DoubleLine Capital, Jeffrey Gundlach’s $137bn asset management firm, has received approval from the Securities and Exchange Commission (SEC) to launch two active non-transparent ETFs.

The company initially filed for the strategies – the DoubleLine Opportunistic Bond ETF and the DoubleLine Shiller CAPE US Equities ETF – in October 2021. The funds have expense ratios of 0.5% and 0.65%, respectively.

The funds will not disclose assets every day, and while the equities ETF will make investments ‘related’ to the Shiller Barclays CAPE US Sector TR USD index, both will be actively managed.

The funds would be DoubleLine’s first own active ETFs, though it advises four other ETFs, including State Street’s SPDR DoubleLine Total Return Tactical ETF.

Harbor Strategic Growth Fund is being reorganized back into the Mar Vista Strategic Growth Fund. Back in 2016, the Mar Vista Strategic Growth Fund was reorganized into the Harbor Strategic Growth Fund. The new Mar Vista Strategic Growth Fund will have the same investment objective and substantially similar principal investment strategies and limitations. The reorganization is expected to occur in July 2022.

JP Morgan is converting its JPMorgan Inflation Managed Bond, JPMorgan Market Expansion Enhanced Index, JPMorgan Realty Income and JPMorgan International Research Enhanced Equity Funds into ETFs on April 8, 2022, May 6, 2022, May 20, 2022, and June 10, 2022, respectively. JP Morgan was among the last major investment house to hold out against using the ETF wrapper for its strategies.

Wasatch US Select Fund has been filed for registration. The fund will invest in the equity securities, typically common stock, issued by US companies. They expect to invest the fund’s assets across all market capitalization levels, ranging from micro capitalization stocks to larger capitalization stocks. However, they expect the fund to invest a significant portion of its assets in small to midsize companies with market capitalizations of greater than US $2 billion at the time of purchase.

In Manager-changeland:

George Jikovski has left the team managing River Canyon Total Return Bond Fund (RCTIX). The multi-sector bond fund has nearly tripled the three-year returns of its benchmark (4.9% APR vs. 1.38%) and has grown from $170 million in late 2020 to $1.2 billion in 2022.

Mark Finn, the sole manager for T. Rowe Price Value Fund and co-manager of T. Rowe Price Large Cap Value Fund, will retire at the end of 2022. Ryan Hedrick, a Price analyst, will take over the Value Fund on January 1, while Large Cap Value will continue to be managed by John Linehan, Heather McPherson, and Gabriel Solomon. In general, Price handles manager changes more smoothly than just about any large firm. The track record suggests that there’s little cause for concern here.

Westfield Capital Dividend Growth Fund is to be reorganized into the Harbor Dividend Growth Leaders ETF on or about May 17, 2022.

Small Wins for Investors

Morgan Stanley reopened its Inception, Growth and Discovery Portfolios to new investors on March 15. Both the Inception and Discovery Portfolios funds have been closed to new investors since April 5, 2021. The Growth Portfolio has been closed since May 21, 2021.

On February 25, Vanguard today reported expense ratio changes for 18 funds across multiple ETF and mutual fund share classes, including a wide range of international strategies. The firm continues to return value to investors through lower fund expenses on its path to returning $1 billion in cost savings to shareholders by the end of 2025:

Vanguard fund and ETF expense ratio changes

| Name | Ticker | 2020 fiscal year-end expense ratio | 2021 fiscal year-end expense ratio | Change (in basis points) |

| Vanguard International High Dividend Yield ETF | VYMI | 0.28% | 0.22% | -6 |

| Vanguard International High Dividend Yield Index Admiral Shares | VIHAX | 0.28% | 0.22% | -6 |

| Vanguard Emerging Markets Government Bond ETF | VWOB | 0.25% | 0.20% | -5 |

| Vanguard Emerging Markets Government Bond Index Fund Admiral Shares | VGAVX | 0.25% | 0.20% | -5 |

| Vanguard Emerging Markets Government Bond Index Fund Institutional Shares | VGIVX | 0.23% | 0.18% | -5 |

| Vanguard International Dividend Appreciation ETF | VIGI | 0.20% | 0.15% | -5 |

| Vanguard FTSE All-World ex-US Small-Cap ETF | VSS | 0.11% | 0.07% | -4 |

| Vanguard International Dividend Appreciation Index Admiral Shares | VIAAX | 0.20% | 0.16% | -4 |

| Vanguard FTSE Emerging Markets ETF | VWO | 0.10% | 0.08% | -2 |

| Vanguard Emerging Markets Select Stock Fund | VMMSX | 0.85% | 0.84% | -1 |

| Vanguard Explorer Fund Investor Shares | VEXPX | 0.41% | 0.40% | -1 |

| Vanguard Explorer Fund Admiral Shares | VEXRX | 0.30% | 0.29% | -1 |

| Vanguard FTSE All-World ex-US ETF | VEU | 0.08% | 0.07% | -1 |

| Vanguard Mid-Cap Growth Fund | VMGRX | 0.34% | 0.33% | -1 |

| Vanguard Tax-Exempt Bond Index Fund ETF | VTEB | 0.06% | 0.05% | -1 |

| Vanguard Total International Bond ETF | BNDX | 0.08% | 0.07% | -1 |

| Vanguard Total International Stock ETF | VXUS | 0.08% | 0.07% | -1 |

| Vanguard Total World Stock ETF | VT | 0.08% | 0.07% | -1 |

| Vanguard International Value Fund | VTRIX | 0.35% | 0.36% | 1 |

| Vanguard International Explorer Fund | VINEX | 0.39% | 0.40% | 1 |

| Vanguard Selected Value Fund | VASVX | 0.31% | 0.32% | 1 |

| Vanguard Windsor Fund Investor Shares | VWNDX | 0.29% | 0.30% | 1 |

| Vanguard Windsor Fund Admiral Shares | VWNEX | 0.19% | 0.20% | 1 |

| Vanguard Alternative Strategies Fund | VASFX | 0.78% | 1.28% | 50 |

Closings (and Related Inconveniences)

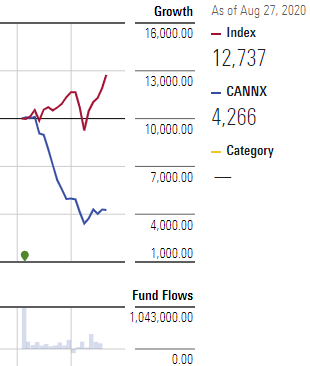

The $3.6m Cannabis Growth ETF (BUDX) will be liquidated on April 29. It converted its Investor share class to Institutional in May 2021, and we reported the “same portfolio of nine stocks whose P/E ratios run from 828 to (-294).” When it slashed its minimum investment from $100,000 to $2,500, we noted: “there are those who might suggest that ‘growth’ is a misnomer.”

In September 2021, when it converted to being an active ETF, we reminded folks that it had booked annualized losses of 10.8% since inception.

With its dissolution, Morningstar’s estimable Jeff Ptak tweeted:

Cannabis Growth ETF ($BUDX) is to be liquidated on or about 4/29/22. It lost ~72% from incept to Mar. ‘20; then soared 325% over next 11 mos.; only to shed ~65% of its value between Feb. ‘21 and now. All told, lost ~58% of its value since incept.

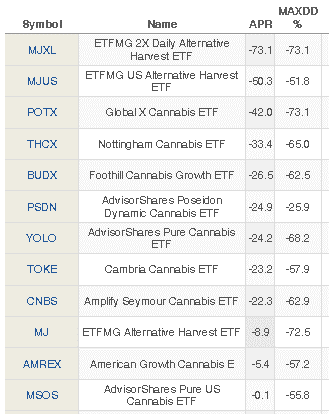

By way of context, every cannabis-related fund and ETF has lost money since inception:

We offer this as a cautionary tale to the investors who’ve recently poured $80 billion into odd little thematic funds—our suggestion: don’t.

Clough China Fund will liquidate on or about April 22, 2022.

Fidelity is going to liquidate its series of Flex Funds: Opportunistic Insights, Large Cap Value, Real Estate, Large Cap Growth, Inflation-Protected Bond Index, Short-Term Bond, International Fund, Core Bond, Intrinsic Opportunities, Small Cap, and Mid Cap Growth are to be liquidated on or about June 10, 2022.

Janus Henderson will liquidate its Emerging Markets Managed Volatility, Global Income Managed Volatility, and International Managed Volatility Funds on or about May 20, 2022. Two of the funds managed by Intertech, which are being sold to a group including Intech management, Janus Henderson US Managed Volatility and Janus Henderson US Low Volatility funds, are being transferred to Janus Henderson to manage.

JP Morgan Emerging Markets Strategic Debt Fund will be liquidated on or about April 29, 2022.

Loomis Sayles Intermediate Municipal Bond will be liquidated on or about April 28, 2022.