Ever seen a lion eating grass? No, right?

Lions don’t eat grass.

Similarly, there are no equity funds that are NOT volatile (risky). All equity investments are volatile. That is the nature of equity investments.

Just like a lion cannot stop being a carnivore, the equity investments will not stop being volatile.

You can tame a lion but still cannot make it eat grass. Similarly, through various strategies, you can reduce losses in the portfolio (at least in back-tests) but cannot eliminate the risk of loss in equity products.

I usually come across queries about a safe or less risky equity fund. Believe me, there is none.

You may say the small cap funds are volatile (risky). More volatile than large cap funds. So, if you are looking for a less risky (less volatile) equity, you must stick with large cap or multicap funds. However, the large cap funds are volatile too. And you can lose a lot of money if the markets correct sharply.

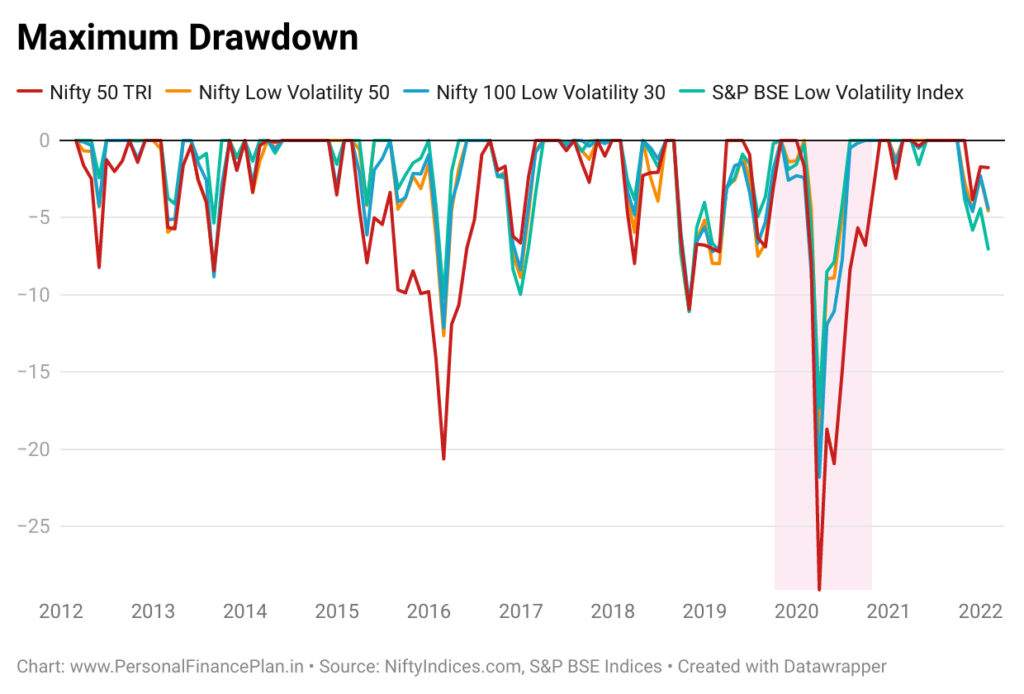

In fact, there are low volatility indices that pick up the least volatile stocks (Nifty 100 Low Volatility 30 index, Nifty Low Volatility 50 and S&P BSE Low Volatility Index). You would expect that these indices will be less volatile. Yes, low volatility indices are less volatile, but that’s relative. Nifty lost 38% in March 2020. The low volatility indices lost ~30%. The following chart is based on monthly data and hence does not reflect the full extent of damage.

What about Hybrid funds?

Yes, there are hybrid funds, asset allocation funds and balanced advantage funds (dynamic asset allocation funds). And such funds are marketed as less risky alternative to equity funds. Usually marketed as “Better than FD returns but less risky than equity funds”.

I must say many such funds have done well.

We discussed a couple of popular hybrid funds and a popular balanced advantage fund and the findings were favourable.

However, these funds do not reduce volatility by selecting a different kind of stocks. Such funds simply invest less in stocks.

And there are a few ways to do that.

#1 Let us say large cap stocks fall 30% in a week. A fund invests only 60% in large cap stocks and keeps the remaining in Government treasury bills. Obviously, since the fund had only 60% in stocks, it will fall only 18%.

OR

#2 These funds bring in different kinds of assets with lower correlation (diversification). So, when Indian stocks are not doing well, international stocks may be doing well. Or gold may be doing well. Or the other assets will not fall as much as Indian stocks.

Expect (1) and (2) in asset allocation funds and hybrid funds.

We discussed this approach in this post on how to reduce portfolio losses. However, even with diversification, you can only reduce the quantum of fall. The drawdowns will still happen.

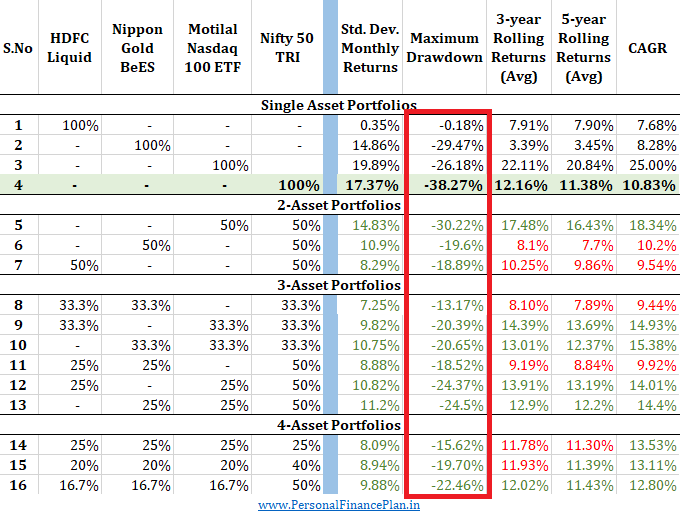

I reproduce the performance of a portfolio with mix of Nifty, Nasdaq 100, Gold ETF, and a liquid fund. Low correlations. Low drawdowns compared to Nifty 50 but significant drawdowns, nonetheless. Data considered from March 30, 2011 until December 31, 2020.

OR

#3 Take an active call on the asset allocation. Active calls are usually driven through proprietary models. The intent is to increase exposure to equities when the markets are expected to do well AND decrease exposure to equities when the markets are not expected to do well. Expect (3) in dynamic asset allocation or balanced advantage funds.

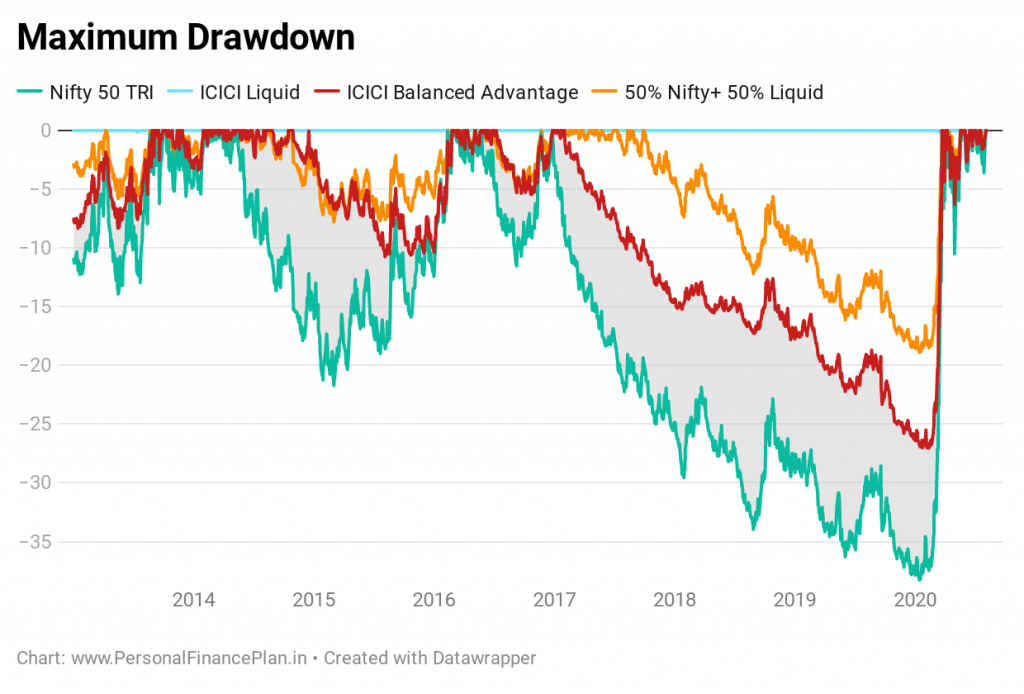

Again, such funds do not eliminate the risk of loss. ICICI Prudential Balanced Advantage Fund lost over 25% in March 2020. While the non-equity portion was less affected, the equity portion must have done equally bad.

How to we reduce volatility (risk) in the portfolio?

Broadly, there are 3 approaches.

- Do not take exposure to risky assets. Stick with the comfort of bank fixed deposits, PPF, EPF etc. That is a fine approach for very risk-averse investors. Nothing wrong. Just that you might have to settle with low expected returns. Be prepared to invest more.

- Bring in different assets with lower correlation: Bring in domestic equity, international equity, gold, fixed income, REITs etc. The premise is that NOT all assets in the portfolio will struggle at the same time. Essentially, diversify your portfolio.

- Pick up a fund that manages the asset allocation for you: Balanced Advantage, hybrid funds, asset allocation funds.

Only approach (1) eliminates volatility completely. You will never see the value of your portfolio go down by even a small amount.

Approaches (2) and (3) can give you discomfort during bad market phases. Therefore, while diversification and active investment strategies can reduce volatility to some extent, these cannot eliminate volatility.

Choose your asset allocation accordingly

When I structure portfolios for my investors, the choice of funds is almost the same for all kinds of investors.

Therefore, both the aggressive and conservative investors are suggested the same funds. Say, the same equity funds E1 and E2. And the same debt funds D1 and D2.

The difference is in the asset allocation. And the asset allocation depends on their risk appetite.

For an aggressive investor, the equity allocation (E1 + E2) will be say 60% of the portfolio. D1 + D2 will be 40%.

For a conservative (or a risk-averse) investor, the equity allocation (E1+ E2) will be say 30% of the portfolio. D1+ D2 will be 70%.

Therefore, focus more on aspects such as asset allocation that you can control. The asset allocation must be in line with your risk appetite.

Do not chase the mirage of safe equity funds. Such equity funds do not exist.

The post was first published in May 2021.

Featured Image Credit: Unsplash