My colleague Devesh Shah sat down with Artisan’s Michael Cirami for a long conversation. Mr. Cirami is a managing director of Artisan Partners, a portfolio manager on the EMsights Capital Group, and lead portfolio manager for the Artisan Emerging Markets Debt Opportunities, Global Unconstrained, and Emerging Markets Local Opportunities Strategies. Two of those three strategies, Debt Opportunities and Global Unconstrained, are manifested in mutual funds.

Prior to joining Artisan Partners in September 2021, Mr. Cirami had a distinguished career at Eaton Vance. He is also a member of the Board of Directors of the Emerging Markets Investors Alliance. The organization seems to strongly emphasize collaborative action to improve transparency and sustainability in emerging markets.

As a complement to their long and thoughtful discussion, we’ll share the answers to two questions. First, what’s the case for investing in EM debt? Second, what’s the case for investing with the Artisan Emerging Markets Debt Opportunities Fund (APFOX)?

The Case for Emerging Markets Debt

-

Emerging markets debt is a major and mature asset class.

The exact size of the universe is unclear. Emerging market investor Ashmore Group estimated it at $30 trillion in 2020, while the Institute for International Finance has over $100 trillion now. Yes, Covid, but really?

The EM government bond market is USD 13.0trn (44% of the total), while the corporate bond market is USD 16.6trn (56% of the total). Financial sector corporates in EM have issued USD 10.7trn of total outstanding corporate debt with the balance of USD 5.9trn issued by non-financial corporates. (Ashmore Group, EM Fixed Income Universe 9.0, 8/202o)

The report showed 75% of the Institute for International Finance’s emerging market (EM) universe saw an increase in debt levels in dollar terms in the first quarter, with the overall figure crossing over $100 trillion for the first time. China, Mexico, Brazil, India and Turkey posted the biggest increases, the data showed. (Reuter, “Global Debt on the Rise,” 5/17/2023)

The IMF Global Debt Monitor report laments:

Adequate debt data are typically lacking for many emerging market and low-income countries. (Global Debt Monitor, 12/2022)

Broadly speaking, historical problems like debt defaults have largely faded as more markets have matured and have taken seriously the conditions imposed by international lenders.

Mr. Cirami, in speaking with Devesh, makes two points: he believes his investable universe is something in the $3 trillion range and, further, that the overall size of the universe is largely irrelevant to his ability to find attractive, mispriced assets.

-

Emerging markets have stronger fundamentals than developed markets.

The question to ask before lending someone money is, are they going to promptly repay it? The answer to that is informed by how much debt they’re already in and what their record of repayments has been. (Those are the dominant factors driving an individual’s credit scores as calculated by Experian, TransUnion, and company.) Emerging markets carry far less debt than developed markets, such as the US and Europe. The developed markets’ debt-to-GDP ratio is over 120%, while the emerging markets are under 70% debt-to-GDP ratio.

Emerging markets have held up surprisingly well against a series of challenges that might previously have led to a debt crisis. Kenneth Rogoff, former chief economist of the International Monetary Fund and Professor of Economics and Public Policy at Harvard University, marveled at the available calamities that might have upended the emerging markets but haven’t:

… wars in Ukraine and the Middle East, a wave of defaults among low- and lower-middle-income economies, a real-estate-driven slump in China, and a surge in long-term global interest rates – all against the backdrop of a slowing and fracturing world economy.

But what surprised veteran analysts the most was the expected calamity that hasn’t happened, at least not yet: an emerging-market debt crisis. Despite the significant challenges posed by soaring interest rates and the sharp appreciation of the US dollar, none of the large emerging markets – including Mexico, Brazil, Indonesia, Vietnam, South Africa, and even Turkey – appears to be in debt distress, according to both the IMF and interest-rate spreads. (“Emerging markets have ignored the ‘Buenos Aires consensus,’” Financial Review, 11/28/2023)

Research Affiliates calculates a 4.5% real return for EM local debt over the next decade, with a Sharpe ratio of 0.32. Of the development markets, only Japan is poised for returns competitive with those (4.6%), with the US and European markets projected to return 1.6 – 3.4%. If correct, EM debt will return about 50% more than developed markets debt, though with higher volatility.

That higher volatility has to be read in context: the long-term returns in EM debt tend to match those of US high-yield debt but with about half of the volatility. So EMD is more volatile than investment grade debt, with higher returns, but dramatically less volatile than high-yield, with comparable returns.

-

Most investors are underexposed to emerging market debt

You need to approach this argument with care.

In an ideal world, your portfolio is composed of a mix of assets that give you the most bang for the buck. That doesn’t mean betting it all on the assets you pray will return the most on their own; it often means including some assets that will zig when the market zags. EM debt tends to be a ziggy asset. The mix of assets that give you the best risk-adjusted returns defines “the efficient frontier,” which is simply an analysis of what mix of assets gives the best results given the amount of risk you’re willing to take on. The mix is different if you’re willing to (or if you think you’re willing to) live with 15% annual volatility than if you’re comfortable with 6%.

Eric Fine and Natalia Gurushina, from the Emerging Markets Fixed Income team at Van Eck, calculate the efficient frontier for fixed-income investors for the period from 2003-2022. By their calculation, “for a fixed income portfolio with a low desired volatility of around 6.5, the optimal allocation to EM debt should have been 8%” (The Investment Case for Emerging Markets Debt, 2023). Sophisticated investors such as US pension funds are typically at 3%, and individual investors have a vanishingly small exposure.

That parallels our biases in EM equity investing. Morgan Stanley estimates that US investors have 6-8% exposure to EM equity, with an optimal exposure of 13-39% based on metrics such as GDP, implied marketing weighting, or efficient market theory (“Emerging Market Allocations: How Much to Own?” 2021).

The Case for Artisan Emerging Markets Debt Opportunities Fund

Passive investors in emerging markets have been plagued by underperformance in both absolute and risk-adjusted terms. That’s true in both equity and debt. The problem in both cases is that the benchmark indexes are poorly designed to favor “scalable” investments; that is, they tend to favor large, indebted issuers in larger markets. Mr. Cirami argues that there are a series of errors embedded in the EM benchmark:

We think there are interesting investments out there. Importantly, we don’t think they’re all represented well by the standard EM debt benchmarks—which exclude significant investable swathes of the markets. To take just one example, consider the hard currency space (wherein, incidentally, we think the benchmark does a slightly better job of representing the asset class): the benchmark excludes countries’ euro-denominated paper issuances, which means countries like Albania, North Macedonia, Montenegro and Benin are underrepresented for (in our opinion) no great reason. As a result, the EM investable universe is actually much broader than represented by the most common benchmark. Additionally, the benchmark has a considerable number of low -spread securities, while also including some from countries that have defaulted. (“Emerging Market Debt: Beyond the Benchmarks,” 5/30/2023)

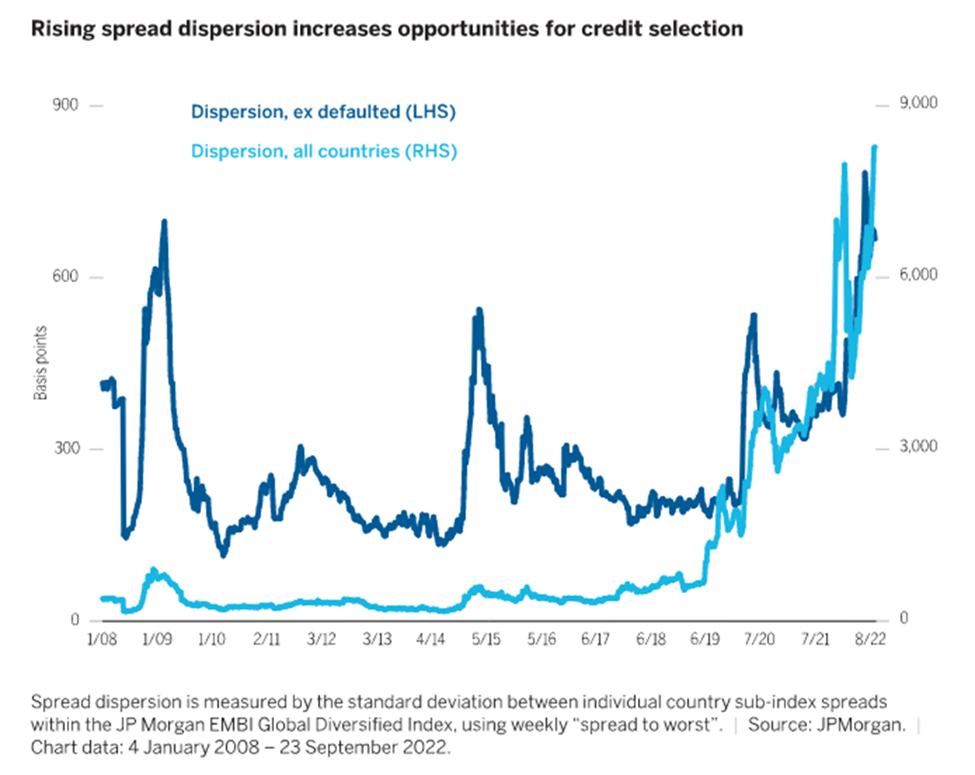

And it turns out that market selection matters a lot. Wellington Management calculates “spread dispersion” in emerging markets; that is, how much more you can get by investing in one market than in another. Wellington Management shows that the spread dispersion is at 15-year highs:

The Artisan team seeks “idiosyncratic opportunities with compelling risk-adjusted return potential.” The team covers 100 markets but invests with only 40 issuers. Morningstar celebrated Mr. Cirami’s historic success in taking out-of-benchmark positions when they provided compelling opportunities:

Unlike many managers in the emerging-markets local-currency bond Morningstar Category, the team looks beyond the relatively concentrated JPMorgan GBI-EM Global Diversified Index, considering investment opportunities in virtually every emerging country that has capital markets. When the team finds the benchmark countries unattractive, it adds out-of-index positions in sovereigns, typically frontier markets such as Serbia or Ukraine, as well as corporates, while keeping the portfolio’s market sensitivity close to the benchmark’s.

The strategy’s out-of-index exposure has historically provided incremental gain on the upside, like in 2019, and acted as a buffer during tough years, as in 2013 and 2015.

That independence has led to an outstanding short- and long-term track record. In the shortest term, the fund dropped 0.35% in the third quarter of 2023, against a benchmark decline of 2.25%. Since its inception, APFOX has decisively outperformed its peers and near-peers.

Artisan EMD Opportunities is categorized by Lipper as an EM local currency debt fund. The related category is EM hard currency debt, with the difference being whether the debt was issued in the local currency or in US dollars. Dollar-denominated debt tends to be a bit more stable but yields less. Between the two groups, there are 111 funds and ETFs.

Of them, Artisan EMD Opportunities has the strongest record since its inception.

| APFOX | Peer ranking | |

| Annualized returns | 9.8% | #1 out of 111 funds (combined local/hard) |

| Standard deviation | 6.3% | #5 in the combined group and #1 in the local currency debt group |

| Down market deviation | 3.1% | #2 of 111 and #1 in the local group |

| Maximum drawdown | 2.7% | #1 of 111 |

| Sharpe ratio | 0.93 | #1 of 111 |

| Ulcer Index | 1.2 | #1 of 111 |

Source: MFO Premium data calculations and Lipper global data feed

The pattern mirrors the work Mr. Cirami did in managing the multi-billion-dollar Eaton Vance Global Macro Absolute Return, Eaton Vance Global Macro Absolute Return Advantage, and Eaton Vance Emerging Markets Local Income funds.

Bottom Line

Artisan prides itself on its ability to identify, partner with, and support management teams that have the prospect of being “category killers.” They’ve done so with exceptional consistency. For relatively sophisticated investors seeking dedicated exposure to EM debt, Artisan EMD Opportunities is likely to remain among the most compelling options.

Investors interested in Mr. Cirami’s services but wary about pure EMD exposure should investigate Artisan Global Unconstrained Fund, which applies the same discipline but has the freedom to invest across markets worldwide. Both funds have Silver analyst ratings from Morningstar, and both have substantially outperformed their peers since inception.