Consider the various types of investments to be instruments that can assist you in reaching your financial objectives. Each major investment category, from stocks to cryptocurrency and bonds, has its own set of general attributes, risk concerns, and methods to which investors might apply them.

Most people are intimidated to make an investment trading since there are so many possibilities, and it may be hard to determine which types of products are best for your account. This article will lead you through ten of the most common types of investments, from stocks to cryptocurrency, and explain why you should include them in your portfolio.

Below are the 10 types of investments:

Stocks

Stocks, usually known as shares or equities, are perhaps the most well-known and primary type of investment. When you buy stock, you are purchasing a share in a publicly listed corporation. Many of the biggest firms in the country such as Nestle Malaysia, Maybank and Sime Darby — are publicly listed, meaning you may purchase shares in them.

When you buy a stock, you become a shareholder in a company. The success or failure of a company, the sort of stock you possess, what’s going on in the stock market as a whole, and other factors all have an impact on whether the share price rises or falls. A buy low, sell high strategy involves purchasing stocks or assets at a cheap price and selling them at a higher price. The market is determined by market emotions and psychology and is hard to anticipate, making this method tough.

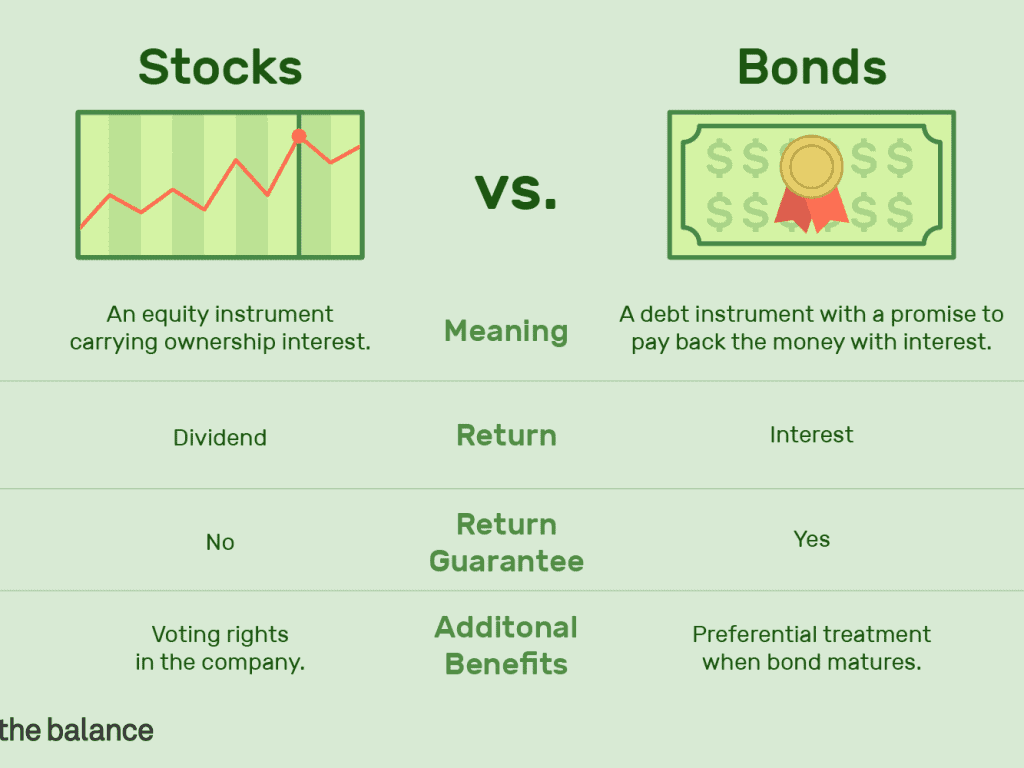

Bonds

A bond is a loan made by an investor to a business, government, federal agency, or other entity in exchange for interest payments over a certain period of time and repayment of principal at the bond’s settlement date. Treasuries, agency bonds, corporate bonds, municipal bonds, and other types of bonds are available.

Bond mutual fund pricing, like stock mutual fund prices, can fluctuate. Risk varies based on the sort of bond you possess. For getting profit return from bonds, the lender would receive interest payments while the money has been loaned and get money back once the bond matures, which means you’ve kept it for the contractually specified period of time.

Bonds normally provide a lower rate of return than stocks, but they also carry a smaller risk compared to stock trading. Of course, there is still some danger involved. The corporation from which you purchase a bond may fail, or the government may default. Treasury bonds, notes, and bills, on the other hand, are regarded as extremely secure investments.

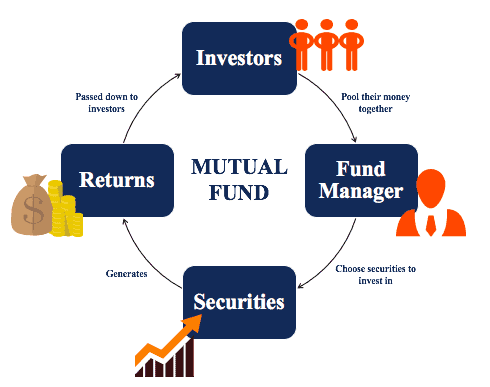

Mutual Funds

A mutual fund is a collection of money from numerous investors that is invested extensively in a variety of firms. Mutual funds can be handled actively or passively. An actively managed fund has a fund manager who chooses which securities to invest clients’ money in. Fund managers frequently attempt to match that certain stock index by better decision-making that outperforms the index.

An index fund, often known as a passively managed fund, merely tracks a major stock market index such as the Dow Jones Industrial Average or the S&P 500. Mutual funds can invest in a diverse range of securities, including stocks, bonds, commodities, currencies, and derivatives.

Funds can provide diversification and expert management, as well as a wide range of investing methods and styles. Investment in a fund, like any other investment, has risk, including the possibility of losing money. Furthermore, how a fund performed in the past does not predict how it will perform in the future.

Investors gain profit from mutual funds when the value of the stocks, bonds, and other linked securities in which the fund invests rises. You can purchase them directly from the management firm or via discount brokerages. However, there is usually a minimum investment and an annual charge.

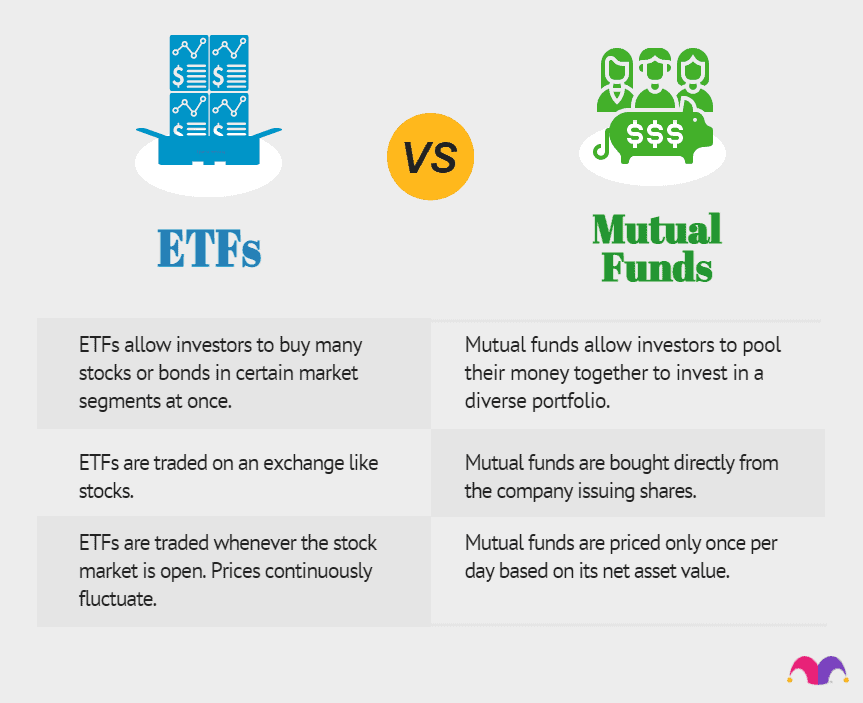

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) combine features of mutual funds and traditional stocks. An ETF, like a mutual fund, is a pooled investment fund that provides an investor professionally managed with a stake in, a varied portfolio of investments. However, unlike mutual funds, ETF shares trade on stock markets like stocks and may be purchased and sold at varying prices during the trading day.

ETFs are suggested for newbie investors because they are more diversified than individual stocks. You may reduce risk even further by investing in an ETF that tracks a wide index. And, like mutual funds, you may profit from an ETF by selling it when its value rises.

Options

An option is a more complicated technique to purchase a stock. When you purchase an option, you are obtaining the right to buy or sell an asset at a specific price and at a specific time. There are two sorts of options: call options, which are used to purchase assets, and put options, which are used to sell assets.

As an investor, you may set a precise stock price with the expectation that it will rise in value. However, the risk of an option is that the stock will lose money as well. So if the stock falls from its starting price, you lose the contract’s money. Options are a technical investment strategy, and individual investors should use them with caution.

Annuities

An annuity is a contract between you and an insurance company in which the firm agrees to provide you with a monthly payment, either now or in the future. Many people buy annuities to supply for their retirement life. When you acquire an annuity, you purchase an insurance policy in exchange for monthly payments.

There are several types of annuities. They may persist till death or for a predetermined period of time. They may need monthly premium payments or one upfront payment. They may connect to the stock market partially, or they could simply be an insurance policy with no direct connection to the markets. Payments can be made immediately or at a later date. They can be either fixed or changeable.

Annuities can provide an extra source of income in retirement. However, while they are relatively low risk, they are not high growth. As a result, investors consider it as a backup to their retirement savings rather than a primary source of money.

Retirement Plans

Retirement planning refers to financial approaches for saving, investing, and eventually distributing money in order to support oneself during retirement. There are several kinds of retirement plans. Employer-sponsored workplace retirement plans such as the Employees’ Provident Fund (EPF), a federally required statutory organization overseen by the Ministry of Finance.

It oversees Malaysia’s mandatory savings plan and retirement planning for private sector workers. Besides that, every insurance company has its own retirement plan, which might be customized for each client. When you retire, how you handle your income might be the difference between living comfortably and running out of money later on. Whether you are already retired or are still saving for it, there are steps you can do right now to manage your retirement income.

Certificates of Deposit (CDs)

Certificates of deposit (CDs) are time deposits. When you select a CD, the bank takes your deposit for a predetermined length of time—usually six months to five years—and pays you interest until maturity. At the conclusion of the term, you may either cash out your CD for the principal plus interest or roll your account balance over to a new CD.

CDs have lower liquidity than savings accounts. You cannot deposit or withdraw from them during the setting time. To purchase a CD, you must deposit the entire money at once. If you cash in your CD before it matures, you will normally be charged a penalty and will lose part of the money you have earned.

To compensate for the difficulty of cashing out your money, CDs often pay higher interest rates than savings or money market accounts at the same bank, with the greatest rates for the longest durations.

Cryptocurrencies

Cryptocurrency is a relatively new investing opportunity. A cryptocurrency is a digital representation of a stored value that is secured. Bitcoin is the most well-known cryptocurrency today, there are many more such as Ethereum, tether and etc. The cryptocurrency markets remain very unpredictable and risky. Before investing your money in cryptocurrency, use the information provided by regulatory bodies to learn more about these markets and products.

Cryptocurrency is still in early stages and is not supported by the government. Those who are interested in them can trade them on cryptocurrency exchanges. Some shops validate them and allow you to make transactions using cryptocurrencies.

Cryptocurrencies frequently experience significant volatility due to not backed by any regulatory bodies, making them a high-risk investment. Cryptocurrencies are viewed as digital speculative investment asset instead of fiat currency or validated finance. However, some investors utilize them to diversify their portfolios beyond equities and bonds.

Commodity Futures

Commodity futures contracts are agreements to purchase or sell a defined quantity of a commodity at a predetermined price on a future date. Metals, oil, grains, and animal products are examples of commodities, as are financial products and currencies. Futures contracts must be traded on the floor of a commodities exchange, with a few exceptions.

Commodity futures have four main categories which are metals, agricultural, livestock and and energy.

- Metals: Rare metals (gold and silver), industrial metals (copper), platinum

- Agricultural: Grains, corn and soybeans

- Livestock: Pork bellies and feeder cattle

- Energy: Crude oil, natural gas, thermal coal, alternate energy

In Conclusion

All investors should understand essential investment concepts before trading in any kinds of investment products. You should take into account a variety of performance measurement options in order to evaluate how effectively your assets are performing. Your measurement approaches will be influenced by the information you’re researching and the sorts of investments you currently hold.

In addition, diversifying your investments is a key approach for minimizing investment risk. You may assign funds to several types of assets in a specific asset class, like stocks, then split those funds across those categories. Preparation precedes success; it is essential to have a good understanding of the sorts of investments in which you are interested before entering the trading market.

References

10 most popular types of investments