With inflation surging and rumors of a recession swirling, investors have been on the hunt for safe-haven investments to stabilize and diversify their portfolios. One of the most promising inflation hedges is US farmland, which has consistently offered high returns with low volatility and lack of correlation to other asset classes.

However, many investors struggle to navigate the complex farmland market on their own. Sourcing and vetting high-quality farm investment opportunities isn’t an easy task, especially if you don’t have any agricultural experience. Luckily Artem Milinchuk recognized these logistical barriers and started a farmland investment platform called FarmTogether to mitigate them. Browse our FarmTogether review 2022 below to learn more about this revolutionary fintech platform and decide if it’s right for you.

What Is FarmTogether?

|

Year Founded |

2017 |

|

Assets Under Management |

$150,000,000 |

|

Minimum Investment Size |

$15,000 |

|

Investment Types |

Crowdfunded Farms Sustainable Farmland Fund Bespoke Offerings |

|

Account Types |

Individual Entities Self-directed IRAs Corporations LLCs Other Vehicles |

|

Geographic Region |

Farms Located Across Seven+ States |

|

Crop Types |

14 (Row and Permanent Crops) |

|

Distribution Schedule |

Quarterly Semi-annually Annually |

FarmTogether is an investment platform that allows accredited investors to gain exposure to farmland without the high cost of buying a farm or the hassle of managing agricultural operations. For as little as $15,000, you can purchase a fractional share of a farm through FarmTogether’s easy-to-use online platform and diversify your investment portfolio.

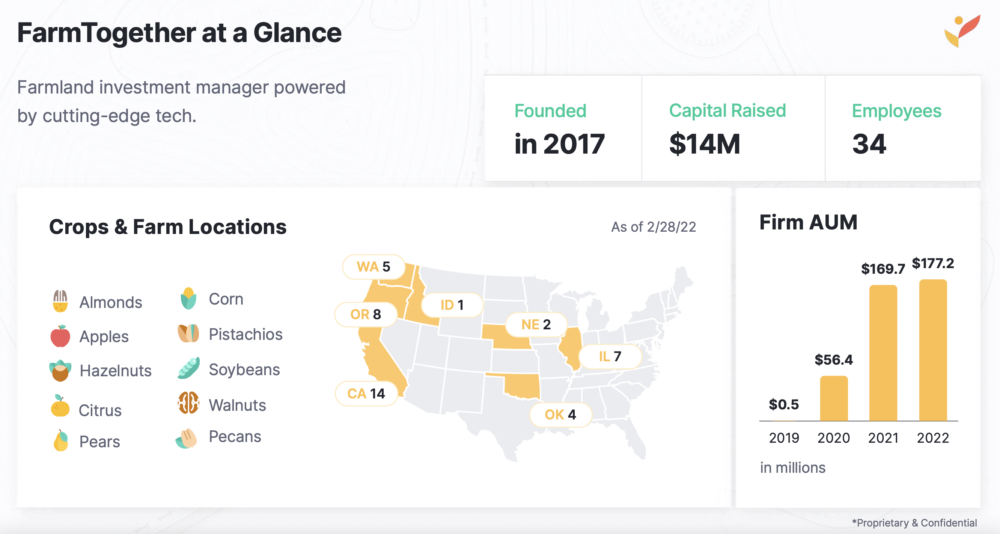

FarmTogether was founded in 2017, so it has a relatively short track record. However, the company’s leadership team is made up of industry experts with decades of experience, so you can feel confident about using the platform.

Artem Milinchuk, FarmTogether’s founder and Head of Strategy, has over 10 years of finance experience in the agriculture, food, and farmland sectors. Jared Hine, the company’s CEO, has over 20 years in asset and wealth management and previously worked for JP Morgan Chase, Bank of America, Deloitte, and Nuveen. Alex Shevchenko, co-founder of Grammarly, is also a board director at FarmTogether.

During our research, we didn’t find evidence that anyone on the leadership team has ever committed crimes like securities fraud. But if you want to perform your own due diligence, you can check out the rest of the team’s professional bios here.

To date, FarmTogether has $150 million in assets under management and over 1,000 investors and counting. Keep reading our FarmTogether review 2022 to learn why you should become the next investor.

FarmTogether’s Investment Offerings

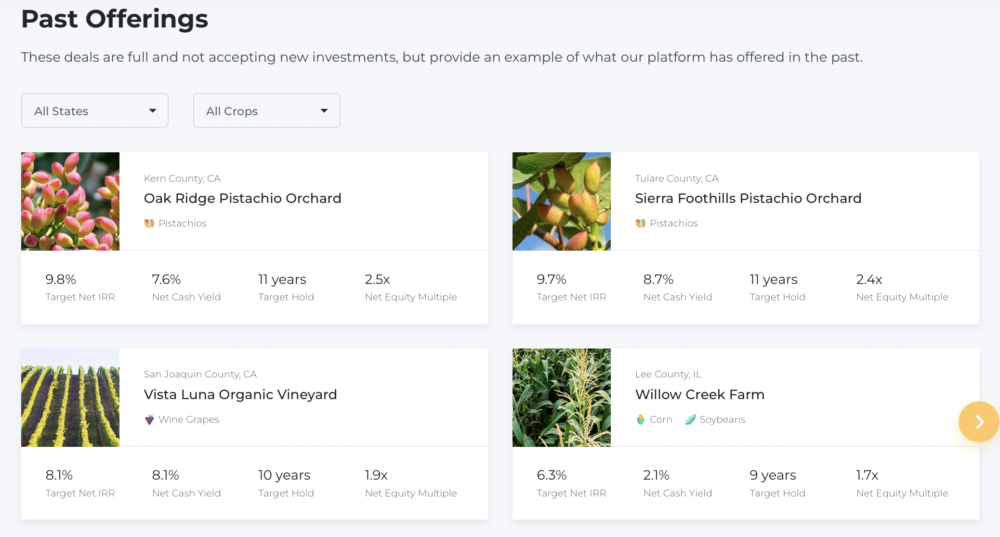

Currently, FarmTogether provides three different types of investment opportunities. One option is the Sustainable Farmland Fund, which gives investors broad exposure to a variety of farmland properties. The company also offers crowdfunded farmland investments and bespoke offerings that allow investors to own an entire farm.

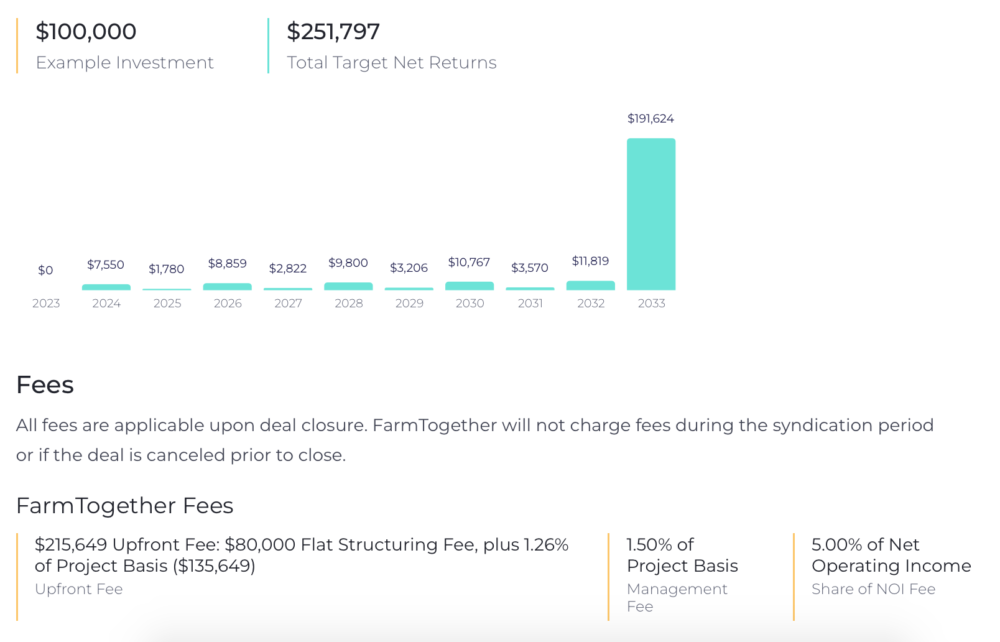

No matter which investment you choose, you’ll be able to earn returns in two main ways. FarmTogether investors get regular distributions from crop sales, rent payments collected from farmers or a mixture of both. They’ll also benefit from the capital growth of the farmland over time.

Here’s a more detailed overview of all three investments to help you decide which one is right for you.

Crowdfunded Farm Investments

FarmTogether’s crowdfunded farm investment opportunities allow you to purchase a fractional share of a farm through an LLC that owns the farmland. Because these offerings are funded by multiple investors, they only require a minimum investment of $15,000.

Holding periods generally range from five to ten years with annual liquidity windows for earlier exits. Projected returns and fees vary depending on which farm you pick. However, the FarmTogether team usually targets opportunities they expect to earn 7-15% returns with 3-9% cash yields, all net of fees.

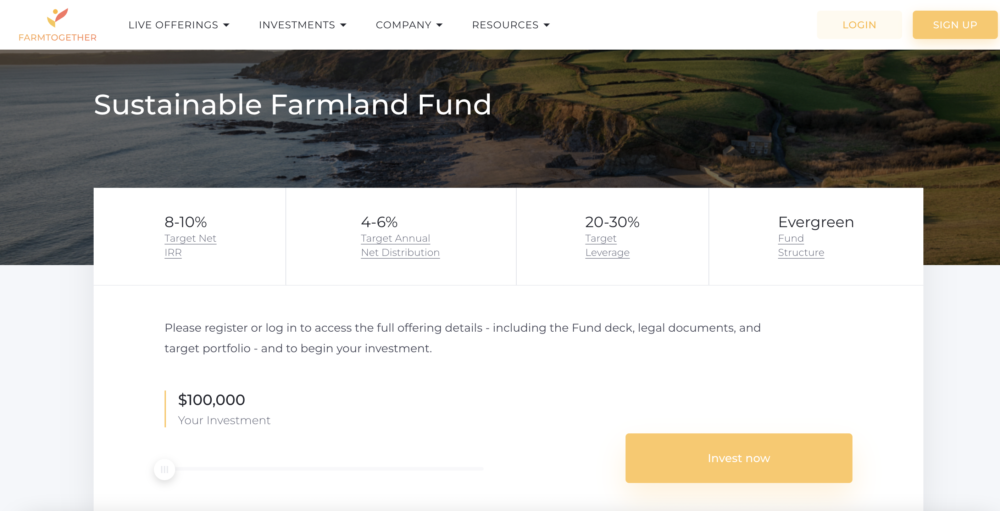

Sustainable Farmland Fund

If you’d rather get broad exposure to a variety of farmland properties through a single allocation, check out the Sustainable Farmland Fund. It’s a portfolio of 15 to 25 institutional-quality properties in an evergreen fund structure, which provides more liquidity than crowdfunded investments. After the two-year lockup period, investors can easily withdraw from the fund.

The Sustainable Farmland Fund mainly invests in permanent cropland, which usually earns higher returns than row crop farms. Investors can expect 4-6% annual target distributions and a net IRR of 8-10%.

As for fees, there’s a reasonable management fee of 1.25%, plus a 2% acquisition fee. There are also incentive fees based on the fund’s performance.

Bespoke Offerings

FarmTogether also has bespoke offerings for investors who want to own an entire farm on their own instead of a fractional share. These custom deals require a minimum investment of $1,000,000 for row crop farms and $3,000,000 for properties with permanent crops such as citrus or nut trees.

Investors pay a 2% administrative fee upon purchase of the farm and are also charged for ongoing management of the property. Since these bespoke offerings are eligible for 1031 exchanges, they’re a great option for investors who are selling another property and looking to defer capital gains tax.

How Investing With FarmTogether Works

Making your first investment with FarmTogether is easy — thanks to its all-in-one online platform. To invest in crowdfunded farmland offerings or the Sustainable Farmland Fund, just follow the simple steps below.

- Sign up for an account. It only takes a few minutes.

- Browse available investment opportunities and review the digital due diligence documents to pick an investment that suits your risk tolerance and goals.

- Choose your investment amount and method. FarmTogether gives you the ability to invest via self-directed IRAs, corporations, LLCs, and other vehicles.

- Provide proof of investor accreditation and sign the subscription agreement through FarmTogether’s secure online portal. Then follow the final payment instructions.

- Track your investment’s performance and access necessary tax documents in the online portal.

For bespoke offerings, the process is a little different. First, you’ll have a discovery call with the FarmTogether team to discuss your goals and requirements for the property, such as deal size, target returns, and hold period. Then they’ll work with you to find a property that meets your needs. Once you find a farm you like, FarmTogether will send a letter of intent on your behalf.

If the seller accepts, FarmTogether will perform extensive due diligence on the farm using a 120-point checklist. Assuming the property passes, FarmTogether will close escrow and transfer the title to you. Although you own the farm, the team will manage the property for you and handle the accounting and preparation of tax documents related to your investment.

Pros of FarmTogether

Low Investment Minimum

FarmTogether’s investment minimum is just $15,000, which is a fraction of the cost of buying a farm. US cropland is valued at $4,420 per acre on average, so it would cost about $220,000 to purchase a small 50-acre hobby farm. If you want to gain exposure to farmland and diversify your portfolio without investing hundreds of thousands of dollars in a farm, FarmTogether is a great option.

Comprehensive Learning Center

FarmTogether has a comprehensive learning center on its website to educate investors about sustainable agriculture and the benefits of investing in farmland. There are dozens of blog posts, podcasts, infographics, and webinars on topics such as investing in citrus, understanding cover crops, and building a passive income. If you’re new to farmland as an asset class, FarmTogether’s robust library of resources will get you up to speed.

Additionally, FarmTogether’s website has useful tools and resources to help you pick the right investment for you. The landing page for each deal includes due diligence documents, a financial summary, a risk-reward profile, a detailed list of FAQs, and more.

You’ll have all the information you need to make a smart investment decision right at your fingertips.

Diverse Investment Offerings

FarmTogether offers a diverse range of investments to help investors reduce their exposure to agricultural risks. For example, spreading your investment dollars across several farms located in different regions can lessen the impact of weather-related crop failures on your portfolio.

To that end, FarmTogether provides investment opportunities in seven states including California, Illinois, Oregon, and Nebraska. This is a key advantage of investing with FarmTogether versus competitors such as FarmFundr, which mainly offers deals in California.

FarmTogether also allows investors to choose from a variety of crop types to balance the risk-reward profile of their portfolios. Farms with permanent crops usually offer higher returns. However, permanent cropland carries more risk because it can’t be replanted with different varieties from year to year like row cropland can.

As a result, a farm growing permanent crops will be hit harder if commodities prices go down or diseases threaten their plant variety. FarmTogether offers a good mix of both of these types of crops to give investors diversification options.

Rigorous Vetting Process

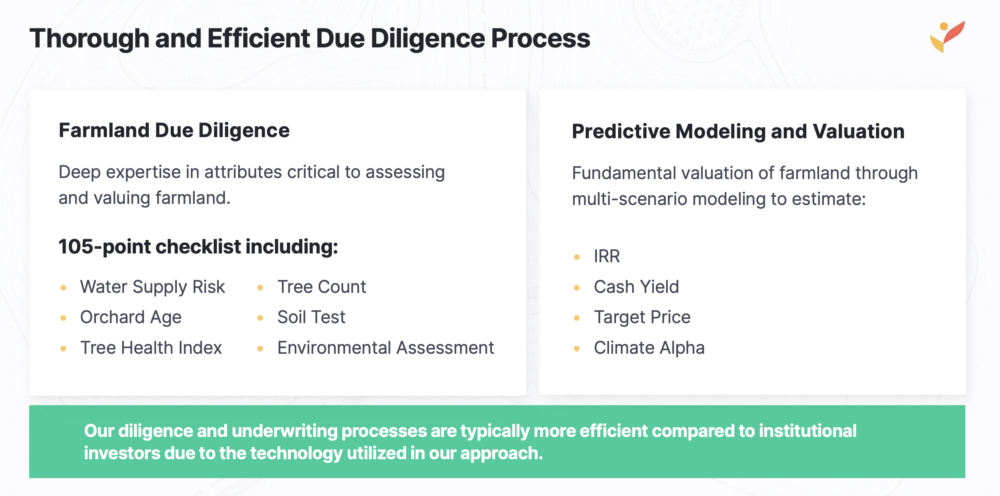

FarmTogether leverages proprietary technology to source and vet farmland investment opportunities more efficiently than institutional investors can. The company’s proprietary AI engine Terra automates the screening and underwriting process, making it faster, cheaper, and more thorough. FarmTogether’s tech innovations enable the company to vet each farm using a comprehensive 120-point checklist including soil tests, environmental assessments, and a tree health index.

Only 2% of the deals in FarmTogether’s pipeline pass these tests and end up on the platform. This rigorous due diligence process helps mitigate agricultural risks such as natural disasters, water shortages, and crop diseases, which is likely to boost returns for investors.

Cons of FarmTogether

Only Open to Accredited Investors

Currently, FarmTogether only accepts investments from individuals and business entities that are considered accredited investors by the SEC. To become an accredited investor, you must meet steep financial requirements, such as having a net worth exceeding $1 million or an annual income higher than $200,000 for the past two years.

Unfortunately, this puts FarmTogether out of reach for the average investor. However, it’s possible that FarmTogether may open the platform to the general public in the future.

Limited Liquidity

Like other real estate investments, FarmTogether’s offerings have relatively limited liquidity. The Sustainable Farmland Fund has a lockup period of two years before you can withdraw, and most of the crowdfunded farm opportunities have holding periods between five and ten years. Although there are annual liquidity windows if you need to make an earlier exit, FarmTogether is best-suited for long-term investors.

FarmTogether Reviews

Because FarmTogether is a relatively new platform, it doesn’t have as many customer reviews as other investment companies. Its Trustpilot page doesn’t have any reviews yet and it doesn’t have a BBB profile. Social media mentions for FarmTogether are dominated by a farming video game that has a similar name.

However, FarmTogether does have over 50 upvotes and a few 5-star ratings on Product Hunt. The company also received five stars on MoneyMade and an average of 4.7 stars from over 30 reviewers on PanelPlace.

The investing community also feels positively about FarmTogether. Many popular finance publications including The College Investor, Money Crashers, Credit Donkey, and Benzinga have given the platform favorable reviews.

Is Farmland a Good Investment?

High Returns

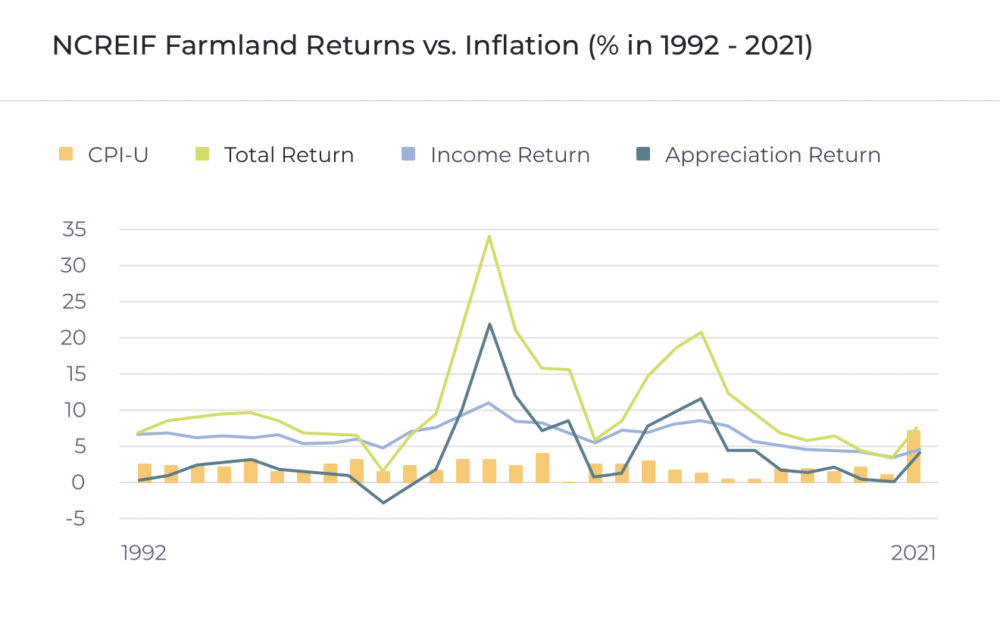

Since 1992, US farmland has generated an average annual return of 11% and outperformed most other asset classes, including US equities, bonds, real estate, and REITs. That trend is expected to continue due to the scarcity of fertile farmland coupled with the growing demand for food. In the United States, more than 31 million acres of farmland have been lost to real estate development since 1982. Even more, farmland is being rendered unusable because of soil erosion and degradation.

As the number of available farmland shrinks, land valuations will continue to rise. So will food prices, especially as the global population surges to a projected 9.7 billion by 2050. The additional pressure on the food supply could cause prices of staple grains to increase by as much as 101%. If you want your portfolio to benefit from rising land and food prices, now is an ideal time to invest in farmland through FarmTogether.

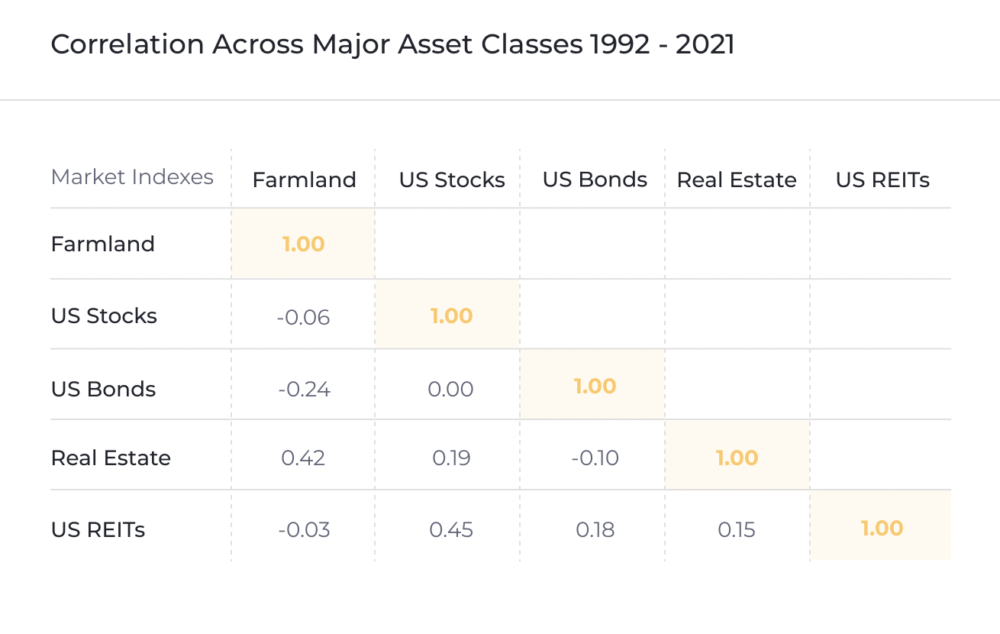

Low Volatility and Lack of Correlation

Farmland returns have had less volatility than most asset classes including gold, the 10-year US Treasury Bond, and the S&P 500. Farmland is also uncorrelated with stocks, bonds, REITs, and private real estate, which means its value and returns don’t move in the same direction as other asset classes.

Even if the stock market is down due to a recession or destabilizing event such as the COVID-19 pandemic, farmland often continues to yield positive returns. This is largely because of the essential nature of farming. During a recession, consumers still need to eat, which makes farmland a relatively safe investment even during uncertain economic times.

Hedge Against Inflation

During inflationary periods, commodity prices go up, which benefits farmland investors who receive distributions from crop sales. Investing in farms that produce permanent crops is a particularly good hedge against inflation.

Production costs for permanent crops usually stay consistent even as commodity prices rise, enabling farmers to maintain or increase their profit margins. When food prices increase, farmland values tend to go up, so investors can capture capital appreciation during inflationary periods as well.

Who Should Invest in Farmland Through FarmTogether?

FarmTogether is best for accredited investors who want to diversify their portfolios and receive passive income from a long-term investment. Because farmland is uncorrelated with stocks, bonds, and real estate, it often generates positive returns even during downturns. This makes it a great diversification tool that will help offset losses in other areas of your portfolio.

Similar to bonds, FarmTogether’s investment offerings also allow you to earn passive income through regular distributions. These dividends can be reinvested to compound your returns, enabling you to grow your wealth over a long-term holding period.

Socially Conscious Investors

Socially conscious investors who want to support sustainable agriculture should also consider FarmTogether. All of the company’s properties are certified by Leading Harvest and meet rigorous sustainable agriculture standards. Investing in farmland also helps fund the innovations necessary to ensure long-term food security for all, such as precision agriculture technologies.

FarmTogether Review 2022: The Final Verdict

So what’s the final verdict of our FarmTogether review 2022? After thoroughly researching FarmTogether, we believe investing in its farmland offerings is one of the best ways to diversify your portfolio during turbulent times. FarmTogether rises above competitors such as FarmFundr due to the quality and variety of farmland deals it provides. The company’s commitment to sustainable farming practices is also admirable. Start reaping the rewards of farmland investing today.

Read More:

Should You Be Investing in Real Estate NFTs?

VTSAX or VTI: Which One Is The Best Investment For You?

Worried About Your Investments? Here Are 5 Signs of Underinvesting