Ethereum has surged more than 70% since mid-June, marking one of its most impressive rallies of the year. The move has been driven by strong momentum, with bulls firmly in control as ETH recently reclaimed the critical $3,500 level. Notably, the uptrend has shown little to no retracement since the initial breakout, signaling sustained buying interest and confidence among investors.

Related Reading

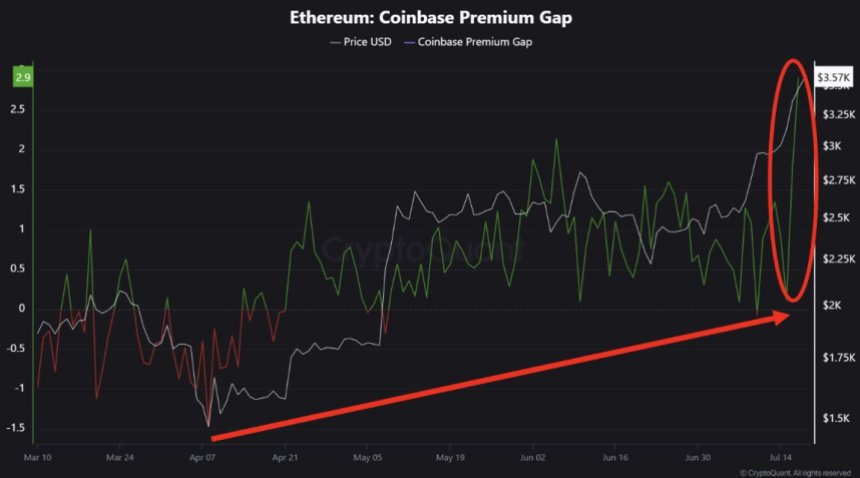

One of the most striking developments supporting this move comes from CryptoQuant, which highlights the emergence of a significant premium on Ethereum traded through Coinbase. This is particularly noteworthy because Coinbase is a platform predominantly used by US institutions and high-net-worth individuals. The premium suggests aggressive spot buying by whales, indicating renewed institutional interest in Ethereum.

This renewed demand comes as the broader crypto market sees clearer regulatory signals and increasing ETF flows into ETH-related products. As Ethereum continues to outperform and attract capital, traders are watching closely to see if this momentum will carry into a broader altcoin rally—or even signal the start of a long-awaited altseason.

US Whales Lead the Charge as Ethereum Buying Activity Accelerates

According to a recent report by CryptoQuant analyst Crypto Dan, Ethereum is seeing a notable increase in buying activity, particularly from US-based whales. The steady rise in accumulation, combined with a clear premium on Coinbase, suggests that high-net-worth players are positioning themselves ahead of further upside.

Supporting this trend, daily inflows into Ethereum spot ETFs have surged to new all-time highs. This sharp spike reflects growing institutional confidence in ETH as a core digital asset, especially following recent regulatory clarity in the US. With Ethereum now trading above $3,600, demand continues to outpace supply across multiple channels.

What makes this rally especially interesting is the current market environment. On-chain metrics show that Ethereum is not yet significantly overheated. Indicators such as NUPL (Net Unrealized Profit/Loss) suggest room for further expansion before excessive euphoria sets in. This creates favorable conditions for ETH to consolidate at higher levels before potentially breaking out again.

However, the coming weeks will be crucial. If strong inflows and bullish momentum persist into late Q3 2025, analysts warn it could trigger signs of overheating. While we are not there yet, repeated vertical moves without retracement should prompt caution. Investors may need to reassess risk levels if the pattern continues.