was also quite different despite Silicon Valley Bank being the second biggest bank failure in American history. Lehman Brothers had $600 billion in assets in 2008. Silicon Valley Bank had $198 billion. Adjusting for 15 years of inflation, Silicon Valley Bank was maybe 20% the size of Lehman Brothers.

Even more important, the assets that caused the runs on Lehman Brothers and Silicon Valley Bank are about as different as could be. For Lehman Brothers, it was a series of highly leveraged derivatives secured against highly leveraged mortgages given to unqualified buyers that were going delinquent en masse. With Silicon Valley Bank, the asset in question were fully performing bonds, supposedly some of the safest assets around.

While that may sound odd, the decisions made by Silicon Valley Bank were about as head-scratching as those made by Lehman Brothers, given the circumstances once you dig into the details.

So let us start there—by digging in and explaining what exactly happened to them.

Why Silicon Valley Bank and Signature Bank Collapsed

What set the stage for Silicon Valley Bank and Signature Bank’s demise was the most dramatic interest rate tightening in history after a prolonged state of interest rates being as low as they had ever been. But moreover, particularly with regards to Silicon Valley Bank, it was actually believing what the Fed said in 2021. When Jerome Powell said that “inflation would be transitory,” they somehow believed it.

Since the 2008 financial crisis, the Fed has consistently kept rates at or near zero. They finally started to bring them up ever so slightly, and then Covid hit, and the Fed pushed them right back down. They proceeded to keep rates near zero throughout 2021 despite the government injecting trillions of dollars into the economy through multiple stimulus packages. The signs of inflation beginning to take hold were as plain as day.

Low interest rates can spur economic activity and increase productivity, but they can create a range of other problems, including inflation, economic inequality, and what’s keenly important here: a desperate chase for yield.

What I mean by a chase for yield is that when interest rates are so low, any “risk-free” asset (such as money market accounts, treasury bonds, etc.) has a return near zero. In 2021, banks were offering around a 0.1 % return to have money in a savings account. It was around 0.5 % in a money market account. You might as well have stored your money under a mattress.

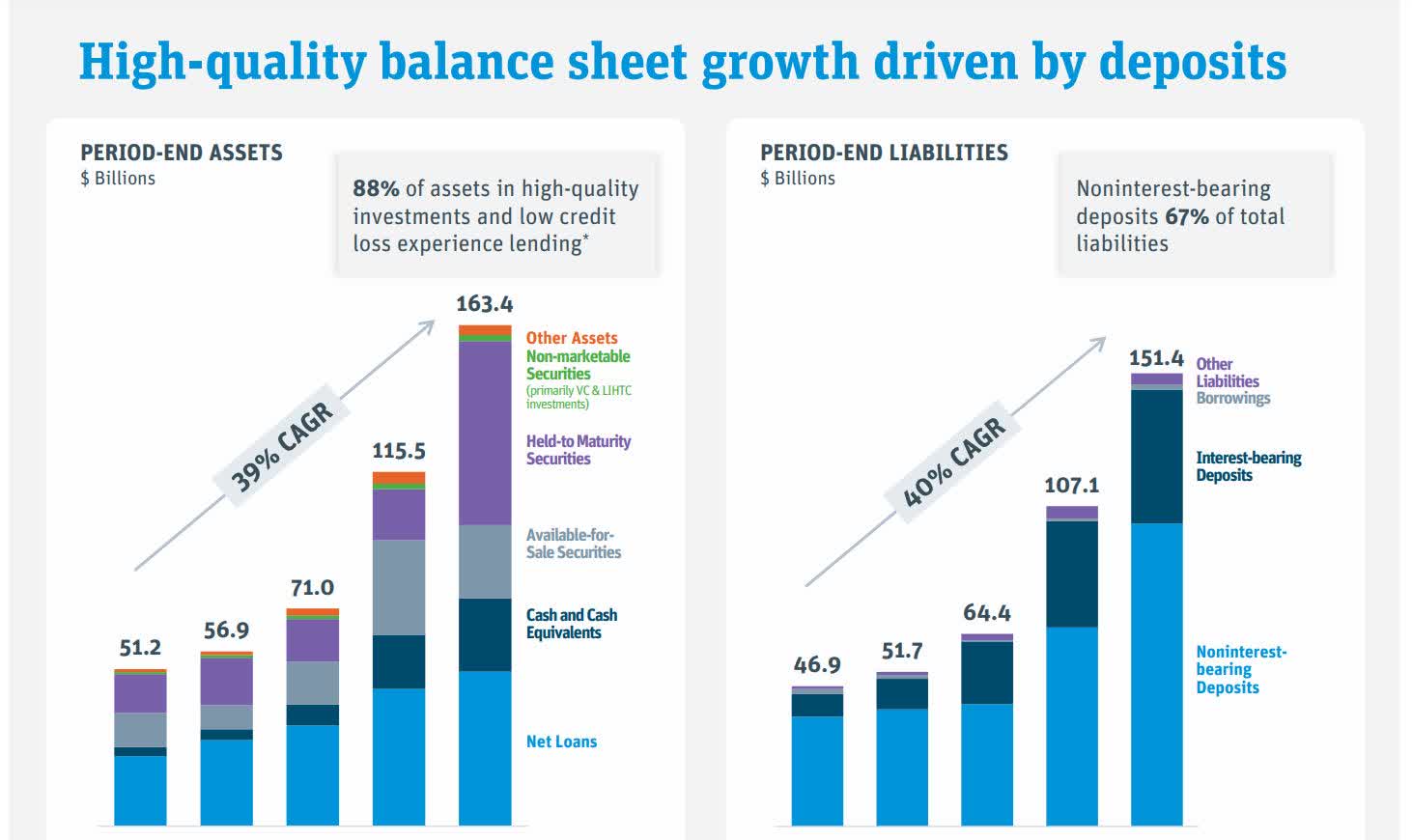

Silicon Valley Bank was the go-to bank for tech startups and Silicon Valley firms, who saw an enormous boom during Covid. This led to a massive increase in depositors for Silicon Valley Bank. The bank’s deposits went from $49 billion in 2018 to $102 billion in 2020 to $189.2 billion in 2021 and peaked at $198 billion.

This is when Silicon Valley Bank made its critical mistake. They chased yield. They bought $80 billion in mortgage-backed securities of over 10 years in duration with a weighted average yield of 1.56%.

1.56% may sound low, but remember what options were available in 2021 for “low-risk” bonds.

Then we had the fastest interest rate increase in history, and this happened to the yield on 10-year mortgage-backed securities:

So, the returns of these “low-risk” assets were less than half of the market value. Needless to say, the value of such bonds plummeted. But there was one more key factor about these bonds. They are what’s called “held-to-maturity.” The point of which is, quite obviously, to hold to maturity.

But what this means, in actual fact, is that these bonds do not need to be revalued unless and until they are sold. Thereby, Silicon Valley Bank was sitting on a huge pile of unrealized losses that amounted to a house of cards. Just look at their own report from 2021 before any grey clouds appeared on the horizon to see how many of these HTM bonds they were holding (in purple).

Then in late 2022, the tech boom burst. Facebook laid off over 10,000 workers on two separate occasions, Amazon laid off 9,000 after having laid off 18,000 earlier, Twitter laid off almost 4,000, and a bunch of other tech firms did as well. The Covid-fueled tech boom was over, and thereby a tech-reliant bank saw significant pressure on its deposits.

Adding to this—inflation is pinching people’s savings and thereby diminishing bank deposits in general.

This pressure on Silicon Valley Bank’s deposits required them to raise capital. But selling those HTM bonds forced them to realize those unrealized losses, as once you sell one, you have to revalue the whole portfolio.

Then Silicon Valley Bank CEO Greg Becker had a disastrous call with investors that amounted to this meme:

In the call, Greg Becker said Silicon Valley Bank would book a $1.8 billion after-tax loss on the sale of many of these bonds and needed to raise $2.25 billion.

As one might expect from a “don’t panic” call, it caused a panic, and a run on the bank ensued.

Silicon Valley Bank, like virtually all banks, does fractional reserve banking, which means a bank does not need to hold all of the deposits it takes on hand, but only a fraction of them—usually 10%. It can lend out the other 90%. (Although now it’s technically zero reserve banking, but that’s another story.)

So, for example, if there is a 10% reserve and a bank holds $100 in deposits, they can make about $900 in loans. Thus, if everyone asks for their money back at the same time, they don’t have it, and the bank collapses. There have been many such bank runs in American history.

Signature Bank also had a whopping $762 million in unrealized losses from the same HTM bonds that sunk Silicon Valley Bank. But they also had some more obvious problems.

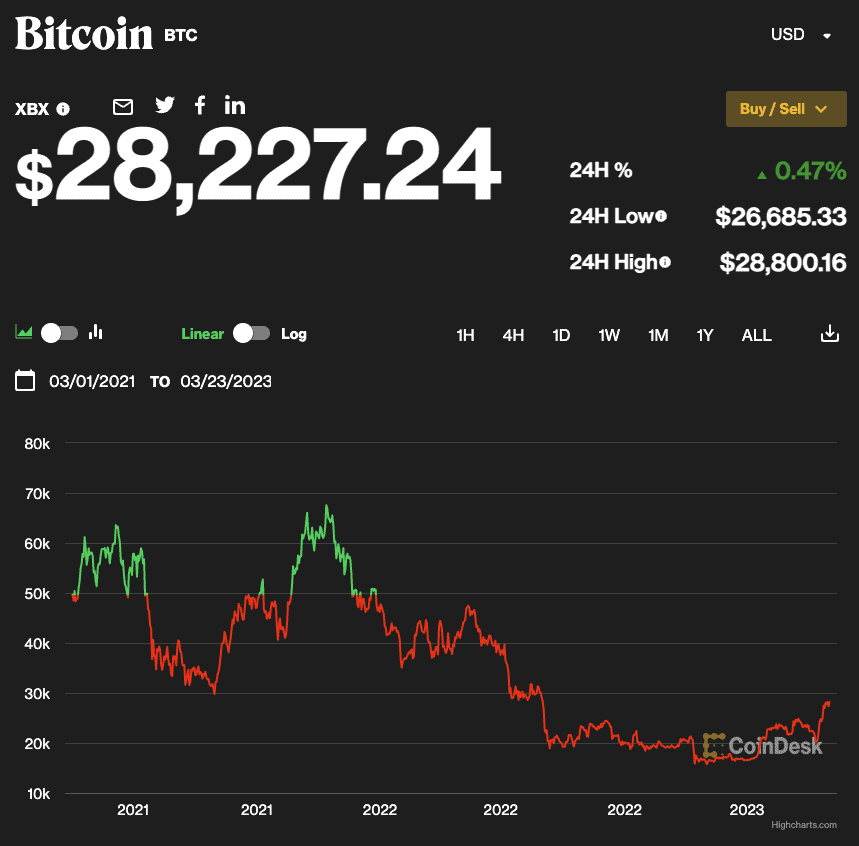

Other than facing a criminal probe before they collapsed, something like 20% of Signature Bank’s depositors were made up of crypto customers. Here’s what happened to Bitcoin over the last couple of years for those who may have forgotten.

Even despite these obvious problems, there is still some ambiguity about what exactly caused Signature Bank to be closed by regulators.

Some have floated the idea that a 2018 bank deregulation bill precipitated this crisis. The bill removed certain oversights, particularly regarding stress tests, to so-called regional banks with under $250 billion in assets.

This deregulation may have made things worse, but it seems highly dubious as a root cause. I’ve seen little evidence that Silicon Valley Bank held insufficient cash reserves. Nor did it have what people think of as “toxic assets,” like the collateral debt obligations with piles of delinquent loans from 2008. What killed these banks were holding large numbers of supposedly safe, fixed bonds in a highly inflationary environment. The rapid increase in interest rates and the peculiar way HTM bonds are valued were the prime causes in my judgment. And it was Silicon Valley Bank and, to a lesser degree, Signature Bank’s poor risk management and inability to foresee the inevitable increase in rates that doomed them.

What Does This Mean for the Economy?

Unlike Lehman Brothers, neither Silicon Valley Bank nor Signature Bank were investment banks, nor were they key intermediaries. Silicon Valley Bank was heavily connected to tech, and Signature Bank to crypto. But moreover, broadly speaking, there are two ways a bank can collapse: insolvency and illiquidity.

Insolvency means the bank’s assets are worth less than its liabilities. This was the case with Lehman Brothers.

Illiquidity means there is a “maturity mismatch,” which, as Investopedia defines it,

“…commonly alludes to situations involving a company’s balance sheet. A business cannot meet its financial obligations if its short-term liabilities outweigh its short-term assets and will likely run into problems, too, if its long-term assets are funded by short-term liabilities.”

Both SVB and Signature are illiquidity bankruptcies, which are less destructive as the bank’s assets aren’t entirely toxic. They just can’t meet their short-term obligations. Indeed, when Silicon Valley Bank’s assets are auctioned off, it won’t come close to a total loss.

For this reason, it is unlikely these bank failures are the beginning of an economy-wide collapse like 2008. Unfortunately, it does create an enormous problem for the Federal Reserve and likely signifies we will be in an economic malaise for some time.

Before either of these failures or the buyout of Credit Suisse, the FDIC had announced that there were $620 billion in unrealized losses being held on the bank’s balance sheets from the same type of HTM bonds that brought down Silicon Valley Bank.

These losses were caused by interest rates spiking. That was done to quell inflation. And while inflation has moderated some, it’s still high at over 6%. And thus, the Fed finds itself between a rock and a hard place.

The Fed’s Catch-22

If you could write a hypothetical scenario of how a central bank could mishandle the economy as badly as feasibly possible, it would be hard to think of one worse than how the Federal Reserve acted between 2021 and the end of 2022.

First, they kept rates at all-time lows throughout 2021 while the economy was doing well and real estate prices were skyrocketing. Then they completely misjudged inflation and then jacked rates up faster than any time in history to quell the inflation they didn’t anticipate, which has created this massive glut of unrealized bank losses and other economic discombobulations.

The goal of any central bank should be to maintain stability, and it’s hard to see how they could have failed to keep things stable more so than they have over the past few years.

Now, due to their own incompetence, they are facing a horrible catch-22. Even before these recent bank failures, the Fed had signaled they would slow down their rate hikes. Now, they may be rethinking their entire policy in that regard.

As I’ve noted in other articles, all other things being equal, the more money injected into the economy, the more inflation there will be. This is one reason that increasing interest rates tends to lower inflation. It reduces economic activity and the number of bank loans. And because of fractional reserve banking, bank loans add money to the economy, whereas paying them off (or loans going delinquent) removes money from the economy. (See here for a more detailed explanation).

Unlike TARP from 2008, Silicon Valley Bank and Signature Bank were not bailed out. But the depositors were entirely bailed out despite FDIC insurance ostensibly capping deposit insurance at $250,000.

A lot of businesses would have been unable to make payroll had the FDIC not done this. Whether it’s acceptable to make the rest of us pay for their deposits is another question. But what’s clear is doing so injected a lot of money into the economy. JPMorgan expects the Fed’s emergency actions, in this case, to have added $2 trillion to the banking system.

In the middle of last year, I predicted inflation would be with us for quite some time. In part, it was because I did not believe that the Fed had the courage (gall?) to raise rates enough to break inflation as it would likely throw the economy into a recession. I have been surprised to see how aggressive they have been. But in doing so, they inevitably created major problems that the collapse of Silicon Valley Bank and Signature Bank, the buyout of Credit Suisse, and the huge amount of unrealized HTM losses make crystal clear.

If they keep raising rates, those unrealized losses will increase proportionally, and more banks will likely fail. If they don’t, any progress thus far on fighting inflation will stall and likely reverse, and high inflation will probably be with us for the foreseeable future.

The Fed already blinked once by bailing out the depositors.

Will they blink further by halting the rate increases? Or will they actually lower them?

Either way, they’ve been backed into a corner of their own making, and the economy will suffer in one way or another. Investors should not expect a 2008-style collapse. But, in my humble judgment, they absolutely should expect continued volatility and a protracted economic malaise.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.