Tata MF has launched Tata Nifty Midcap 150 Momentum 50 index fund. Picks momentum stocks from the midcap universe. The back test results are stunning, far better than any of the factor products I have reviewed so far. But and there are always buts.

Usually, I add the warnings/caveats towards the end of product review post. However, the back test results for Nifty Midcap 150 Momentum 50 index are so good that I thought of starting with the caveats first. Here you go.

- Past performance may not repeat in the future.

- For this index, there is no past performance in the first place. The entire data is back tested.

- The index was launched only in August 2022. Therefore, negligible live performance data.

- If an index provider is launching an index, the back test results must be great. What is the point of launching an index has not even delivered in the back tests? Moreover, no AMC would launch products tracking an index with poor past performance.

- NSE would have evaluated multiple definitions of Midcap momentum index. They would have selected the definition of midcap momentum that delivered the best results in the back tests. The outperformance could simply a result of curve-fitting. Hence, we must take such data with a pinch of salt. Need to see longer live performance.

- Investor money will chase successful investment strategies. More money will flow into the strategy. Just this will reduce alpha (excess returns) from an investment strategy.

- This index selects stocks from universe of midcap stocks. As you go down the market spectrum, the slippages and impact cost increases. Hence, you can expect tracking error to be much higher than Nifty 50 index funds/ETFs.

How to construct the “Best Portfolio” using index funds and ETFs?

Performance comparison of all factor indices (Quality, Low Volatility, Momentum, Value, Alpha)

What is Nifty Midcap 150 Momentum 50 index? How does it select stocks?

Nifty Midcap 150 Momentum 50 selects stocks from the universe of midcap stocks (Nifty Midcap 150).

Nifty Midcap 150 is the parent index.

Launch Date: August 16, 2022

Base Date: April 1, 2005

Rebalancing Frequency: Semi-Annual

Weight of a single stock capped at 5%

The stock picking methodology is like the Nifty 200 Momentum 30 index. From the universe of stocks, normalized momentum score is determined for each stock based on 6-month and 12-month price returns, adjusted for volatility. The stocks that have delivered over these time frames will have better momentum scores compared to stocks that have not done well.

Note that momentum stocks are not just about returns. The path is also important. Between two stocks A and B with the same price performance, the stock with a smoother rise will get a better momentum score.

Stock A: 100, 120, 155, 170, 180, 200

Stock B: 100, 150, 135, 185, 170, 200

Both stocks have gone up from 100 to 200. But stock A had a smoother rise (lower volatility). Thus, A will get a better momentum score than stock B.

For more details about the index, you can refer to the Factsheet and the Index methodology.

Nifty Midcap 150 Momentum 50 index: Performance Comparison

We compare the performance of the following indices since April 1, 2005, until September 30, 2022, against the Midcap Momentum index.

- Nifty 50 TRI (no comparison is complete with Nifty 50)

- Nifty Next 50 TRI (this index behaves more like a midcap fund) Review

- Nifty Midcap 150 TRI (this is the parent index)

- Nifty 200 Momentum 30 (we already have index funds/ETFs tracking this momentum index) Review

- Nifty Midcap 150 Quality 50 (this is another factor product from the midcap universe) Review

- Nifty Alpha 50 Review (this index had also done quite well)

In these 17.5 years (April 2005 – September 2022), the Nifty Midcap 150 Momentum 50 index has gone 40X.

Rs 100 grows to Rs 4,000.

CAGR of 23.47% p.a.

Your money doubles every 3 years.

No other index comes remotely close.

Its cousin Nifty 200 Momentum 30 index is the closest competition. Delivers 19.73% p.a. Rs 100 grows to Rs 2,335. Very good but 40% lower than Midcap momentum index.

Nifty 50: CAGR of 14.27% p.a. Rs 100 grows to Rs 1,031 over the same period.

Nifty Midcap 150: CAGR of 16.54% p.a. Rs 100 grows to Rs 1,456.

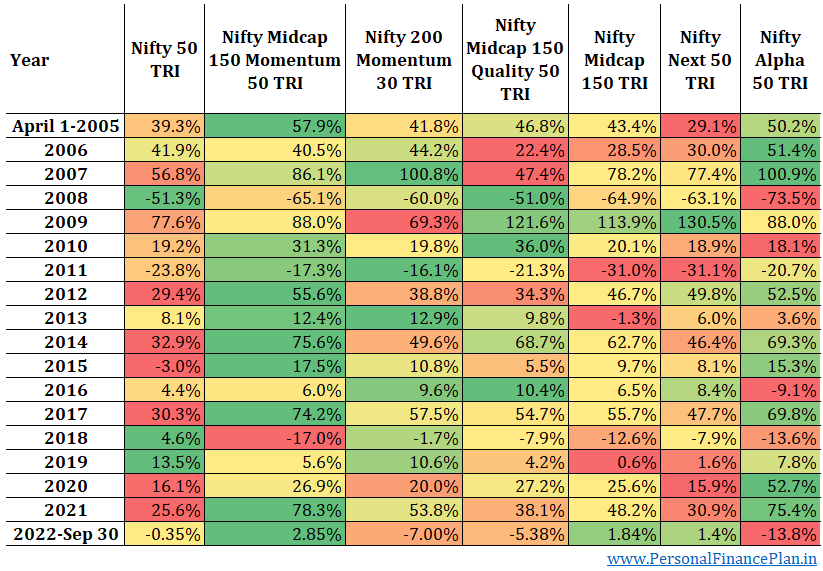

Let us look at the calendar year returns.

We considered 16 complete years in this exercise.

Midcap Momentum Index beats Nifty 50, Nifty Next 50, and Nifty Midcap 150: in 12 out of 16 years.

Nifty Alpha 50 and Nifty Midcap 150 Quality 50 index: in 10 out of 16 years.

Nifty 200 Momentum 30 index: in 8 out of 16 years

Pretty consistent performer, at least in back tests.

The worst years were 2008 and 2018.

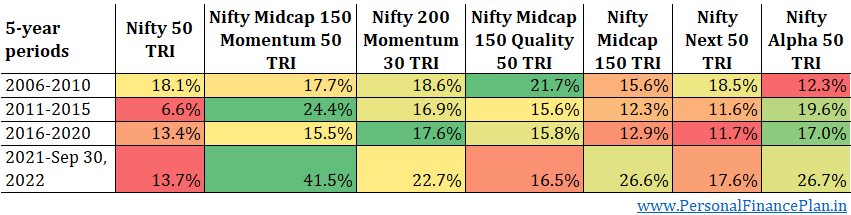

Now, let us look at the performance over blocks of 5 years.

Stark outperformance in 2011-2015 and 2021-Sep 30, 2022.

An interesting observation about Nifty 200 Momentum 30 index: Look at how consistent its performance is across various 5-year periods.

Let us look at the overall performance. No surprises here. Midcap momentum index does better on all return parameters.

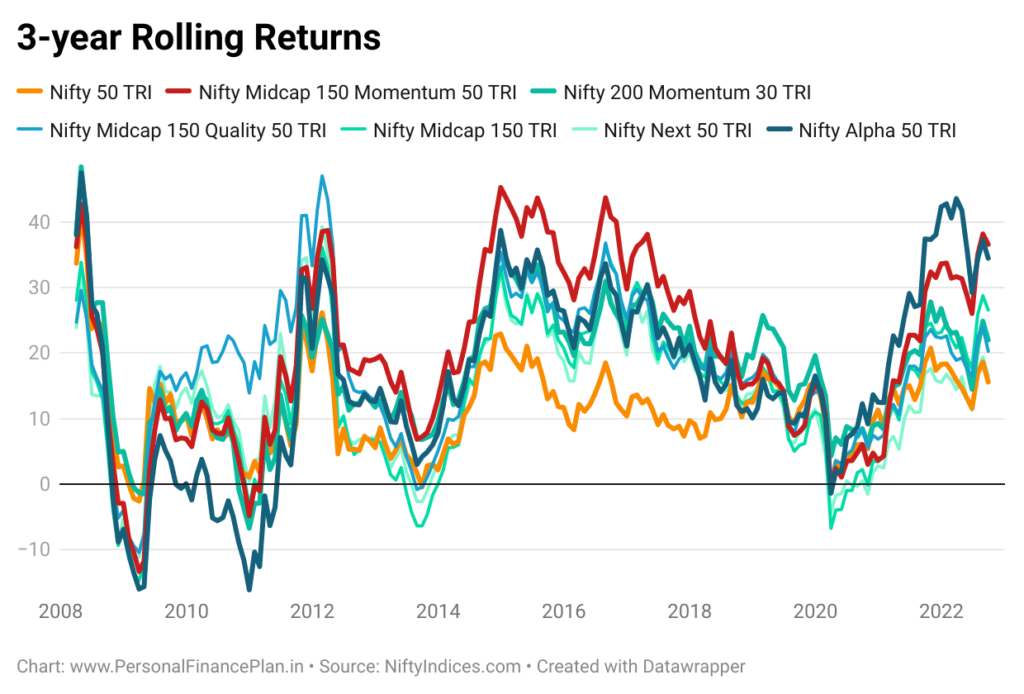

An interesting observation is that Midcap Momentum has lower volatility than its parent index Nifty Midcap 150. We tend to associate momentum stocks with higher volatility.

However, if you look closely at the methodology, low volatility is an important part of stock selection in momentum index. We saw this in the review post on Nifty 200 Momentum 30 index too. The Momentum index was less volatile than its parent index (Nifty 200).

Nifty Midcap 150 Momentum 50 index: Rolling Returns

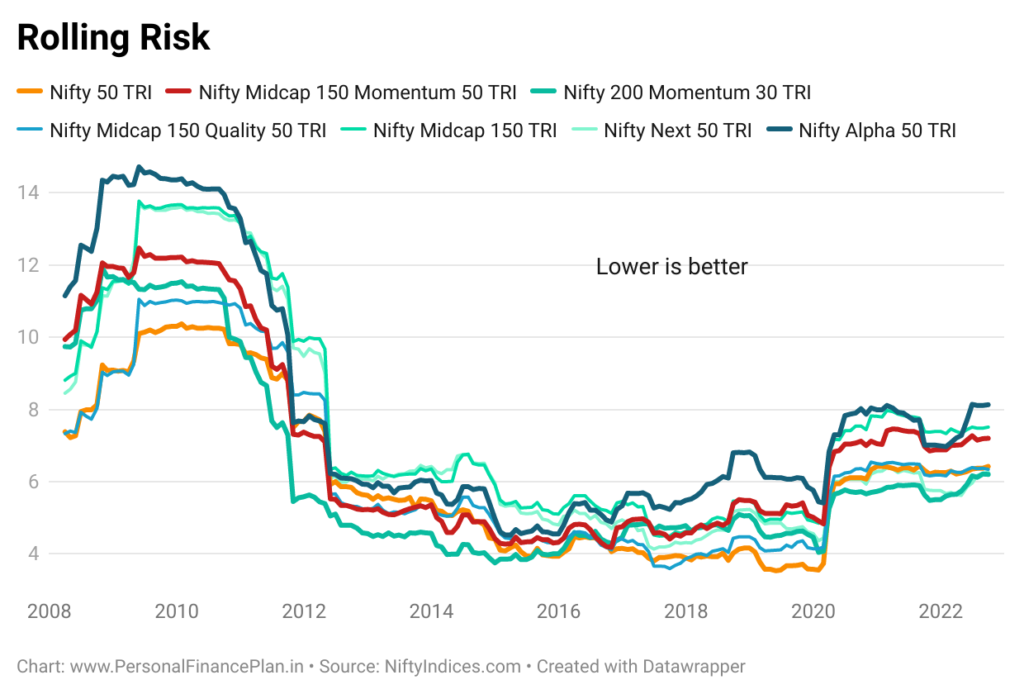

Nifty Midcap 150 Momentum 50 index: Volatility and Maximum Drawdowns

The midcap momentum index beats the parent index on both Maximum drawdowns and rolling risk count too.

Which Momentum Index is better?

Nifty 200 Momentum 30 or Nifty Midcap 150 Momentum 50?

We already have a Momentum index. Nifty 200 Momentum 30 index. And we already have index funds and ETFs tracking this index. The index selects 30 momentum stocks from universe of Nifty 200 stocks. Top 100 large cap stocks and 100 midcap stocks.

Nifty Midcap 150 Momentum 50 picks 50 momentum stocks from the universe of midcap stocks.

I do not have a very crisp answer here.

I like momentum investing. Both are momentum indices.

If I had to pick one Momentum index product, I would go with Nifty 200 Momentum Index fund.

Why?

Even though Nifty Midcap Momentum 50 beats Nifty 200 Momentum in returns data, I choose Nifty 200 Momentum for the following reasons.

- Nifty 200 Momentum 30 index has longer live data (since August 20). Nifty Midcap Momentum has negligible history

- It is a broader index (not just limited to midcap stocks)

- Seems more consistent (look at 5-year data)

- Less volatile (refer to Rolling risk chart)

- Will likely have lower tracking error compared to Nifty Midcap Momentum index

I think I have not yet been able to form conviction about the midcap momentum index. Thus, I am just finding ways to justify my choice. My opinion may change/evolve over a period.

How can I use Nifty Midcap 150 Index Fund in my portfolio?

If you want to use Midcap Momentum index fund in your portfolio, you can consider this part of your satellite portfolio.

You can include this fund in your midcap exposure, potentially as an alternative to actively managed midcap fund. Think Midcap Quality and Midcap Momentum could be an interesting mix for building midcap exposure.

Do not dive headlong into this fund based on back test results. Build the exposure gradually. You may also be able build conviction along the way. No investment strategy outperforms all the time. In fact, no investment strategy can sustain alpha over the long term if the strategy does not go through periods of underperformance. Conviction comes in handy during such adverse phases.

And yes, consider all the caveats shared at the start of this post.

Featured Image Credit: Unsplash