If this is how it ends, it’s been a helluva ride. The S&P 500 has hit new all-time highs every year since 2013. 347 in total, including one from earlier in the year.

Tech stocks have gotten killed, but it’s hard to feel too sorry for investors. Even after the 20% decline, the Nasdaq-100 has compounded at 21% a year for the last five years. So, where do we go from here?

It’s hard to come up with a bull case right now. Sure, a ceasefire would be a ripper of epic proportions. But then what? We haven’t even begun to feel the ripple effects of this global crisis. 7% inflation hurts, but $150 oil is going to leave a mark. Heating oil is going vertical. Real food prices are basically at all-time highs, and wheat, soy, corn, and other agricultural commodities are still going nuts. This will hit consumers and it will hit earnings. It’s hard to see the market brushing all of this off.

Nobody knows where stocks go from here. Not Warren Buffett or Jim Simons or anyone else. The good news is that seeing the future is not necessary for achieving success in financial markets. What you do need is a plan. And nobody who’s selling all their stocks today has a plan because nobody’s plan is to panic sell. If you’re trying to grow your wealth, and I don’t know any other reason for investing, then part of the plan has to include living through discomfort. Any strategy that’s predicated on all upside and no downside is bullshit.

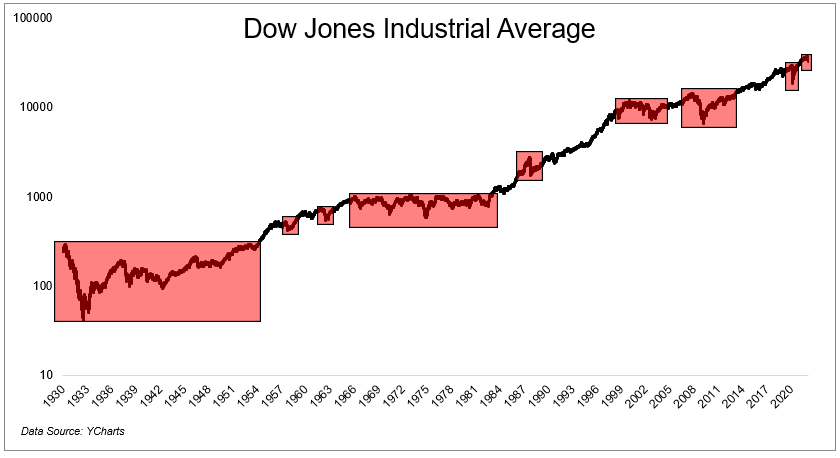

The bull run could be pausing or it might be ending. If it’s the latter and things get more challenging going forward, there’s something important you need to know; The one thing all bear markets have in common is that they eventually end.

You don’t need to know when it will end, you just need to know that it will. If you can tolerate pain, you will make money over time. If not, well, you won’t.

Josh and I are going to cover this and much more on tonight’s What Are Your Thoughts?