We all know that one person who bought a property for a price that seems unfathomably cheap by today’s standards, such as $50,000, and it’s now worth $350,000. It’s crazy to think that just 50 years ago, median home prices were right around $24,000.

Today, the median home price is over $456,000, according to the Department of Housing and Urban Development. In 50 years, property prices have increased by nearly 14x.

This is enough to get anyone to buy real estate and to become wealthy, right? Well, not exactly. The numbers I’ve shown you so far are nominal home prices, meaning they have not been adjusted for inflation. But as investors, we want to understand how our money is growing relative to our spending power, and for that, we need to use real housing prices.

Adjusting Home Prices for Inflation

In this context, “real” just means “inflation-adjusted.” When you adjust real estate prices for inflation, the growth looks much less impressive. Property values are still going up but in a much less dramatic way.

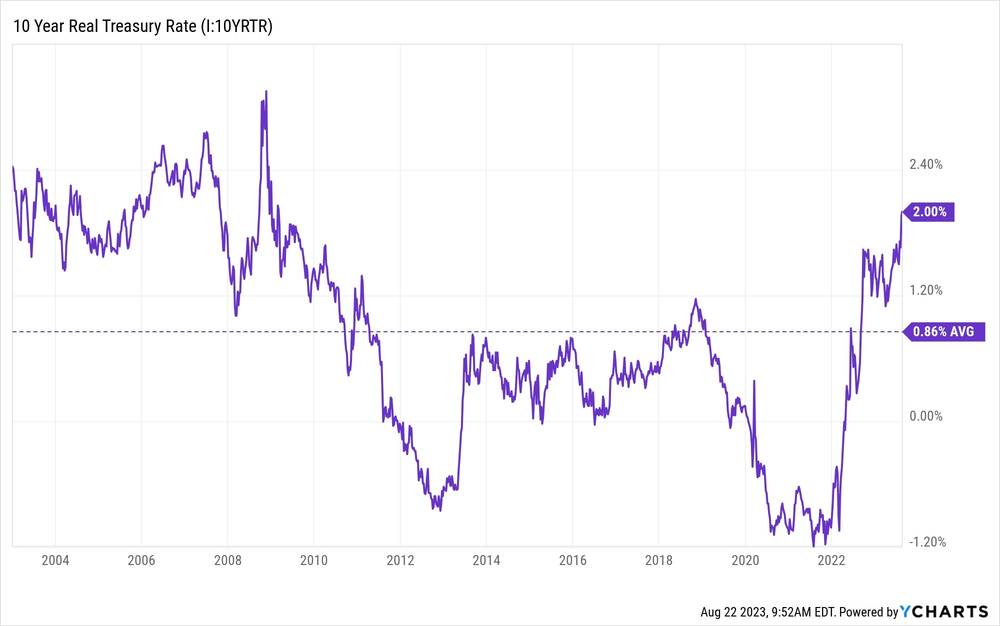

Despite the impressive-looking run-up in housing prices over the last 50 years, the average real growth rate of property values is just 1.8%. Getting 1.8% on your money above inflation is not bad, but it’s not great either. Consider the fact that Over the last 20 years, the real yield on 10-year U.S. Treasuries is 0.86%. This means you could do pretty much nothing with your money and get relatively close to the real growth rate of property values.

Of course, this simple analysis of home prices doesn’t paint the full picture of returns that you get from investing in real estate. It doesn’t factor in leverage, amortization, cash flow, value-add, or many of the tax benefits that come from real estate investing.

Price Growth is Not as Important as We’re Led to Believe

To me, all of this data shows that property prices are not what drive real returns for real estate investors. This data underscores the importance of not counting on appreciation to make your deals work. This is particularly true in today’s uncertain economic climate. If you look at this graph of real property value growth rates over time, you can see that there are many periods of negative growth.

Real property growth is far from certain! Over the last several years, in an ultra-low interest rate environment, it was reasonable to assume price appreciation above and beyond inflation, at least for a few years. Personally, I think those days are behind us. Given high rates and high levels of economic uncertainty, appreciation is falling back to what it was historically: an excellent inflation hedge, a floor for your returns, and a potential bonus if you invest in the right areas.

Final Thoughts

Don’t get me wrong, I look for deals that have strong appreciation potential, but it’s not wise to count on appreciation to drive your returns. You need cash flow, value-add, and amortization to serve as your fundamentals, and if you experience some real appreciation on your property, that’s just gravy. As this data shows, appreciation is not always as powerful as it appears.

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.