Since retiring nearly two years ago, I have been aligning our assets with tax characteristics of our accounts following the Bucket Approach. In this article, I review the tax laws that sunset at the end of next year, President Biden’s proposed tax changes, tax characteristics of account types, and provide example funds for these accounts.

2017 TAX CUTS AND JOBS ACT (TCJA)

Key Points: Parts of the 2017 Tax Cut and Jobs Act will expire at the end of next year.

The Federal deficit as a percentage of gross domestic product has been increasing since the early 1970’s exasperated by the Financial Crisis and COVID Pandemic with the exception of 1997 through 2001 during Bill Clinton’s Presidency. I believe this is unsustainable and that the solution includes both constrained spending and higher taxes.

The Patriotic Millionaires point out that the 2017 Tax Cuts and Jobs Act (TCJA) “disproportionately benefited the rich, but it bears repeating because many of the provisions of the TCJA expire in 2025.” In “A Closer Look”, they state:

The TCJA implemented a number of changes to the tax code that benefited low-income households, most notably raising the standard deduction and doubling the value of the Child Tax Credit. But the fact remains that its largest provisions – among other things, slashing the corporate tax rate from 35% to 21%; reducing the top marginal individual income tax rate from 39.6% to 37%; doubling the estate tax exemption from $11 million to $22 million (for a married couple) – overwhelmingly worked in the interests of the wealthy. The end result? In 2025, the TCJA will boost after-tax incomes of households in the top 1% by 2.9%, while households in the bottom 60% will see a 0.9% increase. “

Anna Jackson wrote “7 Facts About Americans and Taxes” for the Pew Research Center saying, “A majority of Americans feel that corporations and wealthy people don’t pay their fair share in taxes, according to a Center survey from spring 2023. About six in ten U.S. adults say they’re bothered a lot by the feeling that some corporations (61%) and some wealthy people (60%) don’t pay their fair share.” About three-quarters of Democrats and Democratic-leaning independents say they’re bothered a lot by the feeling that some wealthy people (77%) don’t pay their fair share. Over forty percent of Republicans and GOP leaners say this about the wealthy.

PROPOSED TAX CHANGES

Key Point: The Biden Administration proposes raising taxes on the ultra-wealthy to reduce inequality and the Federal deficit.

Fidelity Wealth Management writes in “The Latest Biden Tax Proposal” that the Biden Administration’s proposed tax changes “are unlikely to become law given obstacles in Congress.” They add that “it may be wise to consider certain strategies in anticipation of a future high-tax environment.” “Generally speaking, the income tax changes laid out in the budget would impact a very small number of taxpayers if they were implemented—specifically, those who earn more than $400,000 in annual income.” Fidelity lists the proposed changes:

- The top individual income tax rate would rise to 39.6% from 37% for income above $400,000 (single filers) or $450,000 (married filing jointly).

- The net investment income tax rate would rise to 5% from 3.8% for those earning more than $400,000 in regular income, capital gains, and pass-through business income combined. The additional Medicare tax rate for those earning more than $400,000 would also increase to 5% from 3.8%.

- Qualified dividends and long-term capital gains would be taxed as ordinary income, plus the net investment income tax, for income that exceeds $1 million.

- Transfers of property by gift or death would trigger a tax on the asset’s appreciated value if in excess of the applicable exclusion.

- Roth IRA conversions would be prohibited for high-income taxpayers, and “backdoor” Roth contributions, where after-tax traditional IRA contributions can be rolled into a Roth IRA despite income limits, would be eliminated.

It is important to recognize that long-term investments have the additional benefit of stock appreciation growing tax-free until sold in addition to the lower capital gains tax rate. The US is competitive globally on taxes. According to the Tax Foundation, twelve of the countries in Western Europe have a capital gains tax rate of 26% to 42%. However, most countries use the Value Added Tax [VAT] based on consumption while the US is based more on income. A better comparison is total taxes paid as a percentage of GDP. The Tax Policy Center wrote that “In 2021, taxes at all levels of US government represented 27 percent of gross domestic product (GDP), compared with a weighted average of 34 percent for the other 37 member countries of the Organisation for Economic Co-operation and Development (OECD).” There are efforts for global tax reform and The World Economic Forum describes that “136 countries have signed a deal aimed at ensuring companies pay a minimum tax rate of 15%” in order to reduce tax avoidance.

In this changing tax landscape, Fidelity Wealth Management describes six important steps to building a well-thought-out investment strategy that is flexible, suited to your unique situation, and built to withstand the most difficult market conditions.

- Start with a firm understanding of your goals and needs

- Build and maintain a well-diversified portfolio

- Take advantage of tax-smart investing techniques

- Stick to your plan and stay invested

- Involve your family when planning and making decisions

- Consider partnering with a trusted financial professional

BUCKET APPROACH

Key Point: The Bucket Approach can be aligned to be tax-efficient.

Comments from Readers are that the Bucket Approach is too complicated or there needs to be more buckets. The quote attributed to Albert Einstein, “Make everything as simple as possible, but not simpler” is appropriate for the Bucket Approach.

Christine Benz at Morningstar wrote “The Bucket Approach to Building a Retirement Portfolio” which describes the simplistic concept of segregating assets into short-, intermediate, and long-term buckets. She goes into more detail in “The Bucket Investor’s Guide to Setting Retirement Asset Allocation” in which she provides a dose of reality:

“The preceding steps all relate to setting a retirement asset allocation for your total portfolio. But the reality of positioning your actual retirement portfolio is apt to be messier, complicated by the fact that you’re likely holding your assets in various tax silos (traditional tax-deferred accounts like IRAs, Roth accounts, and taxable accounts), each with its own withdrawal rules and tax implications.”

Ms. Benz adds the final component of withdrawal strategies and taxes in “Get a Tax-Smart Plan for In-Retirement Withdrawals” where she says, “it’s usually best to hold on to the accounts with the most generous tax treatment while spending down less tax-efficient assets.”

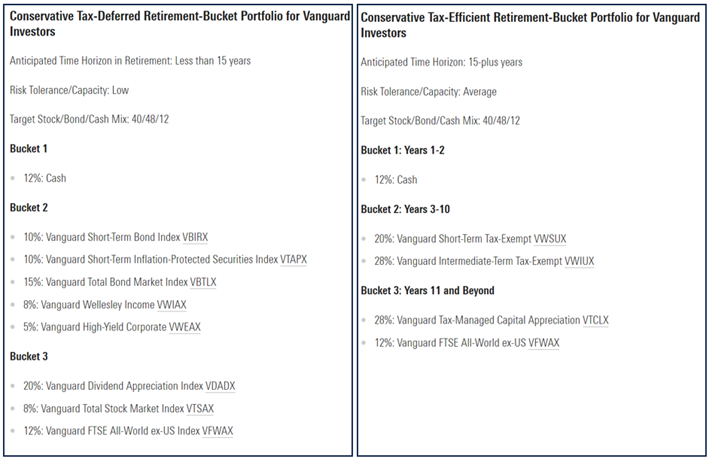

Finally, Ms. Benz provides some examples of tax-deferred and tax-efficient portfolios for savers and retirees in “Our Best Investment Portfolio Examples for Savers and Retirees”. In Figure #1, I compare her model portfolios for conservative investors at Vanguard. One generalization is that Bucket #1 contains cash, Bucket #2 contains mostly bonds which are taxed as ordinary income, and Bucket #3 contains mostly stock. In the MFO April Newsletter, I identified the Vanguard Tax-Managed Capital Appreciation Admiral Fund (VTCLX) to be a single long-term fund for a tax-efficient account.

Figure #1: Tax-Deferred and Tax-Efficient Model Portfolios for Vanguard Funds

MANAGING TAXES

Key Point: Investment location and withdrawal strategies can be adjusted to meet different or multiple goals taking into account taxes.

“How to Make Retirement Account Withdrawals Work Best for You” by Roger Young, CFP, at T. Rowe Price Insights, is an insightful article. Mr. Young says, “Unfortunately, the conventional wisdom approach may result in income that is unnecessarily taxed at high rates. In addition, this approach does not consider the tax situations of both retirees and their heirs.”

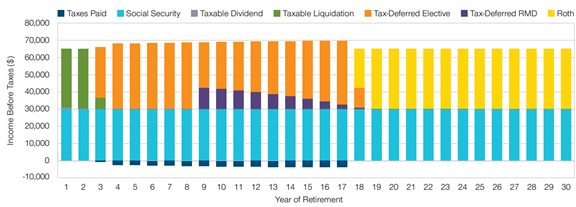

Figure #2 shows the “Conventional Wisdom” for withdrawal strategies where one withdraws first from taxable funds, then tax-deferred fund elective withdrawals, then RMDs, and finally withdrawals from Roth IRAs. Mr. Young points out that the conventional “approach results in unnecessary taxes during years 3 through 17”.

Figure #2: Conventional Approach to Retirement Withdrawals

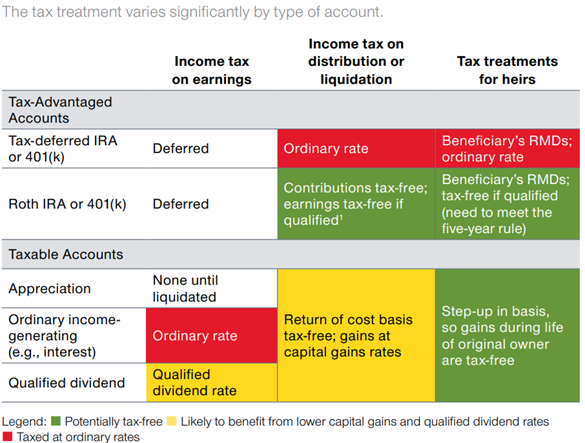

He also shows the tax characteristics of different types of accounts as shown in Table #1.

Table #1: Tax Characteristics of Different Assets

The article considers three objectives that retirees may have:

- Extending the life of their portfolio

- More after-tax money to spend in retirement

- Bequeathing assets efficiently to their heirs

While the examples may not fit everyone’s situation, the concepts can be used to personalize a financial plan.

Another way of using after-tax accounts tax efficiently is using municipal funds. Fidelity Money Market Fund Premium Class (FZDXX) has a current annualized yield of 5.15% while Fidelity Tax-Exempt Money Market Fund Premium Class (FZEXX) has a yield of 3.76% or 27% lower than FZDXX. To be in the 2023 24% federal marginal tax bracket, one’s adjusted gross income would be between $95,376 and $182,100 for a single tax filer and $190,751 and $364,200 for married filing jointly. For income higher than these brackets, owning municipal money market and bond funds may make sense. There are other factors to consider as well.

“Medicare Premiums 2024: IRMAA for Parts B and D” by Donna Levalley at Kiplinger describes how Medicare Parts B and D are increased based on income. Income from tax-exempt funds is not included in Adjusted Gross Income for federal taxes; however, they are included in Modified Adjusted Gross Income (MAGI) for Medicare Premium calculations.

Ben Geier (CEPF) wrote “IRA Required Minimum Distribution (RMD) Table for 2024” at Smart Asset describing how RMDs increase with age based on the IRS’ Uniform Lifetime Table. Required Minimum Distributions start at about 3.8% of tax-deferred assets at age 73 but increase to over 6% at age 85 which when combined with pensions, Social Security, and investment income, may push a retiree into a higher tax bracket or impact Medicare Premiums.

For those with a large percentage of assets in tax-deferred Traditional IRAs and 403b plans, the time in retirement before starting to draw Social Security and/or before RMDs start is an ideal time to convert a traditional IRA into Roth IRA while income can be kept low. In the event that the 2017 Tax Cuts and Job Act expire at the end of 2025, one may consider that there are advantages to doing a Roth Conversion while taxes are lower.

FINANCIAL PLANNING

Key Point: Here is an example template for tracking the Bucket Approach for multiple account types.

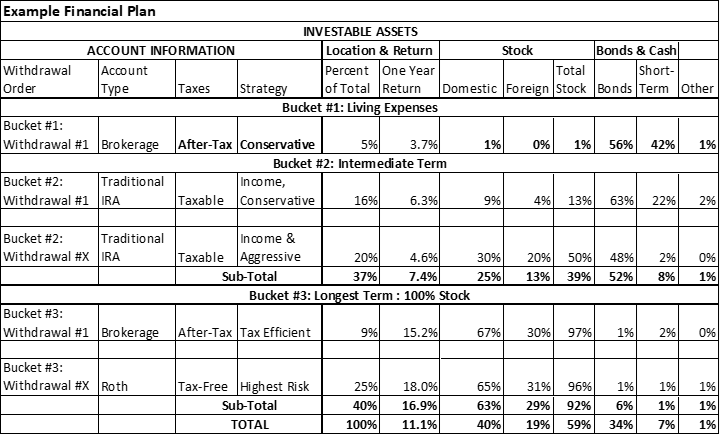

Table #2 is a template that I use to help friends and family as well as myself with financial planning. It starts by listing accounts in order of withdrawals. The accounts should be aligned for risk and tax efficiency. The allocation to each bucket depends upon time horizon, amount of savings, guaranteed income, expenses, and risk tolerance.

Table #2: Author’s Financial Planning Tool Template

My strategy is to do moderate Roth Conversions for the next few years until RMDs begin. Bucket #1 (Living Expenses) will be replenished from Traditional IRAs in Bucket #2. I will continue to meet with my Financial Planners and adjust as justified.

FUNDS BY BUCKET AND ACCOUNT TYPE

Key Point: Potential funds are listed for each bucket and account type.

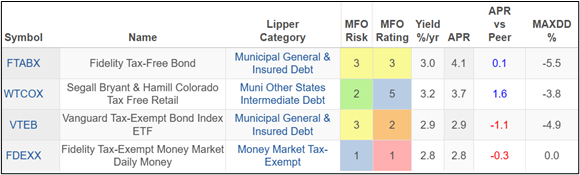

For those wishing to minimize taxable income, Bucket #1 might contain conservative municipal money markets and bond funds such as those shown in Table #3.

Table #3: Bucket #1 (Short Term): Tax Efficient Funds – 1 Year Metrics

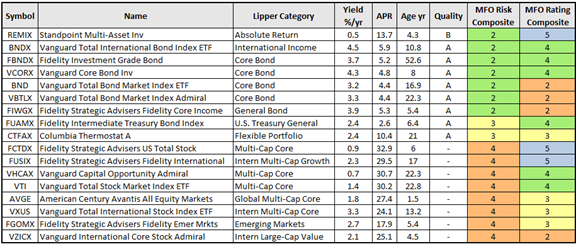

Tax-deferred accounts are ideal for holding tax-inefficient bonds that are taxed as ordinary income in Bucket #2. They may contain mostly tax-inefficient bond funds such as those shown in Table #4. Accounts later in the withdrawal order may have higher allocations to stocks where tax efficiency is not a priority. Fidelity Advisor funds are only available to those using their wealth management services.

Table #4: Bucket #2 (Intermediate Term): Funds for Tax Deferred Accounts – 1.5 Year Metrics

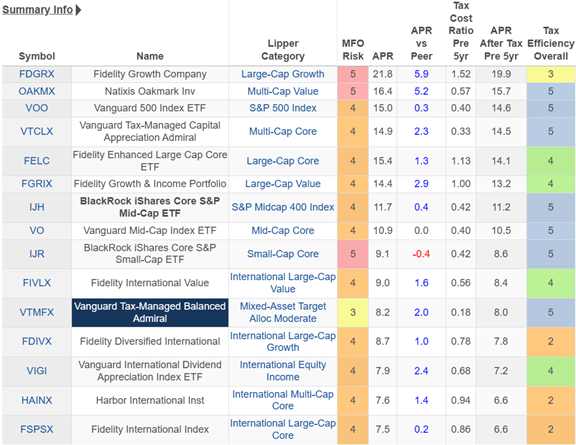

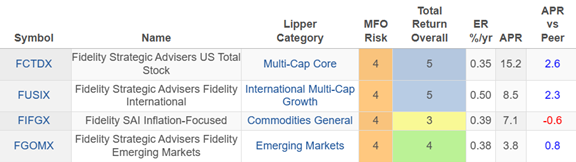

Bucket #3 will have a higher allocation to stocks in tax-efficient after-tax accounts as shown in Table #5. These are usually index funds or those with low turnover. Roth IRAs are not limited to tax-efficient funds and are shown in Table #6. Roth IRAs may be ideal for actively managed funds with higher turnover and/or higher dividends.

Table #5: Bucket #3: Funds for Taxable Accounts – 5 Year Metrics

Table #6: Bucket #3: Funds for Roth Accounts – 5 Years Metrics

Closing

The concepts in this article are not new. Changing my mindset from saver to retiree was new for me. I had a financial plan and worked with Financial Planners, but changes brought new enlightenment. The Planners have discussed more changes for later in the year. Financial Planning is a journey, not a destination.

One of the items on my Colorado Bucket List is to visit Yellowstone Park. I have now booked that trip and am busy planning my next adventure on what to see and do. In the past month, I have taken a day trip to a nature area and another to the Drala Mountain Center. Life in retirement is great!