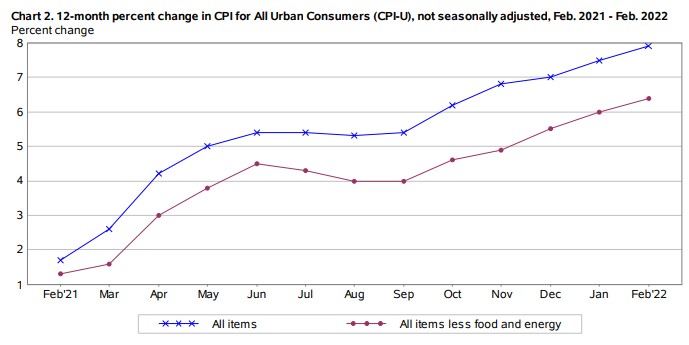

These are extraordinary times. The consumer price index increased by 7.9% over the last 12 months, which is the highest year-over-year increase since 1982.

It’s a weird feeling, to know that you’re living through history. One day we’re gonna talk about this the same way that our parents talk about the 1970s.

Inflation shows absolutely no signs of slowing down. Price increases are broad-based and expanding.

The coffee you wake up to is 10.5% more expensive. The gasoline that you put into used cars and trucks is up 38% while the vehicles themselves are up 41%. The food you eat for lunch costs you 8.6% more. And the bedroom furniture you go to sleep in is up 17.1%.

All of this is from February-February, which, unfortunately, is before the recent spike in commodities. The March numbers could easily hit double digits.

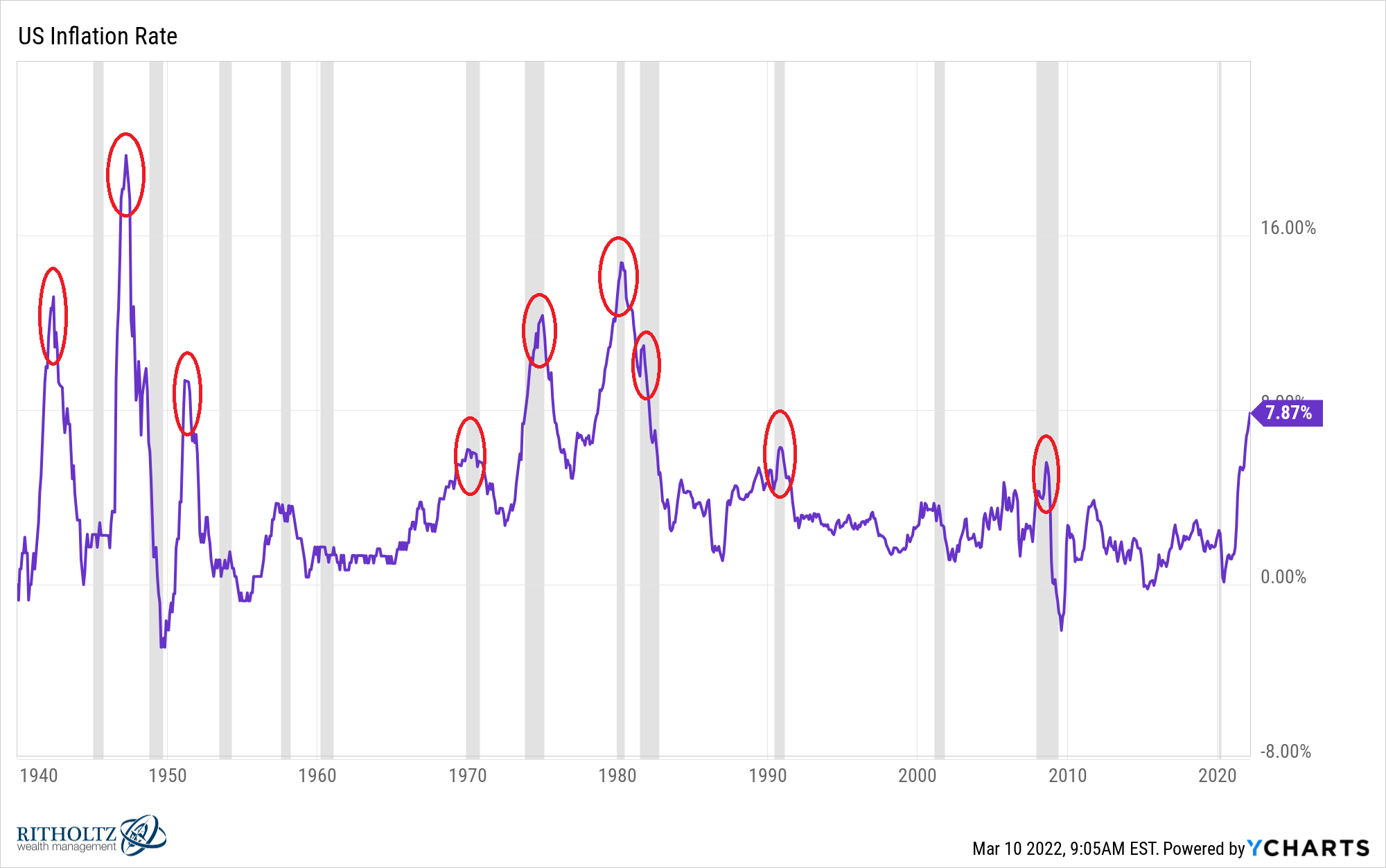

So what could slow this down? The simple answer is a recession. We’ve never seen an inflationary spike that didn’t end that way, as you can see from this chart that Ben made.

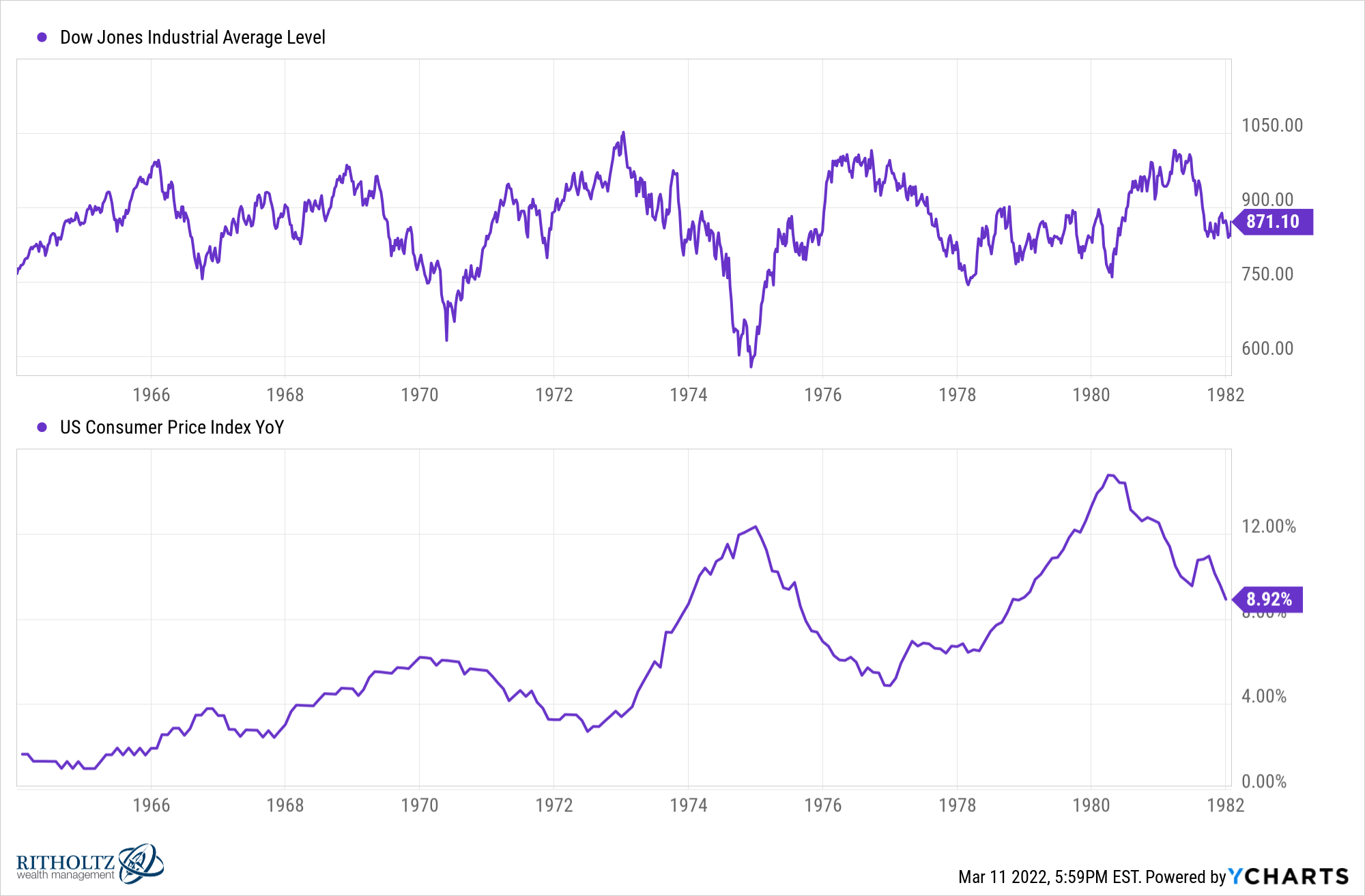

In January 1982, the last time inflation was this high, the fed funds rate was 13%, unemployment was 8.6%, and the economy was in its third recession in ten years. Needless to say, stocks weren’t doing well. The Dow Jones Industrial Average traded in a sideways choppy grind for eighteen years.

There’s no playbook for how this plays out because other than the high inflation, nothing about today’s environment resembles inflationary spikes of the past. The fed funds rate is still at zero, unemployment is below 4%, and the Dow is up more than 150% over the last decade and slightly positive over the last 12 months.

That’s the bad news. The good news, or I guess hopeful news, is that history is a template, not a guide. Things that haven’t happened before happen all the time. So it’s conceivable that inflation pressures ease without the economy falling apart.

We spoke about this and much more on this week’s The Compound and Friends with our friends Allison Schrager and Sam Ro.