This post was originally published on TKer.co

Stocks tumbled last week, with the S&P 500 falling 2.1%. The index is now up 7.7% from its October 12 closing low of 3,577.03 and down 19.7% from its January 3 closing high of 4,796.56.

Last week’s sell-off came as the Federal Reserve renewed its commitment to fight inflation with increasingly tight monetary policy. (You can read more about why this has been bad for stocks here and here.)

Earlier this month, I shared a roundup of what 16 top strategists were forecasting for the S&P 500 in 2023, noting that this stuff has limited value for investors with long time horizons.

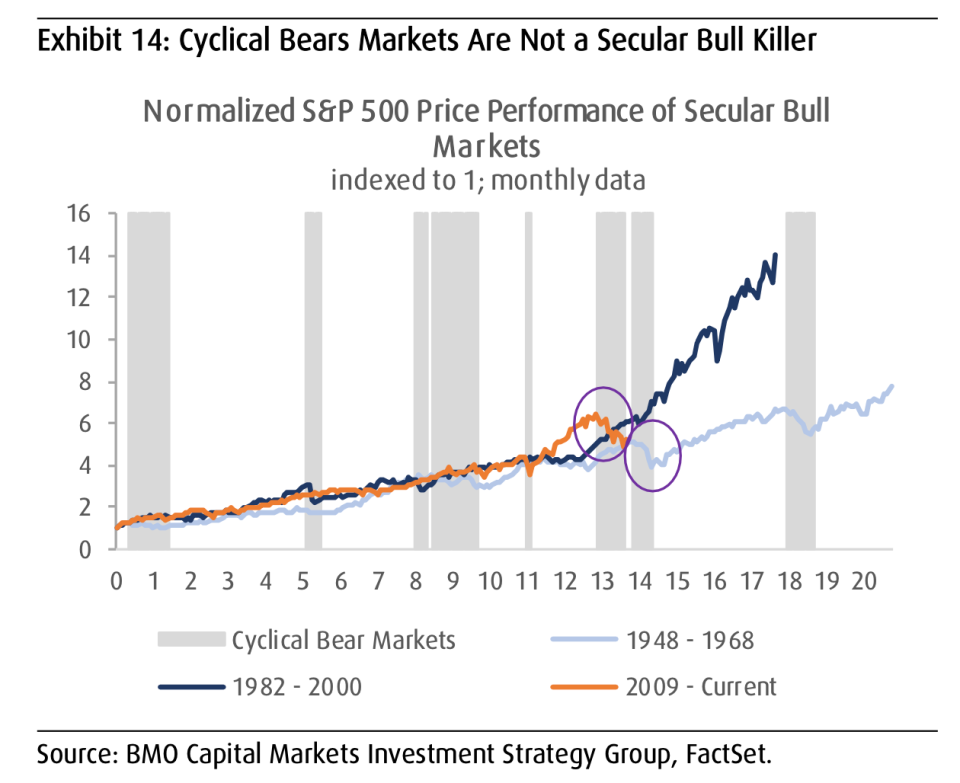

In their reports, some strategists shared their thoughts on the longer-term outlook for the market. They included Brian Belski, chief investment strategist at BMO Capital Markets, who argues that the short-term, cyclical bear market we’re experiencing represents a hiccup in a much longer-term, secular bull market.

“[W]e continue to believe that U.S. stocks are in the midst of a secular bull market,” he wrote in a Nov. 30 research note. “It is important to note that cyclical bears are not necessarily secular bull killers. In fact, there have been six cyclical bears during the previous two secular bull markets — four between 1948 and 1968 and two between 1982 and 2000 — and US stocks managed to continue their trek higher after each of these.”

Belski has been calling this a secular bull market for over a decade, and years of higher prices suggest he’s been nailing it.

Barring some big rallies in the coming years, 2022’s bear market seems likely to put a big dent in longer-term average returns. But by no means does this seem to spell doom for investors.

“Although the S&P 500 10-year annualized return may have already peaked, it has taken roughly six years during the two prior secular bulls for 10-year returns to make definitive moves below the 6.5% historical average,” Belski added. “From our lens, we see normalized and moderate gains in the coming years as more likely than losses.“

Subscribed

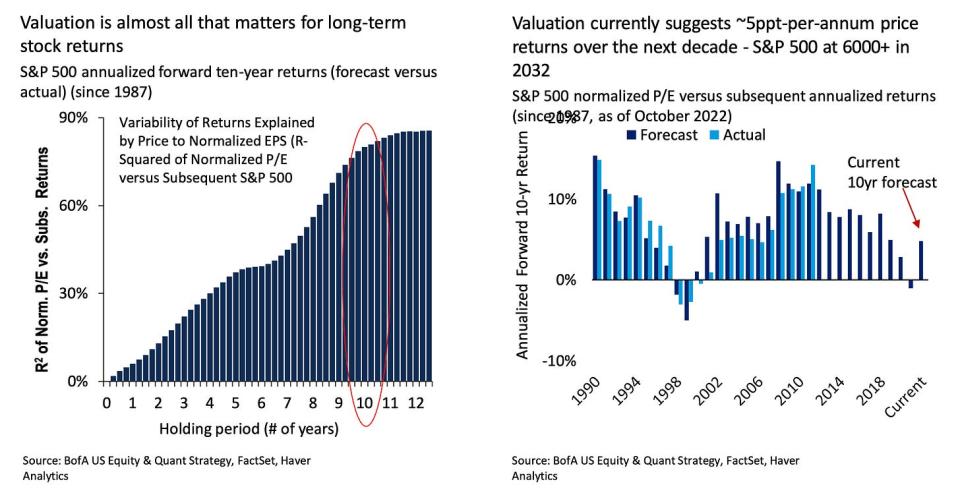

Savita Subramanian, head of U.S. equity strategy at BofA, also sees positive, albeit modest, returns in the coming years. On a November 28 call with reporters, she offered a 10-year forecast of “+5% annualized price returns,” which would bring the S&P 500 north of 6,000.

She pointed to the S&P 500’s P/E ratio, a metric that has little predictive power in the short-run but a better track record in the long-run.

“The current normalized P/E of 22x implies 5.1%/yr annualized returns over the next 10 years based on the historical relationship,” she said.

So, even while many are cautious about the short-term, at least some are confident the longer-term averages will look a lot better. (And who’s to say actual returns won’t blow away those expectations.)

Everyone’s talking about a near-term sell-off. A contrarian signal?

Last week, I wrote about how many market experts predicted earnings estimates would be slashed further and that many saw that as bearish for stocks in the early part of 2023.

Barron’s new cover story, published Saturday, had this narrative right in its headline.

Belski and Subramanian have been among the strategists that have been warning of near-term weakness. But in recent days, both acknowledged the problem of that becoming a consensus call.

“I do think that we are going to go down and then up,” Subramanian said in a Dec. 7 interview with Bloomberg. “The problem is that is an increasingly consensus view. So I think the bigger risk heading into the first half is actually not being invested in equities.“

“We said coming into 2023 and in our year-ahead piece that the first part of the year would be weak and choppy,” Belski said to CNBC on Friday. “We seem to be pulling that a little bit forward. And so the pullback is already done in our view.“

“Everybody and their mother, brother, sister, cousin, and uncle is negative on the first half of the year,” he added. “ So we’ll come out and be a little bit different. I think the weakness is probably not going to be as long as everybody thinks.“

Subscribed

The thing about certain risks is that the become less of a problem for markets the more market participants talk about them.

That said, at TKer we like to emphasize the advantages of thinking long-term when you’re investing in the stock market. As 2022 has confirmed very clearly, the short-term can be very difficult to predict, even if you know where the fundamentals are headed.

“Think about the long game, and don’t sell everything,” Subramanian said to Bloomberg. “I don’t think this is the time to be out of equities.“

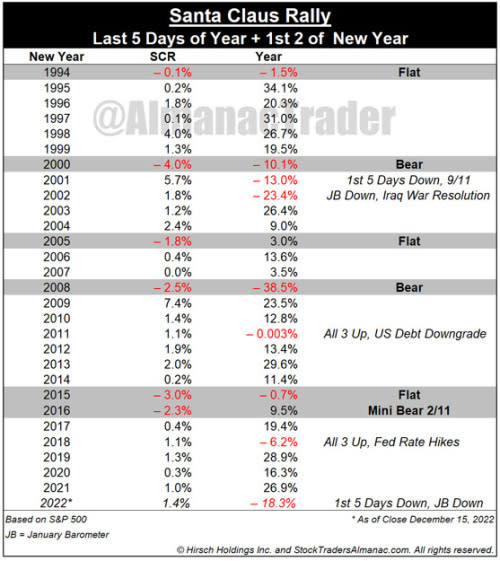

A quick note about the ‘Santa Claus Rally’ 🎅🏻

I know we just spent a bunch of time emphasizing the importance of thinking long term.

But for fun’s sake, here are the stats for the “Santa Claus Rally,” the phenomenon where the S&P 500 tends to trend higher over the last five trading days of the year and the first two of the next.

“The S&P 500 posts an average gain of 1.3%,” Almanac Trader’s Jeff Hirsch writes. “Failure to rally tends to precede bear markets or times when stocks could be purchased at lower prices later in the year.”

I wouldn’t bet my portfolio on this, but I’ll admit it makes for some short-term fun.

📆 TKer will be off Dec. 25 and Jan. 1., so the free weekly newsletter will not go out those days. TKer’s paid content will continue going out as usual. Happy Holidays!

—

More from TKer:

Reviewing the macro crosscurrents 🔀

There were a few notable data points from last week to consider:

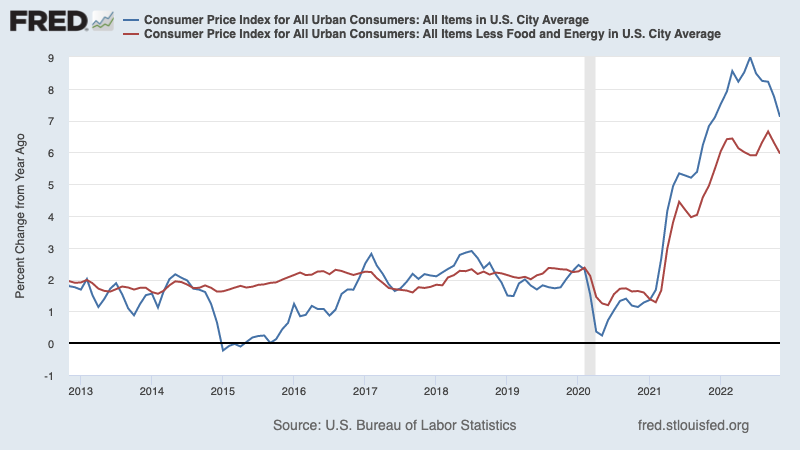

🚨 The Fed says there’s a lot more work to do. At the conclusion of its monetary policy meeting on Wednesday, the Fed announced a 50-basis-point interest rate hike and signaled that it expects to keep raising rates by more than previously forecast. From Fed Chair Jerome Powell: “Inflation remains well above our longer-run goal of 2%… The inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases. But it will take substantially more evidence to give confidence that inflation is on a sustained downward path.“ For much more on the Fed’s efforts to fight inflation, read this.

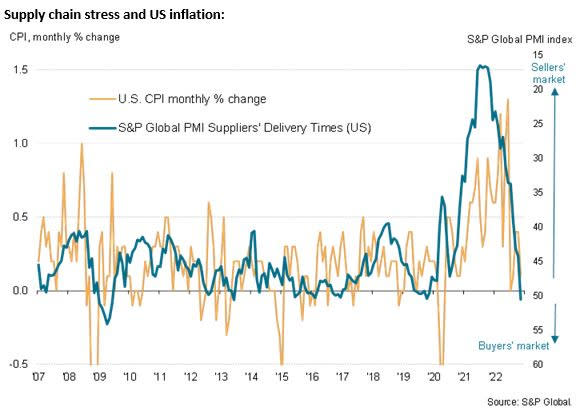

🎈Inflation cools. The consumer price index (CPI) in November cooled a bit, up 7.1% from a year ago. Excluding food and energy prices, core CPI was up 6.0%. These metrics were down from 7.8% and 6.3%, respectively, in October. Nevertheless, both measures are significantly above the Fed’s 2% target rate.

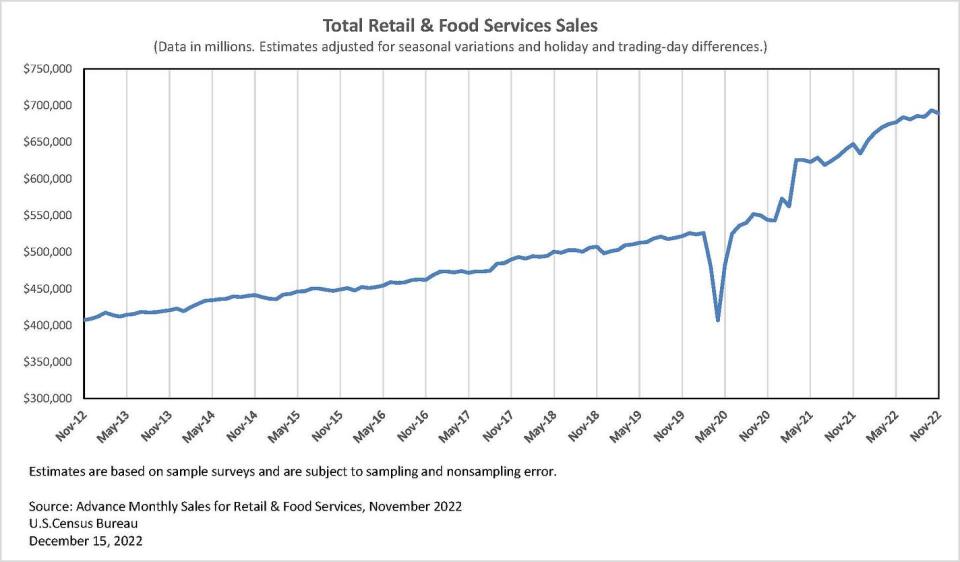

🛍️ Retail sales fall. Retail sales in November fell by 0.6% from the month prior to $689.4 billion. This was the largest drop in 11 months.

Nine of the 13 major retail categories saw declines including motor vehicles & parts, furniture, electronics, and building materials. Notably, sales at restaurants and bars were up, perhaps a reflection of the ongoing trend of consumers spending more money “doing stuff” and less money “buying stuff.”

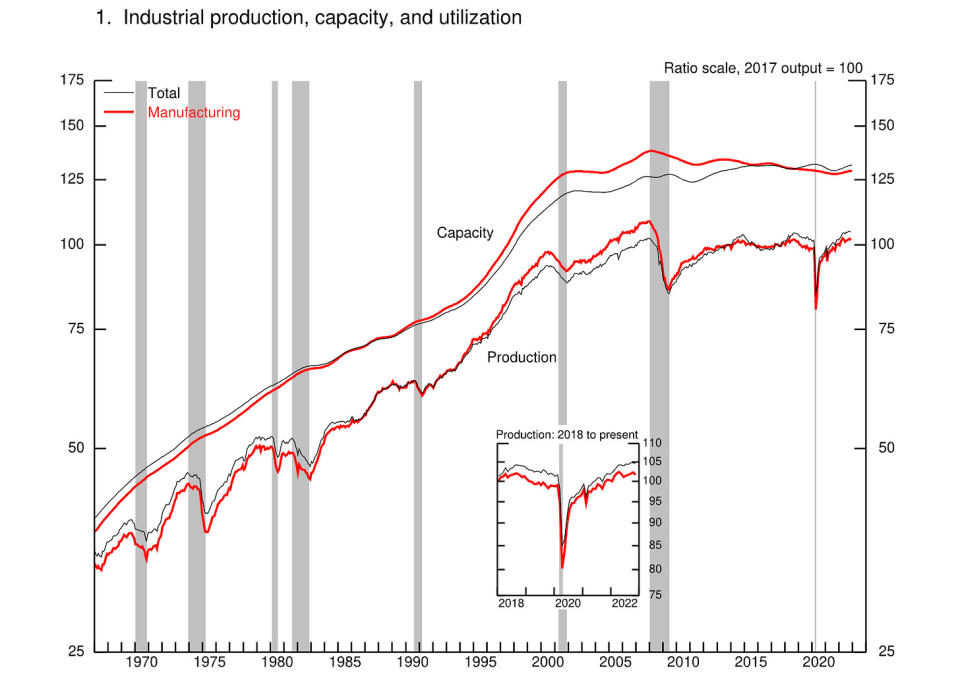

🛠️ Industrial activity falls. Industrial production activity declined by 0.2% in November with manufacturing output falling 0.6%.

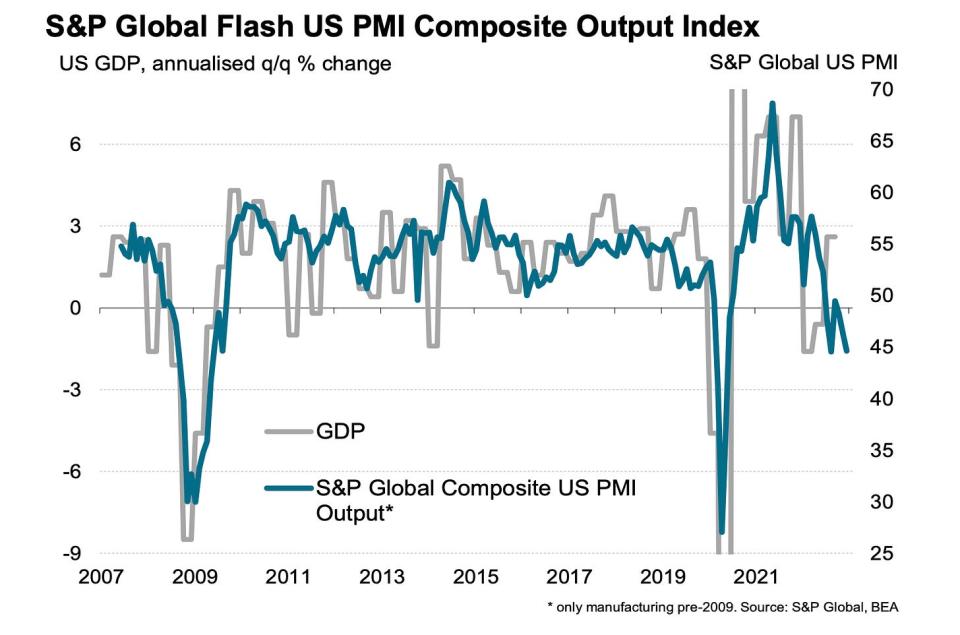

📉 Survey data look bad, but also sorta good. According to S&P Global’s preliminary December PMI survey, private sector businesses say we’re looking at a downturn. From the report: “Business conditions are worsening as 2022 draws to a close, with a steep fall in the PMI indicative of GDP contracting in the fourth quarter at an annualised rate of around 1.5%…“

But also: “…The upside is that weaker demand has taken pressure off supply chains which had been stretched during the pandemic. December saw a second successive month of faster supplier delivery times, a phenomenon which not only signals improving supply conditions but also tends to herald the shifting of pricing power away from the seller towards the buyer.“

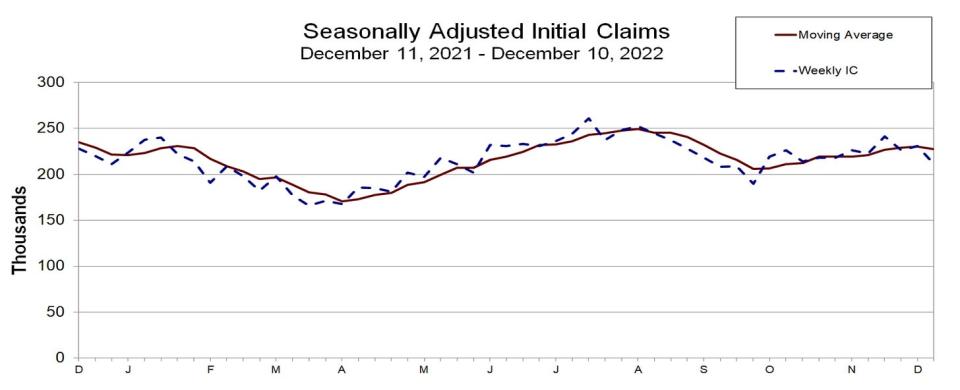

💼 Unemployment claims remain low. Initial claims for unemployment benefits rose to 211,000 during the week ending Dec. 10, down from 231,000 the week prior. While the number is up from its six-decade low of 166,000 in March, it remains near levels seen during periods of economic expansion.

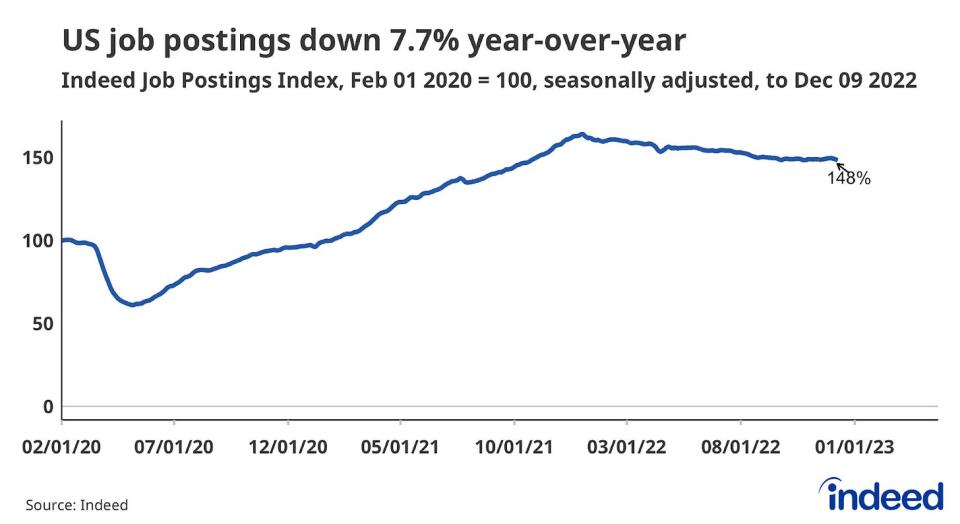

📉 Job openings are declining. The official stats for job openings in November will come in a few weeks. However, private job sites shared their numbers last week. According to Indeed Hiring Lab, the level of job openings were down 7.7% year-over-year as of December 9. The metric was down 0.5% from the month prior. However, it continues to be 48% above pre-pandemic levels.

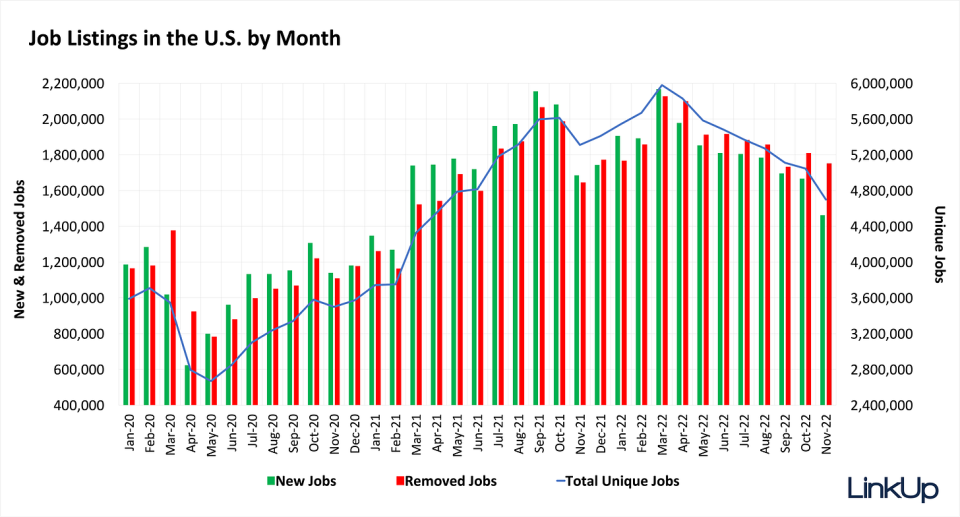

From labor market data firm Linkup: “Labor demand continues to cool as total active job listings dropped 6.9% month-over-month in the U.S. for the month of November and declined across all industries and occupations. LinkUp data shows employers created fewer listings in November, as the count of new job listings dropped 12.3% month-over-month.“

✈️ Top US manufacturer gets massive order. From United Airlines: “United Airlines today announced the largest widebody order by a U.S. carrier in commercial aviation history: 100 Boeing 787 Dreamliners with options to purchase 100 more.“

Putting it all together 🤔

Inflation is cooling from peak levels. Nevertheless, inflation remains hot and must cool by a lot more before anyone is comfortable with price levels. So we should expect the Federal Reserve to continue to tighten monetary policy, which means tighter financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations). All of this means the market beatings will continue and the risk the economy sinks into a recession will intensify.

But it’s important to remember that while recession risks are rising, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

As always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a terrible year so far, the long-run outlook for stocks remains positive.

This post was originally published on TKer.co

Sam Ro is the founder of TKer.co. Follow him on Twitter at @SamRo

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube