A year ago, Bill D’Alessandro and I sat down to record our predictions for 2025. We made calls on everything from Trump’s tariff policy to Google’s search dominance.

Many years, revisiting predictions is a humbling exercise. We’ve had some absolute stinkers in the past—predictions so off-base they’re almost impressive in their wrongness.

How did we fare for 2025? Read on to find out.

—

Prediction #1: Trump = Tariffs + Tax Cuts

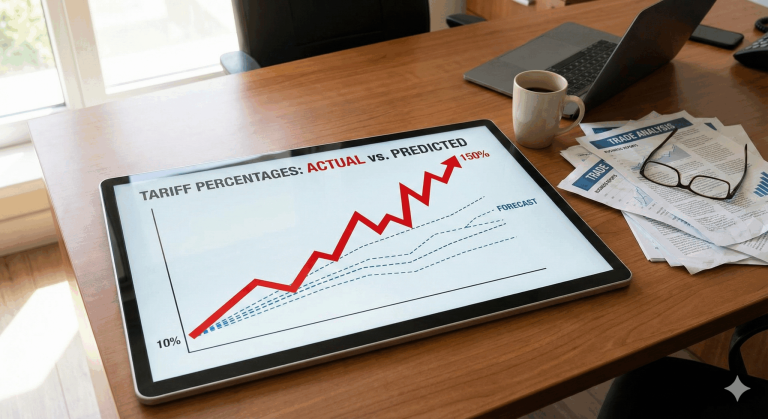

My Call: Trump would raise tariffs on China around 10%, and we’d see tax policy like QBI extension and further tax cuts.

What Happened: I got the direction spot-on, but badly underestimated the magnitude. China tariffs debuted at 150% before settling around 30-40% effective rates. My “plausible 10%” call wasn’t even in the ballpark.

My “plausible 10%” call wasn’t even in the ballpark. China tariffs debuted at 150% before settling around 30-40% effective rates.

On the tax front, I nailed it. The Big Beautiful Bill came through with QBI extension and additional business-friendly tax cuts as predicted.

Grade: 8/10. Right on the trends, wrong on the scale.

#2: Google Shows First Real Weakness

My Call: Google would drop below 90% search market share for the first time in 10 years as AI assistants like ChatGPT stole queries.

What Happened: Google did dip under 90% in early 2025—the first time in a decade they’d fallen below that threshold. For a brief moment, it looked like the prediction would play out perfectly.

But Google didn’t roll over. Gemini 3 turned out to be legitimately strong, and they’ve done an impressive job integrating AI into search. The armor cracked, but they patched it fast.

Grade: 6/10. They stumbled, but recovered faster than I expected.

#3: SEO for AI LLMs Emerges

My Call: A new industry would be born around ranking inside ChatGPT, Claude, and other AI models—essentially SEO for large language models.

What Happened: “GEO” (Generative Engine Optimization) is now a real thing. Terrible name, but the discipline exists. Tools have launched, consultants are selling services, people are talking about it at conferences.

Is it groundbreaking? Not yet. Most of it still looks like traditional SEO wearing a mask. But the industry has emerged exactly as predicted.

Grade: 10/10. Called it.

#4: Bitcoin Strategic Reserve

My Call: The US would establish an explicit Bitcoin reserve stance and BTC would end the year around $150K.

What Happened: We’re keeping seized Bitcoin instead of liquidating it, which is something. But we’re not actively buying more for the treasury.

Bitcoin touched $125K—tantalizing close to my $150K call—before crashing to around $90K where it sits today.

Half right on the reserve stance. Way wrong on price.

Grade: 5/10. This one stings.

#5: Nuclear Power Re-emerges

My Call: Massive power demand from AI data centers would push nuclear power back into the spotlight as a viable energy solution.

What Happened: Four executive orders supporting nuclear in May. Global nuclear investment up roughly 10% year-over-year.

This was the safest bet of my five predictions—pretty obvious if you were paying attention to AI’s energy appetite. But I called it correctly.

Grade: 9/10. Accurate, if not particularly bold.

Bill’s 2025 Predictions

Bill D’Alessandro has been my partner-in-crime for making predictions for the past decade. Here’s a recap and review of his predictions made a year ago:

#1: Offshoring Ramps Up, Staffing Model Shifts

Bill’s Call: The man-in-the-middle staffing agency model would give way to traditional placement for international hires. E-commerce brands would increasingly hire international-first via direct placement instead of ongoing staffing spreads.

What Happened: International-first hiring is absolutely the default now. Bill doesn’t know a single entrepreneur who doesn’t hire international first for most roles.

But the man-in-the-middle agencies are still extracting huge profits. The placement model is gaining ground, but it hasn’t swept the industry the way Bill predicted. Movement in the right direction, just slower than expected.

Bill’s Grade: 50%. Directionally right, velocity wrong.

#2: Margins Rise, Ad Costs Expand to Consume Them

Bill’s Call: AI and offshoring would make teams leaner and lift margins. But because Meta and Amazon run competitive auctions, increased profitability would push up CPAs as sellers bid more aggressively.

What Happened: This played out exactly as predicted. CAC up double digits in 2025. CPMs up double digits across Meta and Amazon.

Bill called this “the most brilliant business model on earth” and it’s proving diabolical. Any margin gains businesses squeeze out get immediately plowed back into ad spend. The auction model dynamically expands to capture surplus.

Bill called this ‘the most brilliant business model on earth’ and it’s proving diabolical. Any margin gains get immediately plowed back into ad spend.

This trend will accelerate into 2026 and beyond.

Bill’s Grade: A+ / 10 out of 10. Nailed it.

#3: Owning Manufacturing Becomes Critical Moat

Bill’s Call: Vertical integration, especially US-based manufacturing, would become essential for better margins, faster innovation, stronger IP, and supply chain control.

What Happened: Everyone in Bill’s network is building factories or aggressively moving toward vertical integration. Tariffs accelerated this trend, but the real drivers are control, speed, and strategic advantage.

With AI commoditizing marketing and content creation, product is increasingly becoming the only real moat. Owning your manufacturing gives you the ability to iterate faster and protect your differentiation.

With AI commoditizing marketing and content creation, product is increasingly becoming the only real moat.

Bill’s Grade: A- to 10/10. Spot on.

#4: Amazon Haul Drives Two-Tier Ecosystem

Bill’s Call: Amazon Haul (their mobile-only, ultra-cheap, direct-from-China section) would succeed and become the home for unbranded bargain products. Amazon.com would tighten policies on non-branded overseas sellers and focus on vetted, brand-registered products.

What Happened: Tariffs kneecapped this prediction before it could gain momentum. De minimis reform also gutted the direct-from-China shipping model that Haul relied on.

There are early signs of a crackdown—Amazon now reports Chinese sellers to the Chinese government for taxation, which is a massive win for US-based sellers. But overall, this didn’t play out the way Bill expected.

Bill’s Grade: 2-3/10. Clear miss, mostly due to policy changes Bill didn’t foresee.

#5: Crypto and Equity Markets

Bill’s Call: Bitcoin would touch $150K, but end below $100K after hype exceeded policy follow-through. The S&P would be up 20% mid-year on animal spirits and M&A activity, then give back gains to finish flat if Doge efficiency efforts actually materialized.

What Happened: Bitcoin hit $125K before crashing to around $87K today. The hype-then-crash pattern was dead-on, even if he didn’t nail the exact numbers.

The S&P is up 16-17% year-to-date and holding strong, not flat as predicted. Why? Because the Doge austerity efforts turned out to be a “giant nothing burger”—zero real cuts, massive spending bill, no impact on risk assets.

Bill’s logic was sound: no austerity means risk assets stay elevated. He just bet on austerity actually happening.

Bill’s Grade: A-. Got the Bitcoin pattern right, partially right on markets.

—

This was legitimately our best year for predictions. Can we do it again?

This Friday on the podcast: Bill and I are recording our 2026 predictions, including a rather ludicrous bet to see who’s more accurate this year. Loser buys the winner a steak—as graded by AI.

Want to see what’s coming BEFORE it hits?

The best way to predict the future isn’t crystal balls—it’s tapping into 1,000+ savvy 7- and 8-figure operators who are seeing trends emerge in real-time.

When tariffs started hitting, our members were sharing strategies weeks before the headlines. When ad costs spiked, they were already testing solutions.

Join the eComFuel community to get ahead of what’s next, not scrambling to catch up.