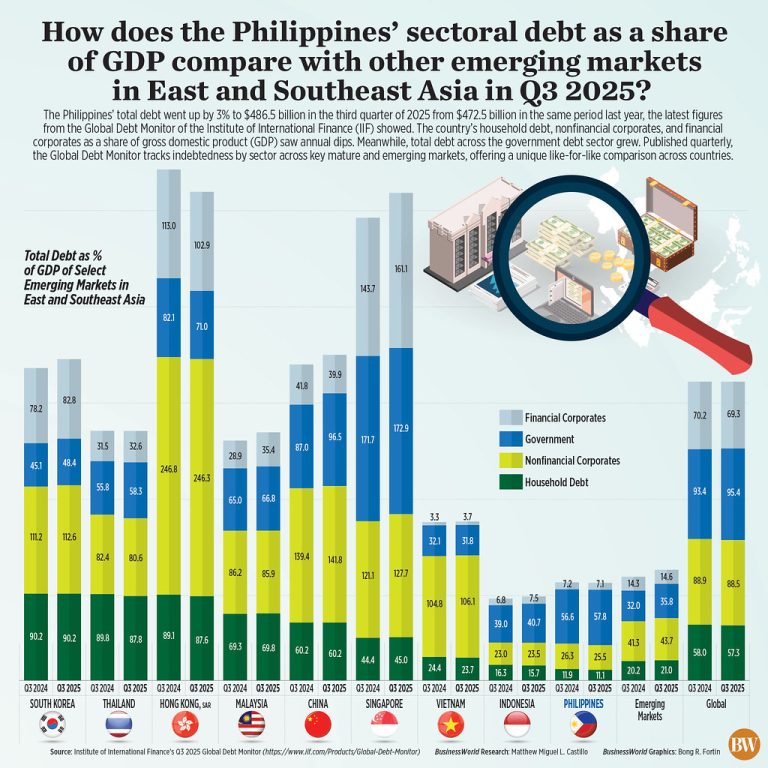

THE Institute of International Finance (IIF) said Philippine government debt as a share of the economy was 57.8% in the third quarter.

The IIF said on Tuesday that the share of government debt had been 56.6% a year earlier and 57.8% in the second quarter.

“As equity markets both locally and globally become volatile, bonds and related securities become more attractive. The debt asset class offers a relatively constant and predictable returns compared to equities,” Reinielle Matt M. Erece, an economist at Oikonomia Advisory and Research, Inc. said via Viber.

Mr. Erece noted that with global trade and geopolitical tensions heightened, returns from equity weakened, triggering what was perceived to be a flight to safety.

“Over $26 trillion was added to global debt stockpiles in the first three quarters of 2025, marking a fresh high of near $346 trillion. Driven largely by government borrowing, debt in both mature and emerging markets has hit new records,” the IIF said.

The IIF also reported that household debt as a share of GDP declined to 11.1% at the end of September from 11.9% a year earlier.

“With regard to household debt, still weak consumer confidence amid global inflation risks and slower income growth all contributed,” Mr. Erece said.

The IIF estimates that the Philippines had the second-lowest household debt as a share of the economy in Southeast Asia, behind only Laos (7.4%).

Corresponding levels were 15.7% for Indonesia, 23.7% for Vietnam, 69.8% for Malaysia, and 87.8% for Thailand.

The Asian emerging-market average was 55.1%, it said.

Meanwhile, the debt ratio of the non-financial corporates dropped to 25.5% in the third quarter from 26.3% a year earlier.

The financial sector posted a debt-to-GDP ratio of 7.1%, against 7.2% a year earlier. — Aubrey Rose A. Inosante