When it comes to eCommerce, the heartbeat of your business is a seamless online payment system. But amidst the digital buzz, false beliefs about online payments can hold merchants back from fully harnessing its power. For the savvy merchant, dispelling these misconceptions is crucial to staying ahead in the competitive game of online commerce. We’re here to set the record straight and arm you with the knowledge to guide your online payment strategy towards growth.

Why should you be wary about these myths? Because your business decisions should always be based on correct data, sourced by reputable outlets. Otherwise, you run risks such as limiting your company’s reach, stalling its growth path, or worse yet, losing customer trust.

Let’s dive into the most widely spread false information on online payments and see what’s fact and what’s fiction.

Myth 1: Online Payments Are Not Secure

The Reality:

Online security is a valid concern for merchants and customers alike, but it’s not a barrier. Prevalence of news of potential digital payments fraud has been increasing year on year, as malevolent actors diversify their options to commit fraud, but this does not make online transactions inherently unsafe. The reality is that robust payment gateways employ state-of-the-art encryption, tokenization, and fraud monitoring that make online transactions as secure or even more secure than traditional methods.

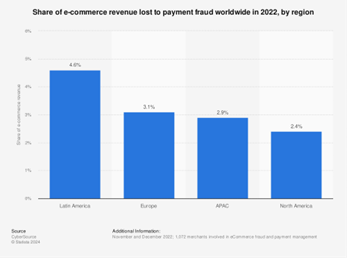

Payment providers and merchants in regions across the world are taking significant strides in combating losses attributed to security issues. And the numbers back these developments. Recently, online merchants from four world regions reported losing just above an average 3% of revenue to payment fraud.

The Solution:

For peace of mind, opt for a payment provider that is PCI DSS compliant, like the 2Checkout platform. Look out for those that offer encryption protocols and tokenization, which replaces sensitive data with non-decipherable values, drastically reducing the risk of a data breach.

Myth 2: Online Payments Are Complicated to Set Up

The Reality:

Gone are the days of complex integrations. Not long ago online sellers with a limited portfolio of products used to prefer the route of developing their own digital commerce solutions in-house. BYOS (Built-Your-Own-Solution) stacks, however, have come to become less appealing, as the cost and effort of integrating proprietary software with external solutions reached new levels of complexity.

Nowadays, advanced APIs, mobile SDKs and turnkey solutions have simplified the setup process, ensuring that online payments can be ready to go in a fraction of the time you might expect. At the same time, merchants leveraging digital commerce platforms and popular shopping carts like Shopify, Magento or WooCommerce now have ready-made plugin solutions available which simplify the process of accepting payments to a 2-3 step integration flow.

The Solution:

Leverage the expertise of established payment providers that offer out-of-the-box solutions which can integrate seamlessly with your eCommerce platform, saving you valuable time and resources. Opt for providers with off-the-shelf capabilities that are readily available and require no extra integration or added cost. The 2Checkout platform, for example, can be easily integrated with over 120 shopping carts available on the market, enabling sellers to seamlessly accept payments. In addition, the solution capabilities are readily available in the merchant dashboard, requiring no extra setup or dev work.

Myth 3: Online Payments Are Expensive

The Reality:

There’s a notion that with the convenience and robust security of online payments comes a hefty price tag. While it’s true that payment processing involves costs, the landscape of online payment fees has diversified to offer more cost-effective options for merchants.

In today’s world many payment providers offer competitive pricing plans, including pricing based on sales volumes, and no hidden costs. With most providers, online sellers pay simply for successful transactions, in percentages of the sum processed.

Source: Freepik

While it’s true that card schemes themselves are often under scrutiny to reconsider their pricing approach, merchants have been successfully lobbying for optimized cost structures. So, while you may have heard that online processing costs are steep, this is not the case.

This type of false assertions haven been aired by those who compare online transaction costs to those for in-store payments. In the case of the former, however, you get a lot more for your fee: enhanced security features like AVS (Address Verification Services) or CVV checks, or CX features like storing payment details for future convenience, for example.

The Solution:

Take a calculated approach to payment costs and do your homework. Compare fee structures and, most importantly, consider the returns on investment. A good payment provider will offer a clear pricing model that aligns with your business goals, with clear cost breakdowns and no hidden fees.

Still not sure where to start? Review our list of 12 questions you should evaluate potential eCommerce providers on and weigh your options.

Myth 4: Customers Prefer Cash Payments

The Reality:

The modern customer craves convenience. It’s easy to believe that the chiming of coins or crinkling of notes is the universal sound of sales satisfaction, however, current trends in consumer behavior suggest that digital wallets are fast becoming the new pockets of preference. With the rise of Alternative Payment Methods, subscription services, and new avenues for delivery and fulfillment, the trend is irreversibly tipping toward digital payment methods.

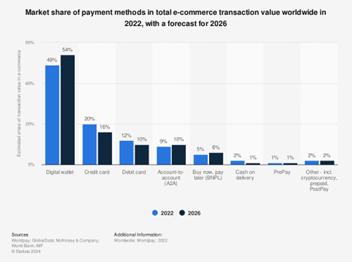

To put things in perspective, more than half of the world’s eCommerce transactions were concluded with digital wallets in 2022. Where is cash in the equation? At just 2% of consumer preference for online spending and forecast to continue decreasing, this myth holds no validity no matter how we look at the issue.

Source: Statista

The Solution:

Stay ahead of customer trends by offering a diverse range of payment options that cater to different preferences, including popular digital wallets, mobile payment solutions and a locally favored selection of cards.

Selling in more than one country? Choose a payment provider that has an extensive portfolio of accepted payment methods. With the 2Checkout platform, merchants can accept transactions in 50+ different payment methods and APMs, for a truly localized shopper experience.

Myth 5: It Takes a Long Time and it is Expensive to Switch to a New Payment Provider

The Reality:

Transitioning to a new payment provider is often perceived as a daunting task, but in reality, it can be a quick, seamless process that brings significant benefits to businesses. With the right preparation and support, and when following a pre-defined migration flow, the switch can be made smoothly, minimizing disruptions to operations.

What prompts merchants to switch payment providers? Often, it’s about overcoming current limitations. They may not have all capabilities needed to scale or they may have outgrown the initial payment provider. Other times, switching providers is a strategic decision that can result in long-term cost savings by offering more competitive transaction fees and better service terms.

Deciding on a new provider can cone with a range of features designed to enhance the customer experience, such as faster processing times, more payment options, and improved security measures. With market-leading providers, the transition is usually a quick, rigorously calculated and seamless process, which is often concluded in a matter of days or weeks.

The Solution:

Opt for a payment provider that offers dedicated support during the transition phase, ensuring minimal disruption and a swift switch that’s both financially viable and operationally efficient. 2Checkout has a thorough process in place for migrating sensitive data – dedicated teams help onboard new merchants while multiple business metrics are monitored throughout the migration process.

Myth 6: You Can’t Change Your Payment Monetization Model

The Reality:

Modern payment providers are designed with versatility at their core, catering to the evolving needs of businesses in a dynamic market. This flexibility is particularly evident in the range of partnership models they offer, which can easily adapt to different sales strategies. So, if you’ve heard information like “Once you’ve signed up with a payment provider, you’re locked in to a particular sales model”, know that this is no longer the case.

Firstly, with modern payment providers merchants can sell one-time, recurring, or any combination between the two, in adaptable flows. For businesses focused on selling one-time items, these providers enable straightforward, secure transactions that reassure both the seller and the buyer. On the other hand, companies aiming to establish a steady income through subscription-based services benefit from payment solutions that support recurring billing, automatic renewals, and easy management of customer subscriptions. All-in-one platforms can support either of these flows, ensuring that whether a business is looking to sell handcrafted goods, digital content, or access to an ongoing service, there’s a payment model that fits under the same roof.

Top of the range payment providers nowadays also enable merchants to update their monetization models as business needs evolve. When partnered with such a platform, a merchant previously selling lifetime licenses, for example, can effortlessly switch to selling monthly or quarterly subscription plans for its product and services. Another aspect of solution flexibility when it comes to monetization also extends to selling beyond a business’ own website. The right payment partner will enable sellers to seamlessly also deploy payments for their mobile apps, without the need for acquiring an additional solution.

By accommodating diverse business needs, modern payment providers not only facilitate smoother operations but also empower businesses to explore new revenue streams and growth strategies without being constrained by their payment processing system.

The Solution:

Partner with a payment provider that understands your industry and offers flexible, future-prof monetization models that support your specific business objectives, no matter how they evolve.

Conclusion

In conclusion, online payments are not the complex, rigid, costly, and insecure processes some myths make them out to be. By staying informed and choosing the right payment partners, merchants can unlock the full potential of their eCommerce operations and ensure they’re not held back by outdated beliefs. It’s time to take control, and the right payment provider can be the game-changer your business needs. Discover how the 2Checkout platform can be your growth partner, with its wide range ecosystem to caters to all your objectives – read this material to get a primer on our solution and its revenue scaling capabilities.