Advertiser Disclosure: This site is part of affiliate sales networks and receives compensation for sending traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

2022.3 Update: The new offer is 120k, and there are some changes of benefits:

- The welcome offer eligibility limit is now across IHG personal credit cards.

- Some other changes that don’t matter.

2022.1 Update: The new offer is 80k.

Application Link

Benefits

- 80k offer: earn 80,000 IHG points after spending $2,000 in the first 3 months. The recent best offer is 100k.

- IHG points are valued around 0.5 cents (Hotel Points Value). So the 100k highest offer is worth about $500.

- Earn 5x points at IHG property; earn 3x points at dining, gas station, and monthly bills (utilities, cable, internet, phone,

cell and select streaming services); and earn 2x point on other purchases. - Earn 10,000 bonus points after spending $10,000 and making one additional purchase each calendar year.

- 20% off 20% on when you purchase IHG points with your card.

- 4th reward night free when you redeem points for any stay of 4 or more nights.

- Complimentary IHG Silver Membership as long as you have this card. Get IHG Gold Membership if you spend $20k.

- No foreign transaction fee.

- No annual fee.

Recommended Application Time

- [5/24 Rule] If you have 5 or more new accounts opened in the past 24 months, Chase will not approve your application on this card, no matter how high your credit score is. The number of new accounts includes all credit card accounts, not only Chase accounts. See this post for details about how to possibly bypass this rule.

- This product is available to you if you do not have a current IHG Rewards Credit Card and have not received a new Cardmember bonus within the last 24 months. Note that what matters here is the time you got the sign-up bonus, not the time you open the account or close the account. This does not apply to Business Card Credit Card products.

- Don’t apply for more than 2 Chase credit cards within 30 days, or it’s highly likely that you will get rejected.

- We recommend you to apply for this card after you have a credit history for more than a year.

Summary

The $99 annual fee version IHG Premier card has higher bonus and gives you a free night every year, so it is more recommended to apply for the IHG Premier card if you are interested in IHG hotels. This IHG traveler card has no annual fee, so it is a good downgrade option.

Related Credit Cards

| Chase IHG Traveler | Chase IHG Premier | Chase IHG Premier Business | |

|---|---|---|---|

| Annual Fee | $0 | $99 | $99 |

| Free Night | none | up to 40k | up to 40k |

| Best Sign-up Bonus | 120k | 150k+$50 | 140k |

After Applying

- Call 800-436-7927 to check Chase application status. This is an automated telephone line, and the information has the following meanings: Receive decision in 2 weeks means your application is probably approved; Receive decision in 7-10 days means your application is probably rejected; Receive decision in 30 days simply means your application requires further review and there’s nothing to tell you for now.

- Chase reconsideration backdoor number: 888-270-2127 or 888-609-7805. Call it if you didn’t get approve immediately. Your personal information will be acquired and they will then review it. You seldom answer questions, instead, just enjoy the music and then you get approved or rejected, or further information is needed to be handed in to the branch or be faxed.

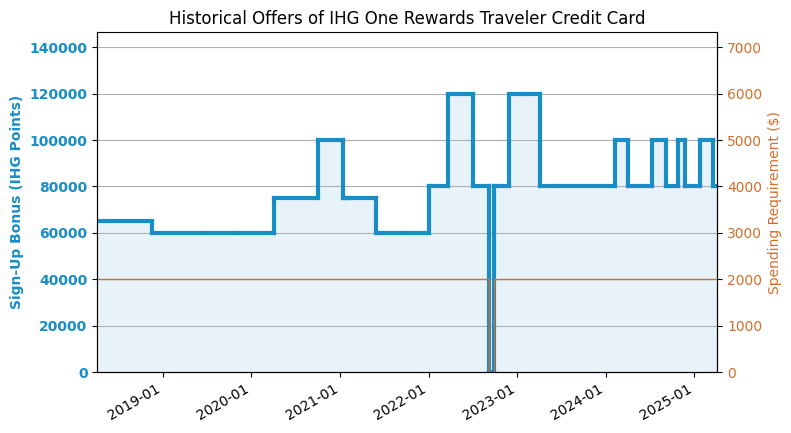

Historical Offers Chart

Application Link

Share this post with friends

If you like this post, don’t forget to give it a 5 star rating!

[Total: 1 Average: 5/5]