If you’re thinking of starting or growing a business this year, knowing what financing options you have is key — and you may have more options than you think, especially if you have retirement funds.

Have you heard of 401(k) business financing? While “401(k)” is in the name, you can use this funding method with nearly any popular retirement plan. The official name of this method is called “Rollovers for Business Startups,” or ROBS for short.

You can use ROBS for virtually any business purpose and even combine it with other funding sources, such as business loans. ROBS has been rising in popularity among small business owners, according to our recent Small Business Trends study. This year, over 50 percent of respondents surveyed (52%) used ROBS to fund their new business.

Since ROBS offers a uniquely debt-free way to start a business — and access to retirement funds without incurring penalty fees — it’s no surprise that many business owners are interested in utilizing this method. Whether we’re in a recession or recovery, most of us are getting more creative when it comes to managing our finances this year. Business owners seeking funding to start or grow their businesses are no exception.

But how does ROBS work? Do you qualify for ROBS, and if so, should you consider using ROBS for business financing? While ROBS might seem intimidating, the process isn’t as complicated as you might think. Let’s break down how ROBS works with a brief survey on what ROBS funding is — and take a look at its pros and cons.

Worried about a possible recession? Here are 5 Tried and True Strategies for a Recession-Proof Business.

As we break down the process of ROBS, we’ll offer some key resources on how all the components of this business financing method — from C Corporations to eligibility requirements. Let’s start with the most common question…

How Does ROBS Work?

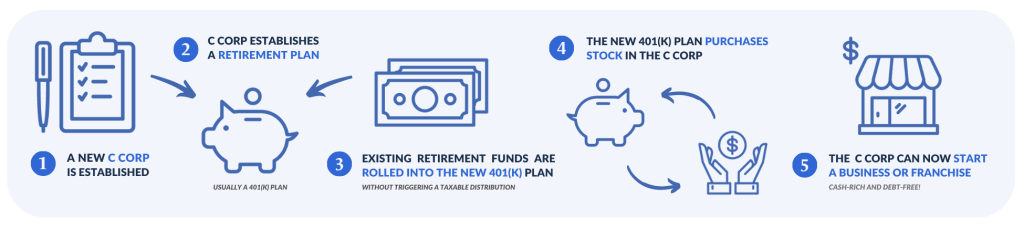

The Five Steps to ROBS

ROBS utilizes your own qualified retirement funds, which is often people’s largest source of personal savings. However, ROBS must be set up utilizing a very specific structure to avoid Internal Revenue Service (IRS) taxation on the funds and potential penalties for early withdrawal.

How Using ROBS Works and Eligibility Requirements

So, how can you utilize ROBS? Let’s take a look at some of the requirements:

- Your company needs to be set up as a C Corporation. In a nutshell, once you set up a retirement plan for that C Corp — such as a 401(k) — you can then roll your existing retirement funds into that new retirement plan. Those funds are used to purchase stock in the C Corp, acting as your angel investor. Once the stock has been purchased, the funds are available to you and, most importantly, all your business purposes.

- You must be a bona fide employee of the new C Corporation, not just a passive owner or investor. What does that mean? To be an official employee of your business, you’ll need to pay yourself like a regular employee. You can pay yourself a salary that is reasonable and commensurate with your title.

However, it’s optional to take a salary if your fledgling company takes a while to achieve operating profit, for example. Choosing not to take a salary, though, is complicated as it’s one of the chief ways of proving to government regulators that you are, in fact, an employee. IRS and other regulations must be strictly followed when using ROBS. Your salary decision should be discussed with your plan administration team and other financial advisors. Learn more about how to pay yourself as a business owner here.

Note: Should you want to exit ROBS at any point, you can do so under two conditions: if the company is insolvent or if you want to buy back the shares.

A C Corporation is a business entity — and to use ROBS, you need to register your business as one. But what is a “C Corp” and its potential downsides or upsides? Find out here.

Retirement Plan Eligibility

ROBS is often known as 401(k) funding — but only because 401(k)s are most often used. But a number of qualified retirement plans can actually be used with ROBS. Here’s a complete list:

- Traditional 401(k) plans

- Traditional Individual Retirement Accounts (IRAs)

- 457(b) Retirement Plans

- 403(b) Retirement Plans

- Thrift Savings Plans (TSPs)

- Roth 401(k), 403(b) or 457(b) Plans

- Savings Incentive Match Plan for Employees (SIMPLE) IRA Plans

- Simplified Employee Pension Plan (SEP) IRAs

- Keogh Plans

- Other Qualified Retirement Plans, such as pension or profit-sharing

If you’re thinking of using an IRA, two notes of caution are in order. First, while a traditional IRA can be used with ROBS, a Roth IRA can’t — because they can’t be rolled into a 401(k). Second, you need to be careful to avoid a prohibited transaction with an IRA. Prohibited transactions include taking a loan from an IRA. This can be confusing as some companies allow loans from 401(k) accounts.

In general, $50,000 is a reasonable minimum to roll over. A lesser amount does not make financial sense due to the cost of setting up ROBS.

Want to learn more about using your IRA to start or grow your business through ROBS? Here’s how you can Use Your IRA to Start or Grow Your Business.

Pros and Cons of ROBS: Is ROBS Right For You?

All potential funding sources need to be evaluated for their pros and cons. Rollovers for Business Startups (ROBS) methods are no exception. Let’s go through some of the pros and potential cons of using 401(k) business financing.

Pros of ROBS

- ROBS offers prospective business owners several notable advantages over more traditional sources of funding, such as business loans.

- ROBS leaves you free of monthly debt payments compared with loans. The monthly payment on a $250,000 loan can run nearly $3,000 per month or more. That’s a significant amount for a beginning business. ROBS leaves your cash flow free to grow the business.

- You don’t need any down payment with ROBS. Business loans will almost always require a down payment of up to 30 percent.

- ROBS does not require collateral. Loans often require you to collateralize your assets, such as investment accounts and homes.

- If you’ve encountered challenges with credit in the past, your credit score might not be high enough to obtain a loan. ROBS never requires a credit score.

- ROBS funding is flexible and can be used for any business purpose, from operating expenses to purchasing equipment or real estate.

- Obtaining ROBS funding, at roughly four weeks, can be considerably quicker than waiting for loan approval.

- ROBS’s structure requires a C Corp retirement plan open to all employees. Not only does your business has many tax advantages as a C Corp — but you can use the retirement plan to build up your retirement savings. Learn more about the 10 Tax Advantages of C Corporations.

Cons of ROBS

- ROBS can be complicated to set up and administer going forward. For instance, it must be set up in the proper way to avoid taxes and penalties on your retirement funds. A 5500 Form must be filed annually to comply with the IRS and Department of Labor (DoL) benefits reporting requirement. You must also offer a retirement plan to every employee.

- ROBS also requires compliance with specific regulations. You must, for example, be an employee of the company yourself. If you want to be a passive investor, ROBS is not for you. It’s often advisable to work with a plan administrator to make sure all requirements are being met, as failure to abide by them can expose you to financial penalties.

- Just like any loan, using your retirement funds as a source of capital is a business investment. All business investments inherently come with risk. It’s true that if a business funded with ROBS fails, there’s a chance that the retirement funds invested in it are lost. For many, this is the biggest drawback of using ROBS — but this risk is present with any business investment, regardless of the way it’s funded. The biggest difference is with using ROBS, you can avoid accruing a large amount of debt.

With ROBS you can leverage your retirement funds instead of using your home as collateral as with many bank loans. So, while the risk is a factor in either method, ROBS could allow you to have time to rebuild your retirement funds, whereas using your home as collateral could have more immediate consequences. You are also in control of how little or how much of your retirement funds you roll into your business.

Get the full scoop on the ins and outs of ROBS in The Pros and Cons of ROBS (Rollovers for Business Startups).

Flexible Solutions with ROBS

Utilizing ROBS also provides a number of flexible solutions for prospective businesspeople who face specific situations. Here are some scenarios where using ROBS can come in handy:

While Staying Employed

Many people want to start a business while staying employed at their current job. It can help them to retain financial security while testing the waters on a business idea or product, for example. However, obtaining funding while you’re employed in one company and working in your own business might be challenging. Loan lenders might see it as risky because they generally want to see the profitability of a business over a multiyear period before they will make a loan. But ROBS can be utilized while you’re employed.

Using ROBS in the Beginning Stages

It can also be challenging to obtain loan funding while your business is in the initial stage. Again, lenders generally require a multiyear record of profitability and can see even a profitable business as risky if you haven’t been in business for a span of time that meets their requirements. But ROBS can be used as cash on hand throughout the life of your company, including the very beginning.

Pairing ROBS with Other Business Financing Methods

ROBS can be used in conjunction with other business financing methods, such as loans — including Small Business Administration (SBA) loans. SBA loans can be one of the most advantageous loans for small business owners. These are offered through participating lenders but guaranteed by the SBA. This lessens the risk to the lenders, so they are able to offer these loans with lower rates and longer terms than other types of business loans. See our Complete Guide to SBA Loans to learn more.

However, SBA loans can be hard to obtain because of their popularity and competitive demand. They require a large down payment that beginning business owners might not have from business profits. ROBS can be used as a down payment for an SBA loan or simply used as additional funding.

Looking for other creative business financing methods that can be paired with ROBS — or used alone? Here are the Best 5+ Alternative Business Loans to keep your eye on.

As advantageous as ROBS can be, it can also be complicated. That’s why it’s crucial to pick the right ROBS provider. Your ROBS provider can help you set up and administer ROBS as well as advise you about ROBS-prohibited transactions, which must be met for a ROBS structure to keep tax penalty-free.

When you pick a ROBS provider, you should choose an experienced one that can help you with both setup and ongoing administration — and one that has been audited neither by the IRS nor the DOL. You’ll also want a provider that focuses on education first and offers pricing transparency for all its services.

Guidant Financial: A Partner for Your Business

Guidant Financial meets all these goalposts and has helped over 30,000 small business owners fund their businesses through ROBS. We’re the number one ROBS provider in the US for a reason.

While many of our competitors often choose to play fast and loose with the rules of the IRS, our team of financial experts plays by the books — getting you the funding you need fast, all with minimized risk and step-by-step support.

Our goal is to help support your unique business journey throughout its lifetime, offering innovative business financing solutions and services to help your business succeed. So whether you want to establish or grow a business, we can help as your trusted partner. Contact us today to learn more about ROBS and what Guidant can do for you as a business owner!

Ready to take the next step and pre-qualify for financing today? Pre-qualify in minutes now, or book your FREE business consultation by calling us at 425-289-3200!

“I owe a sense of gratitude to Guidant for helping me get here. It was a turning point for us moving forward.”

— Stephen Such, Falling Sky Brewing