Down years in the financial markets are a heavy burden on asset holders. (We presume you’re noticed.) Holding assets through down years is the price we pay for earning long-term risk premia embedded in assets. Years like this are particularly challenging because the current downswing feels so very abnormal: it’s a correction in the financial markets (normal but painful) in which both investment grade bonds and speculative tech stocks are falling sharply and simultaneously (utterly abnormal and still painful), and the trajectory of the decline is warped by war in Europe, the threat of a “twin-demic,” and central banks simultaneously – but inconsistently – withdrawing liquidity from the markets.

On the whole, it’s hard to imagine compelling investment opportunities in the short term. That said, for 2022, there are two bright sides to the poor market returns:

- Rebalancing & Portfolio Restructuring

- Tax Loss Harvesting

Both are sensible strategies that can allow a prudent investor to eke out some gains even in uncertain times.

Rebalancing & Portfolio Restructuring

Rebalancing is helpful when one asset is up, and the other is down. You sell the winner to add to the losing asset. This year, Rebalancing does not work in a traditional sense. All assets have lost money. However, a pause and look actually reveals that a very interesting landscape has now opened up.

I was recently able to buy some New York triple-tax exempt AA municipal bonds, with a 10-year to call at a yield of 4.15% to worst. This purchase allows me to lock in a certain level of interest income which is fully free of taxes from all jurisdictions. Investing in such bonds requires the help of a seasoned fixed-income professional. This bond purchase may not work for everyone. If one is in a low tax bracket or lives in a low/zero tax state, such a purchase might not make sense.

For the first time since 2008, 10-year bonds – US Government bonds and tax-exempt municipal bonds – are available at interest rates close to 4% and higher. Savers finally have a solid option. If that means restructuring the overall portfolio and taking off some risky positions to earn tax-free income, one ought to give it serious thought. Good sleep matters.

Tax Loss Harvesting

When the stock market is in the doldrums, people are frightened to do anything. That this behavior pattern is not conducive to future wealth creation is well known. How can we change it? We need the motivation to shake off our inertia.

Tax Loss Harvesting (TLH) is the reward provided by the IRS to break the logjam of being stubborn with one’s investments. Investors with a taxable investment portfolio would benefit well by understanding how TLH works.

A brokerage statement provides the cost basis, line item by line item, of each investment holding. Furthermore, by digging deeper on the website, one can usually find the individual trades which contributed to the position.

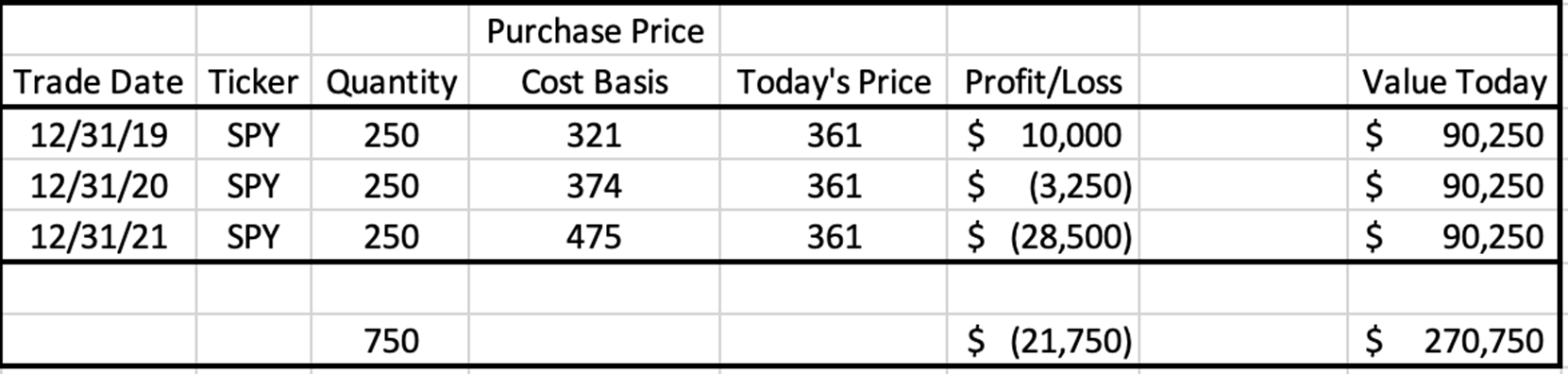

Take, for example, an investor who bought 250 shares of SPY every year for the last three years on the last day of the year in a taxable account. That investor would be sitting at a total loss of $21,750 on the purchase of those 750 shares of SPY. A deeper look shows that the purchase from 12/31/21 is responsible for more than 100% of those losses.

What can this investor do? The following is educational, not tax advice, but instructive, nevertheless. One idea:

- Sell the 250 shares bought on 12/31/21 at $475 per share today and take a loss of $28,500. The broker must be instructed to sell these specific shares. Usually, one can choose the shares on the website or by letting the broker know.

- Use the proceeds of $90,250 to buy another US domestic stock ETF. For example, VTI (Vanguard Total Stock Market ETF) or IVV (iShares Core S&P 500 ETF).

- Although SPY, VTI, and IVV are all similar to each other, the IRS treats them as non-similar because of the subtle differences in their makeup.

With this action, the investor has maintained the exposure to US domestic stocks in a passive ETF format. However, the investor has now taken a Capital Loss of $28,500 in 2022.

What’s the use of this Capital Loss?

Capital Losses can offset Capital Gains.

Short-term capital losses offset short-term gains, and long-term capital losses offset long-term gains. Net short-term losses can also offset net long-term gains and vice versa.

$3,000 of Net Capital loss can be offset against Ordinary income in 2022 if married filing jointly.

Finally, residual net capital losses in excess of $3,000 can be carried over to future years. When, in a future year, any asset is sold for a Capital gain, this residual Capital loss built up in 2022 can be used to offset those gains. Thus, by acting today and building up a Capital Loss, investors can shield some future Capital Gains from taxes. Tax Loss Harvesting works at the Federal level of taxation.

When does Tax Loss Harvesting not work?

Three common reasons are:

- Investments in Deferred Tax accounts do not benefit from this exercise.

- When an investor holds stock in a specific company, say, Microsoft, they may not want to sell it for a loss and replace Microsoft with Meta. There is no exact Microsoft replacement like there is for Index ETFs.

- Some states do not allow for a carry forward of Capital Losses, so one needs to consult a tax accountant.

Bottom line: Tax Loss Harvesting is thus a way to build a “hidden asset” while maintaining market exposure. You cannot get paid for it or sell it to someone else, but you can use it to shield your future Capital Gains taxes. One can also use this opportunity to get rid of bad investments, to restructure the portfolio wholesale, and to set up a portfolio for future success.