As a business owner, there are many documents you need to keep track of for your company. Employee paperwork, bills, invoices, etc., are all essential documents to store in your records. Keeping records isn’t just a good business practice, either. There are specific IRS recordkeeping requirements you must follow. One of those requirements is maintaining tax records. Learn how long to keep tax returns for your business.

How long to keep tax returns

You may know how long you must keep your personal tax records. But, IRS recordkeeping requirements for individuals are different than the rules for businesses. In fact, the IRS recordkeeping requirements for businesses are generally longer than the amount of time for individual tax records.

So, how long do you need to keep tax returns for your business? According to the IRS, there are different amounts of time for recordkeeping for tax purposes. How long to keep tax records can depend on what you need to keep them for. Publication 583, Starting a Business and Keeping Records, details how long you should keep different records.

Period of limitations

There is a period of limitations for tax recordkeeping. What is a period of limitations? It is the period in which a business can amend its returns to claim credits or refunds or in which the IRS can assess additional tax.

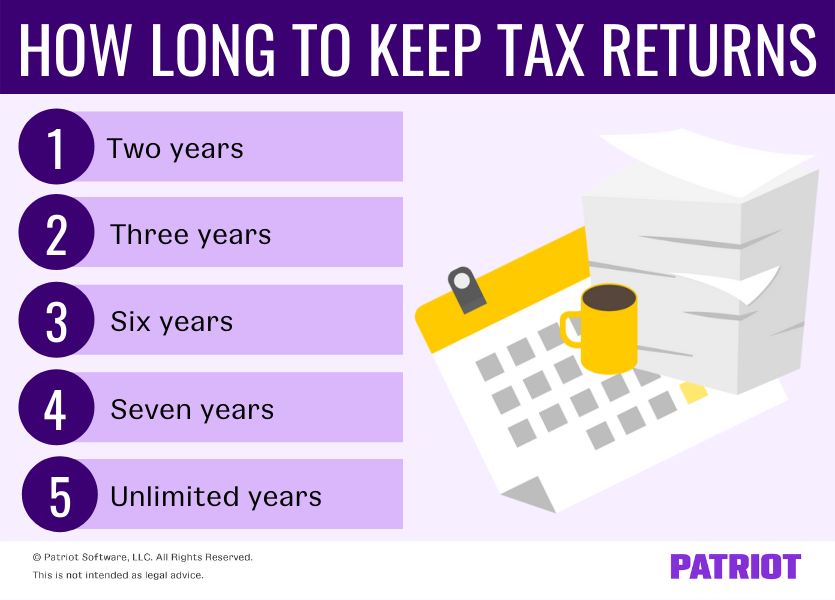

According to Publication 583, your filing situation determines how long you must keep your tax records. Depending on your tax situation, you may need to keep your records for the following number of years:

- Two

- Three

- Six

- Seven

- Unlimited

Publication 583 explains that these are the period of limitations for keeping tax records for specific reasons. Take a look at the period of limitations for each situation.

Two years of tax recordkeeping

Keeping tax records for two years applies to businesses that file a claim for credit or a refund after filing a return. Companies must maintain tax records for two years after they pay the tax. But, the payment date must come after the filing date for businesses to qualify to keep records for only two years.

Three years of tax recordkeeping

There are two reasons you may need to keep your tax records for at least three years. First, you must keep your records for at least three years if you file a claim for a tax credit or refund after you file your return. If that sounds familiar, it’s because it goes hand in hand with the two years of tax recordkeeping.

You must keep tax records for three years if you file a claim for a refund or credit after you pay the taxes. But, you only need to keep the records for two years if you file the claim first and pay second.

The IRS also states that you must keep tax records for a minimum of three years if you owe additional taxes and specific circumstances do not apply to you. The particular circumstances include:

- If your business has employees, you must keep all employment tax records on file for a minimum of four years after the tax due date or you pay it, whichever is later.

- Businesses with property assets must keep tax records until the period of limitations expires for the year the company disposed of the property.

- If you have tax records that non-tax services may need to use, keep your tax records until they inform you they no longer need the documents. Keep the documents for longer, even if the period extends past the IRS recordkeeping requirements. For example, creditors may have a longer period of limitations than the IRS.

If the above circumstances do not apply to your business, you may choose to dispose of your records after three years.

Six years of tax recordkeeping

There is a six-year period of limitations for businesses that don’t report income they should have reported. But, the business’s unreported income must be more than 25% of the gross income shown on the return.

For example, a business reports $100,000 but should have reported $130,000. Because they didn’t report $30,000 ($130,000 – $100,000) worth of income and that is more than 25% ($100,000 X 25% = $25,000) of the reported income, they must keep their returns for six years.

Seven years of tax recordkeeping

Businesses must keep their tax records if they file a claim for a loss from worthless securities or a bad debt deduction.

A bad business debt is one a company incurs while operating as part of the taxpayer’s business or trade. The business can then deduct the bad business debt from ordinary income instead of treating it as a capital loss. Companies must report it as a deduction on tax returns.

Worthless securities apply to shares of stock, stock rights, or evidence of debt issued by a corporation. Stock may become completely worthless, creating worthless security. Or, businesses can abandon their securities by permanently surrendering them and giving up all their rights. Treat worthless securities like capital assets sold or exchanged effective the last day of the tax year. Report worthless securities on tax returns.

Unlimited years of tax recordkeeping

There are two situations in which businesses must keep all tax records, including tax forms and other paperwork:

- Company filed a fraudulent tax return

- Business did not file a return at all

You must keep all tax records and information for an unlimited period if you meet one of the above conditions.

How many years of tax returns should you keep?

So, just how long do you keep tax returns? Consider keeping tax records for at least seven years to be on the safe side. Seven years’ worth of tax returns helps in the event of an IRS audit or if lenders, creditors, or other interested parties need additional information from your business.

The IRS generally includes only three years’ worth of returns when conducting audits. But, they may go back up to six years, if necessary. Maintain substantial enough records to protect your business and provide enough evidence to interested parties.

This is not intended as legal advice; for more information, please click here.