By Katherine K. Chan, Reporter

HEADLINE INFLATION may have eased to a five-month low in December amid the continued drop in rice prices and cheaper electricity costs, which likely brought full-year inflation well below the target, analysts said.

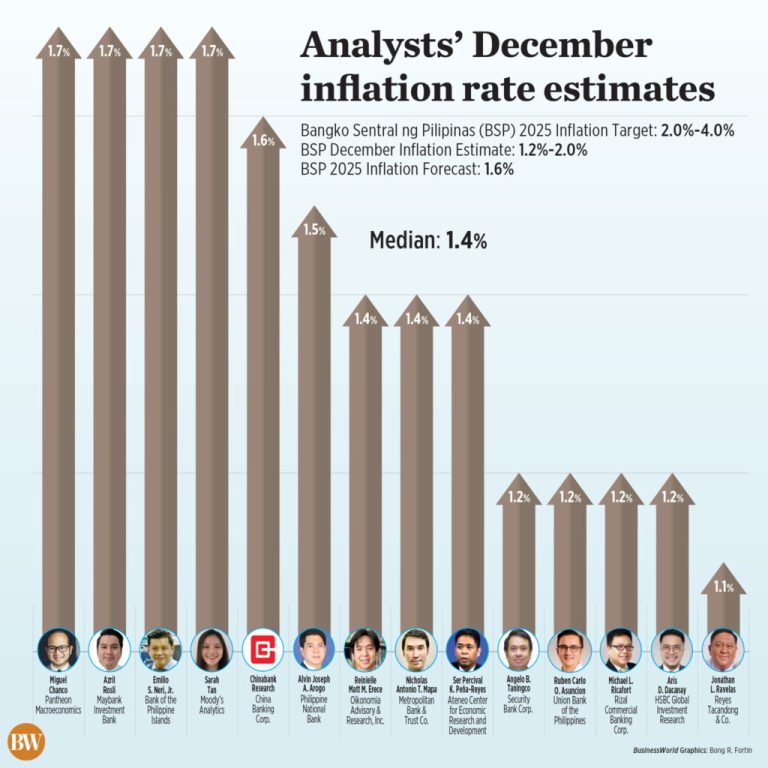

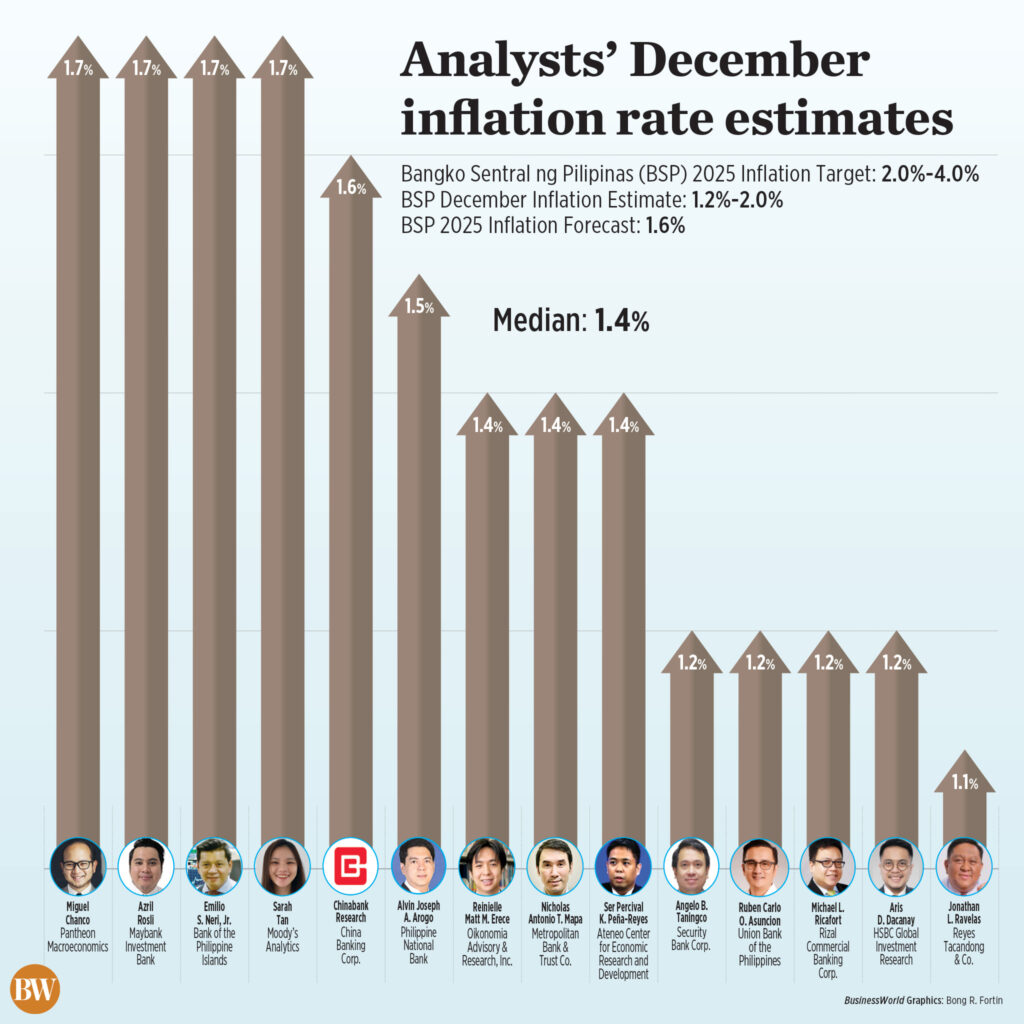

A BusinessWorld poll of 14 analysts yielded a median estimate of 1.4% for the consumer price index (CPI) in December.

This is within the Bangko Sentral ng Pilipinas’ (BSP) 1.2%-2% forecast for the month.

If realized, the December CPI cooled from 1.5% in November and 2.9% in the same month in 2024.

December would also be the tenth straight month that inflation undershot the central bank’s 2%-4% target.

It would likewise bring full-year inflation to 1.6%, matching the central bank’s projection.

The Philippine Statistics Authority (PSA) is set to release December and full-year inflation data on Tuesday (Jan. 6).

Union Bank of the Philippines (UnionBank) Chief Economist Ruben Carlo O. Asuncion said inflation likely eased in December as price pressures remained subdued despite the holiday season.

“Price pressures were limited,” he said in an e-mail. “While the peso stayed weak, this was offset by easing global oil prices toward yearend and cooler weather reducing electricity costs. Rice deflation likely persisted, though its impact is waning.”

In mid-December, the average price of regular milled rice declined by 14.05% year on year to P42.10 per kilo from P48.98 per kilo previously, PSA data showed.

Well-milled rice likewise fell by 9.9% year on year to P49.53 per kilo, while special rice fell by an annual 7.17% to P58.91 per kilo.

Meanwhile, the peso closed slightly weaker on the last trading day of 2025 at P58.79 against the greenback, down by 14.5 centavos from its P58.645 per dollar finish on Nov. 28.

Security Bank Chief Economist Angelo B. Taningco said inflation likely cooled in December due to lower prices of rice, fruits, oil, vegetables, petroleum and electricity.

“While holiday spending is a definite factor in the elevated inflation print, food prices have remained stable,” Reinielle Matt M. Erece, an economist at Oikonomia Advisory & Research, Inc. said in a Viber message.

“The prices of some food items have even gone down, especially vegetables. Electricity prices have also slightly decreased during the month, further taming inflation offsetting the expected holiday surge from more bonuses and remittances,” he added.

Manila Electric Co. (Meralco) last month reduced electricity rates by P0.3557 per kilowatt-hour (kWh) to P13.1145 per kWh from P13.4702 per kWh in November. This is equivalent to a P71 decrease in the monthly electricity bills of households consuming an average of 200 kWh.

Meanwhile, pump price adjustments in December stood at a net increase of P0.80 per liter for gasoline. On the other hand, prices of diesel saw a net decrease of P3.80 per liter, while kerosene saw a net decrease of P4.40 per liter.

However, several analysts said inflation may have slightly quickened in December.

“Inflation during the month was primarily shaped by lower energy and transport costs, and favorable base effects, which more than offset modest upside pressures from holiday-related food demand and localized weather disruptions affecting selected food items,” Maybank Investment Bank economist Azril Rosli said in an e-mail, noting that he expects inflation to pick up to 1.7%.

Moody’s Analytics economist Sarah Tan likewise said December inflation may have quickened to 1.7% due to the temporary rice import ban as well as infrastructure and agricultural damages from Typhoon Kalmaegi (local name: Tino).

“These conditions will exert upward pressure on prices, not just for food but also for utilities, fuel and essential services, which are vulnerable when power lines, roads and supply routes are impaired,” she added.

The National Government extended the suspension of regular and well-milled rice imports until end-2025.

MORE EASING SPACE

The central bank expects inflation to return within target this year, averaging 3.2% by yearend.

With inflation likely within the 2-4% target this year, analysts see more scope for further monetary policy easing.

Security Bank’s Mr. Taningco said inflation is seen to reach the midpoint of the BSP’s target range at 3.2% partly due to base effects.

Alvin Joseph A. Arogo, chief economist and head of research division at Philippine National Bank, said he expects the central bank to bring down the benchmark rate to 4.25% early this year before shifting to a “long pause.”

“Average inflation in 2026 will likely be higher at 3.3%. This is due to wage hike pass-through, utility rate adjustments, and unfavorable rice base effect coupled with the temporary ban on imports,” he said in an e-mail.

UnionBank’s Mr. Asuncion sees two more 25-basis-point (bp) cuts this year, with the first one likely to come at the Monetary Board’s first policy meeting of the year on Feb. 19.

“Given our inflation outlook and expectations of a moderate growth rebound, we anticipate the BSP will maintain an accommodative stance but proceed cautiously,” he said. “We see two additional policy rate cuts in 2026, one 25 bps likely in the first quarter, contingent on inflation staying within target and global monetary conditions remaining supportive for the other potential cut.”

The Monetary Board ended 2025 with a fifth straight 25-bp reduction on Dec. 11, bringing the policy rate to an over three-year low of 4.5%. It has so far lowered key borrowing costs by 200 bps since August 2024.

BSP Governor Eli M. Remolona, Jr. earlier said the central bank is approaching the end of the easing cycle but left the door open for one final 25-bp cut this year amid subdued inflation and clouded growth prospects.

“In 2026, BSP will need to walk a line between supporting a slowing economy and guarding against stronger price pressures,” Ms. Tan said.