Updates

BenWP, a member of MFO’s discussion community, contributed that the Capital Group has several new equity and fixed-income ETFs. One of the newest ETFs is the Capital Group Core Balanced ETF, an active multi-asset ETF. Some of the other active equity ETFs are the Capital Group International Equity ETF, Capital Group International Focus Equity ETF, Capital Group Dividend Growers ETF, Capital Group Dividend Value ETF, Capital Group Global Growth Equity ETF, Capital Group Core Equity ETF, and Capital Group Growth ETF. The Capital Group has several new fixed-income ETFs: Capital Group Core Bond ETF, Capital Group Core Plus Income ETF, Capital Group Short Duration Income ETF, and Capital Group U.S. Multi-Sector Income ETF. There are two municipal ETFs: Capital Group Municipal Income ETF and the Capital Group Short Duration Municipal Income ETF.

Fidelity will convert the following mutual funds, according to an SEC filing:

- International Enhanced Index Fund (FIENX) will become Enhanced International ETF

- Large Cap Core Enhanced Index Fund (FLCEX) will become Enhanced Large Cap Core ETF

- Large Cap Growth Enhanced Index Fund (FLGEX) will become Enhanced Large Cap Growth ETF

- Large Cap Value Enhanced Index Fund (FLVEX) will become Enhanced Large Cap Value ETF

- Mid Cap Enhanced Index Fund (FMEIX) will become Enhanced Mid Cap ETF

- Small Cap Enhanced Index Fund (FCPEX) will become Enhanced Small Cap ETF.

The ETFs will retain their investment objectives and the management of their actively indexed funds. Their related ETF expenses will be significantly less than their mutual fund counterparts. The ETFs will continue to be managed by Anna Lester, Max Kaufmann, and Shashi Naik.

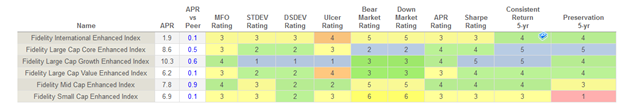

On the whole, the funds have been solid since inception. The chart below reflects performance relative to their Lipper peers on a variety of measures of return, volatility, and risk-adjusted returns. Make it easy on yourself: Blue is high, Green is above average, Yellow is roughly average. You would worry if you saw a lot of orange and red, but you don’t.

All data and ratings are generated at MFO Premium (the web’s best fund analyzer for those with a little knowledge of numbers and a reluctance to share $15,000 for access to The Big Boy’s Toy).

Vanguard International Dividend Growth Fund held a subscription period from November 1, 2023, through November 14, 2023. During this period, the Fund invested in money market instruments or cash rather than seeking to achieve its investment objective. This strategy should allow the Fund to accumulate sufficient assets to construct a complete portfolio and is expected to reduce initial trading costs.

SMALL WINS FOR INVESTORS

Southeastern Asset Management has lowered its expense fees on its Longleaf Partners International and Longleaf Partners Global Funds. Both funds’ expense caps have been reduced from 1.15% to 1.05%, effective November 1, 2023, through at least April 30, 2025.

CLOSINGS (and related inconveniences)

American Beacon FEAC Floating Rate Income Fund, investor share class, will be reorganized into the A share class effective the close of business on December 29. This fund was formerly the Shore Point Floating Rate Income Fund which was reorganized into American Beacon Funds around December 15, 2015. The fund is currently rated two stars by Morningstar.

The Angel Oak High Yield Opportunities and the Angel Oak Total Return Bond Funds have closed their class A shares to new and existing investors effectively immediately on November 8.

PIMCO is liquidating the Administrative Class of PIMCO Global Bond Opportunities Fund (U.S. Dollar-Hedged) on or about March 15, 2024.

OLD WINE, NEW BOTTLES

Allspring C&B Large Cap Value Fund will become Allspring Large Cap Value Fund on or about March 4, 2024. Allspring is the former Wells Fargo Asset Management, which was bought by two private equity funds and rebranded. And, as it turns out, being subjected to a year-end housecleaning. The adviser posted a dozen change announcements to the SEC on a single day. We note, below, the liquidation of their target-date funds. If you’re an Allspring fundholder (a) why? and (b) check your email because there’s a pretty good chance that your fund has been renamed, repurposed, liquidated, or otherwise buffed.

Effective as of March 1, 2024, the name of ClearBridge Value Trust will be changed to ClearBridge Value Fund.

Neuberger Berman U.S. Equity Index PutWrite Strategy Fund becomes the newly-created Neuberger Berman Option Strategy ETF on January 26, 2024. That turns out to be a surprisingly complicated venture. The “A” and “C” shares already rolled into “Institutional.” On January 11, “R6” shares will merge into Institutional. January 19, Neuberger engineers a reverse share split to raise the fund’s NAV. On January 26, the firm cashes out any fractional shares, then converts the fund to an ETF will every shareholder receiving a whole number of shares.

The Roundhill BIG Tech ETF has been renamed Roundhill Magnificent Seven ETF. No change in strategy (buy Amazon, Apple, Facebook, Google, Microsoft, Nvidia, Tesla), but the ticker did transition from BIGT to MAGS. Because, why not declare yourself a slave to named market darlings? Look how well that worked in 2000 when “El Siete Magníficos” would have been Microsoft (hi, Bill), GE, Cisco, Intel, NTT, Nokia, and Lucent. So here is Intel’s price chart:

Hmmm … well, if you had bought this early Magnificent Seven stock at its $41/share peak in 2000, you would have been subject to some short-term repricing (say an 80% loss in the following two years), but you would have roared back to your $41 purchase price … 18 years later. Followed by a surge and another downward adjustment so that the current share price remains about 25% below its 2000 level.

So, stock up on the Magnificent Seven. What’s the worst that could happen?

Virtus Newfleet High Yield Bond ETF became Virtus Newfleet Short Duration High Yield Bond ETF on November 28, 2023.

OFF TO THE DUSTBIN OF HISTORY

In case you’re wondering about the target date for the Allspring (fka Wells Fargo) Target-Date funds, it is December 29, 2023. On that date, Allspring Dynamic Target Today Fund, plus all of its Dynamic Target date siblings, will be liquidated.

In addition, Allspring is merging away for other fours in February 2024.

| Target Fund | Acquiring Fund |

| Allspring C&B Mid Cap Value Fund | Allspring Special Mid Cap Value Fund |

| Allspring Growth Balanced Fund | Allspring Asset Allocation Fund |

| Allspring Moderate Balanced Fund | Allspring Spectrum Moderate Growth Fund |

| Allspring Small Cap Fund | Allspring Small Company Value Fund |

The tiny B.A.D. ETF (well-earned ticker: BAD) was liquidated on November 23, 2023. It was a bad attempt to replicate earlier “sin” funds, such as the Vice Fund and Morgan FunShares, which invested exclusively in socially sanctioned industries. In this case, Betting, Alcohol, and Drugs (or, at least, Canadian cannabis stocks). Two managers, neither of whom committed a penny of their own wealth to the enterprise. Which is good for them since the fund ended life at a loss-since-inception.

Beech Hill Total Return Fund will be liquidated on December 4, 2023.

The Causeway Concentrated Equity Fund will be liquidated on or about December 14.

Clouty Tune ETF was liquidated on November 26, 2023. (Every time I see the name, my brain substitutes Clayton Tune – a hapless quarterback for the Arizona Cardinals whose total quarterback rating, on a scale of 1 to 100, is 1.5 – ETF for it.) The fund opened in June 2023 with what appears to be a seed investment of $500,000. The fund now has … well, under $500,000 in assets and, in the 21st century, five months is more than enough time to become Insta-famous or flameout so …

Clouty Tune ETF was liquidated on November 26, 2023. (Every time I see the name, my brain substitutes Clayton Tune – a hapless quarterback for the Arizona Cardinals whose total quarterback rating, on a scale of 1 to 100, is 1.5 – ETF for it.) The fund opened in June 2023 with what appears to be a seed investment of $500,000. The fund now has … well, under $500,000 in assets and, in the 21st century, five months is more than enough time to become Insta-famous or flameout so …

The Energy & Minerals Group EV, Solar & Battery Materials (Lithium, Nickel, Copper, Cobalt) Futures Strategy ETF (CHRG) has lost its charge and will be liquidated on December 15, 2023. We are now on the lookout for a new contender to the title “pointless fund with the longest name.” The decedent clocked in at 17 words.

iShares Factors US Value Style ETF, iShares Currency Hedged MSCI Canada ETF, iShares Currency Hedged MSCI United Kingdom ETF, and iShares MSCI Germany Small-Cap ETF were liquidated effective November 2, 2023.

The Jacob Internet Fund, institutional share class, was liquidated on or about November 17.

JPMorgan Social Advancement ETF and JPMorgan Sustainable Consumption ETF are the latest victims of “green flight” and will be liquidated and dissolved on the day after Christmas in 2023. (Fa-la-la-la-la!)

JPMorgan Tax Aware Equity Fund will be liquidated on or about December 19 due to it sustaining significant outflows during the past year.

The Kelly Hotel & Lodging Sector ETF (HOTL) will be liquidated on or about December 8.

The Loomis Sayles Credit Income Fund was liquidated on November 6.

After careful consideration and at the recommendation of Roundhill Financial Inc., the investment adviser to the Roundhill BIG Bank ETF, Roundhill MEME ETF, and Roundhill IO Digital Infrastructure ETF will close and liquidate on December 14, 2023.

After careful consideration and at the recommendation of Roundhill Financial Inc., the investment adviser to the Roundhill BIG Bank ETF, Roundhill MEME ETF, and Roundhill IO Digital Infrastructure ETF will close and liquidate on December 14, 2023.

On October 31, 2023, Pear Tree Axiom Emerging Markets World Equity Fund merged into Pear Tree Polaris International Opportunities Fund.

Sanford Bernstein Short Duration Plus Portfolio and Short Duration Diversified Municipal Portfolio will make a “liquidating distribution” on or shortly after January 26, 2024. (The visual image of what “distribution” one makes as one is being liquidated is … striking.)

The Virtus Duff & Phelps International Real Estate Securities, Virtus Stone Harbor Emerging Markets Debt Allocation, Virtus Stone Harbor High Yield Bond, and Virtus Stone Harbor Strategic Income Funds will be liquidated on or about December 13, 2023.

The SGI U.S. Small Cap Equity Fund will be liquidated on or about December 28.

The tiny and consistently underperforming Sterling Capital SMID Opportunities Fund merges into small and inconsistent Sterling Capital Mid Value Fund on or about January 26, 2024.

Utah Focus Fund had all the markers of an upcoming wreck: weird, narrow focus, managers who had no fund management experience and who wouldn’t invest in the fund, high expenses … wisely no one else would invest in it either, so it’s 15% loss over its first 11 months of operation hurt few and its pre-Christmas liquidation will close the book.

Virtus Funds will reorganize its Virtus Seix High Income and Virtus Seix Ultra-Short Bond Fund into Virtus Seix High Yield and Virtus Seix U.S. Government Securities Ultra-Short Bond Fund, respectively. The reorganizations are expected to occur on or about February 23, 2024.

Wildermuth Fund is making its liquidation look more than real. Effective November 1, 2023, Wildermuth Advisory, LLC was terminated adviser to the Fund. Daniel Wildermuth and Carol Wildermuth each resigned from the Board of Trustees. Daniel Wildermuth also resigned as Chairman of the Board. Daniel and Carol Wildermuth also resigned from their positions as officers of the Fund, including Daniel’s resignation as portfolio manager.

They’ve been succeeded by BW Asset Management Ltd, a sort of undertaker for condemned funds which has overseen the liquidation of over $1 billion in assets. Currently, they’re providing end-of-life / beginning-of-death services for a Mauritius-regulated fund with $110 million AUM; five private funds under voluntary liquidation with combined assets of $120 million; and “various funds in provisional or official liquidation with combined assets of $300 million.”

Shadow

Briefly Noted . . .

FPA Funds has registered the FPA Global Fund and the FPA Global ETF. Total annual expenses will be .49% for the ETF; expenses have not been stated for the FPA Global Fund.

Steven Romick, CFA, Managing Partner of the Adviser; Mark Landecker, CFA, Partner of the Adviser; and Brian A. Selmo, CFA, Partner of the Adviser, serve as portfolio managers of the Fund and of the ETF (and its predecessor fund inception in December 2021).

T Rowe Price has filed a registration filing for its Hedged Equity Fund for Investor, I, and Z class shares to become available on November 8. Total annual fund operating expenses for the Investor class will be .58%. The fund normally invests at least 80% of its net assets (including any borrowings for investment purposes) in equity securities and derivatives that have similar economic characteristics to equity securities or the equity markets. The fund may purchase the stocks of companies of any size and invest in any type of equity security, but its focus will typically be on common stocks of large-cap U.S. companies. Sean P. McWilliams will be the portfolio manager.