The typical response from someone when they find out that I have retired is, “Congratulations! What do you do in your spare time?” To which I reply, “I volunteer at Habitat For Humanity and Neighbor To Neighbor, go to the gym, visit family, take day trips, and write financial articles.” I would get a more excited response if I replied that I go paragliding in Costa Rica. I do occasionally get a response from people wanting to know more about investing.

This article summarizes how I rate equity funds. I follow the bucket strategy. I invest for income in Bucket #2 and concentrate risk in Bucket #3, where I am more concerned about tax efficiency. I use a simple approach of investing in funds and not individual stocks. Fidelity and Vanguard manage most of my more aggressive accounts.

I have refined my rating system to evaluate how my retirement nest egg is performing and if I should make any adjustments. It is based on Risk, Valuations, Three Year Risk Adjusted Performance, and Momentum using the MFO Premium fund screener and Lipper global dataset. I am moderately risk off now, but in the future, I may want to invest in equity funds for yield.

Stocks are riskier than most bond funds but have higher returns over the long term. In this article, risk is relative to other equity funds. I classify Lipper Categories and funds into four categories as follows.

- Section 1, TIER ONE (Lower Valuations, Lower Risk, Higher Yield)

- Section 2, TIER TWO (Low to Moderate Valuations, Lower Risk)

- Section 3, TIER THREE (Moderate Risk)

- Section 4, TIER FOUR (Higher Risk)

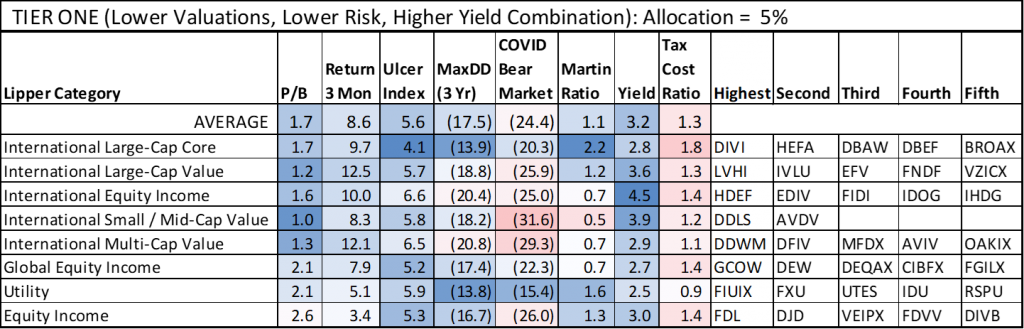

TIER ONE (Lower Valuations, Lower Risk, Higher Yield Combination)

Table #1 contains the Lipper Categories that have lower relative risk and valuations and higher yields. I have 5% of my allocation to equities in these Lipper Categories. The higher yield helps dampen volatility. Most are international funds that may also be exposed to currency risk. The five highest-rated funds are listed.

Table #1: Tier One Equity Funds for Safety and Yield

Source: Author Using MFO Premium fund screener and Lipper global dataset; Morningstar for three-month return as of March 21st.

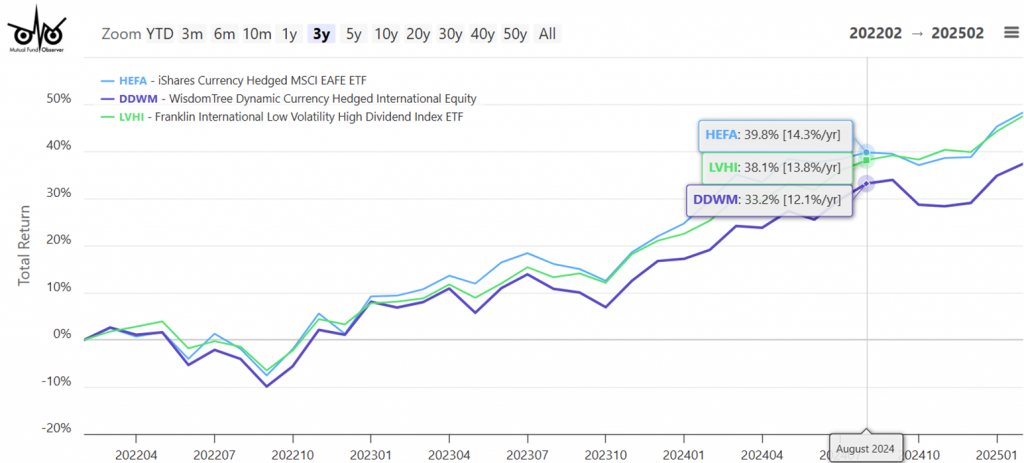

Figure #1 contains several Tier One funds that I find attractive.

Figure #1: Selected Tier One Equity Funds for Safety and Yield

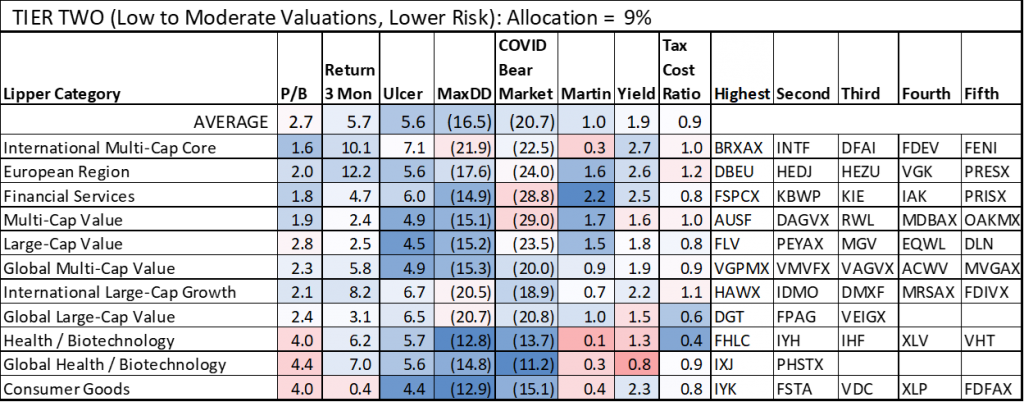

TIER TWO (Low to Moderate Valuations, Lower Risk)

Tier Two funds have low to moderate risk and valuations, but yields are lower than in Tier One. I have 9% of my allocation to equities in these Lipper Categories. They are sorted by my rating system from highest to lowest. International, Financial Services, and Value funds rate highly. During the COVID Bear Market, most of these funds had a maximum drawdown of less than 25%.

Table #2: Tier Two Equity with Low to Moderate Valuations and Lower Risk

Source: Author Using MFO Premium fund screener and Lipper global dataset; Morningstar for three-month return as of March 21st.

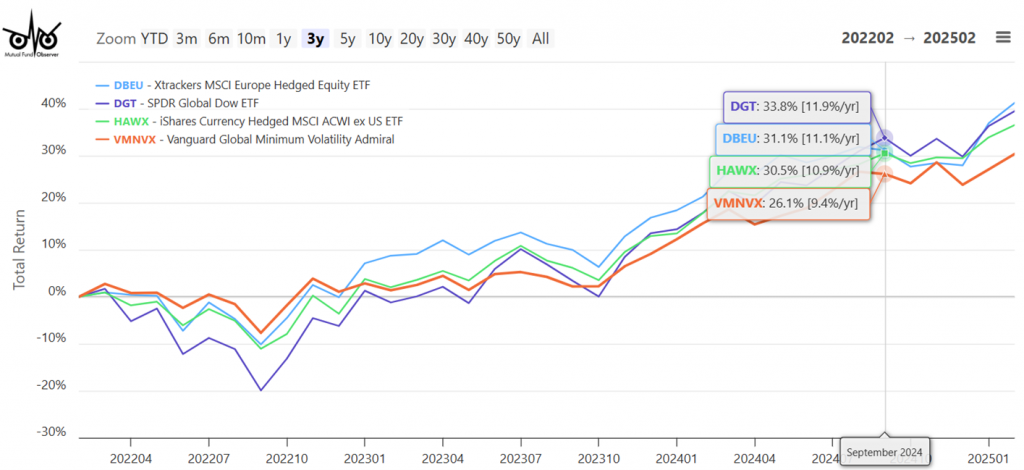

Figure #2 contains several Tier Two funds that I find attractive.

Figure #2: Selected Tier Two Funds with Low to Moderate Valuations and Lower Risk

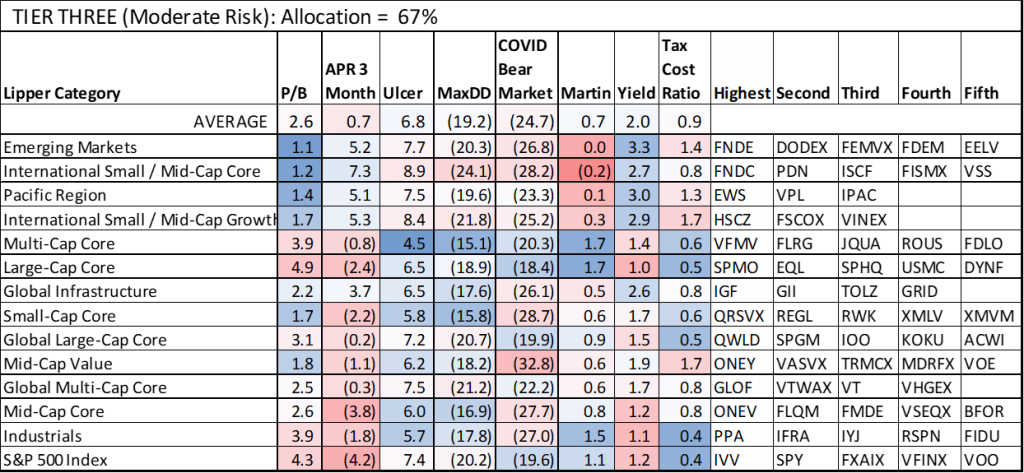

TIER THREE (Moderate Risk)

Table #3 contains Lipper Categories with moderate equity risk. It is where the bulk of my equity investments lie. It contains diversified core and total market funds. During the COVID Bear Market, many of these funds had a maximum drawdown of 25% or more.

Table #3: Tier Three Equity Funds with Moderate Risk

Source: Author Using MFO Premium fund screener and Lipper global dataset; Morningstar for three-month return as of March 21st.

Turning over your retirement nest egg to Financial Advisors requires a leap of faith. Fidelity uses Fidelity Strategic Advisers US Total Stock (FCTDX), and Vanguard uses Vanguard Total Stock Market Index ETF (VTI) for Multi-Cap Core funds, which I wrote about in Top Performing Multi-Cap Core Funds (FCTDX, VTI, VTCLX). They are good funds. The two highest-rated Multi-Cap Core funds that I track are Vanguard US Minimum Volatility ETF (VFMV) and Fidelity US Multifactor ETF (FLRG). My ranking system is based on my opinion that value and lower risk will outperform in the intermediate-term. Both Fidelity and Vanguard tilt their portfolios using other funds.

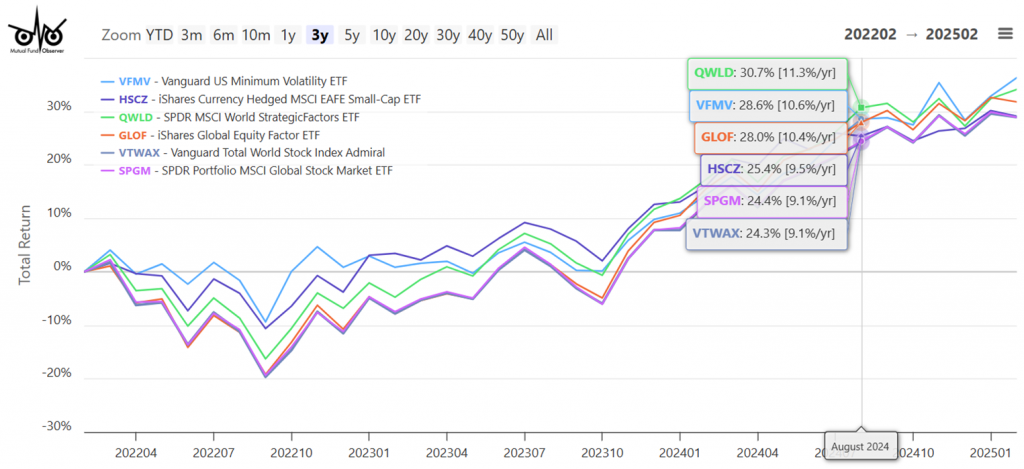

Figure #3 shows selected Tier Three funds that I find attractive.

Figure #3: Selected Tier Three Equity Funds with Moderate Risk

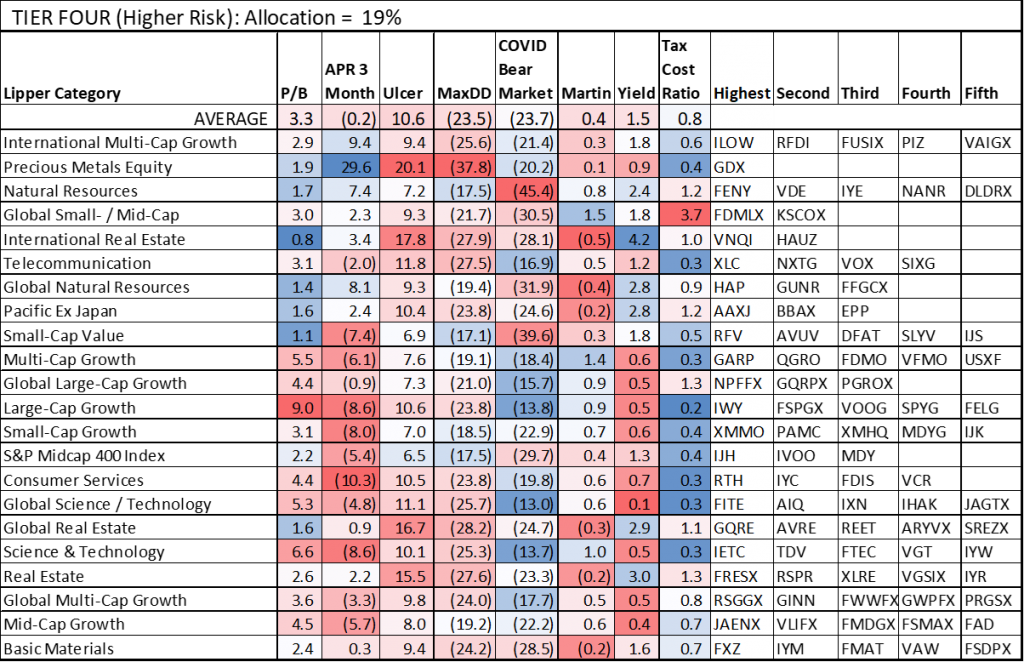

TIER FOUR (Higher Risk)

Tier Four equity funds tend to have a high Ulcer Index value. Valuations and drawdowns vary widely. Many are funds that one may want to use to tactically invest through the business cycle. I have 19% of my allocation to equities in the Tier Four categories, mostly in International Multi-Cap Growth, which are performing well now.

Table #4: Tier Four Equity Funds with Higher Risk

Source: Author Using MFO Premium fund screener and Lipper global dataset; Morningstar for three-month return as of March 21st.

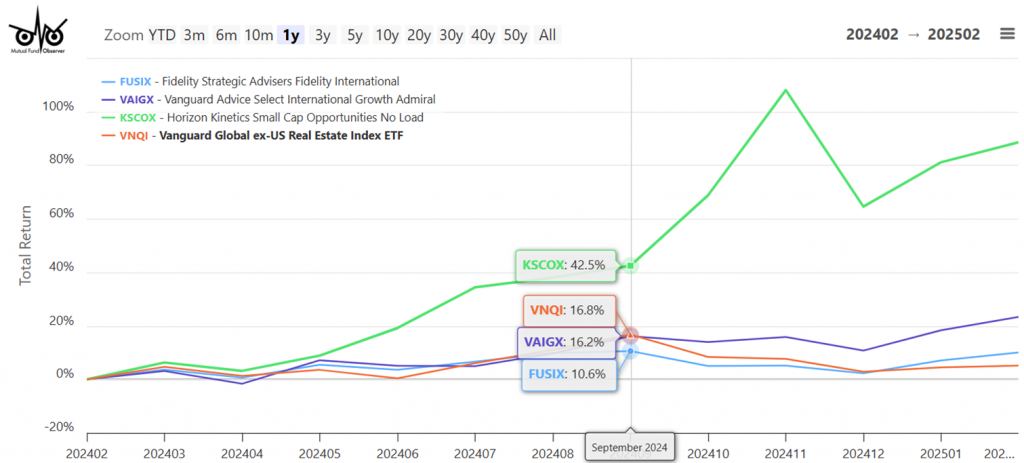

Figure #4 contains Tier Four Equity funds that are trending. Fidelity Strategic Advisers Fidelity International (FUSIX) and Vanguard Advice Select International Growth (VAIGX) are only available to clients using financial planning services.

Figure #4: Selected Tier Four Equity Funds with Higher Risk

Closing

Uncertainty is high now for many reasons, and the markets are volatile. I expect things to calm down in the next few months. The economy is strong but slowing. I made most of my bucket strategy adjustments at the end of last year and am riding out the volatility.

One younger person who asked about investing made the comment that his portfolio was not doing well. I got the impression that he was investing in individual technology stocks, which have fallen hard. I suggested considering a robo-advisor to get exposure to international stocks that are doing well. Mixed-asset funds would be another good option.