Synopsis: The Indian real estate market is booming, creating an opportunity for the NRIs, which is being driven by economic growth, transparency, and high demand across major cities in India. From Bengaluru’s IT-driven housing demand to Mumbai’s financial powerhouse. With such a wide variety of options NRIs can successfully benefit from strong rental yields, capital appreciation, and even be able to achieve secure long-term investments in India.

The year 2025 has made the Indian real estate market shine as the most dynamic and promising industry for Non-Resident Indians (NRIs), individuals who want to invest in their homeland. Driven by robust economic growth, enhanced transparency, increased infrastructure, and high demand, India’s real estate arena is now capable of providing a variety of alternatives for both capital appreciation as well as rental yields. In this article, we are going to take you through the process of finding the best Indian cities where NRIs can make the most out of their real estate investments.

Why would NRIs invest in Indian Realty?

There are several reasons for responding to this question as to why NRIs are attracted to investment in property in India:

- Being close to your roots

- Relatively more lucrative returns compared to the overseas market

- Beneficial regulations and rules.

- Growing demand for high-end housing

- Security feeling when you possess a physical asset in a stable market

Major Trends for NRI Investment in 2025

- Premium Segment Boom: The NRIs from the US, UK, GCC, and Southeast Asia, have been opting for the luxury homes in India with international standard amenities. Additionally, this sector is likely to expand by 20% in 2025, with tier 2 cities joining in as well.

- Development of Integrated Townships: Contemporary gated communities with wellness zones, parks, and smart technology are gaining popularity.

- Rental Returns: Urban cities providing consistent rental returns, particularly along IT and business corridors, are the first preference for investors considering their investment as a passive income source.

Top Indian Cities to Invest for NRIs

1. Bengaluru

Offering careers in organisations within the IT and startup ecosystem, Bengaluru has enticed professionals and firms from across the globe. This city feature modern facilities, international connectivity, and a steady housing demand. Knight Frank’s Prime Global Cities Index 2025 even placed it in 4th place on the list of top global prime residential markets.

- Micro-market Hotspot: Whitefield, HSR Layout, Indiranagar, Koramangala

- Rental Yield: 3.5-5%

- Why Invest Here: High rental yields, fast price appreciation, cosmopolitan style of living, and tremendous NRI population.

2. Hyderabad

This place is accompanied by affordable property prices, remarkable growth in the tech, pharma industry, and also has a fame for high-return investments. Hyderabad was always an NRI favourite.

- Hotspot Micro-markets: HITEC City, Gachibowli, Financial District

- Rental Yields: 4- 5.5%

- Why to Invest: Reasonably priced luxury, strong infrastructure, and investor-friendly policies.

3. Pune

With educational institutes, manufacturing units, and IT parks side by side, pune boasts its fairly productive infrastructure. Pune is counted among the cities that is ideal both for real estate investment and for living.

- Major Micro-markets: Baner, Hinjewadi, Magarpatta, Kharadi

- Rental Yields Range: 3-4% (even up to 5% in some micro-markets)

- Reasons to Invest Here: This is a mix of that provides safe returns as well as long-term appreciation for ideal family and retirement living.

Also read: Top 10 States in India with Best Public Transport Facilities in 2025

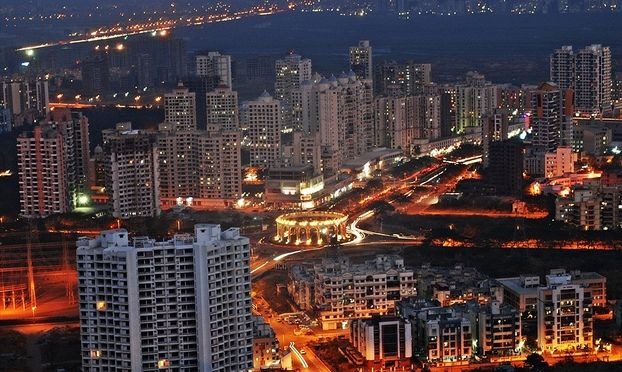

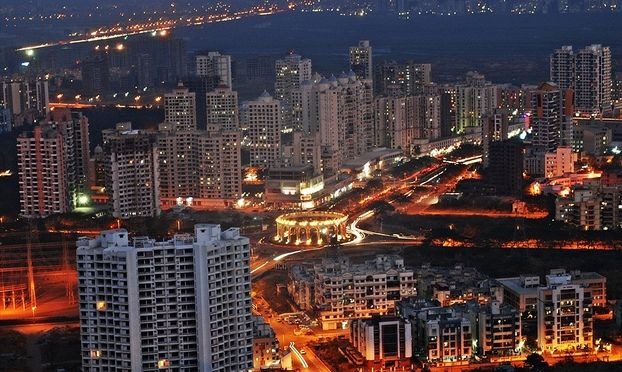

4. Mumbai Metropolitan Region (MMR)

Being the finance capital of India, Mumbai holds immense importance and is known all over the country as the financial powerhouse. Real estate there has always been in great demand. Satellite towns and new suburbs such as Thane and Navi Mumbai provide a wider range of options for NRIs to consider for investment.

- Major Micro-markets: Mulund, Goregaon, Kandivali, Navi Mumbai, Thane

- Rental Yields: 2- 2.5% (central), 5% (suburban)

- Why to Invest here: High capital appreciation, best luxury projects, conducive international business environment.

5. Gurgaon

Gurgaon has been synonymous with its business expansion, cosmopolitan culture, and fast pace of urbanization. NRIs are attracted here because of its luxury integrated townships and the steady rising property trends experienced by the city.

- Hotspots Micro-markets: DLF- Golf Course Road, New Gurugram, Dwarka Expressway

- Rental Yields: 2.5- 4%

- Why Invest here: High rental demand, Quick capital appreciation, and a stable regulatory environment.

6. Chennai

Chennai has its contemporary manufacturing hub, as well as its logistics industry and early adoption of infrastructure projects, which have put its real estate market on the upswing.

- Hotspots: Old Mahabalipuram Road, Guindy, Porur, Tambaram

- Rental Yields: 3.5%- 4% (even up to 6% in certain zones)

- Why to Invest: Stable prices, NRI-friendly communities, balanced rental and appreciation potential.

Also read: Top 10 Indian States Contributing the Most to GST Revenue 2025

7. Ahmedabad

The key features of this city are the Smart city projects, better infrastructure, and budget-friendly entry points into the real estate markets, due to which Ahmedabad has emerged as a growing investment choice for NRIs for their investments.

- Locations: SG Highway, Bopal, Satellite, Prahlad Nagar

- Rental Yields: 3.9- 4.1%

- Why Invest: Varied property types, simple investor entry, long-term appreciation.

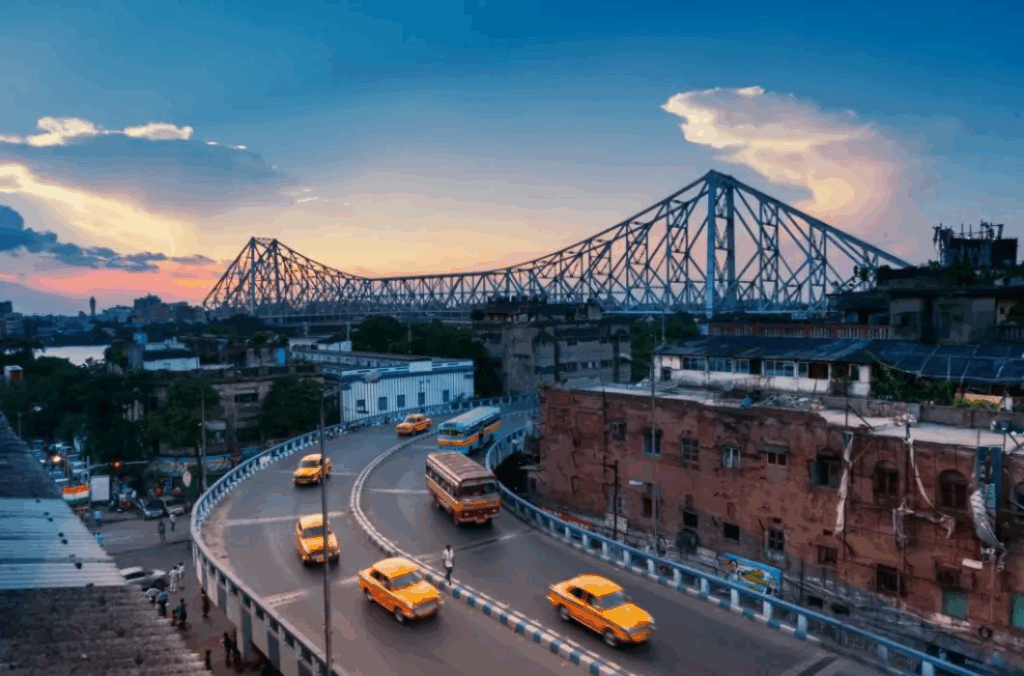

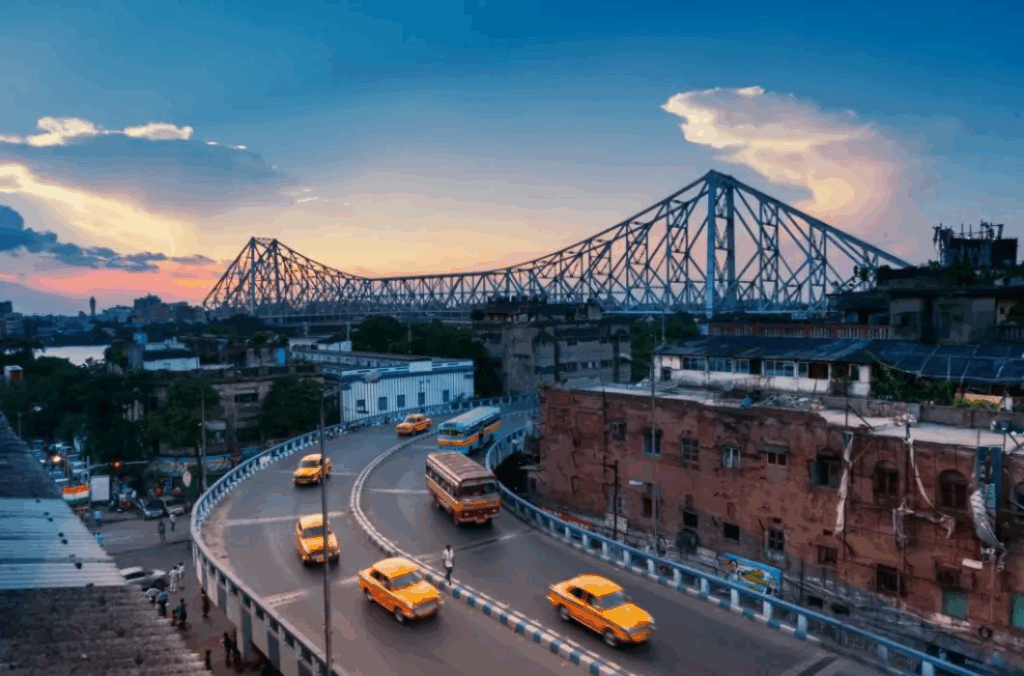

8. Kolkata

Kolkata, previously an emerging market, is now in a position to provide properties at reasonable prices as well as good appreciation opportunities, which is because of its rapidly developing infrastructure.

- Hotspots Micro-markets: Rajarhat, Salt Lake City,New Town

- Rental Yields: 3.5- 6.3%

- Why to Invest here: Reduced barrier to entry, high demand for residential housing, and growing commercial hubs.

What NRIs Should Look for in Real Estate Investments

- Location near the IT and business hubs: This provides stable rental demand and future valuation of the property.

- Amenities Offered: The property must be incorporated with contemporary, green, and safe communities that address international standards.

- Clear title and builder reputation: Ensure that the property is RERA approved or that the project is being regulated by a regulatory authority, which may give a tangible track record to instill investor confidence.

- Tax policies: The recent reforms have enabled to implement smoother fund flow and streamlined tax compliance procedures.

Conclusion

The Indian real estate sector is still NRI-friendly. All the cities discussed here have ranked consistently in the top positions for their safety, investment return, lifestyle, and transparency of law. The growing digital innovations like virtual tours and AI-driven house finding have made distant investments simple and secure. Since these industries are likely to keep growing, NRIs investing today have the potential to benefit from both- substantial financial gains as well as a long-term bond with India’s urban future.

Written by Adithya Menon