After incredible appreciation over the past few years, the residential real estate market has finally started to decline. Many chicken littles are saying this is the beginning of an all-out collapse. While the market will almost certainly go through a correction, a collapse is almost certainly not in the cards. There is a segment of real estate, however, that will go through something close to a collapse.

Broadly speaking, the outlook for commercial real estate, specifically office buildings, is not great. And large office buildings, in particular, are doing poorly and will have difficulty in the coming years. It will be even worse in large, coastal cities, particularly acute in downtown areas, with San Francisco being the poster child for this coming collapse.

Indeed, if such a thing as credit default swaps or some sort of short position on downtown San Francisco real estate, I would strongly recommend thinking about buying such (I believe non-existent) investments.

As The San Francisco Standard points out, “Citing data from real estate firm JLL, chief economist Ted Egan tagged future vacancies, in a worst-case scenario, as high as 53% in the Jackson Square area and 43% in the mid-Market area in 2024 as the clock runs out on office leases.

“The current vacancy epidemic cuts across buildings of all sizes and price ranges in San Francisco’s downtown core, from the struggling mid-Market area to the sparkling office towers of the East Cut.”

For some buildings, the collapse has already happened, “For example, 415 Natoma, a 653,900 square foot office tower owned by Brookfield Properties that was the sole ground-up office project to deliver in San Francisco in 2021, currently has just one announced lease: 20,000 square feet taken by ‘remote-first’ startup Thumbtack.”

The reason we can know for certain that this problem is going to get worse is the way commercial leases are structured. Unlike the typical lease on a home or apartment unit, commercial leases are usually 3-5 years long and sometimes more.

Downtown commercial real estate was already declining before 2020, but the pandemic turbocharged that decline. Many of the firms that signed leases in 2017, 2018, and 2019 are stuck in those leases for a few more years. But all signs point toward a large number of them leaving after the end of their lease.

So, if you think vacancy is high now, I’d recommend you buckle up.

As I noted, San Francisco is only the poster child for this phenomenon. San Francisco came in dead last in the Urban Displacement Project’s ranking of 62 cities’ downtown recoveries from Covid and lockdowns. But the rest didn’t do well either. Only four of 62 cities had fully recovered, with the average being somewhere in the 60% range (San Francisco was at 31%).

This has, quite understandably, led analysts at the Institute of Taxation and Economic Policy to project huge losses in downtown commercial real estate, with San Francisco coming in first (or, more accurately, last).

High Office Vacancy All-Around

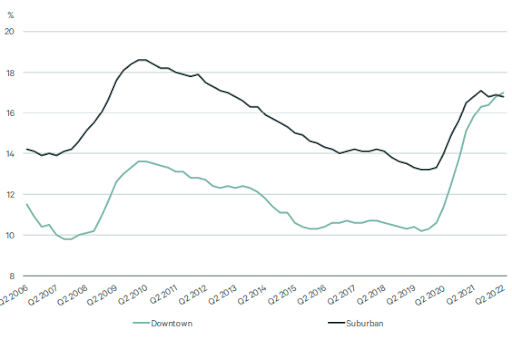

As The Business Journal notes, “Office vacancy is on the rise everywhere, but the rate of increase in downtown office vacancy is outpacing that of suburban office.”

They quote Ian Anderson, senior director of research and head of Americas office research at CBRE, who points out that,

“Downtowns across the U.S. have gotten clobbered much more through the crisis…People have been much more comfortable driving to work in suburban locations with less density, so that’s favored them more.”

Indeed, downtown Los Angeles office space has hit 25% vacancy. In Manhattan, it’s over 17%, downtown Portland, Oregon, is at 26% vacancy, and in Washington D.C., it stands at 20%.

And all of them have the same problem with pending move-outs once pre-Covid leases expire.

Typically, suburban vacancy rates are substantially higher than downtown rates. But the latest report from CBRE has shown the two rates have not just compressed but actually flipped.

The increase in vacancy rates has tapered off this year (for now) as Covid receded and various restrictions have been lifted. Even still, vacancy rates have leveled off over 50% higher than where they were before the pandemic.

The First Cause: The Pandemic and Downtown Deterioration

Obviously, the immediate cause of this commercial real estate calamity was Covid-19 and the subsequent lockdowns.

A report from The Visual Capitalist noted in September 2020, during the first year of the pandemic (but after the most severe lockdowns had been lifted), that small business revenues in 52 American metro areas were down between 13%-49%. (And, of course, San Francisco was the city where they were down 49%). Furthermore, “Small businesses in the leisure and hospitality sector [had] been particularly hard hit, with 37% reporting no transaction data.”

The New York Times also pointed out that as many as 400,000 small businesses closed, and many went under, never to return.

Downtowns were hammered during the height of Covid, with places like Manhattan looking like a ghost town. And while things have gotten better since then, the damage done cannot easily nor quickly be fixed, especially since many downtowns have notably declined in quality since then.

A lack of proper maintenance and upkeep causes deterioration, making fewer people want to visit or work there, reducing the area’s revenues and funds available for maintenance and upkeep even more so, and the vicious cycle perpetuates itself.

Other policies have also caused significant issues as well. Unlike some memes you may have seen, California did not actually legalize stealing $950 or less, but it did downgrade and deprioritize such crimes leading to a noteworthy uptick in shoplifting which has led multiple retailers to relocate. Walgreens, for example, has closed 10 stores in the city, including several downtown and cited “organized retail crime” as a leading cause.

In general, crime is on the rise throughout the country, and that tends to be worse in densely populated areas, which makes downtowns less desirable.

The Martin v. Boise decision also made it difficult to remove homeless encampments from downtown areas unless the city has sufficient homeless shelter beds for its homeless population. Unfortunately, very few cities have enough beds to do so, and California’s “housing first” instead of a “shelter first” policy has resulted in a much larger homeless population sleeping on the streets at night. Thus, tent cities accumulate in high-density areas and often dissuade foot traffic and lower demand.

Unfortunately, as things get worse, they tend to spiral out of control as you reach a point where people don’t see the point in putting in any effort to improve a situation because their effort would make almost no difference.

Why pick up litter in a garbage dump? In fact, why not litter yourself?

This has gotten so bad in San Francisco that someone even made an interactive “poop map,” and the number of “human feces incidents” on the streets, showing that it had increased by over 500%, even before Covid struck.

And again, while I’m clearly picking on San Francisco, this is a problem in many large coastal cities and really throughout the country as well.

The Second Cause: Work From Home

A while back, flex work was all the rage, and futurists dreamt of a time where everyone would work from home and live happily ever after. Then Covid hit, and those dreams were, more or less, realized.

And it turns out that working only from home drives a lot of people crazy.

That being said, many (probably most) people love the option of working from home and want to be able to do so 1-2 days per week. And there are some who prefer it and would like to work from home all the time.

The Census reported that the number of people working from home tripled between 2019 and 2021. Companies like Twitter (but certainly not Tesla) now allow employees to work from home as much as they want.

A survey by McKinsey & Company found that 87% of employees who are given the chance to work from home take it at least sometimes. They further found that 35% of job holders can work from home full-time and 23% part-time.

That seems a bit high to me, but such arrangements are certainly on the rise. Further, some research shows that people who work from home some of the time can be even more effective than those who only work at the office.

What this means for commercial real estate is that we don’t need as much office space as we did before. Sure, companies still need offices (working only from home makes a lot of people feel really “cooped up,” and zoom meetings can’t completely replicate the real thing). But those spaces don’t need to be as big. And we don’t need as many of them.

Furthermore, the ones that will be hit the hardest are the ones that require the longest commutes to get to. I know I would be much more apt to work at home if my commute was two hours of traffic!

And in the spirit of continuing to bash San Francisco, the average commute for San Francisco residents is the third worst in the U.S. at 34.4 minutes each way. The worst is New York at 37 minutes, and the national average is 27.6 minutes.

Lastly, as BiggerPockets’ Ben Leybovich pointed out, “Another major issue is vintage and the functional obsolescence that comes with it. Huge swaths of commercial real estate in old primary markets are aging. Before the pandemic, people were in those units by inertia. Now, nobody wants to go back there.”

It will cost huge sums of money to upgrade these outdated and sometimes obsolescent units.

Risks and Opportunities

Needless to say, right now is not the time to be buying downtown office real estate. Offices, in general, are something investors should be cautious of. But if you are going to buy office space, smaller units and buildings are safer. As far as commercial real estate goes, restaurants, industrial and retail are a better bet (although with retail, large outlets are still at risk of being bled out by Amazon).

That being said, every bear market has a trough. There will continue to be demand for office space in the future, and there will continue to be demand in downtown areas. We have, after all, seen this story play out once before. Downtowns throughout the country deteriorated drastically in the 1970s before making a major comeback in the 1990s and 2000s.

Right now, there is still an enormous housing shortage in the United States. In 2020, Freddie Mac released a report arguing there was a 3.8-million-unit shortfall in available housing units. And the pandemic and lockdowns slowed new construction to exacerbate that gap.

The National Association of Realtors even has an interactive housing shortage tracker with a map of where the problem is the most acute.

As you can see, the biggest housing shortages are in many of the same areas that are having and will continue to have severe vacancy issues in commercial real estate.

Despite crime and livability issues, many people love living downtown and being “close to the action.” Once the bottom falls out (probably around 2024), there should be major opportunities to convert old office buildings into swanky condos and apartments.

Sure, it will be very capital intensive, but for those looking for big projects in the relatively near future, this is definitely something to keep an eye on.

Run Your Numbers Like a Pro!

Deal analysis is one of the first and most critical steps of real estate investing. Maximize your confidence in each deal with this first-ever ultimate guide to deal analysis. Real Estate by the Numbers makes real estate math easy, and makes real estate success inevitable.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.