Nestled along the northwestern edge of Scandinavia, one of the world’s richest and most technologically advanced regions, Finland is an obvious choice for those looking to expand their global eCommerce business. The combination of ubiquitous banking, logistics, and digital infrastructure combined with the relative wealth of Finns—the average Finn has more per-person buying power than 87% of the world—is a reason for eCommerce companies to take a keen interest.

But this market’s maturity means that merchants also need to do their due diligence. Worth 5 billion (US) in 2019, the Finnish market is full of discerning shoppers with culturally-specific preferences, concerns, and habits. Catering to these aspects of the market is the key to success in a country forecasted to experience strong growth in the future.

COVID-19 Impact Reveals Market Fundamentals

It’s important to understand the precise factors that drive a given eCommerce market. This allows you to play to your target market’s strengths and actively avoid its weaknesses.

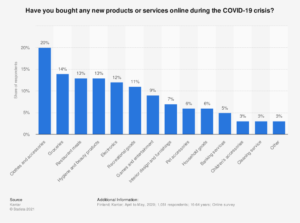

During the first year of the pandemic, Finland’s overall digital commerce contracted by close to $2 billion (US). However, the pandemic proved to be a boon to the Finnish online goods and services market, which increased by 33% as shoppers expanded their online purchasing into new categories.

Source: Statista

If we dive deeper into the data, we can see that this increase in online goods and services due to the pandemic was supported by a solid foundation of already high eCommerce penetration rates and, in fact, was a continuation of Finland’s pre-COVID trend of online service growth and increasing online sales volume.

These metrics were already on track to increase by over 22% and 11%, respectively, in 2020. During the pandemic, the increase in online goods and services was led by 18-44 year olds, but distributed across the entire population, with 25% of all Finns reportedly shifting more of their shopping online.

The takeaway? These metrics point to the fundamentals of the robust Finnish eCommerce market: a large base of young, affluent shoppers that are also heavy online users, as well as eCommerce penetration that is expected to grow to 4 million users by 2024.

mCommerce is the Future of Finnish eCommerce

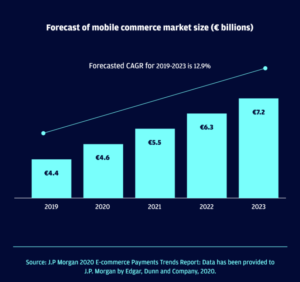

Finns lead Europe and most of the world in terms of their smartphone penetration (79.9%) and mobile commerce rates (50%), so it should come as no surprise that Finns are almost as likely to complete an online purchase on their mobile phone as they are on a computer.

Looking forward, it is expected that the Millennial and Z generations will continue to fuel this trend towards mobile commerce and lead the Finnish market to around $8.39 billion (US) by 2023. Thus, an important way that merchants can future-proof their businesses is by optimizing their stores, payments, and cart flow for mobile and/or omnichannel.

Source: J.P. Morgan

Finland Offers Broad Market Support for All eCommerce Categories

Luckily for those looking to expand, the Finnish eCommerce market has both very specific strengths and the ability to provide broad market support for almost all categories, and even across both B2B and B2C.

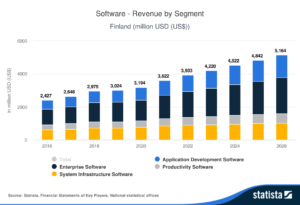

Want to sell shoes to Finns online? Great! How about furniture, food, toys, personal care products, or digital media? Still great! Notably, even within its own specialty categories, like enterprise software, Finnish eCommerce is mature enough to support those businesses working outside of its most successful sectors. Enterprise software, for example, makes up an ample 42% of the total 3.15 billion (US) Finnish software market, but alongside this dominant sector, productivity software, application development software, and more are also thriving. Finland’s total eCommerce software market is expected to reach close to $5.16 billion by 2026, so the opportunity here is vast for businesses of many types and sizes.

Source: Statista

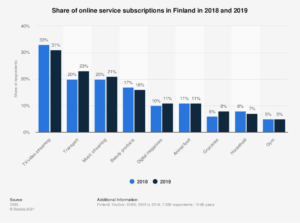

Finnish Preferences for Subscriptions

Like most Westerners, a large number of Finns put their buying power towards subscriptions, with a preference for video and music. In 2019, of all online service subscriptions in the Finnish market, video subscriptions accounted for 31%, and music for 21%. Subscriptions are also increasing in many less obvious categories, like beauty products, animal feed, and transport.

For merchants, this trend in eCommerce towards the subscription model is worth taking note of, in part because it often demonstrates powerful customer retention rates. In its own customer data, 2Checkout has seen a very solid 77% renewal rate for its yearly subscribers of digital goods, as well as an outstanding renewal rate of 88% for those subscribing to monthly plans. It also pays to look closely at the subscription preferences of Finns when deciding how you can best reach your clients (hint: most prefer yearly renewals, but those who prefer monthly subscriptions renew at higher rates).

Source: Statista

Optimize For Finnish Payment Methods

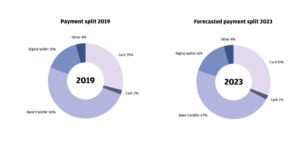

Although most people have heard the term “cashless society,” many don’t realize that this futuristic ideal is already a way of life in the Nordic countries. Finland, like its neighbor Sweden, has actively pursued and already nearly reached a “cashless” state. The Bank of Finland has even announced that it expects the use of bank notes to end completely by 2029.

Source: J.P. Morgan

The key thing to understand is that this pursuit of the cashless ideal has a very unique cultural and technological landscape behind it. In Finland, a whopping 99.8% of people are fully banked, citizens largely trust government and other institutions, and the services that compose the cashless landscape are willing to cater to Finns’ demand for user privacy.

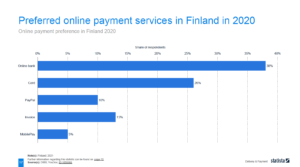

What does this mean for eCommerce today? The biggest takeaway is that Finns simply do not pay for their purchases the way the rest of the world does! The most popular way to pay, making up 50% of all payments, is one that many outside of the country may not have even heard of: netbanking. Close behind, and growing, are cards (at 29%) and digital wallets (15%).

It is crucial that cross-border merchants familiarize themselves with popular payment services in Finland, such as the global giants PayPal and Amazon Pay, the debit and credit card issuer Nordea or the digital wallet MobilePay.

Source: Statista

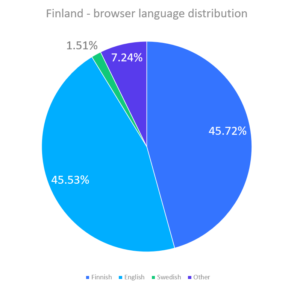

Localize Your Cart and Checkout Experience

Interestingly, Finns are split nearly 50/50 on the question of whether they prefer a native experience when shopping online. Since the vast majority of Finns speak English, and 22.3% of all eCommerce purchases in the country are made cross-border, it makes sense that Finns are used to making due. But 2Checkout data shows an aspect merchants need to pay attention to: localization yields higher conversion rates.

Based on this, it is advised that merchants localize their cart and checkout experiences. This does not just mean changing the language used in the checkout process, but also the currency, payments, and social and other proof displayed in the shopping cart.

Source: J. P. Morgan

2Checkout data can also provide some guidance around cart flow. 2Checkout merchants have found that Finnish shoppers demonstrate 46% higher conversion when served a shorter cart flow—with one big caveat. A streamlined cart flow provides this benefit on orders only up to around $150 (US). Beyond that price range, shoppers prefer a longer cart flow that allows more time to review before purchasing. Every merchant can implement changes based on this data now, but it is also essential to run your own testing so that you design for your precise niche.

Be Aware of Privacy and VAT

As members of the EU, Finns are entitled to certain protections, as well as subject to certain taxes, that may not apply to others.

The most important set of rules for merchants to familiarize themselves with is the General Data Privacy Regulation (GDPR), a set of laws that regulate how the data of EU citizens must be treated. Lack of compliance can be extremely costly. Just ask British Airways, which was forced to pay a $27 million (US) fine over a data breach in 2020.

Cross-border merchants should also be aware of how the EU Value-Added-Tax (VAT) rules apply to them. The rules vary for those selling to Finland from an EU country, versus those selling from outside the EU. Under EU VAT rules, EU merchants selling cross-border to Finnish users must observe the One Stop Shop (OSS) rules, and collect VAT in Finland if yearly sales to EU countries exceed €10,000 (~$10,800 US). On the other side, merchants selling from outside the EU to Finland must abide by the Import One Stop Shop scheme (IOSS). The standard VAT rate in 2021 in Finland was 24%, with reduced rates applicable to some categories like eBooks. A little research up front will save headaches down the road.

Expand Your Business into Finland Now

A competitive edge in Finland’s thriving eCommerce market will go to those who can deploy a knowledge-based strategy that builds on the best parts of this market, while dodging the potential hazards. This post has covered some of the main points you need to know, but make sure you are armed with as much knowledge as you can be. Check out our eBook, “eCommerce in Finland: A Merchant’s Cross-Border Guide to Online Sales,” which takes a more detailed look at how to successfully sell online in Finland.