ELSS (Equity Linked Saving Scheme) is one of the best investment options. ELSS not only helps you to save taxes but also gives opportunity to grow your money. You can claim a tax deduction of 1.5 Lakh under section 80C by investing in ELSS. ELSS comes with 3 years lock-in period.

Tax saving season is almost at its peak only one month is left to complete your tax planning and investment exercise for FY 2021-22. If you are interested to save tax by investing in ELSS, here are the Top 5 Best performing ELSS to invest in 2022 along with the evaluation method.

How to evaluate ELSS for investment?

You should consider the following parameters while evaluating ELSS for investment.

Fund Returns

You should check fund returns and compare them with other peer funds. Fund, where you are investing your money, should be consistently giving higher returns. But please note that a higher return in the past does not mean that in the future also a similar return is guaranteed. Fund return is an indicative parameter. Fund return is completely dependent on market movement and the fund manager’s capability.

Fund History

Select the fund that has performed consistently over the long run. You must check the fund performance history of the last five years before investing in the fund.

Expense Ratio

The expense ratio indicates how much money is going into the fund management. A lower expense ratio means higher returns. That’s why if you come across two funds with similar track record performance you should select the fund with a lower expense ratio.

Financial Ratios

You also need to check various financial ratios such as standard deviation, sharp ratio, alpha, and beta to analyze the fund. You should avoid the fund where standard deviation and beta are higher. It is advisable to invest in a fund with a higher sharp ratio.

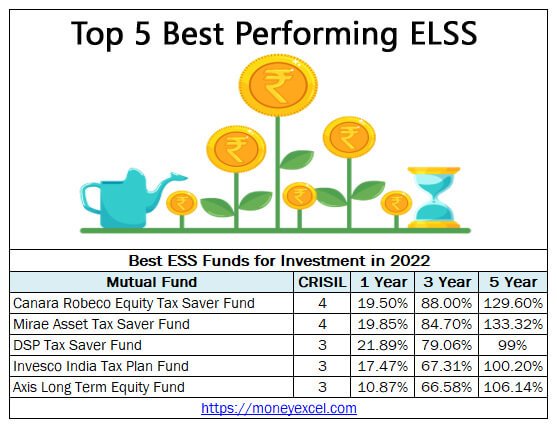

Top 5 Best Performing ESS to Invest in 2022

Note – Above returns are as of Feb 2022

Canara Robeco Equity Tax Saver Fund – Growth

Canara Robeco Equity Tax Saver Fund is one of the best ELSS for investment in 2022. This fund has given consistently higher returns to the investors. In the last five years, this fund has given more than 125% absolute return to the investors. The expense ratio of this fund is slightly higher. However, if you have the risk-taking capacity you can go with this fund.

Mirae Asset Tax Saver Fund – Growth

Mirae Asset Tax Saver Fund is one of the top-performing ELSS funds where you can invest your money in 2022. Mirae Asset Tax Saver Fund has given consistent two-digit returns to the investors in the last 3 years. The expense ratio of this fund is low. The major investment of Mirae Asset Tax Saver Fund is in blue-chip stocks such as Infosys, Reliance, HDFC Bank, etc.

DSP Tax Saver Fund – Growth

DSP Tax Saver Fund is next in the list of top-performing best ELSS for investment in 2022. DSP Tax Saver Fund has given 21% returns to the investors last year. This fund is consistently performing well. The expense ratio of this fund is manageable.

Invesco India Tax Plan Fund – Growth

Invesco India Tax Plan Fund is another top-performing ELSS fund where you can plan to invest your money. Invesco India Tax Plan fund has given 67% returns to investors in the last three years. The expense ratio of this fund is slightly higher.

Axis Long Term Equity Fund – Growth

Axis Long Term Equity Fund is one of the best performing ELSS funds. This fund was able to deliver 106% absolute returns for the investors in the last five years. If you are planning to invest money for the long term you can go for Axis Long Term equity fund.

Things you should consider before investing in ELSS

You should consider the following things when you consider ELSS for investment.

Lock-in-Period

ELSS comes with a lock-in period of 3 years and it is mandatory. There is no provision to withdraw your money before 3 years. This means if you are selecting ELSS for the investment you are completely blocking your money for 3 years.

Risk Factor

ELSS funds are linked with equity and it is subject to market risk. The returns given by ELSS are completely dependent on market movement. You should evaluate your risk profile before investing your money in the ELSS.

SIP or Lumpsum

You can invest your money in two ways SIP (Systematic Investment Plan) or lump sum. It is always advisable to go for the SIP route while investing in mutual funds. It gives you the benefit of rupee cost averaging in the long run. Lumpsum investment in a mutual fund is not advisable.

Over to you

You can invest in ELSS fund for tax saving purpose.

Please note that If you are new investor and finding difficulty in identifying good ELSS fund for investment you should consult expert while selecting mutual fund for investment.