Dear reader,

Thank you for your question.

The answer is quite tricky as this depends on your current financial situation, age and risk appetite. However, from your question above it seems that your risk appetite is moderate, but you are looking to invest in a more conservative investment vehicle. As the South African Reserve Bank is increasing interest rates to control inflation, you may look at this as an opportunity to invest in cash-related investments, but is this advisable in the long term?

We believe it is not advisable to withdraw from your voluntary investment and invest in a cash-related investment for the following reasons:

- Firstly, a voluntary investment has many benefits, such as: the flexibility to contribute or start a debit order at any time; when you do require funds, you can withdraw without incurring penalties or costs; you can switch from one underlying fund to another; and you can adjust your risk strategy as per market conditions.

- Currently, cash-related investments are attractive due to increases in interest rates, however, certain investments such as fixed deposits require that you tie your funds in for a certain period. This means you will have limited access – and, if you do withdraw, there will be penalties. This is not advisable as you have mentioned that the funds are used for additional income.

Assuming you have a long-term investment horizon, where your investment benefits from compounding and portfolio adjustments due to market downturns, investing in a cash-related investment may result in modest capital growth, which may be detrimental to your long-term goals. This is because the current interest rate hike cycle is provisional, likely to last until the first quarter of 2023, and a reversal is possible in the second half of 2023, so interest rates will not remain as elevated as they are presently.

Our suggestion is that you switch the underlying funds into a more conservative strategy. In this way you will have exposure to funds that are linked to the money market interest rates and have some exposure to the equity asset class. When switching the underlying funds in your voluntary investment, a capital gains tax event may trigger.

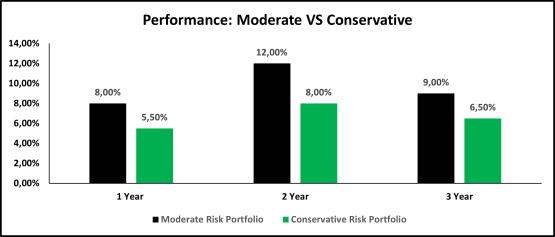

[It’s important] to understand that when you implement a conservative strategy, this will influence the performance of the investment as shown in the following graphs.

* Please note an average performance for each asset class was taken into account when determining the performance for one, two and three years.

* Please note the above asset allocation is based on the weighted average of moderate and conservative funds used in this analysis.

A moderate (medium-risk) portfolio allows you to experiment with different types of investments, while also putting some of your money in safer funds. A moderate-risk portfolio should include 40% to 60% risky investments (such as equities) and 40% to 60% safer investments (like money market instruments).

With a conservative portfolio (lower risk), it allows you to invest without taking huge risks with your money. For a more conservative portfolio, you’ll want a combination of 20% to 40% risky investments (like equities) and 60% to 80% of safer investments (like money market instruments).

Home property

With regards to your second question, we are not aware of your financial situation, property status and investment objectives, thus the following is a suggestion based on the face value of the information provided in the question.

There is a positive correlation between real estate and inflation, where property prices rise in value during inflationary conditions, thus offering real value. [Given the] high-interest-rate and high inflationary environment, retail housing property nominal prices soared by 3.3% during the third quarter of 2022.

This increase, however, is not being backed by property sales, due to suppressed demand by consumers.

This slowdown in demand is being spearheaded by stagnant disposable incomes, high interest rates to finance mortgages, possible retrenchments as the global economy potentially slides into recession, and weaker consumer sentiment, among other reasons. This has an inverse ripple effect on property prices, as there is a likelihood of properties being sold at discounted prices, in spite of the nominal growth recorded. As a result of these factors, selling your property may be unwise, as there is a possibility of selling at a discounted price.

I do hope the above has answered your question, however you are more than welcome to contact us.