As you might know if you’re a regular reader here, I live in San Francisco. Therefore, I’m used to housing prices that most people in the United States would consider ridiculous. Whether renting or buying, California home prices are high. So, when people say, “I can’t believe that housing cost,” I assume that they mean it’s higher than they expected. In contrast, for myself, when I see some of the median housing prices in other states, my shock comes from the low price. What about for you? Are you more shocked by high housing prices or low ones? Let’s look at the cost of homes in five states at opposite ends of the spectrum to consider.

Calculating Median Home Prices

Before we begin, it’s important that we acknowledge that there are many different ways to calculate a state’s median home costs. Moreover, the numbers can be a little bit deceptive, since some states have huge variations in their lowest and highest prices while others don’t.

If you take a look at World Population Review’s 2022 report on Median Home Price by State, you’ll see that they acknowledge the following:

- They note that the median price of houses sold so far in 2022 is $428,700.

- However, the average sales price is higher, at $507,800.

- Moreover, some reliable reports eliminate the lowest and highest price outliers, using only the middle price tiers in their calculations. For example, Zillow does this, and they report the 2022 median US home price at $344,141.

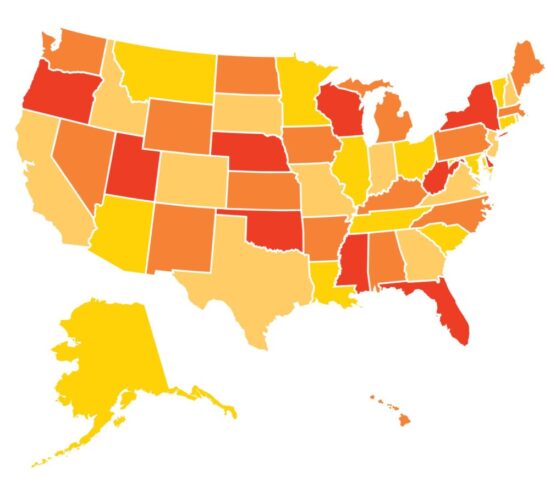

So, it’s a little bit complicated. However, regardless of which system you use, the same states tend to lie at the top and at the bottom of the range. Hawaii and California are always among the most expensive states for housing, for example.

Cost Per Home vs. Per Square Foot

It’s important to look at a variety of different factors when reviewing home costs. For example, the aforementioned report ranks states by median home price. However, they also note the average price per square foot, which can make a big difference. In some states you get a lot less space for the price.

For example, in both Colorado and Massachusetts, they list the median home price as approximately $559,000. However, for that price, you get about 500 more square feet in the home in Colorado. So, the average cost per square foot in Colorado is $263. In contrast, it’s $321 in Massachusetts.

You’ll also want to consider other factors such as homeowner’s association fees, property taxes, common property insurance costs, median income in the state, etc. The numbers themselves for median home prices are just one story.

Cost of Homes in 5 States: The High End

In order to get a general sense of median housing costs across the United States, we’re going to look at the cost of homes in five states in 2022. We’ll start with two of the most expensive states. Then we’ll look at two of the least expensive states. Finally, we’ll wrap up with the median home price in one of the states in the middle of the spectrum. Let’s begin.

Housing Costs: Hawaii

Hawaii consistently ranks at the top of the list for median home prices in the United States. According to the aforementioned report, the median 2022 home price in the state is just below $850,000. And yet, you only get about $1300 square feet of home for that price, making the cost per square foot about $650. This is higher than other states no matter how you look at it. On the plus side, Hawaii’s property taxes are among the lowest in the United States.

Housing Costs: California

Of course, California ranks high on the median home price list as well. Although, remember, there’s a big difference between the average home cost in San Francisco as compared to, say, Fresno. California is, after all, a huge state. The report says that the 2022 median California home price is just over $760,000. You get a bit more space than in Hawaii, though, with 1625 square feet. This puts the cost per square foot at $468. This is actually lower per square foot than the District of Columbia even though the media home price there is lower, because you get more home for the price in California.

Cost of Homes in 5 States: The Low End

I read the numbers above and they don’t shock me at all. What can I say; I’ve lived in the Bay Area for a long time. You know what shocks me, though? The astoundingly low home prices in some states. Let’s look at two of the cheapest options:

Housing Costs: West Virginia

West Virginia typically ranks among the lowest when it comes to median housing prices in the United States. According to the aforementioned report, the median home price there in 2022 is $129,103. You get a lot of home for that price, over 1700 square feet. Therefore, the cost per square foot is just $75. I can’t even imagine!

Housing Costs: Mississippi

Mississippi is another state with a low median housing cost. You’ll pay under $160,000 for the average home there, and you’ll get nearly 1900 square feet! The cost per square foot is $84. Of course, it’s important to remember that these states also have some of the highest unemployment rates and lowest median income numbers across the United States. So, just because housing is cheaper doesn’t mean that it’s easier to pay for your house there. There are many different factors to take into consideration.

Cost of Homes in 5 States: Right in the Middle

Perhaps the ideal situation for many people would be to find a home somewhere in the middle, where both the income and the median housing price for the state are average instead of extreme. I grew up in Arizona, which is pretty well situated in the middle of the spectrum.

The World Population Review’s 2022 report puts Arizona’s median home value at about $225,500. However, it’s important to note that this varies widely throughout the state. While many of the small cities in Arizona offer a lot of space at a very low price, the capital city of Phoenix is much costlier to live in. In fact, throughout the COVID-19 pandemic, Phoenix housing prices have climbed and climbed as more and more people relocate away from states like California. They’ve gone up over 50% in the past two years and now exceed over $400,000 by most reports.

So, although the cost of homes in 5 states can give us a lot of helpful information, do remember that many factors come into play. You always want to think about quality of life from many perspectives, not just housing costs in the moment.

Read More:

Come back to what you love! Dollardig.com is the most reliable cash-back site on the web. Just sign up, click, shop, and get full cashback!

Kathryn Vercillo is a professional writer who loves to live a balanced life. She appreciates a good work-life balance. She enjoys balance in her relationships and has worked hard to learn how to balance her finances to allow for a balanced life overall. Although she’s only blonde some of the time, she’s always striving for total balance. She’s excited to share what she’s learned with you and to discover more together along the way.