Irresponsibility might not be the gravest sin committed by internet pundits, but it’s surely one of the most widespread. We are forever regaled by advice from “the strategist who called the 2008 crash” has announced the 2022 recession will be worse than 2008, though we are spared the messy details about the source’s other 49 missed guesses. It’s the nature of the internet that pundits can live forever on one right guess while being confident that all of their errors will pass from human memory.

Do you remember Elaine Garzarelli, who warned of the 1987 crash ten days before it happened? Personal Finance for Dummies (2006) notes that she’s still “an expert” because of that call and despite a long-term record that is “poor”. Others describe it as “unremarkable,” “mixed” and not enough to keep her from being laid off by Lehman.

Quick tip for prudent investing: if a story is headlined by the fact that the source got something right, once, but doesn’t immediately highlight their long-term record or the risks associated with following their advice: DO NOT READ THE ARTICLE! It’s simple financial porn, constructive to the author’s ego, destructive to your wealth, and not worth your time.

Quick tip for prudent investing: if a story is headlined by the fact that the source got something right, once, but doesn’t immediately highlight their long-term record or the risks associated with following their advice: DO NOT READ THE ARTICLE! It’s simple financial porn, constructive to the author’s ego, destructive to your wealth, and not worth your time.

By the way, that one rule will reduce by 90% the amount of stuff in your newsfeed that you need to attend to. Use the hours you’ll save to read a book or plan a trip with your family.

I hold myself to a higher standard. Like all of my colleagues here, I try hard to assess the evidence available in light of my personal and professional experience. Sometimes I’m right, sometimes I’m wrong and, quite often, I’m somewhere between those two poles. For our mid-year retrospective, I wanted to highlight some of the arguments that I’ve made in my first six months with you here and reflect a bit of how they’ve held up.

February: What is Your Edge?

Takeaways: Markets are complex. Having “an edge” in the market means that you have some special skill or insight that allows you to outthink and outperform hundreds of thousands of full-time professional investors. A true trading and security selection edge is difficult to find. Most people don’t have edge. We should try and be long-term focused and avoid the urge to dabble too much.

Mid-year 2022 Update: Boy! Has this been a year when investors ought to have stuck to their knitting! Everything has been decimated (except a finite Resource equities and Commodities). Tourists in crypto, meme stocks, and even risky fixed income were taken to the woodshed. It’s time to ask once again, “Do I have edge”, in trading or stock selection? If not, come back home to a Balanced Portfolio.

February: Thoughts on Inflation Protection

Takeaways: With inflation raging, investors could protect their portfolios using Inflation-linked Bonds. The preference was I-Bonds >> Short-Dated Tips >> Long-Dated TIPS.

Mid-year 2022 Update:

I-Bonds win: The US Treasury is offering 9.62% annualized coupon until October 2022.

Short-dated TIPS: Year-to-date to June 28th, the Total Return (Price + Coupon) = -1.38%.

Despite inflation, the short-dated TIPS are mildly down because the Federal Reserve raising rates hits bonds of all durations.

But this -1.4% of short-dated TIPS (STIP, VTIP) is actually a victory compared to how the rest of the Fixed Income Assets have performed this year:

| Fixed Income Asset | YTD June 28th, 2022, Returns (Source: Portfolio Visualizer) |

| Short Term Treasury | -3.6% |

| Intermediate Term Treasury | -8.3% |

| Long Term Treasury | -22.9% |

| Total US Bond Market | -11.5% |

| TIPS | -8.4% |

| Corporate Bonds | -16.8% |

| High Yield Corporate Bonds | -12.0% |

| Intermediate Term Tax Exempt | -8.3% |

Short-dated TIPS thus came out as a clear winner among all fixed income publicly traded products.

What about Equity REITs?

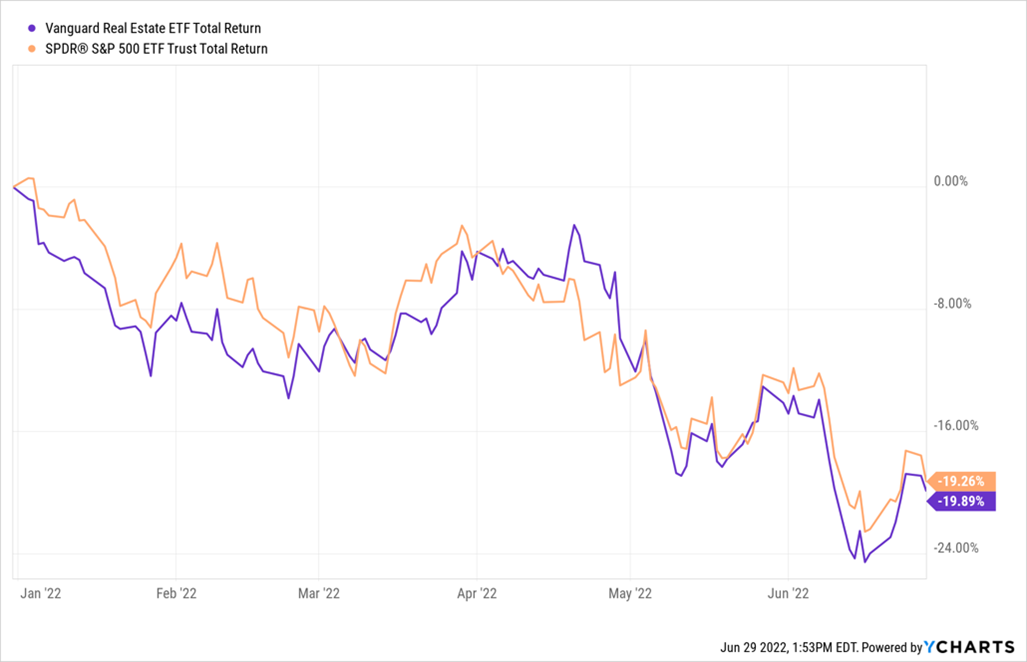

Takeaways: I had mentioned in the article that equity REITs have historically been good hedges to inflation BUT the mark-to-market is nasty given the high correlation to broader equities.

Mid-year Update:

Public equity REITs and the S&P 500 total returns are both down about 19-20% this year. No mercy. And definitely a good reason to avoid making TIPS the first weapon in inflation defense.

But what now?

In observing the REITs universe and in conversations with others, there has been a big opening between public equity REITS and private real estate accounts:

- David Snowball mentioned the TIAA Real Estate Account is up on the Year, a topic covered extensively by Mark Freedman in the MFO Article: Getting Real.

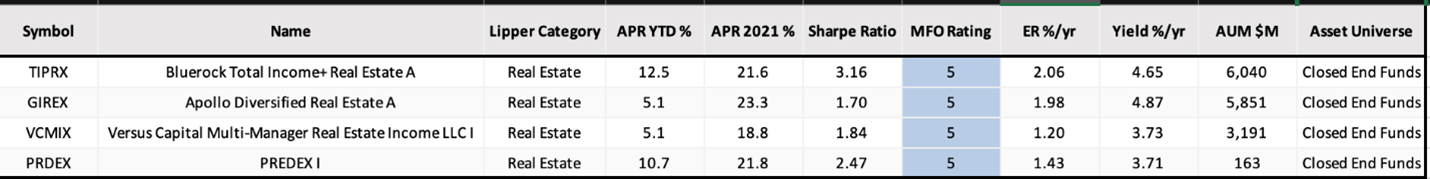

Mark’s article and David’s comment on TIAA had me look up MFO Premium Search engine for Real Estate funds which were up on the year. I found a curious bunch of Private Real Estate Closed End Mutual Funds (some set up as Interval Funds).

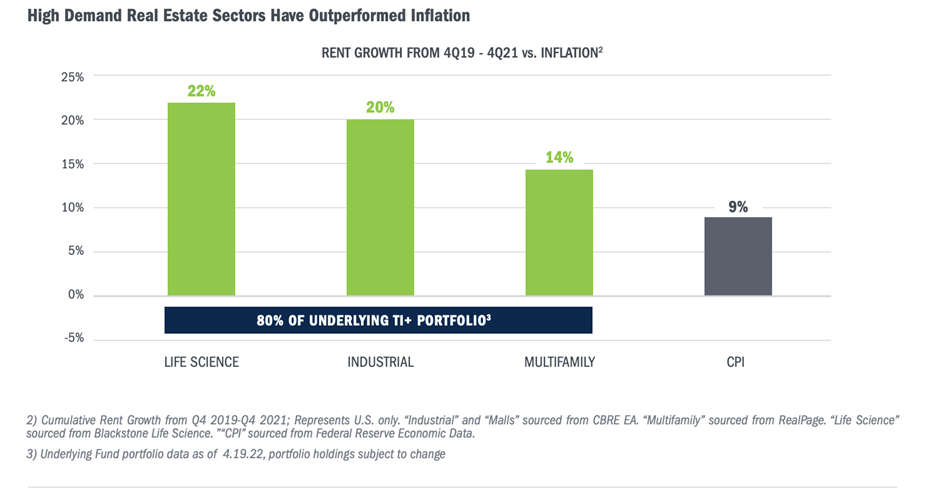

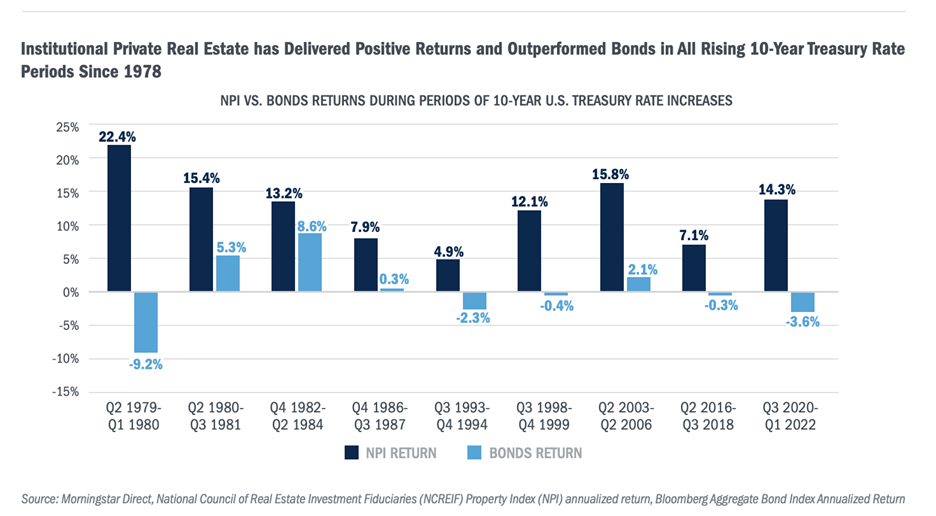

I think it’s interest that some of these funds are up YTD. They’ve performed their function. Investing in them is less straightforward for various reasons but it was good to see a few funds live up to their mission. In fact, here are two charts from Bluerock Total Income’s March-22 Semi-Annual Report:

Mind you, reader, the charts refer to Private Real Estate, not public REITs. Nevertheless, the economics eventually should be similar between Private and Public.

Mind you, reader, the charts refer to Private Real Estate, not public REITs. Nevertheless, the economics eventually should be similar between Private and Public.

Given the sharp sell-off in Public Equity REITs, perhaps one can now think as a good way to protect against inflation. The froth has come off and if inflation persists, it would be nice to see rental income kick in higher for the REITs.

March Article: Overcoming Drawdowns (and Rebalancing)

Takeaway: Use market selloffs as rebalance opportunities.

Mid-year Update: Markets have sold off, rather uniformly, but some opportunities may exist depending on the individual’s portfolio allocation.

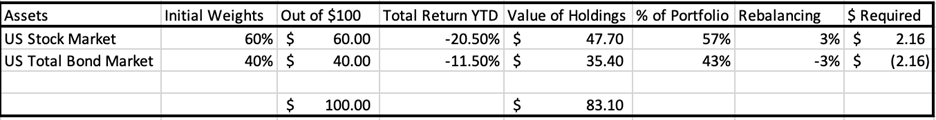

Let’s take two simple portfolios:

- The 60-40 in US Stock/US Total Bond Market.

The above work shows that for a person who came in with a $100 portfolio with a 60/40 weight in US Stock Market/US Total Bond Market, the $100 has now become $83.10 (down 16.9% YTD) as a result of the selloff in both assets. If one desired to rebalance to 60/40, that would mean buying $2.16 worth of US Stock Market and selling the same amount in US Total Bonds.

The above work shows that for a person who came in with a $100 portfolio with a 60/40 weight in US Stock Market/US Total Bond Market, the $100 has now become $83.10 (down 16.9% YTD) as a result of the selloff in both assets. If one desired to rebalance to 60/40, that would mean buying $2.16 worth of US Stock Market and selling the same amount in US Total Bonds.

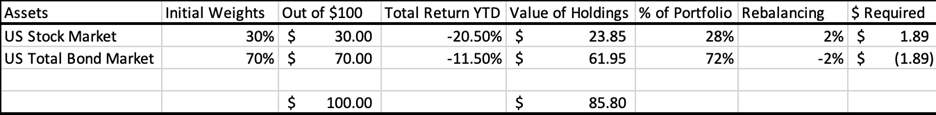

- What if you had a 30 Equity/70 Bond Portfolio?

The $100 would have become $85.80 and the rebalancing would be $1.89 of stock purchase at the expense of bonds.

The $100 would have become $85.80 and the rebalancing would be $1.89 of stock purchase at the expense of bonds.

The problem this year has been that both STOCKS and BONDS are down leaving us with very little rebalancing opportunities.

Still good advice over longer periods, but no magic bullet in the “we all fall down” market.

April MFO Article: On Active vs Passive Equity

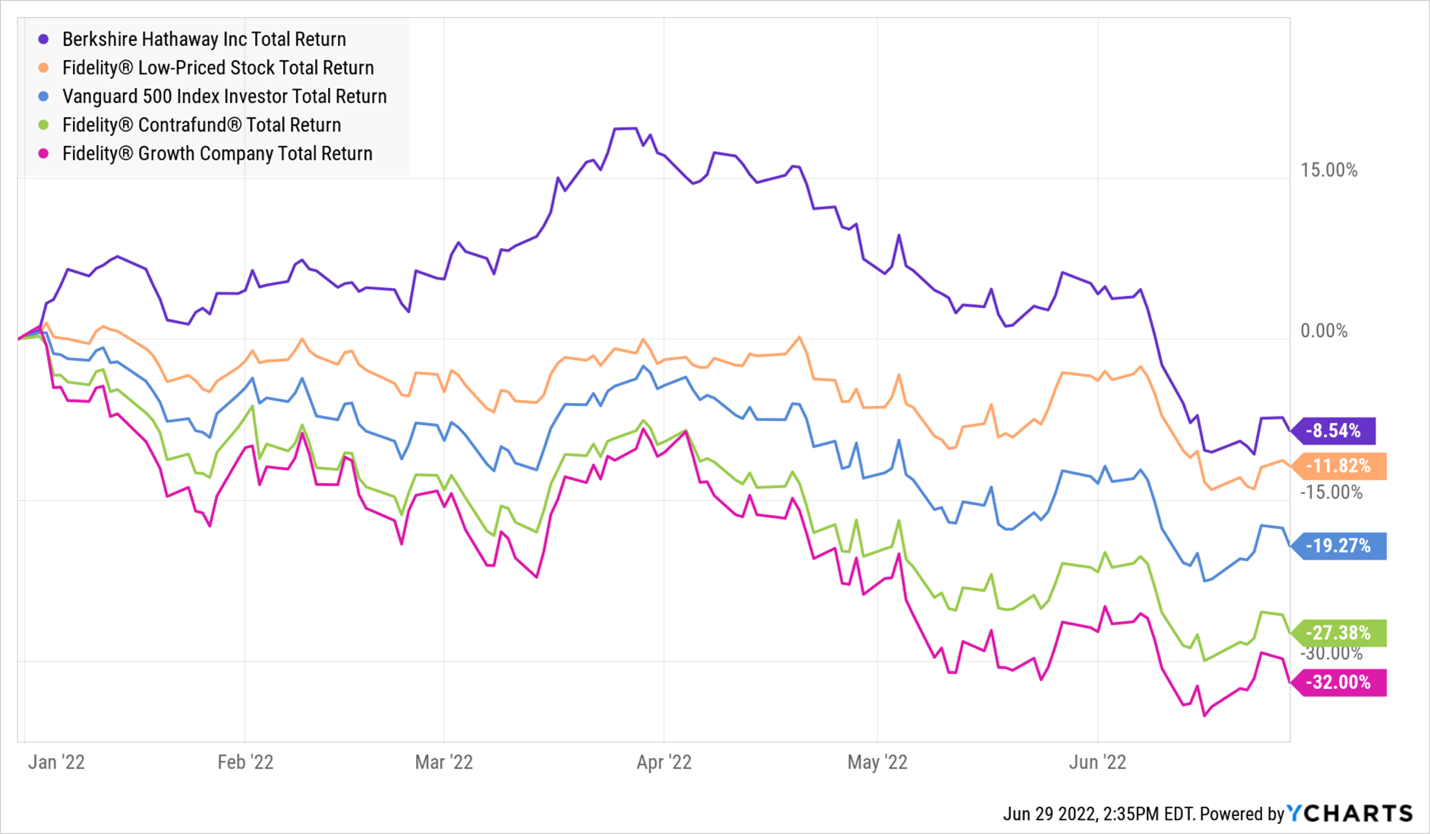

Takeaway: Active is on the backfoot. Definitely, there are managers who know how to produce alpha, but they are few and far between. I compared five “funds”: Fidelity Growth Company, Fidelity Contrafund, Fidelity Low Priced Stock Fund, Berkshire Hathaway, and the Vanguard 500 Index Investment. I had said that Berkshire’s the only large fund that seemed interesting for its active management skill.

Mid-year Update: Picture speaks a 1000 words

What I have learned this year from MFO:

This above picture is a small and faulty sample. There are many active funds that have outperformed and MFO’s Discussion boards and profile letters have talked about these funds in depth. I look forward to learning more about Active Mutual Fund Managers adding alpha to my portfolio in future years.